Social Security Announces Three Rule Changes — And One More That Could Reduce Your Raise

The Social Security Administration has announced three significant rule changes set to take effect in 2025 and 2026, affecting cost-of-living adjustments, taxable wage thresholds, and earnings limits for millions of Americans.

Officials and policy analysts warn that an additional change — rising Medicare premiums — may reduce the net increase beneficiaries receive. The updates come as Social Security faces long-term funding challenges and ongoing debates over its future.

Social Security Announces Three Rule Changes

| Key Fact | Detail |

|---|---|

| COLA for 2026 | 2.8% increase |

| Estimated Medicare Part B premium increase | Roughly 10% |

| Trust Fund depletion projection | 2034 |

| Working beneficiary earnings limit | Rising in 2025 |

| WEP/GPO repeal effects | Millions to receive higher checks |

Understanding the Social Security Announces Three Rule Changes

The SSA’s newly announced rules involve three main adjustments: the cost-of-living increase for benefits, changes to taxable earnings limits, and revisions to the earnings test for those who work while collecting benefits.

These changes are part of the routine annual update cycle, but their combined effect — along with rising Medicare premiums — underscores how benefit amounts are shaped by multiple interacting factors.

1. The Cost-of-Living Adjustment (COLA)

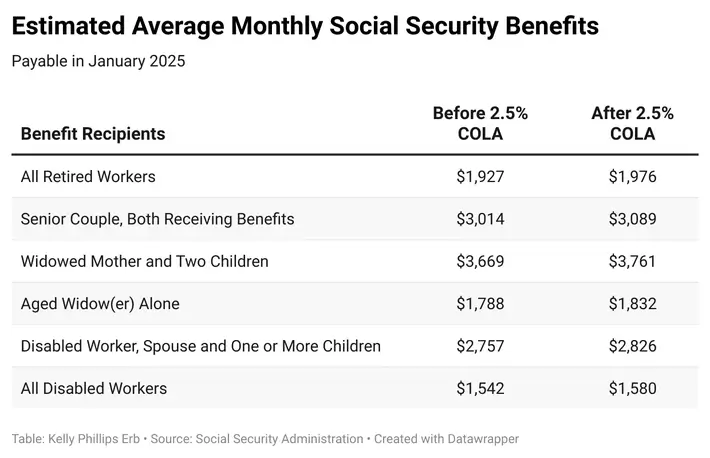

The COLA for 2026 will be 2.8 percent, a modest increase compared to the elevated adjustments seen during the recent inflationary period. The SSA calculates the COLA based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a standard inflation measure used since 1975.

Economists note that while inflation has eased, essential costs for older adults — such as food, rent, and medical care — have continued to rise faster than the broader CPI-W index. This sometimes causes real purchasing power to lag behind the nominal benefit increases.

What a 2.8% COLA means in practice

- A retiree receiving the average monthly benefit of roughly $2,000 would see an increase of about $56.

- For individuals on disability benefits or survivor benefits, the percentage increase applies similarly but varies based on their existing benefit structure.

2. Adjustments to the Taxable Earnings Base

Beginning in 2026, the maximum amount of earnings subject to Social Security payroll tax will rise. The exact figure will be released later by the SSA but is expected to follow the pattern of recent increases.

The taxable wage base is a key part of Social Security’s financial health because payroll tax revenue funds the majority of benefits. According to the SSA Trustees Report, expanding the taxable base slightly increases revenue while ensuring the system adjusts in line with rising national wages.

Workers earning above the new threshold will still pay Medicare tax but will not pay additional Social Security tax on income above the cap.

3. Changes to the Earnings Test and Full Retirement Age

For beneficiaries who work while collecting Social Security before reaching their Full Retirement Age (FRA), the earnings limit will increase in 2025. This allows individuals to earn slightly more without facing temporary benefit reductions.

The FRA continues to rise for those born after 1959, gradually moving toward age 67. This shift affects claiming strategies:

- Claiming benefits early results in a steeper reduction.

- Delaying benefits past FRA provides delayed retirement credits up to age 70.

Financial planners say that understanding both the earnings test and FRA timeline is essential for retirement planning.

4. The Hidden Change That Could Reduce Your Raise

While three SSA rule changes bring modest increases or adjustments, analysts warn that rising Medicare Part B premiums may significantly reduce the net increase beneficiaries receive in 2026.

According to MarketWatch, premiums are projected to rise by around 10 percent, from approximately $185 per month to about $202.90. Because Part B premiums are deducted directly from Social Security checks, the increase reduces the net benefit.

For example:

- A $56 COLA increase could shrink by $18–$20 after Part B deductions.

- For low-income beneficiaries, the impact could be more severe.

- Some individuals covered under Medicare Savings Programs may see minimal effects.

As Mary Johnson, a Social Security and Medicare policy analyst, explained, “Higher Medicare premiums often absorb a significant portion of the annual COLA, which can leave beneficiaries feeling like they received no effective increase at all.”

Background: Why Social Security Rules Change

These updates occur annually and are mandated by federal law. Several factors drive the changes:

Inflation and CPI-W Data

COLA adjustments are tied to the third-quarter CPI-W averages.

Wage Growth

The taxable wage base rises to reflect national earnings levels.

Program Solvency

Incremental adjustments help stabilize the system as the population ages.

The program currently provides benefits to more than 71 million people, including retirees, disabled workers, survivors and dependents.

Financial Impact on Different Groups

Low-income beneficiaries

More vulnerable to premium increases because their COLA raises are smaller in dollar terms.

Middle-income retirees

Experience moderate benefit increases but must budget for rising health-care costs.

High earners

Affected most directly by the taxable wage-base increase, which raises payroll tax exposure.

Working beneficiaries

Higher earnings limits provide modest flexibility, especially for part-time workers.

Experts Weigh In

Dr. Amelia Price, a public-policy scholar at Georgetown University:

“These changes reflect the balancing act of maintaining program solvency while protecting beneficiaries from inflation. The challenge remains that Medicare costs rise faster than Social Security benefits.”

John Redding, senior analyst at the Center for Retirement Research at Boston College: “Beneficiaries often focus on the COLA headline, but the true effect depends on net benefits — and those depend heavily on Medicare premiums.”

How These Changes Compare to Previous Years

- The 2.8% COLA is lower than the unusually high increases in 2022 and 2023.

- Premium increases have outpaced COLAs six times in the past decade.

- Earnings limit increases have followed a steady upward trend in line with wage growth.

Analysts note that the 2026 changes represent a “return to normal” following several volatile inflation years.

Legislative Context and Future Outlook

Congress continues to debate the long-term solvency of Social Security. Proposals under discussion include:

- Raising the payroll tax rate

- Lifting or eliminating the wage cap

- Adjusting benefit formulas

- Introducing means-testing

- Gradually increasing the FRA beyond 67

The SSA Trustees warn that without federal action, the program could face a depletion of reserves by 2034, resulting in across-the-board benefit cuts of approximately 20 percent.

However, lawmakers across political parties have expressed reluctance to reduce earned benefits.

Case Study: Net Benefit Impact on a Typical Retiree

Linda, a retired administrative worker in Ohio, receives $1,800 monthly in Social Security benefits. The 2.8% COLA would increase her check by about $50 per month. But if Medicare premiums rise by $17:

- Her net benefit increase falls to roughly $33

- Rising food and energy prices may offset this gain

- She may need to reduce discretionary spending

Financial analysts say Linda’s case is typical of many middle-income retirees.

Related Links

New York Announces November Tax Rebates — Homeowners May Receive $300 to $1,500

Walmart Settlement Update — Shoppers Could Be Eligible for Part of a $5.6 Million Payout

Practical Steps Beneficiaries Can Take

- Check your mySocialSecurity portal for updated benefit estimates.

- Review Medicare plan options, particularly if you face higher premiums.

- Consult with a financial planner to understand the best claiming strategy as FRA rules shift.

- Track inflation and budget accordingly, especially for prescription drugs and housing.

- Plan for additional deductions, including potential increases in Part D premiums or supplemental coverage.

The SSA’s three rule updates will help benefits adjust modestly to inflation and shifting wage levels, but rising Medicare premiums may limit how much of the increase retirees actually receive.

As policymakers continue to debate long-term reforms, beneficiaries face rising costs and uncertain economic conditions. Analysts say awareness and early planning remain the best tools for navigating these changes.