Social Security Payments for Nov. 26 — Find Out Which Groups Receive Checks

The Social Security Payments for Nov. 26 represent the final scheduled benefit distribution for November 2025, completing the Social Security Administration’s (SSA) monthly cycle. These payments are issued to individuals whose birthdays fall between the 21st and 31st of any month.

As millions of retirees, disabled workers, and survivors approach year-end expenses and prepare for the 2026 cost-of-living adjustment, the timing of this late-month deposit plays a critical role in their financial planning.

Social Security Payments for Nov. 26

| Key Fact | Details |

|---|---|

| Payment Date | Wednesday, Nov. 26, 2025 |

| Eligible Group | Birthdays 21–31 |

| Number of Beneficiaries | 70+ million nationwide |

| Method | Direct deposit / Direct Express only |

| Next Adjustment | 2.8% COLA begins January 2026 |

Who Receives Social Security Payments for Nov. 26?

Birthdate Determines Eligibility

The SSA distributes monthly benefits according to the beneficiary’s birthdate. The Nov. 26 payment is assigned to individuals with birthdays falling between the 21st and 31st of the month. This includes beneficiaries of:

- Retirement benefits

- Social Security Disability Insurance (SSDI)

- Widow(er) and survivor benefits

- Spousal benefits

- Dependent benefits

This payment cycle is part of the Social Security schedule (KW2) established to streamline deposits and reduce system strain on financial institutions.

Why a Wednesday Distribution System Exists

Before 1997, the SSA issued all payments on the third day of each month, often overwhelming banks and delaying processing. A 1994 SSA task force report recommended staggered payments to reduce bottlenecks, distribute Treasury outflows more evenly, and improve fraud detection. Congress approved the change, and the modern Wednesday schedule was implemented in 1997.

Who Does Not Receive Payments on Nov. 26

Pre-May 1997 Beneficiaries

Individuals who began collecting Social Security before May 1997 follow a legacy payment system.

- Their November 2025 payment posted on Monday, Nov. 3.

- Their deposits remain tied to the third day of each month.

The SSA chose to preserve this structure to avoid disrupting long-established financial routines for older beneficiaries.

SSI Recipients and Dual Beneficiaries

Supplemental Security Income (SSI) does not follow the Wednesday schedule.

- SSI for November was paid Friday, Oct. 31 because the first day of November fell on a Saturday.

- Dual beneficiaries—those receiving both SSI and SSDI—receive two separate payments according to each program’s rules.

This distinction reflects the purpose of SSI, which supports low-income elderly and disabled individuals, including many who do not qualify for retirement benefits.

Understanding the Social Security Schedule (KW2)

Monthly Payment Structure

There are three standard Wednesday payments each month:

| Birthdate Range | Payment Week |

|---|---|

| 1–10 | 2nd Wednesday |

| 11–20 | 3rd Wednesday |

| 21–31 | 4th Wednesday (Nov. 26 group) |

This staggered structure reduces the likelihood of systemic delays, especially around federal holidays, banking closures, or periods of increased transaction loads.

Example Scenarios

To clarify eligibility:

- Example 1: A retiree born on April 23 receives the Nov. 26 payment.

- Example 2: A widowed spouse receiving survivor benefits born on Sept. 18 receives the Nov. 19 payment.

- Example 3: A disabled worker who began SSDI in 1995 receives their benefit on Nov. 3.

- Example 4: An SSI-only recipient does not receive a Nov. 26 payment at all.

Benefit Amounts and COLA Outlook (KW3)

Current Average Benefits

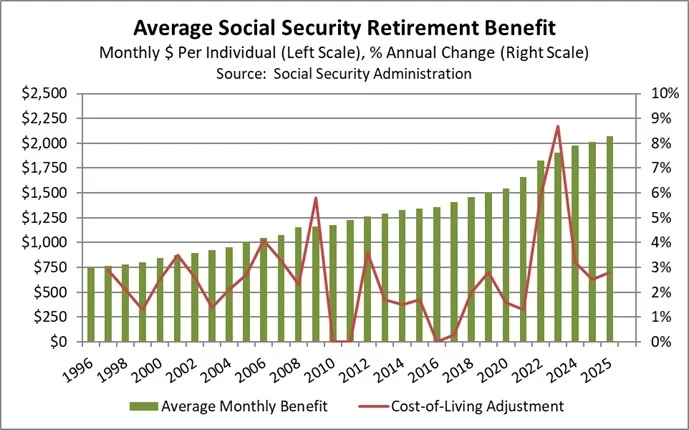

According to the SSA’s 2025 reports:

- The average retirement benefit is approximately $2,008 per month.

- The average SSDI benefit ranges from $1,500 to $1,700.

- Survivor benefits typically fall between $1,300 and $1,600.

Maximum benefits vary significantly depending on filing age:

- Filed at 62: Approx. $2,831

- Full retirement age (67): Approx. $4,018

- Filed at 70: Approx. $5,108

These figures differ by work history, earnings record, and claiming age.

COLA Adjustment Starting January 2026

The SSA has announced a 2.8% cost-of-living adjustment (COLA) for the coming year, reflecting inflation trends measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

- This translates to an average increase of about $56 per month for retirees.

Dr. Samuel Ortiz, a policy analyst at the Urban Institute, notes:

“While the 2.8% COLA is modest compared to earlier years, it helps offset rising medical and housing costs, which disproportionately affect older Americans.”

Economic Significance of the Nov. 26 Payment

Impact on Consumer Spending

The late-month payment arrives during a period of increased holiday purchasing. According to recent data from the Bureau of Labor Statistics (BLS), older households allocate a larger share of their budgets to healthcare, housing, and essential goods.

Regional Effects

States with higher concentrations of retirees—such as Florida, Maine, West Virginia, and Arizona—experience small but measurable increases in local spending following late-month Social Security deposits.

Economist Dr. Emily Raines of the National Bureau of Economic Research (NBER) explains:

“Social Security payments act as immediate economic stimuli. The Nov. 26 distribution will support local economies at a time when consumer momentum is crucial.”

Fraud Prevention, Safety Tips, and Payment Delays (KW4)

Increasing Holiday-Season Scams

The Federal Trade Commission (FTC) warns that Social Security-related fraud attempts rise during the holiday period. Common schemes include:

- Fake calls claiming benefits are “suspended”

- Text messages requesting “urgent verification”

- Phishing emails pretending to be from SSA

The SSA reiterates:

- It will not threaten benefit loss over the phone

- It will not request payment via gift cards or wire transfers

- It will not send unprompted links to update information

Troubleshooting Payment Delays

The SSA advises recipients to wait three business days if the Nov. 26 deposit does not appear. Delays usually result from:

- Recently changed bank accounts

- Outdated routing or account numbers

- Mismatched names on accounts

- Bank holiday slowdowns

- Suspicious-activity holds initiated by the financial institution

Beneficiaries can check their status via their mySocialSecurity online portal.

Related Links

COLA Cap Proposal Targets High-Earning Seniors — Here’s Who Might Lose Out

ATM Skimming Explained — How Thieves Drain Accounts and What Signs to Look For

Planning Ahead for December and 2026

December Payment Notes

December follow the usual Wednesday schedule, but SSI benefits for January will be released on Dec. 31 because Jan. 1 is a federal holiday.

Early 2026 Projections

As discussions continue in Congress about long-term Social Security funding, analysts expect renewed debates in early 2026 regarding payroll tax adjustments, benefit formulas, and trust-fund solvency.

As the Social Security Payments for Nov. 26 reach millions of Americans, the transition into the year’s final weeks highlights the critical role Social Security plays in household stability and economic activity. With the 2026 COLA on the horizon, beneficiaries will soon see adjustments reflecting ongoing cost pressures and broader economic trends.

FAQ About Social Security Payments for Nov. 26

Q: Who exactly receives Social Security Payments for Nov. 26?

Anyone with a birthday between the 21st and 31st receiving Social Security retirement, SSDI, or survivor benefits.

Q: Why didn’t I receive an SSI payment on Nov. 26?

SSI follows a different schedule and was paid early on Oct. 31.

Q: Does the Nov. 26 payment include the COLA increase?

No. COLA increases begin in January 2026.

Q: What if I changed banks recently?

Update your direct deposit information immediately. Late updates may cause delays.

Q: Will a government shutdown impact the Nov. 26 payment?

No. Social Security benefits are mandatory spending and continue regardless of shutdowns.