Five Social Security Rule Changes Coming Soon — What Retirees Need to Know

The Social Security Administration (SSA) will implement five major rule changes beginning in late 2025 and continuing into 2026, affecting benefit amounts, payment delivery, taxation rules, earnings limits and wage-base thresholds.

These updates—referred to collectively as the Five Social Security Rule Changes changes—will influence how retirees receive and manage their monthly payments. Understanding these adjustments is essential for seniors who rely heavily on Social Security for income stability.

Five Social Security Rule Changes

| Change | What’s Changing | Effective Period |

|---|---|---|

| COLA Increase | 2.8% benefit increase for 2026 | January 2026 |

| Paper Check Phase-Out | Shift to electronic payment methods | Late 2025 |

| Higher Wage Base | More earnings subject to payroll tax | Tax year 2026 |

| Earnings Limit Adjustment | Higher thresholds for working retirees | 2026 |

| New Tax Deduction | Additional tax relief for seniors 65+ | Tax year 2026 |

Understanding the Five Social Security Rule

The Five Social Security Rule Changes refers to the group of five significant rule adjustments scheduled for implementation by the SSA. These changes aim to modernize payment systems, adjust taxes and earnings rules for wage growth, improve benefit accuracy and expand tax relief for some retirees.

While not a comprehensive reform, the updates reflect a broader attempt to align Social Security with economic and demographic realities.

Change #1 — 2.8% COLA Increase for 2026

Background and Economic Context

Social Security benefits will rise by 2.8% in January 2026, following an inflation measurement period based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This Cost-of-Living Adjustment (COLA) is slightly higher than the previous year and attempts to preserve retirees’ purchasing power amid price increases.

Impact for Retirees

- Average benefits will rise from roughly $2,015 to $2,071, an increase of about $56 per month.

- Higher COLAs do not necessarily mean retirees “come out ahead,” as health-care costs—especially Medicare Part B premiums—continue to rise faster than inflation.

Why COLA Still Matters

The COLA mechanism is critical for older Americans because retirees are more vulnerable to inflation-driven increases in food, housing and medical expenses. Without COLA, Social Security income would decline in real value over time.

Change #2 — End of Paper Check Payments

What’s Changing

By late 2025, the SSA will discontinue nearly all paper check payments. Beneficiaries will instead receive monthly payments through:

- Direct deposit, or

- The Direct Express® prepaid debit card, issued through the U.S. Treasury.

Why This Matters

The Treasury Department has promoted electronic payments for more than a decade, citing benefits that include:

- Faster deposit times

- Lower fraud risk

- Fewer lost or stolen checks

- Greater administrative efficiency

Concerns for Vulnerable Groups

Some seniors, particularly in rural areas or those without reliable internet access, may struggle with the transition. This raises issues for:

- Older adults without bank accounts

- Individuals who rely on physical mail

- Beneficiaries uncomfortable with digital financial tools

The SSA has pledged additional outreach, including phone support and local field office assistance, to help affected groups transition smoothly.

Change #3 — Higher Taxable Earnings Cap for Workers

What’s Changing

The maximum earnings subject to Social Security payroll taxes—known as the taxable wage base—will increase from $176,100 in 2025 to $184,500 in 2026.

Implications for Workers

- High-income workers will pay more payroll tax.

- Individuals earning above the new threshold will not see those extra wages count toward retirement benefits.

- Workers nearing retirement may see the increase improve their 35-year earnings average, which can raise future benefits.

Why It Matters for the Program

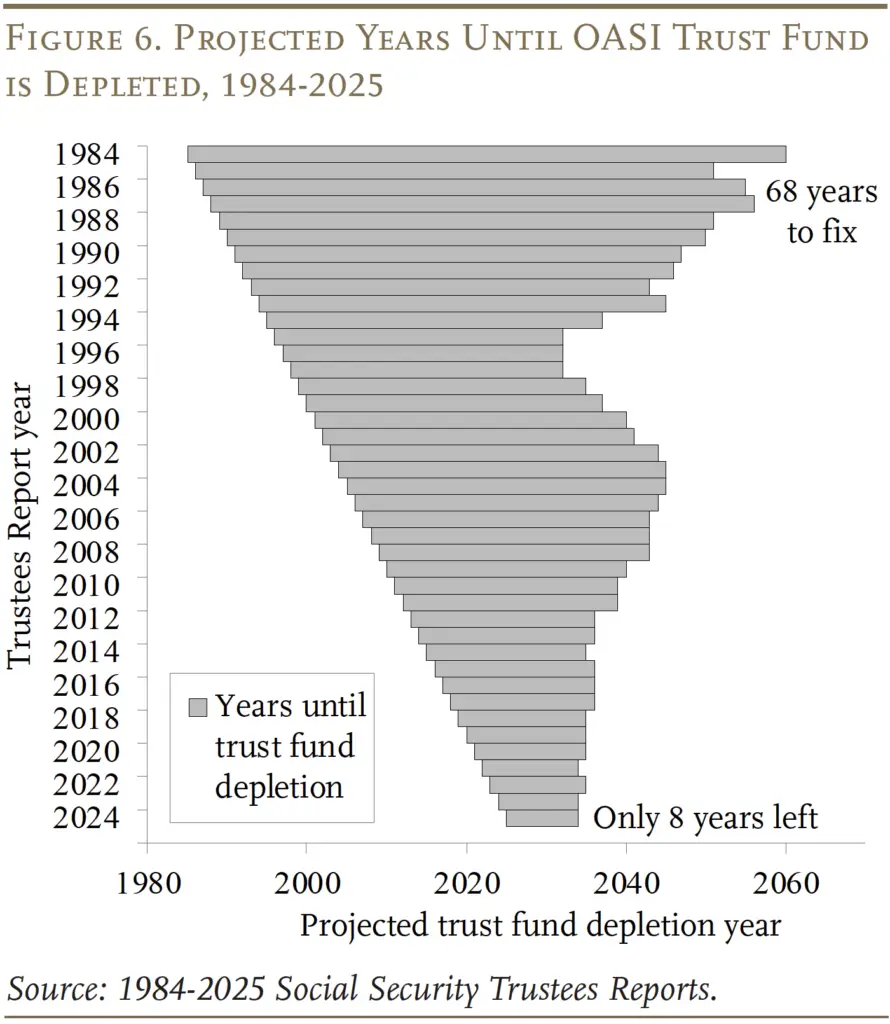

The change increases SSA revenue at a time when the trust fund faces long-term financial strain. Current projections show the Old-Age and Survivors Insurance (OASI) Trust Fund may face depletion around 2033–2034 without legislative action.

Change #4 — Higher Earnings Limits for Working Beneficiaries

Background

Retirees who claim benefits before reaching full retirement age (FRA) are subject to the Retirement Earnings Test (RET). Benefits may be temporarily reduced if annual earnings exceed prescribed limits.

What’s Changing in 2026

- The annual limit will rise from $22,320 (2025) to $24,480 (2026).

- In the year that a worker reaches FRA, the threshold will increase as well, meaning more income can be earned without penalty.

Who Benefits

Retirees who work part-time or continue participating in the labor force—an increasingly common trend—will benefit. The retirement landscape is shifting as more older Americans:

- Work longer,

- Delay full retirement, and

- Seek supplemental income due to rising costs.

Key Clarification

No earnings limits apply once you reach full retirement age.

Change #5 — New Tax Deduction for Retirees 65 and Older

Overview

Beginning in tax year 2026, the IRS will allow a new deduction of up to $6,000 for eligible seniors (with income limits) when calculating taxable Social Security benefits.

Who Qualifies

- Single filers with MAGI up to $75,000

- Married couples filing jointly with MAGI up to $150,000

Partial deductions may apply for higher incomes.

Policy Significance

The deduction represents a targeted attempt to provide relief for older adults facing financial strain. However, economists caution that lowering revenue from benefit taxation may contribute to future trust-fund shortfalls unless paired with broader reforms.

Additional Relevant Changes and Considerations

Medicare Premium Increases and Net-Benefit Impact

Although technically separate from Social Security, Medicare premium increases can offset much of the COLA boost. For 2026, projections suggest a 10% rise in Medicare Part B premiums, reducing retirees’ net monthly benefit.

Fraud and Scam Risks Amid the Transition

Shifts in payment methods and new benefit rules increase fraud exposure. The SSA warns retirees to avoid:

- Requests for fees to switch payment methods

- Calls asking for Social Security numbers

- Websites pretending to mimic official SSA platforms

Scammers often target older adults during rule-change periods.

Digital Divide Concerns

Mandatory electronic payments may disadvantage seniors without:

- Internet access

- Bank accounts

- Digital literacy

Organizations like AARP are calling for targeted support to prevent benefit disruptions in vulnerable regions, especially in rural states.

Long-Term Solvency and Future Policy Debates

While the five rule changes adjust operational procedures and benefits, they do not address long-term solvency concerns. Lawmakers continue debating options such as:

- Raising the payroll tax rate

- Increasing or eliminating the taxable wage cap

- Modifying benefit formulas

- Adjusting full retirement age

These conversations are likely to intensify as the projected trust-fund depletion date approaches.

What Retirees and Future Beneficiaries Should Do Now

1. Review benefit statements

Check your “my Social Security” account to verify earnings history and projected benefit amounts.

2. Update payment information early

Switch from paper checks to electronic payments before mandated deadlines.

3. Consider working strategies

Understand how the new earnings limits affect part-time or post-retirement employment plans.

4. Evaluate tax implications

Determine whether the new $6,000 deduction applies to your income situation.

5. Consult a professional

An accredited financial planner or retirement adviser can help interpret the changes based on your personal income, assets and health-care costs.

Related Links

Two Social Security Payments Arriving This Week — One Group Receives an Extra Deposit

$725 Monthly Benefit Continuing Through 2026 — Check If You Qualify

Expert Commentary

Dr. Teresa Ghilarducci, economist and retirement specialist:

“These rule changes are important but incremental. Retirees are dealing with rising costs, and even modest policy adjustments can make meaningful differences in financial security.”

Jason Fichtner, former SSA Chief Economist:

“Many of the updates reflect long-term shifts in the labor market and technology. But they also highlight the need for comprehensive Social Security reform to address structural funding issues.”

As the implementation dates for the Five Social Security Rule Changes changes approach, retirees should monitor official SSA communications and verify that their payment methods, tax plans and earnings expectations align with the new rules.

While these adjustments are not sweeping reforms, they represent meaningful updates capable of influencing how older Americans manage their retirement income in the years ahead.