Homebuyers Face Record $63000 Down Payments — New State Assistance Programs Launch in TX, CA, and FL

If you are trying to buy a home right now, it probably feels like every headline is stacked against you. When you see that Homebuyers Face Record $63000 Down Payments, it is not just a scary number on a screen; it is the concrete wall between you and the front door of your own place. In many markets, the monthly mortgage is not the real problem the hardest part is pulling together enough cash upfront while rents, groceries and everything else also cost more.

At the same time, there is another story that gets far less attention. While typical down payments have climbed to record territory, states like Texas, California and Florida are quietly rolling out and expanding programs designed specifically to help you clear that hurdle. New grants, zero‑interest second loans, and special first‑time‑buyer products are all aimed at one thing: making sure that even though Homebuyers Face Record $63000 Down Payments, they do not have to shoulder that entire burden alone.

Homebuyers Face Record $63000 Down Payments

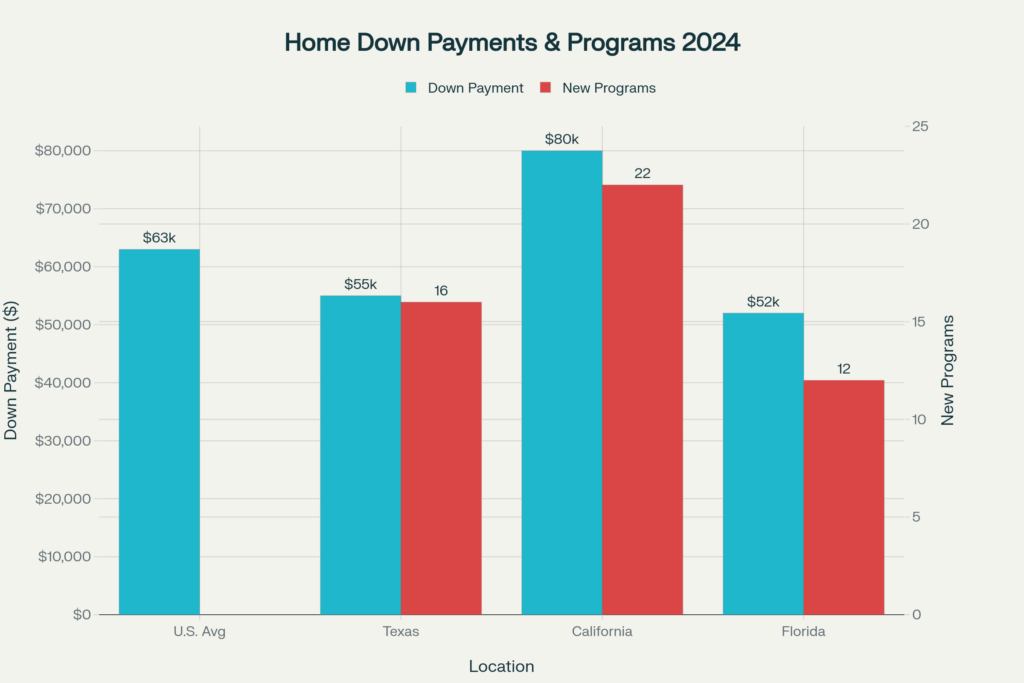

In late 2024, the typical U.S. buyer was putting down just over sixty‑three thousand dollars about sixteen percent of the purchase price up noticeably from the prior year. That jump reflects a mix of higher home prices and a market where sellers often favor buyers who can bring more cash to the table, seeing them as “safer” and less likely to run into financing issues.

For first‑time buyers, that is brutal. A renter does not have equity from a previous sale to roll into a new home, so every dollar of that down payment has to come from savings, side hustles, family gifts, or some combination of all three. That is exactly why state‑level help in TX, CA and FL is getting so much attention in 2025.

2025 Down Payment Trends

Big picture, the affordability story is a tug of war. On one side, you have rising home prices, higher down payments and stubborn mortgage rates that keep monthly costs elevated. On the other, you now have more structured help than ever before, particularly targeted at down payments and closing costs rather than just interest rate “buys downs.”

What is new in 2025 is the sheer number of assistance options. Tracking services that monitor these programs report record availability, with dozens of new offerings added in just the last few quarters alone. In other words, while Homebuyers Face Record $63000 Down Payments at the headline level, the support network underneath that figure has also grown dramatically.

How Down Payment Assistance Actually Works

Most down payment assistance programs share a common goal: reduce the amount of cash you need to bring to closing without blowing up your monthly payment. The money usually comes in one of three forms:

- A true grant that never has to be paid back if you meet basic conditions, like living in the home for a set number of years.

- A zero‑interest or low‑interest second mortgage with no monthly payments, due only when you sell, refinance or pay off the first loan.

- A fully amortizing second loan with a modest rate that spreads the added cost over many years.

To qualify, you generally need to:

- Buy a primary residence, not an investment property.

- Stay within local income and purchase‑price limits.

- Use an approved lender and complete a homebuyer education course.

The payoff can be huge. If a program covers, say, 3–5 percent of the price, it can easily chop tens of thousands of dollars off what you personally need to save, which matters a lot in a world where Homebuyers Face Record $63000 Down Payments on paper.

New Support In Texas, California And Florida

Here is where things get more encouraging. Texas, California and Florida have become three of the most important states for buyers trying to bridge the down‑payment gap. Each has a web of statewide and local programs that stack on top of federal options like FHA, VA and USDA loans.

In Texas, state housing agencies and local partners offer grants and deferred‑payment loans that can be layered with FHA or conventional financing. Many Texas buyers use these to cover the entire minimum down payment plus a chunk of closing costs, turning a once impossible number into something manageable.

California, with some of the highest home prices in the country, leans heavily on tools like “silent second” loans. These are second mortgages that sit quietly in the background with no monthly payment until you sell or refinance, often covering 3–3.5 percent of the purchase price for eligible first‑time buyers. At the same time, newer initiatives focused on first‑generation homeowners aim to give families who have never owned before a leg up in markets that might otherwise shut them out.

Florida’s main housing agency coordinates multiple down‑payment and closing‑cost programs, including zero‑interest second mortgages that can reach up to around $10,000 for qualifying borrowers. For many Florida buyers, that is enough to get over the last hump—especially when combined with a low‑down‑payment FHA, VA or conventional loan product.

Why Cash Buyers And Loan Type Matter

- One reason it feels so tough, even if you earn a decent income, is competition from cash buyers. In some recent periods, nearly a third of all home purchases nationwide were all‑cash deals, particularly in hotter markets and investor‑heavy areas. When a seller sees one offer with a large cash down payment and another contingent on financing with limited funds, the cash offer often wins.

- This is where choosing the right loan type matters. Government‑backed programs like FHA and VA were built to expand access to homeownership. FHA allows down payments as low as 3.5 percent, and many down‑payment‑assistance programs are specifically designed to pair with FHA loans. VA loans, for eligible service members and veterans, often require no down payment at all, and can still be combined with certain assistance programs to help with closing costs. When Homebuyers Face Record $63000 Down Payments in headlines, using these tools smartly can dramatically lower the real amount you need to bring to the table.

Record Growth In Assistance Programs

Behind the scenes, the infrastructure for helping buyers is expanding. Indexes that track homebuyer assistance report that more than 2,600 programs are active nationwide, with dozens added just in recent quarters and new providers joining the ecosystem. A growing share of these do at least one of the following:

- Serve repeat buyers as well as first‑timers.

- Focus on first‑generation homeowners.

- Target specific professions such as teachers, nurses or first responders.

- Support alternative property types like manufactured homes or new construction.

For you, this means it is increasingly likely there is something you qualify for—even if you earn more than a strictly “low income” wage, or if you have owned a home in the past but are re‑entering the market after several years of renting. The challenge is not that nothing exists; it is knowing where to look and how to combine programs without overcomplicating your purchase.

What This Means If You Are Buying Soon

If you plan to buy within the next 12–24 months, the worst move is assuming the headline number applies directly to you with no help available. Start by getting clear on three things:

- Your realistic budget – Not just what a bank might approve, but what monthly payment you can live with comfortably.

- Your minimum down‑payment target – Based on loan type (FHA, VA, conventional) and whether you want to avoid or reduce mortgage insurance.

- Your assistance options – State and local programs in TX, CA or FL, plus any employer or lender‑sponsored grants.

Social Security Update — New Deadline Set That Could Affect Your Future Payments

With those pieces in place, you can build backward. Maybe you only need to save half of that scary number yourself and lean on assistance for the rest. Maybe a combination of a smaller home, a slightly different neighborhood and a stacked set of programs gets you into the market years sooner than waiting to save a full 20 percent. In a housing landscape where Homebuyers Face Record $63000 Down Payments, the buyers who win are often the ones who do the paperwork and research, not just the ones with the highest salaries.

FAQs on Homebuyers Face Record $63000 Down Payments

1. Do I really need a full $63000 to buy a home now?

Not necessarily. That figure is a national typical down payment, not a rule. Depending on your loan type and where you buy, you may be able to put down as little as 3–5 percent.

2. How do I find down payment assistance programs in my state?

A smart starting point is your state housing finance agency website, which usually lists statewide programs and often links to local city and county options.

3. Can I use assistance if I am not a first‑time buyer?

4. What is the single best step I can take today if I know down payment is my biggest obstacle?

The most practical move is to pair a detailed savings plan with a list of assistance programs you are likely to qualify for.