A New $5,251 Monthly Social Security Benefit Is Now Possible — But Only If You Meet These Key Requirements.

In 2026, the maximum Social Security monthly benefit could reach $5,251 — but only under specific conditions. To qualify for this substantial payout, individuals must have had a high earnings record over 35 years and delay their claims until age 70. Here’s a closer look at the requirements to unlock this benefit.

Understanding the $5,251 Monthly Social Security Benefit

The Social Security Administration (SSA) has confirmed that for individuals retiring in 2026, it will be possible to receive a monthly benefit as high as $5,251. This represents the maximum payout available under the system. However, qualifying for this substantial amount requires meeting strict financial criteria.

The $5,251 figure applies only to those with significant lifetime earnings and who claim their benefits at age 70, which is the latest eligible age for maximising benefits. Understanding the necessary conditions to reach this amount is critical for individuals planning their retirement.

The Path to $5,251: Key Requirements

Earnings History: A Crucial Factor

To be eligible for the maximum Social Security benefit in 2026, one must have earned the maximum taxable income for 35 years. This income is subject to Social Security taxes, which for 2026, will be capped at $184,500.

The benefit is calculated based on the highest-earning 35 years of an individual’s career, adjusted for inflation. If there are fewer than 35 years of full earnings, the SSA averages in zeros for the missing years, which can significantly reduce the monthly benefit.

Example: For individuals who earned close to or at the maximum taxable earnings throughout their careers, the maximum benefit is achievable. Conversely, those with fewer years of high earnings will see a lower benefit.

Waiting Until Age 70

While Social Security benefits can be claimed as early as age 62, claiming benefits before reaching full retirement age (FRA) leads to a permanent reduction in the monthly benefit. Full retirement age varies by birth year but generally ranges between 66 and 67.

To receive the maximum possible payout, individuals must wait until age 70 to begin their benefits. This strategy increases the monthly benefit by about 8% per year for each year of delay beyond FRA, up until age 70.

For instance, if someone’s FRA is 66 and they delay claiming their benefits until age 70, they would receive 132% of the base amount they are entitled to, maximising their lifetime payout.

Impact of Social Security Payouts on Retirement Planning

Balancing Benefits with Other Retirement Income Sources

The maximum $5,251 Social Security benefit might be a goal for some, but it’s important to remember that this amount will likely represent only a portion of an individual’s total retirement income. Experts recommend that individuals aim to have other savings, such as through employer-sponsored retirement plans (e.g., 401(k) or pension plans), personal savings, or investments, to ensure a comfortable lifestyle after retirement.

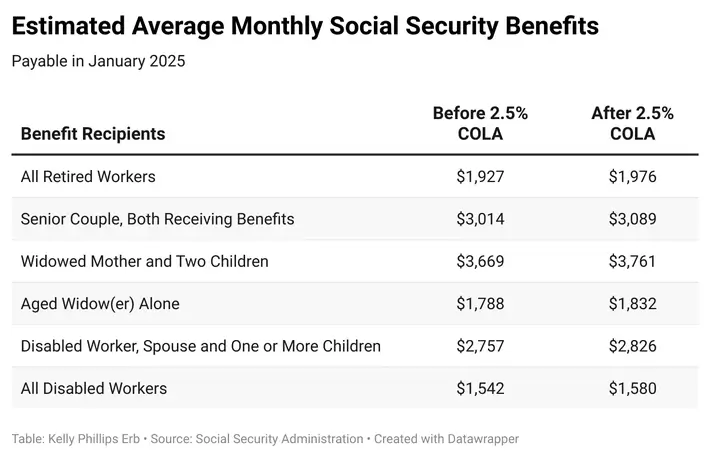

It is also vital to consider the cost-of-living adjustments (COLA), which can affect the purchasing power of the benefit. For example, if inflation rates are high during a given year, the actual purchasing power of the $5,251 may be less than it appears on paper.

What Happens if You Claim Early?

For many, the decision to claim early is unavoidable due to financial necessity or health issues. However, claiming Social Security benefits before full retirement age can result in a permanent reduction in the monthly payout.

For every year you claim early, the benefit is reduced by 5/9 of 1% per month until you reach FRA, after which the reduction stabilises. This could lead to receiving far less than the $5,251, even with substantial lifetime earnings.

What Happens if You Don’t Meet the Criteria?

Even if individuals do not meet all of the requirements for the maximum Social Security benefit, there are still steps they can take to maximise their payments.

- Working Longer: Individuals who have fewer than 35 years of high earnings should consider working longer to fill in any gaps.

- Increasing Contributions: Maximising annual earnings or working a few extra years can help increase the average indexed monthly earnings, which directly influences the benefit.

Retirement experts also recommend consulting with a financial planner to develop a strategy for managing income in retirement and integrating Social Security into a broader financial plan.

Examples of How Social Security Benefits Work

Example 1: High-Earner Retiree

John, 65, earned the maximum taxable amount for the past 35 years, and plans to retire at age 70. He will likely qualify for the maximum benefit of $5,251 per month, as his career earnings and delayed retirement meet all criteria.

Example 2: Early Claiming

Sita, 62, earned an average income during her career, but she needs to retire early for health reasons. She plans to claim Social Security at age 62. However, her monthly benefit will be significantly lower than the $5,251 maximum because of the permanent reduction for claiming early.

Current Proposals for Social Security Reform

Despite Social Security’s importance, its future is under scrutiny. Some experts warn that the trust fund, which finances Social Security benefits, could run into challenges in the coming decades due to demographic shifts, especially the aging Baby Boomer generation.

In response, lawmakers are considering several reforms to ensure the system’s long-term sustainability. Proposals include gradually increasing the retirement age, adjusting the Payroll Tax cap to include higher earners, or revising the benefit formula to reflect a different balance between the working population and retirees. While these discussions are ongoing, retirees need to be prepared for potential changes.

Related Links

Advice from Experts: Maximising Your Social Security Benefit

To maximise your Social Security benefits, experts recommend:

- Delaying Claims: The longer you wait to claim, the higher your monthly benefit will be. However, the decision should be based on your personal circumstances.

- Assessing Other Savings: Since Social Security alone may not be enough for a comfortable retirement, contributing to savings and investments is crucial for future financial security.

- Consulting a Financial Planner: A retirement plan is unique to each individual. Professionals can help assess personal situations and strategize for the most beneficial approach to Social Security and retirement planning.

Maximising Your Social Security Benefit

Achieving the maximum Social Security benefit of $5,251 per month in 2026 is a challenging yet achievable goal for individuals who meet the stringent earnings and age requirements. Planning ahead and delaying benefits until age 70 are crucial steps to securing this higher payout.

However, it is essential for retirees to remember that Social Security benefits should form part of a wider retirement strategy, supplemented by personal savings and investments. By understanding the rules and planning accordingly, retirees can make the most of what Social Security offers while preparing for their financial future.