New Trump–Xi Agreement in the Works to Avoid 100% Tariffs—Global Markets on Edge

The tentative trade framework between the United States and China marks a critical inflection point for global commerce. As both nations step back from the brink of a 100 % tariff escalation, the world’s markets, industries, and governments are watching closely—balancing cautious optimism with concern over lingering strategic and economic uncertainties.

New Trump–Xi Agreement in the Works

| Key Fact | Detail / Statistic |

|---|---|

| U.S. tariff rate on Chinese imports under deal | Reduced to ~47 % from ~57 % |

| Tariff on fentanyl-related goods | Cut to 10 % from 20 % |

| Rare-earth export controls | China agrees one-year pause on new controls |

| Global markets reaction | Cautious optimism; still many open risks |

What the Agreement Entails

Understanding the “New Trump–Xi Agreement in the Works” Framework

The deal between the U.S. and China establishes a temporary truce in their increasingly volatile bilateral trade war, according to officials. It aims to prevent the threatened escalation to 100 % tariffs on Chinese imports.

Under the terms:

- The U.S. will reduce tariffs on certain Chinese goods—most notably those tied to fentanyl precursor chemicals—from 20 % to 10 %. The overall U.S. tariff on Chinese imports thus falls to around 47 % from 57 %.

- China commits to resume significant purchases of U.S. soybeans and other agricultural goods.

- China will pause the implementation of its new export-control regime on rare earth minerals and magnets for one year, easing a major source of friction.

- Both countries will suspend certain shipping-port and logistical levies for 12 months.

Why Markets Are on Edge

The global economic community is watching this “New Trump–Xi Agreement in the Works” agreement with interest. Many corporations and investors had been planning for the worst—such as full-scale tariffs or supply-chain disruptions. The deal brings relief but also leaves uncertainties.

Analysts note several areas of caution:

- The arrangement is described as a tactical truce, not a full resolution of structural trade issues.

- Key issues remain unresolved, including Chinese industrial subsidies, advanced-technology export controls, and U.S. national-security concerns.

- The one-year pause means markets must assess whether this is durable or merely a breathing space.

Markets responded with muted relief: equities modestly improved, but volatility remains elevated as businesses consider what deeper changes will follow.

Business and Trade Flow Implications

For U.S. exporters—especially in agriculture—the prospect of renewed Chinese purchases offers a tangible boost. The restoration of soybean trade alone could strengthen rural economies dependent on China as a major buyer.

For Chinese exporters and high-tech supply chains, the rare-earth export-control pause reduces the risk of sudden disruptions. But firms engaged in semiconductors, aerospace or next-generation electronics remain exposed to future policy shifts.

Background and Significance

Why the Deal Matters

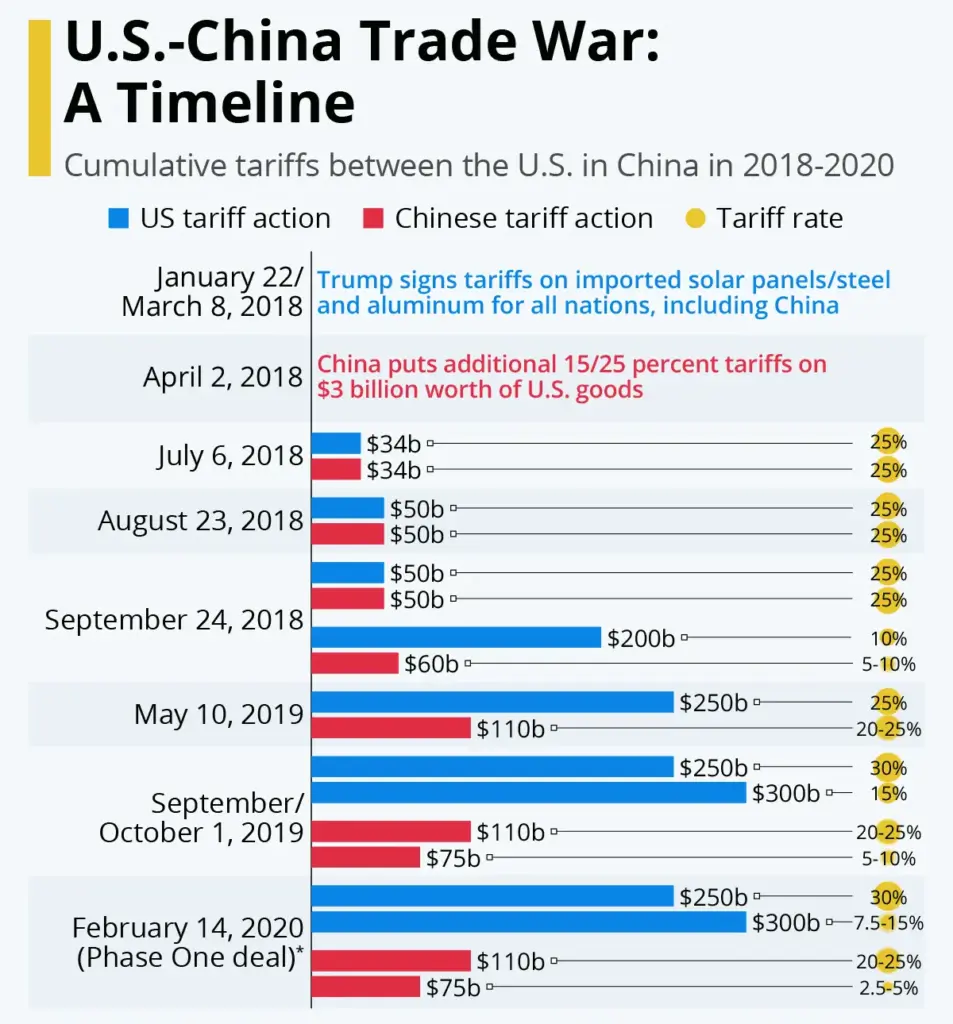

This agreement arrives against a backdrop of escalating pressure: earlier in 2025 the U.S. threatened sweeping tariff increases on Chinese goods, and China threatened export restrictions on minerals used in high-tech manufacturing.

By establishing the “New Trump–Xi Agreement in the Works” framework, the U.S. and China essentially stepped back from the brink of a full-scale trade war. The potential impact spans global supply-chains, commodity markets and corporate planning.

Remaining Risks and Strategic Challenges

Even with this deal, several obstacles persist:

- U.S. concerns about China’s high-tech ambitions, subsidies and industrial strategy remain largely unaddressed.

- China retains leverage via rare-earth minerals and global value chains, meaning future bargaining power is intact.

- Domestic political pressures in both countries could destabilize the arrangement: U.S. protectionists may object to any perceived concession; China may resist deeper structural changes.

- The deal covers about one year, making the next twelve months a key test of durability.

What Comes Next

Implementation begins immediately, but the road ahead includes several milestones:

- Finalising detailed regulatory and licensing changes related to the tariff reductions and export-control pauses.

- Monitoring the fulfilment of Chinese commitments to agricultural purchases and rare-earth flows.

- Watching for the scheduled April 2026 U.S.–China summit, which may test the permanence of the truce. (The summit is widely expected though not officially confirmed.)

- Observing whether this agreement leads to broader negotiations on deeper structural issues or simply postpones them.

Why It Matters to You

For consumers and businesses, this “New Trump–Xi Agreement in the Works” trade deal may ease import-cost pressures, improve supply-chain predictability and reduce risk of sudden escalation. Farmers in states heavily tied to exports can gain clarity on the Chinese market outlook.

For investors, the truce reduces one major geopolitical risk but does not eliminate it. The durability of the deal, its scope beyond one year, and the handling of unresolved issues will shape emerging opportunities and threats.

In Summary

The “New Trump–Xi Agreement in the Works” deal between the U.S. and China marks a significant step away from heated trade-war escalation—tariffs will be reduced, certain export-controls will pause, and Chinese agricultural purchases will resume.

But the arrangement is a tactical pause, not a comprehensive solution. With major issues left unresolved, global markets remain on edge as the world’s two largest economies test whether this can become a lasting strategic reset.