Alaska PFD Update — Over 600,000 Residents Set to Receive $1,000 Payments This Year

The State of Alaska confirmed that over 600,000 residents will receive $1,000 Permanent Fund Dividend (PFD) payments beginning in October 2025. The Alaska PFD Update reflects the government’s effort to balance rising public-service costs, fluctuating oil revenues, and the long-standing policy of sharing state resource wealth with its residents.

Alaska PFD Update

| Key Fact | Detail |

|---|---|

| PFD Amount | $1,000 per eligible applicant |

| Estimated Recipients | 600,000+ residents |

| First Payment Date | October 2, 2025 (direct deposit) |

| Prior-Year PFD | $1,702 (2024 payout) |

| PFD Formula Value (if applied) | About $3,900 |

Understanding the Alaska PFD Update

The Alaska PFD Update describes the state’s annual Permanent Fund Dividend distribution, a program established to ensure that Alaskans benefit directly from oil- and mineral-resource revenues. The fund, managed by the Alaska Permanent Fund Corporation, invests a portion of oil royalties and distributes a dividend annually to qualified residents.

The PFD system, created in 1976 and first paid in 1982, is internationally recognized as one of the most enduring examples of a universal basic-income-style resource dividend.

Payment Amount and Timeline

How Much Residents Will Receive

The 2025 dividend is set at $1,000, one of the lowest payouts in the past decade. The prior year’s payment was $1,702, and several earlier distributions exceeded $3,000 when supplemental energy rebates were included.

Officials state that the amount reflects “responsible balancing of the state budget” during a period of reduced oil revenue and increased spending obligations.

Payment Schedule

- October 2, 2025: First direct-deposit payments for applicants listed as “Eligible–Not Paid” by Sept. 18.

- October 23, 2025: Second round for both direct deposit and paper-check applicants eligible by Oct. 13.

- November–December 2025: Additional monthly batches for later-verified applicants.

Eligibility Requirements for Alaska PFD Payment

Residency Rules

To qualify, individuals must:

- Have lived in Alaska for the entire 2024 calendar year.

- Intend to remain an Alaska resident indefinitely.

- Not claim residency in another U.S. state or foreign country.

Absence Limits

Applicants must have been physically present in Alaska for most of the year. Certain absences up to 180 days are permitted, including:

- Active-duty military service

- Full-time postsecondary education

- Medical treatment

- Competitive sports (for qualifying minors)

Criminal Eligibility Restrictions

Felony convictions can disqualify applicants for that year’s PFD. Certain misdemeanor sentences may also result in partial or full forfeiture.

Child Eligibility

Children are eligible when a qualifying parent or guardian files on their behalf.

How the State Determines the PFD Amount

The Statutory Formula vs. Legislative Appropriations

Historically, the PFD was calculated using a statutory formula tied to the five-year average earnings of the Permanent Fund. But since 2016, lawmakers have set the amount annually through the budget process.

If the original formula had been used in 2025, the dividend would have been nearly $3,900. Instead, the payout was set at $1,000 to maintain fiscal stability.

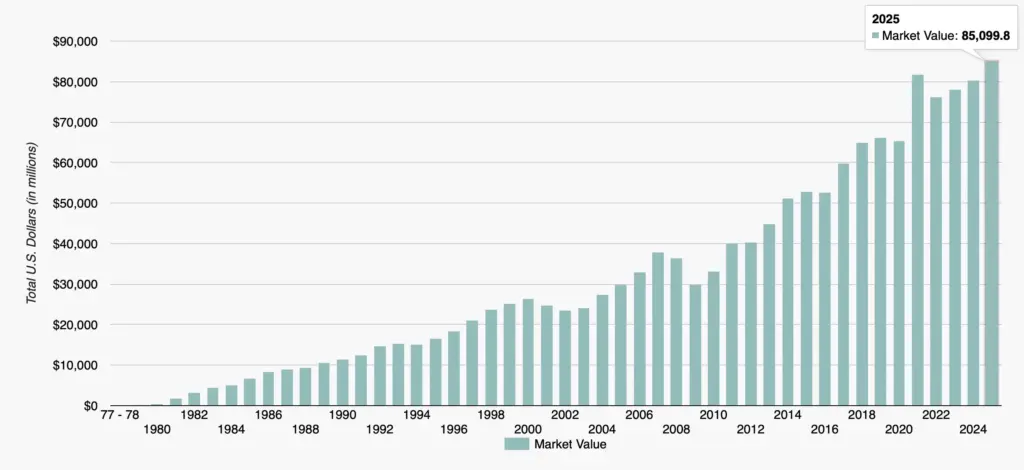

Performance of the Permanent Fund

The fund is valued at $74 billion, making it one of the largest sovereign-wealth funds in the world. Annual investment returns directly influence PFD funding capacity, but withdrawals are capped to preserve long-term growth.

Oil-Revenue Declines

Alaska’s North Slope oil fields—once among the most productive in the U.S.—have experienced falling production levels for more than three decades. Slower output means fewer royalty deposits into the fund.

Economic and Social Impact

Household Relief in a High-Cost State

Alaska has some of the highest living costs in the United States. Remote villages face grocery prices that can be two to three times higher than national averages. A $1,000 PFD often supports:

- Heating fuel purchases

- Food supplies

- Winter clothing

- Travel to medical appointments

- School expenses for children

Boost to Local Economies

Economists note that PFD payments generate a short-term spending surge each fall. Local businesses in Anchorage, Fairbanks, and rural hubs experience noticeable increases in:

- Retail sales

- Travel bookings

- Restaurant traffic

- Automotive services

Concerns About Inequity

Some lawmakers and researchers argue that a flat payment disadvantages residents in remote regions where costs are highest. Others argue that funding public services instead of a large dividend could provide broader benefits.

Government and Public Reactions

Legislative Response

Lawmakers remain split on the payout amount. Fiscal conservatives argue that Alaska must prioritize budget stability, while others argue the state should restore the statutory formula.

Public Reaction

Many residents expressed disappointment at the lower amount compared to previous years. Others appreciated that the payment still provides meaningful support during a period of rising energy costs.

Expert Commentary

Dr. Emily Foster, an economist at the University of Alaska Anchorage, notes:

“The PFD remains a powerful stabilizer for household budgets, especially in rural areas. But declining oil revenues mean the state will continue facing difficult trade-offs.”

Long-Term Policy Considerations

Debates Over the Future of the PFD

The state continues to debate whether:

- To restore the full statutory formula

- To adopt a 50/50 model splitting revenues between dividends and government services

- To introduce new revenue sources to sustain higher dividends, such as a sales tax or income tax

Impact of Energy Transition

As global economies shift away from fossil fuels, Alaska is exploring new revenue sources:

- Carbon-offset leasing

- Renewable-energy investments

- Natural-gas export markets

- Responsible tourism and mining expansion

Whether these options will stabilize the PFD remains uncertain.

What Residents Should Do Now

Verify Application Status

Residents should check their myPFD status and update any missing documentation immediately.

Prepare Direct-Deposit Information

Incorrect routing or account numbers can delay payments by weeks.

Beware of Scams

Officials highlight that the state never asks for personal banking passwords or unsolicited verification. Fraudulent texts and emails spike around distribution season.

Related Links

Social Security Increase for 2026 — Steps You Must Take Now to Get the Updated Payment on Time

New York Expands Its Tourism Push — State Joins Major Cities to Showcase Itself at IMEX America 2025

As Alaska prepares to distribute the 2025 Permanent Fund Dividend, households across the state await a benefit that has become both a financial support and a symbol of shared resource wealth. While the payout is smaller than in many previous years, it reflects the state’s effort to balance fiscal responsibilities with longstanding commitments to residents.

The months ahead will reveal whether Alaska can sustain this balance in an era of shifting energy markets and evolving budget priorities.

FAQs About Alaska PFD Update

1. Do I need to repay the PFD if I move out of Alaska?

No, as long as you met eligibility requirements for the year of the payment.

2. Will the payment be taxed?

Yes. The Internal Revenue Service considers the PFD taxable income.

3. Are undocumented residents eligible?

No. Applicants must be lawful U.S. residents who meet Alaska residency rules.

4. What happens if my application was marked ‘Incomplete’?

You must resolve the issue before the cutoff date for your payment batch, or your payment is delayed.

5. Can the PFD be garnished?

Yes. Child-support enforcement, federal debt collection, and court judgments may reduce or seize the dividend.