The Social Security increase 2026 will take effect on January 1, but millions of Americans will see the higher payment a day early. Supplemental Security Income (SSI) beneficiaries will receive the first cost-of-living adjustment (COLA) boost on December 31, 2025, due to the holiday payment schedule, according to the Social Security Administration (SSA).

First Social Security Increase in 2026

| Key Fact | Detail / Statistic |

|---|---|

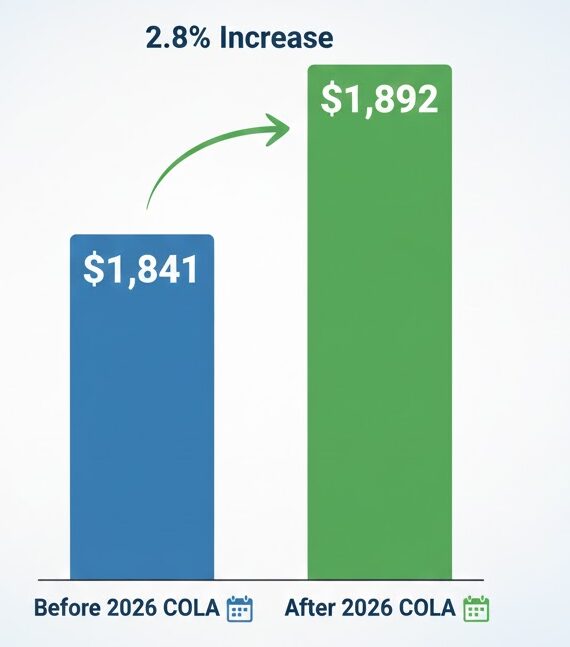

| COLA for 2026 | 2.8% annual adjustment |

| First group receiving increase | SSI recipients on Dec. 31, 2025 |

| Average retiree benefit increase | About $56 per month |

Understanding the 2026 COLA Increase

The Social Security Administration (SSA) announced a 2.8% cost-of-living adjustment for 2026. The annual adjustment is tied to inflation and is based on changes measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). According to the SSA’s October release, the new rate aims to help beneficiaries maintain purchasing power as living costs rise.

Economists at the Center on Budget and Policy Priorities noted that the COLA formula “remains one of the essential safeguards for older Americans who rely heavily on fixed income,” though actual household inflation may vary among seniors.

How COLA Is Calculated

The COLA is determined by comparing third-quarter CPI-W data with the previous year. If inflation rises, benefits increase; if inflation falls or remains flat, benefits stay the same.

A senior economist at the University of California, Berkeley, Dr. Helen Ortiz, explained that “COLA increases are not meant to provide additional income—they are meant to protect the purchasing power retirees already have.”

This distinction underscores why even modest inflation changes can have a major impact on Social Security recipients, especially those with limited or no supplemental income.

Who Gets the First COLA Increase? SSI Payments Arrive Early

SSI beneficiaries are the first group to receive the updated payments each year. Because January 1 is a federal holiday, SSI payments scheduled for that date shift to the previous business day, which in 2025 is December 31.

The SSA confirmed that “when a payment date falls on a weekend or federal holiday, benefits are issued the preceding business day.” This long-standing schedule rule is why SSI recipients consistently receive COLA earlier than retired workers, survivors, and disability beneficiaries.

Individuals who receive both SSI and Social Security benefits will see their SSI portion on December 31, while their Social Security benefit arrives on its normal January payment date.

January 2026 Payment Schedule for Social Security Benefits

Most Social Security benefits—including retirement, disability (SSDI), and survivors’ benefits—follow the SSA’s regular staggered payment system:

Payment Dates Based on Birthdays

- January 8, 2026: Beneficiaries born on the 1st–10th

- January 15, 2026: Beneficiaries born on the 11th–20th

- January 22, 2026: Beneficiaries born on the 21st–31st

The staggered schedule helps the SSA manage payment distribution for more than 70 million recipients.

A senior SSA official explained in an earlier briefing that the agency’s goal is “to ensure timely, predictable benefits for all beneficiaries while coordinating with federal banking systems.”

Why the 2026 Increase Matters to Beneficiaries

Rising costs remain a central concern for older Americans. According to an analysis from the Bureau of Labor Statistics, price pressures continue to affect essential categories such as food, utilities, and medical care. A 2.8% COLA may not fully offset inflation in high-cost regions, said Dr. Laura Benton, a public policy scholar at the University of Michigan.

“Cost-of-living adjustments are critical, but their effectiveness depends on the inflation seniors actually experience,” Benton said. “Healthcare expenses often grow faster than the broader index.”

Historical Comparisons and Long-Term Trends

Understanding how the Social Security increase 2026 compares to past adjustments helps provide clarity for beneficiaries assessing real-world impacts.

Recent COLA History

- 2022: 5.9%

- 2023: 8.7% (highest since 1981)

- 2024: 3.2%

- 2025: 3.0%

- 2026: 2.8%

This reflects a gradual cooling of inflation after the sharp increases triggered by pandemic-era economic disruptions. However, smaller increases may challenge households facing persistent inflation in healthcare and housing.

Long-Term Outlook

The Congressional Budget Office (CBO) projects moderate COLA increases through the early 2030s, assuming inflation stabilizes near historical norms. Policymakers continue to debate whether the COLA formula should be revised to better reflect senior-specific expenses.

The Impact of Medicare Premiums on Net Benefits

While the COLA is expected to raise nominal benefits, many seniors may not see the full amount due to Medicare Part B premiums.

The Centers for Medicare & Medicaid Services (CMS) will announce 2026 premiums later in the year. In previous years, premium increases have offset part of the COLA for millions of retirees.

Health policy specialist Karen Dorsey at Johns Hopkins University noted, “Even a modest increase in Medicare premiums can significantly reduce the real value of COLA, especially for lower-income seniors who depend almost entirely on Social Security.”

Demographics of Beneficiaries Most Affected

More than 70 million Americans receive monthly benefits from programs administered by the SSA. The groups most affected by the Social Security increase 2026 include:

Older Retirees

These individuals often rely heavily on benefits as their primary income source.

Disabled Workers

For many SSDI beneficiaries, Social Security represents nearly all earned income.

Low-Income Americans

SSI recipients, including adults and children with disabilities, will feel the early increase most immediately.

Survivors

Widows, widowers, and dependent children may depend on COLA to offset rising household costs.

According to the National Institute on Retirement Security, nearly half of American retirees lack sufficient private savings, increasing the importance of annual COLA adjustments.

Administrative and Policy Context

Federal agencies are continuing efforts to modernize benefit processing, reduce wait times, and improve outreach.

The SSA has been investing in technology upgrades to reduce application delays, while Congressional committees remain active in evaluating the financial long-term health of the Social Security Trust Fund.

In a recent hearing, lawmakers discussed proposals that include:

- Adjusting payroll tax caps

- Revising COLA formulas

- Strengthening SSI asset limits

- Introducing new minimum benefit thresholds

Although no immediate changes are expected in 2026, long-term reform discussions will shape policy debates heading into the next decade.

December SNAP Deposit Dates and Maximum Benefit Amounts for Every Eligible Household – Check Details

Outlook for Beneficiaries Moving Into 2026

While the COLA ensures a modest rise in benefits, retirees should monitor upcoming announcements from the Centers for Medicare & Medicaid Services (CMS). Part B premium changes for 2026, typically released in the fall, may reduce net monthly increases for many beneficiaries.

Analysts expect debates over long-term Social Security solvency to continue into 2026, but officials emphasize that benefits will remain fully funded for years. “The program remains a lifeline for millions,” said Acting Commissioner Kilolo Kijakazi in an earlier statement.

FAQs About First Social Security Increase in 2026

Who gets the Social Security increase first?

SSI recipients receive the increase first because their January payment is issued early when the first of the month falls on a holiday.

How much is the COLA 2026 increase?

The SSA announced a 2.8% increase for all beneficiaries.

Do both SSI and Social Security recipients get early payments?

Only the SSI portion arrives early. Regular Social Security benefits arrive in January according to the standard schedule.

Will Medicare premiums reduce my net increase?

Possibly. CMS has not yet released 2026 premium changes, which may affect take-home benefits.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores