Proposal for a $200 Monthly Social Security Increase Under Review — Why Approval Remains Uncertain

A proposal in the U.S. Senate that would provide a $200 monthly increase to Social Security benefits for the first half of 2026 is now under formal review, but its future remains uncertain due to fiscal constraints, administrative hurdles, and a lack of bipartisan support.

The measure, tied to the $200 Monthly Social Security Increase, would affect more than 70 million Americans if approved.

$200 Monthly Social Security Increase

| Key Fact | Detail |

|---|---|

| Proposed Increase | $200/month for 6 months (Jan–Jun 2026) |

| Bill Name | Social Security Emergency Inflation Relief Act (S.3078) |

| Affected Groups | Retirees, SSDI, SSI, Veterans, Railroad Retirement beneficiaries |

| Status | Introduced; not yet scheduled for full vote |

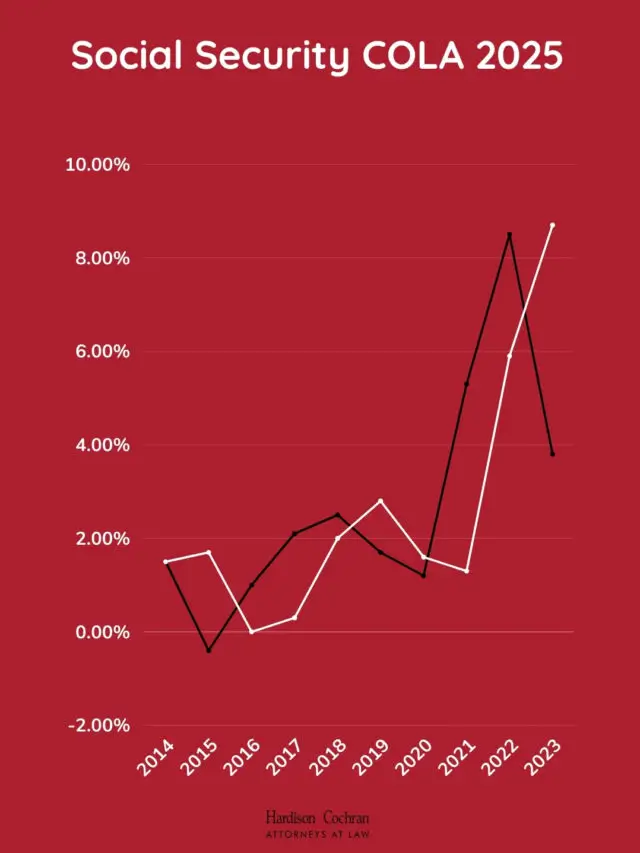

| COLA 2026 | 2.8% increase (approx. $56/month) |

What the $200 Monthly Social Security Increase Proposal Includes

The $200 Monthly Social Security Increase proposal centers on providing a temporary $200 per month benefit boost to eligible Social Security recipients for six months beginning in January 2026. Lawmakers describe it as an “emergency inflation relief measure” aimed at offsetting expenses that have risen faster than seniors’ income.

Sponsors argue the existing 2.8% Cost-of-Living Adjustment does not fully reflect true inflation for seniors, who experience disproportionate increases in medical and housing costs. The supplemental payment is tax-free and would not count as income for Medicaid, SNAP, or other means-tested programs.

Why Supporters Say the Supplemental Payment Is Necessary

Supporters—including several senior-advocacy groups—argue that inflation has eroded purchasing power faster than adjustments can compensate.

Inflation has outpaced Social Security benefits

Healthcare costs are up 7–9% annually, depending on the category. Housing and utilities have also increased faster than national averages.

Retirees rely heavily on Social Security

Roughly 40% of older Americans depend on Social Security for half or more of their income; 20% rely on it for 90% or more.

Rising medical and prescription-drug costs

Medicare-related expenses remain the largest financial burden for retirees, and Medicare Part B premiums have risen in 12 of the last 15 years.

Supporters note that even the 2026 COLA—while welcomed—is insufficient compared to the real inflation seniors experience.

Why Approval Remains Uncertain

The proposal is appealing politically, but several fiscal and legislative factors limit its prospects.

1. Cost and impact on federal spending

A six-month payment of $200 for all eligible recipients would cost roughly $70–75 billion, based on SSA beneficiary numbers.

With federal deficits already projected to exceed $1 trillion annually, lawmakers from both parties are increasingly cautious about unfunded expenditures.

2. Trust-Fund solvency concerns

The Old-Age and Survivors Insurance (OASI) Trust Fund is projected to become insolvent by 2033–2034 without changes. Though the supplemental payment would be funded by general federal revenue—not the trust fund—critics argue it diverts focus from long-term solvency solutions.

3. Lack of bipartisan support

While Senate Democrats are backing the bill, Republicans have raised concerns about its cost and its temporary nature. A senior Republican aide told reporters:

“If Congress is serious about helping retirees, we need structural reforms, not election-year bonuses.”

4. Administrative challenges

Even if passed, implementing a rapid six-month nationwide payment requires coordination across SSA, Treasury, Veterans Affairs, and the Railroad Retirement Board.

Historical Precedent — Emergency Boosts Have Been Issued Before

This proposal would not be the first time the federal government approved special payments to Social Security recipients.

- 2009: Congress approved a one-time $250 Economic Recovery Payment for seniors.

- 2020–2021: Seniors received three rounds of stimulus checks, though those were not Social Security–specific.

Advocates cite these precedents as proof that temporary relief can be administratively feasible.

Alternative Proposals on the Table

Instead of a temporary $200 increase, lawmakers have proposed other reforms:

The Social Security 2100 Act (Democratic proposal)

Would expand benefits permanently and increase payroll taxes on higher earners.

Bipartisan Solvency Framework (Republican-leaning proposal)

Would gradually raise the full retirement age and modify the benefit formula.

Cost-of-Living Adjustment Reform

Several economists endorse switching from CPI-W to a CPI-E formula that reflects senior spending habits more accurately.

What Retiree Advocacy Groups Are Saying

AARP (American Association of Retired Persons)

AARP has not endorsed the bill but acknowledges that current benefits “have not kept up with inflation for several years.”

National Committee to Preserve Social Security and Medicare (NCPSSM)

The organization supports the $200 increase but warns that it cannot replace long-term solvency reforms.

The Senior Citizens League (TSCL)

TSCL strongly favors the supplemental payment and reports record levels of financial stress among retirees.

White House Position

The White House has not formally endorsed the bill but expressed general support for “efforts that protect retirees from inflation.” However, administration officials also note the importance of “responsible budgeting” and long-term Social Security solvency—signaling neutrality rather than advocacy.

What Happens Next — Realistic Legislative Timeline

Scenario 1: Passed in late 2025 (20–25% likelihood)

- Payments begin January 2026.

- SSA issues guidance by November 2025.

Scenario 2: Bill stalls but revives later (30–35% likelihood)

- Could merge with broader Social Security reform legislation.

Scenario 3: Denied or expires in committee (40–50% likelihood)

- No additional payments; retirees receive standard COLA only.

Most analysts consider passage possible but not probable without significant political momentum.

Related Links

New York Announces November Tax Rebates — Homeowners May Receive $300 to $1,500

Walmart Settlement Update — Shoppers Could Be Eligible for Part of a $5.6 Million Payout

What Beneficiaries Should Do Now

- Do not budget as if the $200 increase is guaranteed.

- Monitor SSA announcements and credible news outlets.

- Create emergency savings buffers where possible.

- Review Medicare and Part D plans for 2026 cost changes.

The proposed $200 monthly increase offers meaningful short-term relief for millions of older and disabled Americans, but its future remains tied to federal budget constraints, legislative politics, and broader debates about Social Security’s long-term stability.

For now, retirees are advised to stay informed and prepare for either outcome as Congress weighs competing fiscal priorities.

FAQ About $200 Monthly Social Security Increase

Will every Social Security recipient receive the $200?

Yes, if the bill is approved, all retirement, SSDI, SSI, veterans, and railroad benefits would qualify.

Is the $200 payment permanent?

No. It lasts only six months unless Congress renews or expands it.

Does it affect eligibility for Medicaid or SNAP?

No. The bill specifies that the payment will not count as income in these programs.

Will the increase affect taxes?

No. The payment is tax-free.

Could the payment be delayed even if approved?

Yes. Administrative constraints may require a staggered distribution.