New York Announces November Tax Rebates — Homeowners May Receive $300 to $1,500

The New York Announces November Tax Rebates takes effect this November as the School Tax Relief (STAR) Program disburses one-time payments ranging from US$300 to US$1,500 to eligible homeowners across New York State.

Announced by Kathy Hochul and the New York State Department of Taxation and Finance (NYS DTF), the relief is designed to ease the burden of soaring property and school taxes amid rising living costs. The payments form part of the state’s broader affordability strategy for nearly 3 million homeowners.

New York Announces November Tax Rebates

| Key Fact | Detail/Statistic |

|---|---|

| Total recipients | Nearly 2.83 million homeowners statewide |

| Total budget | Around US$2.2 billion in relief funds |

| Payment range | Most homeowners: US$350-US$600; Seniors (Enhanced STAR): up to US$1,500 |

| Eligibility income cap for Enhanced STAR | US$107,300 (2023 income) for seniors |

Understanding the New York Announces November Tax Rebates

The term “New York Announces November Tax Rebates” refers to the STAR tax rebate payments issued by New York State under the School Tax Relief Program. The program has two main components: Basic STAR and Enhanced STAR. Basic STAR applies broadly to eligible homeowners, while Enhanced STAR targets homeowners aged 65 or older who meet stricter income limits.

Under this year’s rollout, homeowners eligible for Basic STAR can expect payments generally in the US$300-US$600 range. Those qualifying for Enhanced STAR, especially seniors on fixed incomes, may receive rebates up to US$1,500 depending on their school tax burden and district rates.

The payments are either issued as credits/checks or applied as exemptions against school-district property tax bills, depending on how the homeowner is enrolled.

Why the State Is Offering the November Tax Rebates

New York’s reimbursement through STAR is meant to address two key pressures: rising property and school taxes, and the cost-of-living squeeze facing many households.

Governor Hochul said:

“The STAR program provides needed school tax relief to millions of New York homeowners … putting money back in the pockets of families.”

A tax policy expert at Cornell University, Dr Amy Chernoff, noted:

“STAR rebates serve as one of the largest targeted property-tax relief tools in New York State and are especially helpful for fixed-income homeowners.”

By allocating approximately US$2.2 billion and directing relief to the nearly three million homeowner households, the state aims to bolster affordability and prevent homeowner‐displacement in high-tax districts.

Eligibility Criteria and How November Tax Rebates Will Be Made

Who Qualifies

- Basic STAR: Homeowners whose property is their primary residence and whose combined income (owners + spouses) is up to US$500,000.

- Enhanced STAR: Homeowners age 65 or older (or turning 65 in the year) with 2023 income not exceeding US$107,300.

- Home must be in New York State and properly enrolled in the STAR program. New homeowners or those who have not registered must apply via the state portal.

How Payments Are Delivered

Eligible homeowners receive the benefit in one of two ways:

- STAR Credit: A check or direct deposit from the NYS DTF.

- STAR Exemption: A reduction on the school tax bill for those still under exemption option.

Timing of Payments

Distribution is phased according to school tax due dates. According to the July 2025 announcement:

- Phase 1 (tax due dates June/July) completed in select regions.

- Phase 2 (due dates August–October) will continue into November.

Homeowners should check the “STAR Credit Delivery Schedule” on the state site.

Regional and Financial Breakdown

According to state data, in the current cycle the relief funds are allocated regionally as follows:

- Long Island: ~US$698.4 million → ~582,000 recipients

- Mid-Hudson Valley: ~US$488.5 million → ~404,000 recipients

- New York City area: ~US$158.6 million → ~483,000 recipients

- Central & Western New York, Finger Lakes, and other regions share the remainder

This distribution underscores how more than half the budget is concentrated in the high-tax downstate and Hudson Valley regions.

Impact on Homeowners and Housing Affordability

For many homeowners, these rebates offer meaningful relief. A payment of US$1,500 for a senior homeowner, for example, can cover multiple months of utility bills or a significant portion of a school-tax line item.

Michael O’Brien, of the Real Estate Board of New York (REBNY), observed:

“While US$300 may seem modest in the New York context, for many middle-income families or senior homeowners it can represent a tangible reduction in tax strain and help maintain homeownership.”

However, the benefit size varies by district tax rates, property value and homeowner income. Critics note that in districts with extremely high school taxes, even the top rebate may not fully offset annual increases.

Comparison with Previous Years & Changes

The STAR program has existed since 1997 under New York Real Property Tax Law §425, but recent iterations have adjusted income caps, delivery methods and benefit distributions.

In previous years, payments were largely exemption-based. Now, more recipients receive checks or direct deposits, intended to speed relief. The July 2025 announcement indicates more inclusive eligibility for seniors due to the raised income cap of US$107,300.

As affordability pressures grow, state officials indicate the program may evolve with inflation indexing or broader eligibility in the future.

Limitations and Things to Know

- The rebate only applies to the STAR portion of school tax burdens; other property tax components (town, county, municipal) may still rise.

- Homeowners must be enrolled in the correct programme; unregistered individuals may miss payments.

- Some relief amounts are credited to tax bills rather than issued as direct checks.

- Homeowners should verify their entry in the programme and update their direct deposit or mailing address ahead of the distribution schedule.

- District-by-district differences mean the precise amount may vary widely — check the official lookup tool.

Expert Perspectives & Broader Fiscal Context

Dr Rubin Patel, a fiscal policy analyst at the Rockefeller Institute of Government, noted:

“Property tax relief through targeted programmes like STAR offers short-term respite, but long-term affordability depends on managing school and municipal tax growth.”

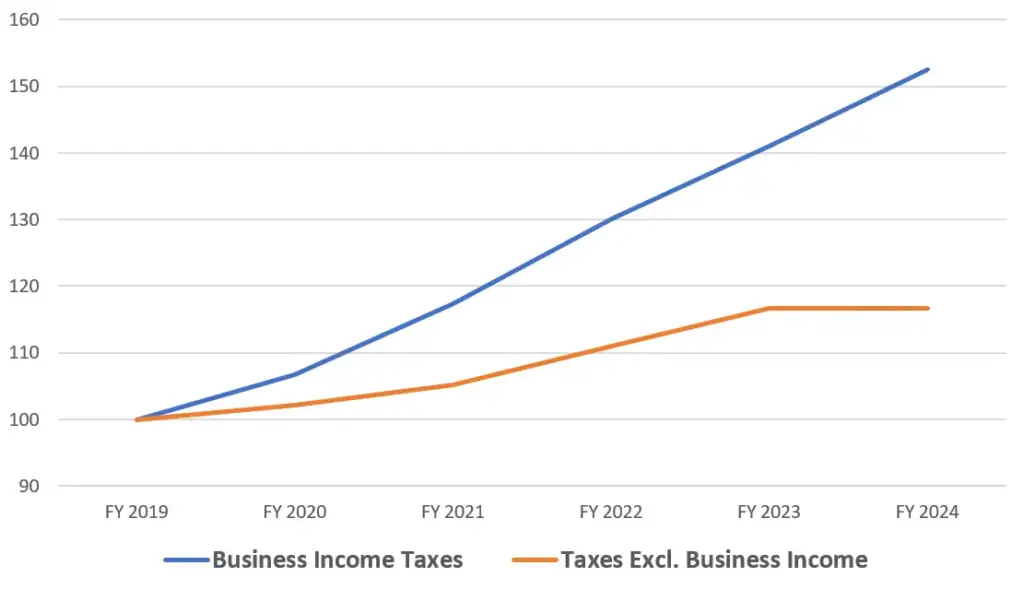

From a budgetary viewpoint, the US$2.2 billion funding is part of New York’s 2025–2026 budget package and reflects rising state revenue amid inflation and sales-tax buoyancy.

Some critics argue that the relief does not substitute for structural property-tax reform. Others point out that the majority of benefits go to homeowners, not renters, thereby excluding non-owners facing similar cost pressures.

Related Links

What Homeowners Should Do

- Visit the official STAR portal at ny.gov/STAR to check eligibility and delivery schedule.

- Confirm registration for either Basic or Enhanced STAR, and ensure your status is current.

- Check and update your direct deposit or mailing address so payment delivery is not delayed.

- Monitor the STAR Credit Delivery Schedule and your region’s tax-due date to anticipate when you’ll receive payment.

- Consider that while the rebate is helpful, it may not fully counterbalance rising taxes — budgeting accordingly is prudent.

The New York Announces November Tax Rebates represents a major relief initiative for New York State homeowners facing mounting property and school taxes. With nearly US$2.2 billion allocated and up to US$1,500 disbursed to eligible homeowners, the programme reinforces state efforts to ease affordability pressures.

While the rebate is not a comprehensive fix to high tax burdens, the streamlined delivery and scale of the programme underscore a meaningful step in fiscal relief. Homeowners should ensure their eligibility and enrollment details are up to date to receive the benefit when it arrives this November.

FAQ About November Tax Rebates

Q. Do I need to apply for the rebate?

A. Homeowners already enrolled in STAR typically do not need to apply; new homeowners must register via the portal.

Q. When will the checks be delivered?

A. Checks or credits start with regions whose school tax bills are due earliest (June/July) and continue through November for later deadlines.

Q. Can renters receive a payment?

A. No. The rebate is for homeowners whose primary residence is in New York State and enrolled under the STAR programme.

Q. Is the payment taxable?

A. No. The rebate is a property tax relief benefit and is not treated as taxable income.