Social Security’s 2.8% Increase in 2026 Sounds Good—Until You See What’s Happening to Prices

The Social Security Administration (SSA) announced on October 24 that benefits for nearly 71 million Americans will rise by 2.8% beginning in January 2026. The annual cost-of-living adjustment (COLA) is intended to preserve beneficiaries’ purchasing power as prices rise.

The change means the average retired worker’s monthly check will increase from $2,015 to $2,071, or roughly $672 more annually before deductions. The boost also applies to disabled workers, survivors, and Supplemental Security Income (SSI) recipients.

Yet for millions, that promise rings hollow as essential costs surge well beyond the official inflation measure used to calculate the increase.

Social Security’s 2.8% Increase in 2026

| Key Fact | Detail |

|---|---|

| 2026 COLA | 2.8 % |

| Average monthly benefit | $2,071 (up from $2,015) |

| Average raise | $56/month |

| Medicare Part B premium | +11.6 %, to $206.50 |

| Inflation index used | CPI-W (Urban Wage Earners) |

The 2.8% Social Security increase in 2026 will raise average monthly benefits by about $56. But with healthcare, housing, and grocery prices climbing far faster, many older Americans say the adjustment barely dents their rising costs—and exposes deep flaws in how inflation is measured.

“COLA ensures benefits keep pace with inflation,” said Kilolo Kijakazi, Acting Commissioner of Social Security. “The 2026 adjustment reflects changes in consumer prices and the program’s commitment to retirees’ economic security.”

Why the Raise May Not Keep Up

The COLA is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks the spending of working-age households—not retirees. Critics say it underestimates inflation faced by seniors, who spend heavily on healthcare, housing, and prescription drugs.

“The formula simply doesn’t reflect older Americans’ realities,” said Mary Johnson of the Senior Citizens League, a nonpartisan advocacy group. “Even small miscalculations, year after year, erode retirees’ purchasing power.”

Healthcare premiums are a prime example. The Centers for Medicare & Medicaid Services (CMS) projects the standard Medicare Part B premium will jump by 11.6 % in 2026—from $185 to $206.50—outpacing the COLA nearly fourfold.

Meanwhile, the Consumer Price Index for All Urban Consumers (CPI-U) rose 3.2 % year-over-year through September 2025, further widening the gap between benefit increases and real-world prices.

What’s Driving Higher Living Costs

According to the U.S. Bureau of Labor Statistics (BLS):

- Food-at-home prices rose 4.1 % in the past year.

- Shelter costs, including rent and utilities, climbed 5.3 %.

- Medical care services increased nearly 6 %.

“Retirees are seeing inflation where it hurts most,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “They spend twice as much on health-related expenses as younger households.”

The result is what economists call “stealth inflation”—a steady decline in real income even when nominal payments rise.

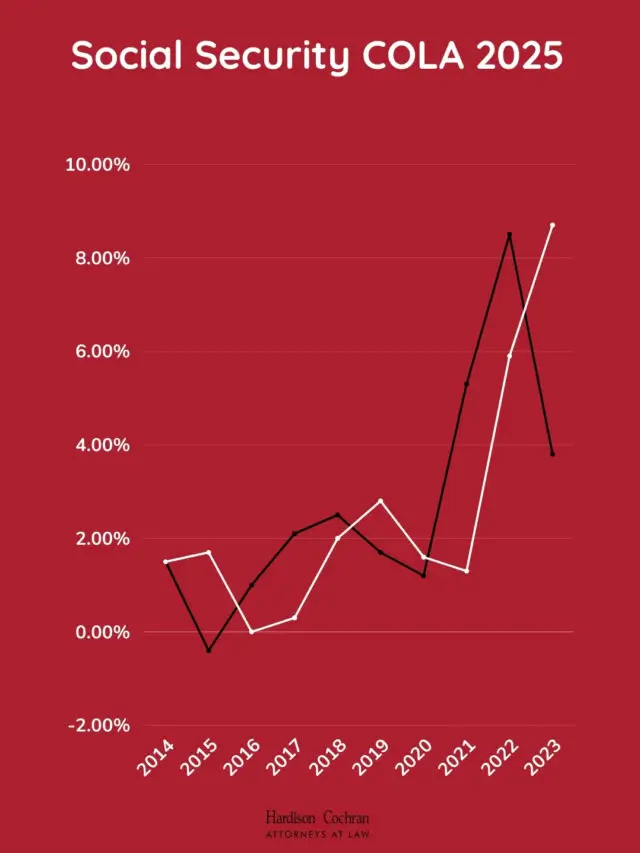

A Look Back: COLA in Historical Context

While 2.8 % is higher than the 2.1 % average over the past decade, it is far smaller than the 8.7 % jump in 2023, the largest in 40 years. That spike followed record inflation after the pandemic.

“The new figure looks tame because inflation has cooled, but seniors’ costs haven’t,” explained Nancy Altman, president of Social Security Works. “When inflation slows unevenly across categories, older Americans still lose ground.”

In effect, the 2026 COLA restores some ground lost during high-inflation years but does not fully compensate for cumulative price increases since 2021.

The Broader Economic Landscape

Economists note that while headline inflation has declined, “sticky” categories such as housing and medical care remain elevated. The Federal Reserve’s prolonged high-interest-rate policy has helped curb inflation but raised borrowing costs for households.

“For retirees, this environment means higher yields on savings but also higher costs for credit cards, insurance, and home maintenance,” said Greg McBride, chief financial analyst at Bankrate.

The Federal Reserve Bank of Atlanta’s Inflation Project reports that prices for essential goods continue rising at 3.5–4 % annually, well above the Fed’s 2 % target.

Lawmakers and Advocates Push for Reform

Several advocacy groups and lawmakers renewed calls to replace CPI-W with the Consumer Price Index for the Elderly (CPI-E), which better mirrors seniors’ spending. A Government Accountability Office (GAO) analysis found CPI-E-based adjustments would average 0.25 percentage points higher annually since 2000.

“Using CPI-E would give seniors a fairer adjustment without being extravagant,” argued Sen. Elizabeth Warren (D-Mass.), who co-sponsors the Boost Social Security Now Act.

Opponents caution that adopting CPI-E could increase program costs by tens of billions annually and accelerate the depletion of the Social Security Trust Fund, which the Congressional Budget Office (CBO) projects could run dry by 2034.

“We need solvency and fairness,” said Andrew Biggs of the American Enterprise Institute. “Reforming inflation measures without fixing the fund is only half the solution.”

The Human Impact

For many beneficiaries, the numbers translate to daily trade-offs. Margaret Lopez, 73, a retired postal worker in Arizona, said her 2025 grocery bill rose about $40 per week despite careful budgeting.

“I’m grateful for any increase,” Lopez said, “but my Medicare premium alone wipes half of it out. I’ve had to cut back on fresh produce and delay a dental visit.”

Her story reflects what advocates describe as a widening disconnect between official inflation measures and retirees’ lived experience.

Financial Planning and Next Steps

Financial advisors urge beneficiaries to use the 2026 COLA as a trigger to reassess budgets:

- Review Medicare plans during open enrollment to offset higher premiums.

- Refinance or pay down debt while rates remain high.

- Diversify income sources, such as part-time work or annuities.

- Revisit tax strategies to minimize withholding on benefits.

“The COLA isn’t a windfall; it’s a cushion,” said Christine Benz, director of personal finance at Morningstar. “Inflation protection requires ongoing planning, not just an annual raise.”

Looking Ahead to 2027

Forecasting groups such as the Committee for a Responsible Federal Budget expect the 2027 COLA to range between 2.4 % and 3.0 %, assuming inflation stabilizes. Still, advocates warn that modest increases could leave millions struggling if essential costs remain stubbornly high.

“A 2.8 % raise looks fine on paper,” said Johnson of the Senior Citizens League. “But when you walk into a grocery store, it feels like standing still.”

FAQ

Q: What is the 2026 COLA?

A 2.8 % cost-of-living adjustment effective January 2026, based on CPI-W inflation data.

Q: How much will retirees gain?

The average retired worker will receive about $56 more per month before Medicare and taxes.

Q: Why do experts call it insufficient?

Because seniors’ real costs—especially healthcare and housing—are rising 4 % to 6 %, outpacing the 2.8 % increase.

Q: Could the inflation formula change?

Congress may consider using CPI-E, but no legislation has advanced beyond committee.