Social Security 2026 Rule Change — How Higher Earnings Will No Longer Reduce Your Benefits

A major adjustment for retirees and workers will take effect next year: the Social Security 2026 Rule Change. Under current rules, if you claim benefits before you reach your full retirement age (FRA) and continue working, your benefits can be reduced under the “earnings test.”

Now, beginning in 2026, the thresholds for the earnings test have been raised and for those who have reached their FRA there will be no earnings limit on work income while receiving benefits.

According to the SSA’s 2026 fact sheet, the annual exempt amount for beneficiaries under FRA all year will be $24,480, up from $23,400 in 2025. For individuals reaching FRA in 2026, the amount is set at $65,160. Most notably, for persons who are at or beyond full retirement age, “there is no limit on earnings.”

Understanding the Old Rule: The Earnings Test

What it was

Under the existing structure, the Social Security earnings test required that if you claim benefits and are under your FRA for the whole year, you face a limit on how much you can earn. For 2025, that annual limit was $23,400. Exceeding it triggers a reduction of $1 of benefits for every $2 of earnings above the limit.

If you reach your full retirement age during the year, a higher limit applies (for 2025 it was $62,160), and in those months before you attain FRA, $1 in benefits is withheld for every $3 of earnings above that limit.

Why it mattered

The earnings test existed to reduce the simultaneous receipt of full Social Security benefits and high employment income, thus preserving the integrity of the benefit system and encouraging recipients to remain in the labor force without “double-dipping.”

Also, the amounts withheld are not lost permanently: once you reach full retirement age, the SSA recalculates your benefit to credit the months in which benefits were withheld.

What’s New in Social Security 2026 Rule

Higher exempt amounts

For 2026, the threshold for working beneficiaries under full retirement age increases to $24,480 annually (or $2,040/month) up from the previous year. For those reaching their FRA during 2026, the limit rises to $65,160 annually (or $5,430/month) for months prior to attaining FRA.

No limit after FRA

The most significant change is that after you reach your full retirement age, you can earn any amount and still receive full Social Security benefits. The earnings test will no longer apply after the month you attain FRA.

Implications for working retirees

This means that retirees who continue to work full time or part time after FRA will no longer face benefit reductions due to earnings. For near-retirees, the raised thresholds provide more flexibility while still subject to the earnings test until FRA.

Who Will Benefit Most from Social Security 2026 Rule Change?

Workers near or at full retirement age

Individuals planning to continue working past FRA stand to gain the most. Under the new rule they no longer need to worry about how their job income will reduce their benefit checks.

Early retirees who still work

Those who have claimed benefits early and continue working before FRA still face the earnings test, but the higher exempt amounts give them greater room.

Part-time and gig economy workers

Retirees earning from freelance work, consulting or part-time employment will have improved flexibility under the 2026 rule change.

Expert Commentary

Dr. Emily Harris, associate professor of retirement income at the Center for Retirement Research, said:

“Raising the earnings test threshold and eliminating limits after full retirement age gives retirees more freedom to continue working without fear of lost benefits.”

She added that while the change is positive:

“It doesn’t change how your initial benefit is calculated — it simply removes one constraint.”

Broader Context: Funding and Long-Term Trends

Social Security fiscal pressures

While the earnings test changes increase flexibility, they do not address long-term funding concerns for the Social Security program. According to the Actuarial Note, the trust fund depletion date is projected around 2034-2035 unless reforms are made.

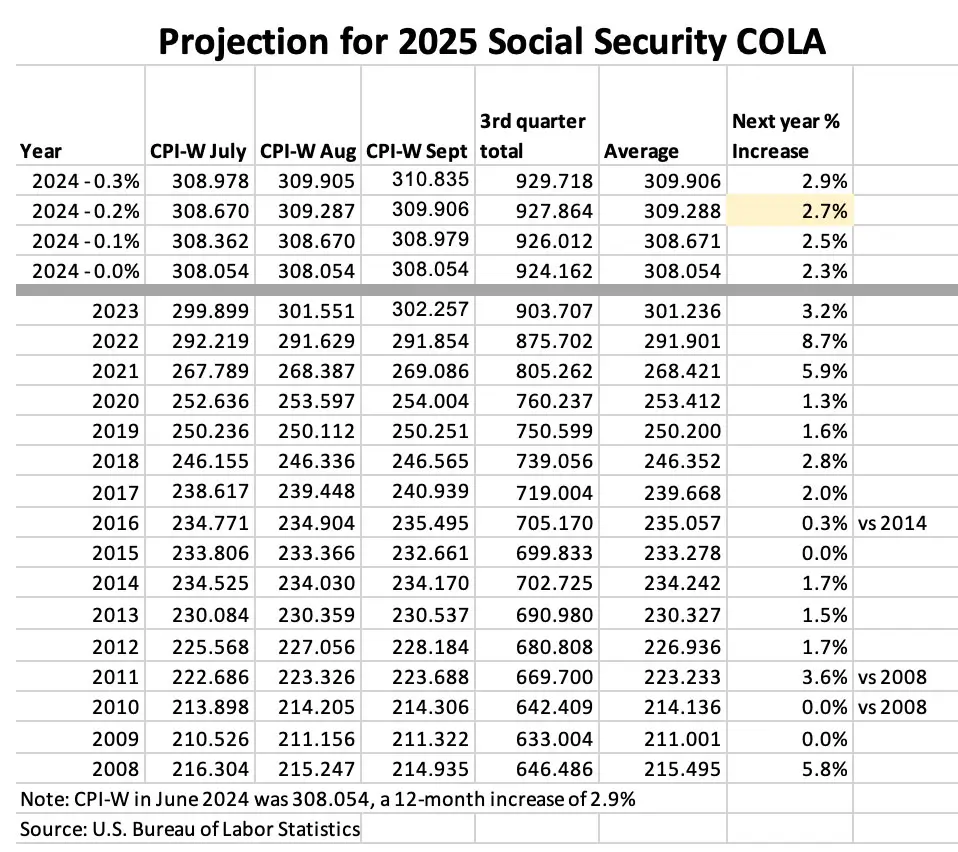

Link with other 2026 updates

Other 2026 changes include a 2.8% cost-of-living adjustment (COLA) with increased taxable maximum earnings ($184,500 up from $176,100) for Social Security tax contributions.

Related Links

What You Should Do Now

- Check your full retirement age (FRA) using the SSA chart.

- If you plan to work while collecting Social Security, review your projected earnings and how they interact with the 2026 exempt amounts.

- If you’ve reached FRA, you can now plan to work without concern for earnings reducing your benefit starting in the month you attain FRA.

- Open or log into your “my Social Security” account to review benefit statements and monitor any work earnings you report.

- Consult a retirement-income advisor if you have complex income sources (self-employment, rental income) that may affect benefit taxation or Medicare premiums.

The Social Security 2026 Rule Change represents a meaningful shift for retirees and near-retirees who continue working: once you reach full retirement age, your earnings will no longer reduce your benefits. While it doesn’t change how benefits are calculated or solve long-term funding challenges, it does provide substantially improved flexibility for older Americans balancing work and retirement.

FAQ About Social Security 2026 Rule Change

Q1. Does the rule change mean my benefits will never be reduced for working?

No. The change applies only once you reach your full retirement age. If you work before FRA, you remain subject to the earnings test.

Q2. Do I need to take any action to have the new rule apply?

No. The SSA will automatically apply the 2026 exempt amounts. However, you should monitor your earnings and file accurate estimates if required.

Q3. Will this change raise my monthly benefit amount?

Not directly. It removes the barrier of benefit reduction for earnings after FRA. The benefit formula itself remains unchanged.

Q4. Are there tax implications of working more while claiming Social Security?

Yes. Higher earnings can still affect how much of your Social Security is taxable and may influence Medicare premium brackets, even though benefits will not be withheld after FRA.