2026 Social Security Increase Set — But Will Higher Medicare Part B Costs Reduce Your Raise?

For 2026, Social Security beneficiaries are finally getting some good news: a confirmed cost‑of‑living adjustment (COLA) that will push monthly checks higher. On the surface, that sounds like much‑needed relief after years of stubborn inflation in groceries, housing, and healthcare. But there’s a catch. Medicare Part B premiums are also jumping sharply in 2026, and that increase will be taken straight out of your Social Security before the money ever hits your account. So yes, your benefit is going up but the real question is how much of that raise you actually get to keep.

This tug‑of‑war between a higher Social Security benefit and rising Medicare costs is exactly what worries many retirees heading into 2026. A percentage increase on paper is not very comforting if most of it disappears into medical premiums and deductibles. For people on fixed incomes, every dollar counts, and understanding how these two moving parts Social Security and Medicare Part B interact is critical for planning your budget, avoiding nasty surprises, and knowing whether your “raise” is real or mostly technical.

2026 Social Security Increase

| Key Item | 2025 | 2026 | What It Means For You |

|---|---|---|---|

| Social Security COLA | Lower COLA | 2.8% COLA | A modest raise to reflect inflation |

| Average retired worker benefit (gross) | Lower starting point | Higher average benefit, up by around mid‑double digits | More money on paper before deductions |

| Standard Medicare Part B premium | About mid‑$180s/month | Just above $200/month | Nearly 10% jump in the premium |

| Part B annual deductible | Mid‑$250s | Low‑$280s | You pay more out of pocket before Medicare pays |

| Share of COLA lost to Part B | — | Roughly one‑third of the raise for many people | Net benefit increase is much smaller |

| Hold harmless protection | In effect for eligible beneficiaries | Still in effect | Helps some low‑benefit recipients avoid a negative net change |

However, Medicare Part B is the other half of the story. Premiums for 2026 are climbing at a much faster rate than Social Security benefits close to a double‑digit percentage jump. Because most retirees have those premiums deducted directly from their Social Security checks, the increase acts like a built‑in clawback on your raise. The result: the 2026 Social Security Increase Set may feel underwhelming when you see your actual deposit in January.

How The 2026 Social Security Raise Really Looks After Medicare

When you look at percentages, a 2.8% COLA sounds reasonable, especially coming after years when increases were lower or inflation was running hot. But Medicare Part B premiums are jumping much faster than that close to 10%. A smaller percentage increase on a big benefit and a large percentage jump on your premium is exactly how your raise starts to shrink. Think of it this way: Social Security might add something like $50–$60 a month to a typical benefit, but Medicare Part B can easily claim almost $18 of that in higher premiums alone. By the time the deduction is taken, your “raise” is suddenly more like $35–$40 in real new money. For retirees with smaller checks, the impact is harsher, because that flat premium hike is taking a bigger slice of a smaller pie. Some people could see their effective COLA drop close to 1% or even have almost no extra spending room at all.

Why Medicare Part B Premiums Are Jumping So Much

Medicare Part B premiums are not set randomly; they’re based on formulas that try to match expected program costs. In recent years, outpatient care, doctor visits, and new treatments have all become more expensive. Healthcare inflation often runs ahead of general inflation, and 2026 is no exception. As these costs climb, premiums follow. Another piece of the puzzle is how care is delivered. More services and medications are shifting from inpatient hospital settings to outpatient facilities and clinics. That means more of the spending lands in Part B instead of hospital insurance, which also pushes premiums up. When you put that together higher usage, more expensive treatments, and structural shifts in how care is billed it’s easier to see why Part B is rising so much faster than the 2026 Social Security Increase Set.

Hold Harmless: Who It Protects and Who It Doesn’t

- The “hold harmless” rule is one of the most important but least understood protections built into the Social Security and Medicare system. In simple terms, it says that for most people who have their Part B premium withheld from their Social Security, a premium increase cannot cause their net Social Security payment to go down. If the Part B hike is bigger than the COLA, the premium increase gets capped.

- That sounds like full protection, but it has limits. Hold harmless generally does not protect new Medicare Part B enrollees, higher‑income beneficiaries who pay surcharges, or people who pay premiums directly instead of through Social Security. Those groups can feel the full force of the premium jump, even if their Social Security COLA is modest. And even for those shielded by hold harmless, it doesn’t magically create extra money; it just prevents a cut. The 2026 Social Security Increase Set still gets chipped away just not enough to push your check below last year’s level.

What This Means For Your Monthly Budget In 2026

From a household‑budget perspective, the key question is simple: how much will actually hit your bank account after Medicare pulls its share? For many retirees, the answer will be “more than last year, but less than it sounds like.” That might still be enough to keep up with some price increases, but probably not all especially when groceries, rent, and utilities are all stubbornly high.

This is why it’s useful to think of your benefit in two lines: gross Social Security and net Social Security after Medicare premiums. The 2026 Social Security Increase Set improves the first line, but Medicare significantly drags on the second. If you build your budget on the gross figure, you risk overestimating how much you can comfortably spend each month. Taking the time to calculate your likely net amount can help you avoid relying on money that will never actually arrive.

How To Prepare Now for The 2026 Changes

- Preparation starts with knowing your numbers. Look at your latest benefit statement, note your current monthly gross amount, and apply the approximate 2.8% COLA to estimate your 2026 figure. Then subtract the new, higher standard Part B premium. The result is a realistic preview of your actual monthly deposit once the 2026 Social Security Increase Set and Medicare changes kick in.

- Once you have that estimate, adjust your budget accordingly. You might decide to trim some discretionary expenses streaming subscriptions, dining out, travel or re‑prioritize what gets paid first every month. During Medicare open enrollment, it also makes sense to compare plans. While you cannot escape the standard Part B premium by switching plans, you may be able to lower your total healthcare costs by finding a better fit on drug coverage, copays, or Medicare Advantage options, as long as you’re comfortable with the trade‑offs.

Trump’s Sudden Reversal on Disability Cuts: Why the SSA Plan Was Pulled and What Happens Now

Long‑Term Planning Beyond 2026

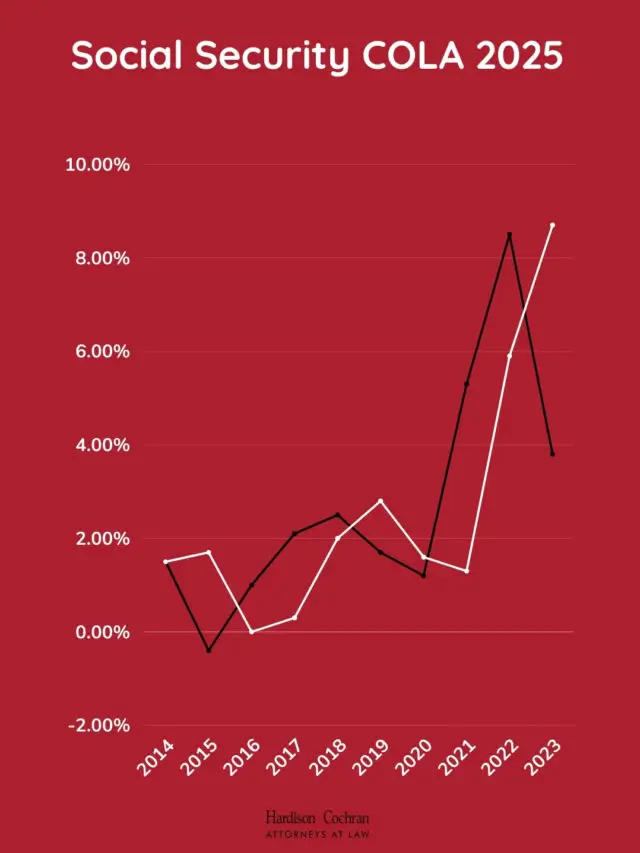

The pattern you’re seeing in 2026 moderate Social Security increases and faster‑rising healthcare costs is not likely to be a one‑year anomaly. Historically, medical inflation tends to outpace general inflation, and that erodes purchasing power for retirees over time. The 2026 Social Security Increase Set helps, but it does not fully solve this long‑term squeeze.

If you have savings or investments, this is a good reminder that relying solely on Social Security may not be enough to maintain your lifestyle. Keeping at least part of your portfolio positioned for long‑term growth, while still managing risk, can help offset the impact of future Medicare increases and other rising costs. Even small, steady gains over time can make a big difference when your primary guaranteed income source is growing more slowly than your key expenses.

By understanding how these pieces fit together, estimating your true net benefit, and adjusting your budget and Medicare choices accordingly, you put yourself back in control. You cannot change the COLA formula or the Part B premium, but you can respond wisely so that more of that 2026 raise actually ends up working for you, not just for your healthcare bills.

FAQs on 2026 Social Security Increase

Q1. Will I actually see more money in my bank account in 2026?

Q2. How much of my 2026 Social Security raise will Medicare Part B take?

Q3. Could my Social Security check actually go down in 2026?

If you’re covered by the “hold harmless” rule and have your Part B premium deducted from Social Security, your net check generally cannot be lower than last year, even with the big premium hike.

Q4. Is there anything I can do to reduce the impact of higher Medicare costs?

Q5. Will this pattern of modest Social Security increases and faster Medicare hikes continue?

Healthcare costs have historically risen faster than overall inflation, so it is likely that future years will see similar pressure, with Medicare premiums often growing quicker than Social Security benefits.