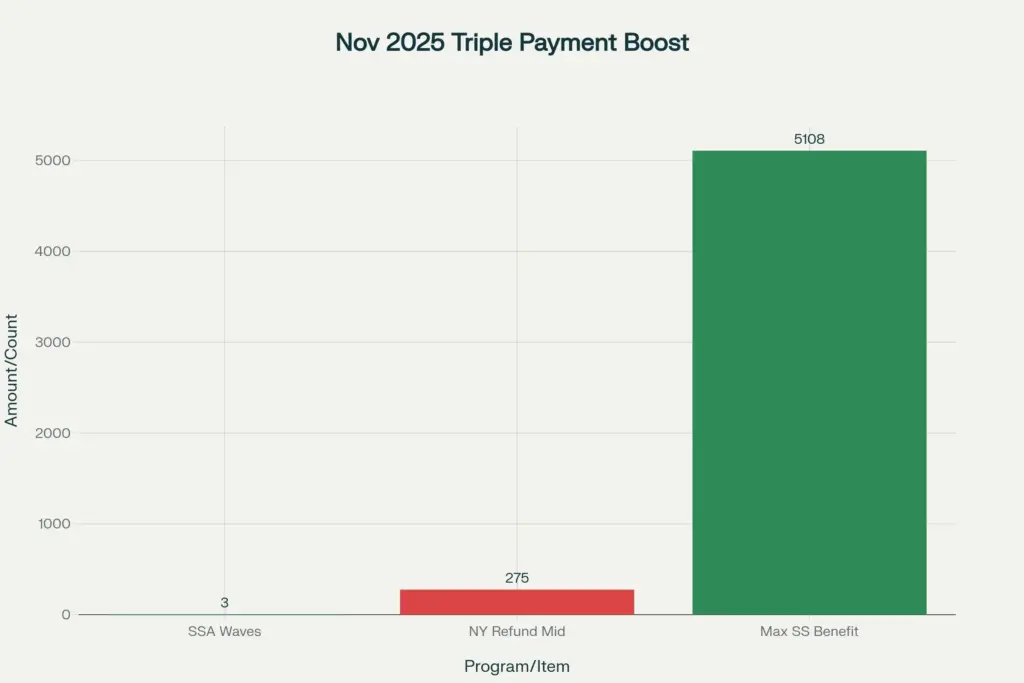

New Yorkers are zeroing in on a rare window before Thanksgiving when multiple payments may land close together a genuine triple payment boost that can make a meaningful difference heading into the holidays. The anchor is the November Social Security deposit, which, for a small group of high earners who delayed claiming until age 70, can reach up to $5,108. The kicker is timing: with state relief like New York’s Inflation Refund checks still rolling out in the fall and property-tax relief such as STAR aligning for many households, the overlap can feel like a windfall rather than a routine month.

Here’s why this moment matters. The triple payment boost isn’t a single combined payout; it’s a convergence of separate programs that may hit in the same window. Social Security follows a mid-month Wednesday schedule tied to birthdays, while the state’s Inflation Refund checks continue to be mailed in waves. Add in ongoing property-tax benefits via STAR for eligible homeowners and for some families, restored SNAP benefits issued in November after recent disruptions, and you get a pre-holiday cash flow lift that eases bills, groceries, and travel. The headline figure of up to $5,108 is the federal maximum Social Security benefit for those who waited to age 70 and contributed at the top of earnings over many years; most recipients will receive less. Still, when these programs line up, the impact is tangible.

Triple Payment Boost

| Item | What It Is | Who May Get It | Key November Timing | Amount Details |

|---|---|---|---|---|

| Social Security Benefit | Monthly federal retirement, disability, or survivor payment | Eligible SSA beneficiaries | Direct deposits on Nov 12, 19, 26 based on birth date; legacy group on the 3rd | Up to $5,108 for age-70 claimants with very high earnings; average is lower |

| SSI | Federal Supplemental Security Income | Eligible low-income aged/disabled | Follows SSI calendar; timing can shift for weekends/holidays | Federal maximum differs from Social Security retirement |

| Inflation Refund (NY) | One-time state check to counter inflation pressures | Millions of eligible NY residents | Checks mailed in waves through fall | Generally $150–$400 based on filing status and income |

| STAR Relief | School Tax Relief for homeowners | Eligible NY homeowners | Timing varies by credit/exemption and locality | Amount varies by STAR tier and location |

| SNAP Benefits | Federal nutrition aid administered by NY | Eligible low-income households | November benefits restored and issued in full | Amount varies by household size and income |

What “Up To $5,108” Really Means

Only a small slice of beneficiaries qualifies for the maximum Social Security amount. To reach that level, a worker typically needs decades of contributions at or near the taxable wage cap and must delay claiming to age 70 to capture the full delayed retirement credits. For everyone else, the monthly benefit will be lower but still crucial. The triple payment boost is about synchronized timing rather than a guaranteed sum. A typical scenario: a mid-month Social Security deposit, a mailed Inflation Refund check arriving anytime in the fall, and a STAR credit or check aligning with local property tax cycles.

November Payment Dates To Watch

Social Security generally pays on Wednesdays, with the specific week determined by your birthday. For November, that means deposits on the second, third, or fourth Wednesday. People who’ve been receiving benefits since the late 1990s may be on the fixed 3rd of the month schedule instead. Supplemental Security Income follows its own payment calendar and can shift when the first of the month falls on a weekend or holiday. Paper checks can take longer to arrive than direct deposit, so build in mailing time if you’re not on electronic payments.

New York’s Inflation Refund Update

The state’s Inflation Refund checks are being mailed to eligible residents in waves. These are automatic for qualified residents; you don’t apply separately. The typical amount ranges from roughly $150 to $400 depending on your 2023 filing status and income. Checks began going out in late September and continue through the fall, so it’s normal for some neighborhoods to see staggered arrivals. Direct deposit generally isn’t used for this check, so keep an eye on your mailbox and make sure your address with the Department of Taxation and Finance is current.

Why This Feels Like A Triple Payment Boost

Stacking matters more than labels. A Social Security deposit hitting mid-month, a state Inflation Refund showing up the same week or the next, and an ongoing relief program landing near property tax due dates can feel like a combined payout even though each program is separate. For households juggling rent or mortgage, utilities, groceries, and travel costs, this overlap offers breathing room. For those receiving SNAP, restored November issuance was designed to stabilize food budgets during a volatile period.

Who May Benefit the Most

- Retirees or SSDI recipients with November Wednesday deposits who also meet eligibility for the Inflation Refund check.

- Homeowners who receive STAR as a credit or mailed check around their local billing cycle.

- Low- and moderate-income households relying on consistent mid-month benefits and food assistance to cover essentials.

- Seniors who delayed claiming and have higher Social Security benefits though this group is relatively small.

How To Check Your Status for Triple Payment Boost

- Social Security: Log into your online account to confirm your exact payment date and amount. If you’re expecting the maximum benefit, verify your claiming age and lifetime earnings history.

- Inflation Refund: No separate application is needed if you filed a 2023 NY resident tax return and meet income and status criteria. If you moved, update your mailing address with the state to avoid delays.

- STAR: Verify whether your relief comes as a direct credit (check) or an exemption on your property tax bill. This affects the timing and how you’ll see the benefit reflected.

- SNAP: Confirm issuance timelines for November and ensure your EBT card is active and secured.

Practical Tips to Optimize the Triple Payment Boost

- Prioritize fixed obligations. If multiple payments arrive close together, cover rent or mortgage, utilities, and insurance first, then allocate to groceries and transport.

- Separate funds by goal. Consider keeping the Inflation Refund check for necessities or one-off seasonal costs like winterization, travel, or medical co-pays.

- Watch your mail. Inflation Refund checks are mailed in waves and are not always synchronized by ZIP code; patience is key.

- Beware of scams. No government office charges a fee to release your benefit or refund. Avoid links in unsolicited messages, and go directly to official portals to verify status.

Eligibility Criteria For Triple Payment Boost

- Social Security: Benefit size depends on your lifetime earnings and claiming age. The top-end $5,108 applies only to those with very high earnings who waited to age 70. Most beneficiaries receive less.

- Inflation Refund: Typical amounts range from about $150 to $400, mailed automatically to eligible residents based on their 2023 tax return information. If your address changed, update records to prevent delays.

- STAR: Homeowner relief varies by program tier and locality, and it may arrive as a check or appear as a credit on your school tax bill.

- SNAP: Benefits are issued by the state on a monthly schedule, and the November cycle was restored in full after earlier uncertainty.

Common Timing Scenarios

- Mid-Month Doubling: Your Social Security hits on a Wednesday and your Inflation Refund check arrives in the mail the same week, creating an immediate cushion.

- Check-Then-Deposit: Your state check arrives first, then the SSA deposit posts the following week, helping you stage bills across the month.

- Property-Tax Offset: STAR relief is applied close to a local due date, freeing up cash as your Social Security payment lands.

What To Do If Your Payment Hasn’t Arrived

- Give it a few days. Mailed checks, especially in rolling mailouts, may arrive later than neighbors.

- Verify addresses and accounts. Ensure your mailing address is accurate and your bank details are current for direct deposits.

- Check the official calendars. Federal and state payment calendars explain weekend and holiday adjustments that may shift dates.

- Contact the relevant agency if your payment is significantly late beyond published windows.

Budgeting Ideas for the Holiday Stretch

- Create a two-week plan. If deposits land mid-month, map critical expenses for the next 14–21 days, then set aside a portion for late-month or early December bills.

- Build a small buffer. If the Inflation Refund check feels “extra,” earmark at least part of it for emergency needs car repairs, copays, or higher heating bills.

- Prep for property taxes. STAR benefits can offset school taxes; align your payments so you’re not scrambling when bills arrive.

Key Cautions

- The triple payment boost is about timing overlap, not a special bundled program. Payments come from different sources and will not be combined into one deposit.

- The $5,108 figure refers to a specific Social Security maximum for a small group, not a universal benefit level.

- Avoid third-party services that promise faster checks for a fee; official channels never require payment to release benefits.

The triple payment boost anchored by November’s Social Security schedule, complemented by New York’s Inflation Refund checks, and supported by ongoing programs like STAR and SNAP can provide a timely cushion before Thanksgiving. Treat it as a strategic opportunity: cover essentials first, plan for near-term bills, and, if possible, set aside a buffer for late-year expenses. While not everyone will see all three payments at once, understanding the calendars, eligibility, and amounts will help you make the most of whatever lands in your account or mailbox this month.

FAQs on Triple Payment Boost

Who actually gets the $5,108 Social Security payment?

Only those who delayed claiming to age 70 and had many years of earnings at or above the taxable maximum can reach the top benefit. Most people receive less, based on their lifetime earnings and age at claim.

When are November Social Security payments sent?

Payments generally go out on the second, third, and fourth Wednesdays of the month based on the beneficiary’s birth date. A legacy group is paid on the 3rd, and SSI follows its own monthly calendar that can shift around weekends or holidays.

Do I need to apply for New York’s Inflation Refund?

No application is required for eligible residents. If you filed a 2023 resident return and meet the state’s criteria, the check is mailed automatically to the address on your return.

How much is the Inflation Refund check?

Most eligible New Yorkers receive a check in the range of roughly $150 to $400, depending on their filing status and income. The state is mailing these checks in waves, so arrival dates can vary by household.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores