Millions of Americans will see important Social Security activity in their bank accounts this week as two scheduled payments are issued within days of each other. The unusual timing means that one group of beneficiaries will receive an early deposit, leading many to believe they are getting extra funds.

However, the Two Social Security Payments Arriving This Week stem from the Social Security Administration’s (SSA) standard calendar adjustment, not a benefit increase.

The SSA confirmed that the affected group consists exclusively of Supplemental Security Income (SSI) recipients, who will receive their regular monthly benefit along with next month’s payment arriving early because the first day of the upcoming month falls on a weekend.

Two Social Security Payments

| Key Fact | Detail / Statistic |

|---|---|

| Who receives two payments? | SSI beneficiaries only |

| Why two payments this week? | The 1st of next month falls on a Saturday |

| Does it count as extra income? | No, the early deposit is next month’s payment |

| Number of SSI recipients | Over 7 million Nationwide |

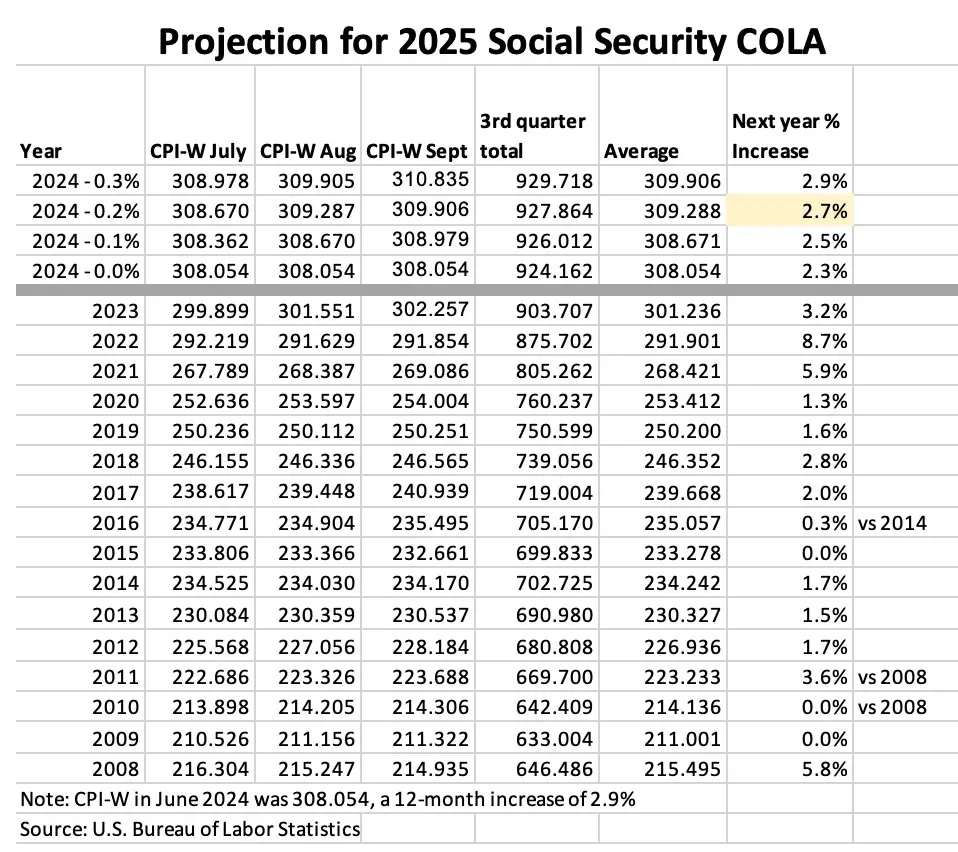

| COLA adjustment | 3.2% increase for 2024; 2025 COLA to be announced |

Why There Are Two Social Security Payments Arriving This Week

SSI benefits are typically issued on the first day of every month. But when that date lands on a weekend or federal holiday, the SSA pays beneficiaries on the last business day of the previous month.

This week, that rule has triggered the Two Social Security Payments Arriving This Week, prompting confusion among recipients who may not understand the advance-payment policy.

SSA spokesperson Jeffrey Jackson explains:

“This payment timing is a standard procedure. It ensures beneficiaries have uninterrupted access to their monthly SSI benefits.”

The early payment functions as a safeguard, preventing delays that might otherwise occur if financial institutions remain closed on weekends or holidays.

Who Qualifies for the Extra Deposit

Only SSI Recipients Receive Two Payments

The additional deposit applies solely to individuals receiving Supplemental Security Income, a program designed to help:

- Adults aged 65 or older with limited income

- Adults with disabilities

- Children with qualifying disabilities

More than 7.4 million Americans rely on SSI benefits for basic needs such as food, housing, and healthcare.

Not Included: Social Security Retirement, SSDI, Survivor Benefits

Recipients of other Social Security programs will not receive more than one payment this week. These include:

- Social Security retirement beneficiaries

- Social Security Disability Insurance (SSDI) recipients

- Survivors of deceased workers

These groups receive payments based on their birthdate and are not affected by the SSI calendar shift.

How Much Recipients Will Receive

SSI payment amounts vary based on individual circumstances, but the federal base rates for 2024 are:

- $943 per month for individuals

- $1,415 per month for eligible couples

- $472 per month for essential persons

(Some states provide additional supplements.)

The early second payment will match the beneficiary’s usual monthly amount.

State-Level SSI Supplement Differences

States Adding Extra Funds to SSI

Several states contribute additional payments on top of the federal SSI benefit, including:

- California

- New York

- New Jersey

- Michigan

- Pennsylvania

- Vermont

The amount varies widely. In California, for example, single recipients can receive over $200 more per month.

States Without Supplements

Some states do not offer SSI supplements, including:

- Florida

- Texas

- Arkansas

- West Virginia

SSI beneficiaries in these states receive only the federal amount.

Historical Context: How Often Early SSI Payments Occur

Early SSI payments happen multiple times each year, depending on the calendar.

Historical data shows:

- In 2022: Three months had double payments

- In 2023: Four months had advanced payments

- In 2024: Early payments occur in March, August, November, and December

- In 2025: Expected in May, October, and December

Thus, the Two Social Security Payments Arriving This Week are not unusual. They are part of the SSA’s established mechanics for maintaining uninterrupted income flow.

Expert Analysis: Financial Planning Implications

Experts warn that while receiving two payments may feel like a bonus, it is crucial for recipients to budget carefully.

Dr. Samuel Ortiz, economist at the National Retirement Institute, explains:

“A double-payment month is the most common point of confusion for SSI recipients. It’s important to remember that the early payment substitutes next month’s income.”

Linda McHenry, a financial counselor with AARP, adds:

“We recommend dividing the funds or setting aside a portion. Otherwise, beneficiaries may face financial hardship during the month without a scheduled payment.”

Does the Extra Payment Affect Other Benefits?

The early SSI deposit does not affect:

- SNAP (food stamps)

- Medicaid

- Housing subsidies

- Medicare Savings Programs

- TANF assistance

Because the payment is attributed to the following month, it is not treated as additional income.

However, SSA advises beneficiaries in income-dependent programs to monitor their account balances. Exceeding resource limits temporarily can trigger administrative reviews.

Misconceptions and Myths About the Double Payment

Myth #1: “This is a bonus from the government.”

→ False. It is simply an early payment.

Myth #2: “SSI benefits are being increased.”

→ False. Increases only occur through COLA adjustments.

Myth #3: “Retirement and SSDI recipients get two payments too.”

→ False. Only SSI recipients receive advanced payments.

Myth #4: “The government is eliminating next month’s payment.”

→ Misleading. There is no payment next month because it arrives early this week.

SSA Fraud Alert: Protect Your Benefits

Whenever unusual payment activity occurs, scams increase.

The SSA warns recipients of:

- Fake phone calls asking for account verification

- Phishing emails claiming payment “errors”

- Text messages requesting Social Security numbers

- Fake websites pretending to be the SSA

SSA Commissioner Martin O’Malley stated in a recent press briefing:

“The SSA will never call or email beneficiaries to demand personal information. Any such request is a scam.”

Beneficiaries should report fraud to:

▶ OIG Fraud Hotline: 1-800-269-0271

▶ Online Reporting: oig.ssa.gov/report

What To Do If Your Payment Is Missing

Delayed or missing payments may occur due to:

- Bank account changes

- Closed accounts

- Direct Express® card issues

- SSA address mismatches

- Bank holidays

Steps to follow:

- Wait three business days

- Check your bank or Direct Express® activity

- Log in to your My Social Security account

- Call the SSA directly at 1-800-772-1213

- Avoid third-party help — scammers target beneficiaries during double-payment weeks

Related Links

SNAP Benefit Deadline — Last Week to Claim Payments in Texas and Florida

Amazon Prime $1.5 Billion Settlement — Check If You’re Eligible for a $51 Refund

Future Outlook: Will This Happen More Often?

Calendar forecasts suggest that early SSI payments will continue regularly over the next decade.

Dr. Helen Brooks, a Social Welfare Policy Professor at the University of Michigan, notes:

“As long as the SSA maintains the current payment structure, advanced deposits will remain necessary during calendar disruptions.”

Some lawmakers have proposed shifting SSI payments to a fixed weekday rather than the first of the month. The SSA has not indicated plans to adopt such changes.

The SSA’s advance-payment mechanism ensures SSI beneficiaries receive timely support even when calendar conflicts occur. The Two Social Security Payments Arriving This Week are part of a long-standing schedule designed to protect vulnerable Americans from delays. Beneficiaries are encouraged to plan ahead, remain vigilant about scams, and monitor their payment activity closely.

FAQ About Two Social Security Payments

Do all Social Security beneficiaries get two payments this week?

No. Only SSI beneficiaries receive two payments.

Is the second payment taxable?

SSI benefits are not taxable at the federal level.

Will this affect next month’s deposit?

Yes. There will be no SSI payment next month.

Is this related to COLA increases?

No. COLA adjustments are announced annually and apply uniformly.

Can this affect SNAP or Medicaid?

Generally no, because the early payment belongs to the next month.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores