Up to $4,018 in Social Security Payments Going Out This Week — Check If You’re on the List

The Social Security Administration (SSA) is distributing Social Security payments this week, including checks reaching the maximum monthly benefit of $4,018 for eligible retirees at full retirement age. Payments follow the agency’s staggered Wednesday schedule based on beneficiary birth dates. The distribution comes as more than 70 million Americans prepare for next year’s cost-of-living increase, while policymakers debate the long-term stability of the program that remains the primary income source for most older adults.

Up to $4,018 in Social Security Payments

| Key Fact | Detail |

|---|---|

| Maximum monthly benefit | $4,018 for full retirement-age retirees in 2025 |

| Number of beneficiaries | 52+ million retired workers; 70+ million including disability & survivors |

| Payment grouping | Birth-date-based Wednesday distribution |

| Next COLA increase | Estimated 2.8% beginning Jan. 2026 |

Future updates to the Social Security system will depend on congressional negotiations, inflation trends, and economic performance. For now, the SSA’s monthly payments continue to provide essential support to millions of Americans, and beneficiaries receiving their deposits this week are among the first to feel the impact of ongoing economic shifts and next year’s anticipated cost-of-living adjustments.

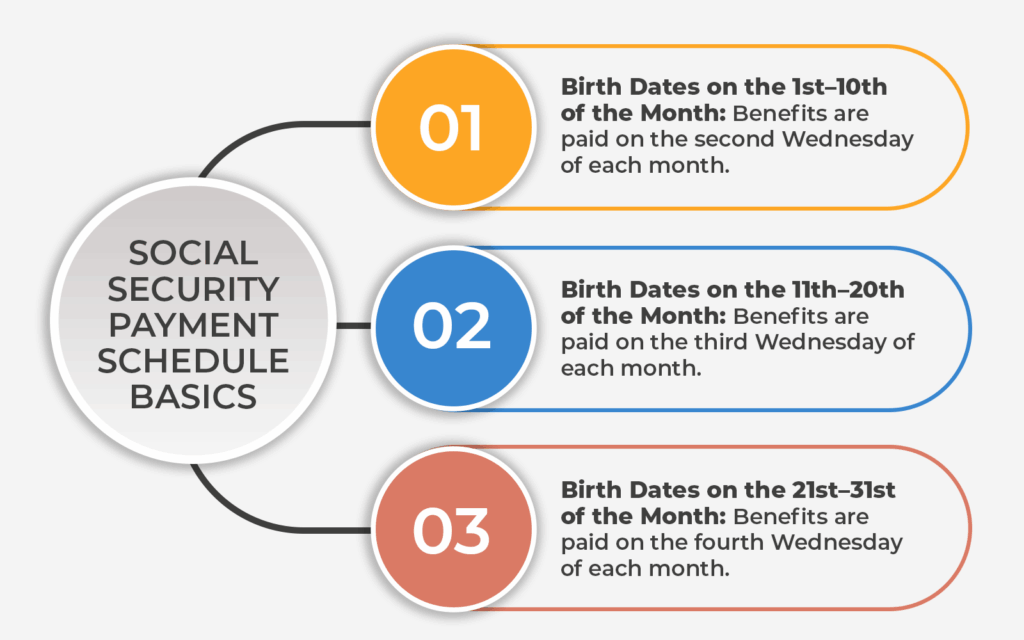

How This Week’s Social Security Payments Are Structured

Every month, the SSA distributes payments using a three-tier schedule. Beneficiaries with birth dates on the 1st–10th, 11th–20th, and 21st–31st receive their funds on separate Wednesdays. According to the agency, this structure reduces operational strain and ensures that financial institutions process deposits smoothly.

An SSA spokesperson said the system “remains one of the most reliable and predictable benefits pipelines in the federal government,” noting that electronic delivery eliminates most delays.

Who Receives the Highest Up to $4,018 in Social Security Payments?

The $4,018 maximum monthly benefit applies only to individuals who:

- Reached full retirement age (67 for most current retirees),

- Worked at least 35 years,

- Earned at or above the taxable maximum—the income limit subject to Social Security tax—for most of those years.

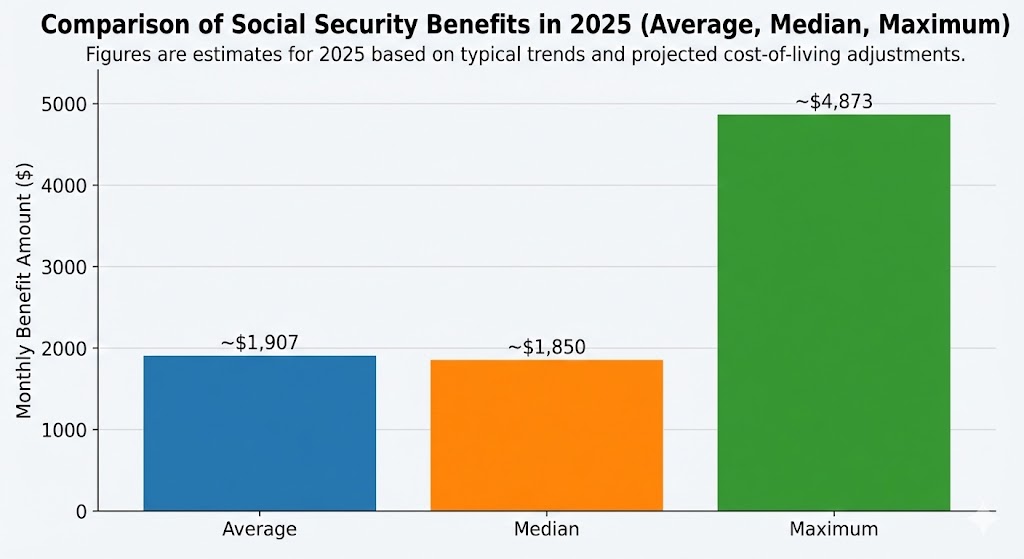

Policy researchers note that only a small percentage of beneficiaries meet all three conditions. The average monthly retirement benefit sits far lower, at around $1,900.

Dr. Karen Smith of the Urban Institute has explained in prior research that “many Americans experience uneven work histories or years outside the workforce, which tends to reduce their lifetime earnings record and ultimately their monthly benefit.”

Understanding SSI Benefits and Dual Eligibility

Not all beneficiaries fall under the Wednesday schedule. Individuals receiving Supplemental Security Income (SSI)—a program serving older adults and people with disabilities who have limited income—typically receive payments on the first of each month.

Those who qualify for both SSI and traditional retirement benefits receive deposits on two separate dates. Because federal holidays sometimes shift SSI payments earlier, many dual-eligible individuals will see January’s SSI payment arrive on December 31.

SSA policy expert Mark Hinkle has long emphasized the importance of calendar awareness, stating that “SSI recipients should anticipate schedule changes and maintain updated banking information to avoid confusion.”

Why Birth Dates Determine Payment Timing

Before 1997, nearly all beneficiaries received their payments at the same time each month, creating heavy service bottlenecks. SSA officials and federal auditors recommended staggering payments to improve stability. The birth-date system was chosen because it offered a neutral, predictable method tied to each individual’s existing records.

The Government Accountability Office reported that the reform significantly reduced call-center spikes and processing errors, allowing the SSA to maintain efficiency despite rising enrollment.

What the COLA Increase Means for Beneficiaries

The next cost-of-living adjustment (COLA)—estimated at 2.8% for January 2026—will raise monthly benefits for all recipients. COLA is determined by inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

Economists note that while COLA helps preserve purchasing power, inflation often affects retirees differently. Rising costs for health care and housing typically outpace general inflation, meaning a modest COLA may not fully offset expenses.

A policy analysis from the Center for Retirement Research at Boston College warns that “many retirees experience real declines in spending ability over time, even with annual COLA increases.”

The Economic Significance of Social Security Payments

Social Security represents one of the largest components of consumer spending among older Americans. According to the SSA’s most recent data:

- 50% of married couples and

- 70% of unmarried adults

rely on Social Security for half or more of their retirement income.

For millions of Americans, the system functions as a lifeline rather than a supplement. Economists estimate that Social Security lifts nearly 15 million older adults out of poverty, highlighting its role in stabilizing both household finances and regional economies.

A report from Moody’s Analytics found that every $1 in Social Security payments generates nearly $1.50 in economic activity due to consumer spending patterns among older populations.

Who Is Most Affected by This Week’s Payments?

Although millions receive monthly retirement income, payment timing matters most for:

1. Lower-Income Retirees

Households with limited savings tend to spend their entire benefit within days of receipt. Payment timing influences their ability to cover essentials such as housing, food, and medical expenses.

2. Americans Living on Fixed Incomes

Rising prices place additional pressure on retirees who depend almost entirely on Social Security.

3. Disabled and Vulnerable Populations

For individuals receiving SSI benefits, even small delays can disrupt access to medication, utilities, or transportation services.

4. Rural Communities

Social Security payments serve as a major income source in rural counties with aging populations. Economic studies show that delays or disruptions disproportionately affect these regions.

How Recipients Can Protect Against Fraud and Payment Scams

The SSA has reported a rise in scams involving fraudulent calls, emails, and text messages claiming to represent the agency. Common tactics include threats of benefit suspension or requests for personal information.

The Office of the Inspector General recommends:

- Never responding to unsolicited requests for Social Security numbers or bank information.

- Using the official mySocialSecurity portal for account changes.

- Reporting suspicious activity through the SSA’s fraud hotline.

Cybersecurity researchers note that scammers tend to target elderly Americans, particularly during months of increased payment activity.

Policy Debates Shaping the Future of the Program

Social Security faces long-term financial pressures as demographic trends shift. The U.S. Census Bureau projects that Americans aged 65 and older will outnumber children under 18 for the first time in U.S. history by the mid-2030s.

The Congressional Budget Office has warned that the Old-Age and Survivors Insurance Trust Fund may face depletion within the next decade unless Congress enacts funding or structural reforms.

Current proposals in Washington include:

Raising or eliminating the payroll tax cap

Advocates say this would strengthen funding without reducing benefits.

Gradually increasing the retirement age

Opponents argue it would penalize workers in physical labor sectors.

Revising COLA calculations

Economists debate whether the CPI-W accurately reflects retiree spending patterns.

Creating new revenue streams

Some lawmakers support alternative payroll tax models or wealth-based contributions.

While no proposal has gained bipartisan consensus, legislators agree that early action would reduce the severity of future adjustments.

What To Do if Your Payment Is Late

The SSA advises beneficiaries to:

- Wait at least three mailing days after the expected deposit.

- Verify bank information through the mySocialSecurity portal.

- Contact the SSA or their financial institution if the delay persists.

- Report suspected fraud immediately if payment patterns become inconsistent.

Most delays arise from bank processing errors rather than SSA distribution problems.

Outlook for Beneficiaries in 2026 and Beyond

The SSA plans to release updated projections on benefit levels, trust fund reserves, and demographic trends later this year. Analysts anticipate continued debate as policymakers consider income inequality, wage stagnation, and rising life expectancy.

Will Foreign Pension Benefits Reduce Your $3,674 Social Security Check? Here’s What to Know

Dr. Brian Holt, a retirement policy specialist at Boston University, has stated that “the coming decade will likely bring the most significant Social Security reforms since the 1983 amendments.” He emphasized that any adjustments must balance fiscal sustainability with the program’s foundational role in preventing poverty among older Americans.