Discount grocer Aldi is featuring a private-label premium ice cream this week, priced around $5, that shoppers and analysts note bears a strong resemblance to products from the popular brand Tillamook. The limited time offering, widely dubbed the Aldi Tillamook copycat online, underscores a significant shift in consumer behavior and the growing sophistication of store brands amid persistently high grocery prices.

The Rise of Premium Private Labels

The product, sold under Aldi’s house brand Belmont, is part of the retailer’s “Aldi Finds” program, which consists of rotational items available for a limited time. The 48-ounce container of “Super Premium Ice Cream” has been noted for its similar packaging style, flavor profiles such as Vanilla Bean and Chocolate, and an emphasis on a creamy texture, drawing direct comparisons to the Tillamook County Creamery Association’s well-regarded products, which typically retail for $6 to $8.

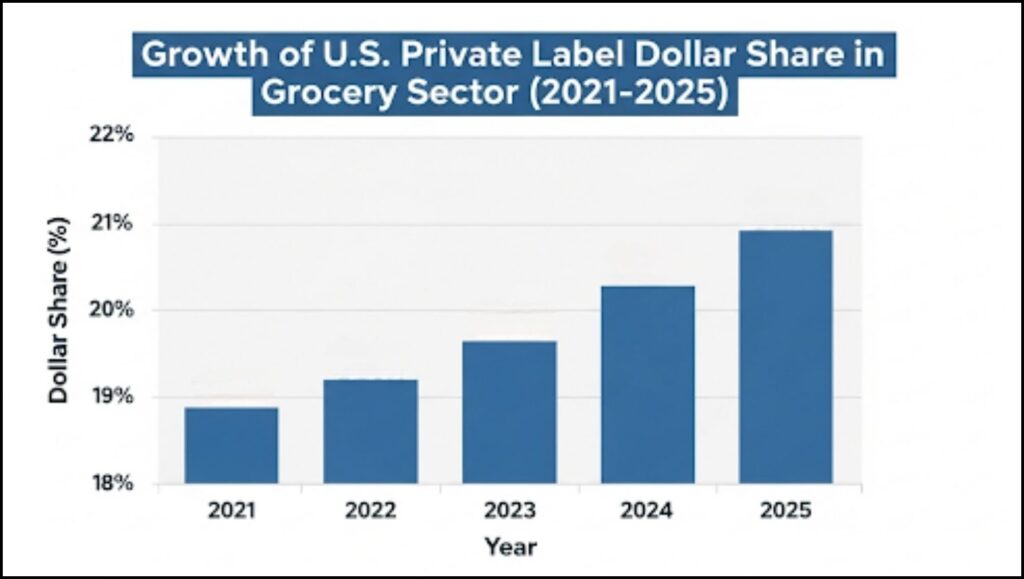

This strategy is indicative of a larger trend in the grocery industry: the growth of premium private label brands. Historically, store brands were seen as basic, no-frills alternatives to national brands. Today, retailers like Aldi, Kroger, and Trader Joe’s are developing high-quality private labels that compete directly with established market leaders on quality while significantly undercutting them on price.

“Retailers have recognized that they can build significant customer loyalty and improve their profit margins by offering premium private-label products,” said Dr. Priya Raghubir, a professor of marketing at the NYU Stern School of Business, in a 2024 industry report on consumer trends. “Instead of just being a cheaper option, these products are now a destination in themselves. They mimic the quality cues of national brands, from ingredient sourcing to packaging, to signal to the consumer that they are not making a compromise.”

An Economy-Driven Shift in Consumer Habits

The increasing consumer appetite for such products is closely linked to the economic environment. While overall inflation has shown signs of cooling, grocery prices have remained stubbornly high for many households. According to the latest Consumer Price Index data from the U.S. Bureau of Labor Statistics, the index for food at home has seen a significant cumulative increase over the past three years, forcing many shoppers to re-evaluate their brand loyalties.

A recent report from management consulting firm McKinsey & Company found that over 40% of U.S. consumers have switched to lower-priced brands or retailers in the past year to save money. This “trade-down” effect is a primary driver of private label growth.

The strategy behind the Aldi Tillamook copycat appears to directly target this value-conscious but quality-seeking consumer. By offering a product that delivers a comparable experience to a beloved premium brand at a 20-35% discount, Aldi leverages its famously efficient operational model to capture market share from larger, more expensive competitors.

The Aldi Finds Model and Brand Competition

The limited availability of the product as an Aldi Finds item creates a sense of urgency and excitement for shoppers, a key component of Aldi’s business strategy. This “fear of missing out” drives frequent store visits and encourages impulse buys, according to a 2023 analysis by Supermarket News.

For established brands like Tillamook, the rise of premium private-label competitors presents a challenge. Tillamook, a farmer-owned cooperative founded in 1909, has built a powerful brand based on its Oregon heritage and commitment to high-quality ingredients, resulting in strong consumer loyalty. However, retailers’ sophisticated private-label offerings force such brands to continually justify their higher price points through marketing, innovation, and by emphasizing their unique brand story.

So far, Tillamook has not issued a public statement regarding the Belmont product. Competing directly with private labels is often a complex decision for national brands, who must balance protecting their brand equity with maintaining their retail partnerships. As consumers continue to navigate an uncertain economic landscape, the battle between established national brands and increasingly sophisticated private labels is expected to intensify. The presence of a product like Aldi’s premium ice cream in the freezer aisle is more than just a good deal; it’s a reflection of a fundamental and perhaps permanent shift in the American grocery landscape.

How Aldi Peanut Butter Cups Became the Snack Shoppers Can’t Keep in Stock

Citing Consumer Trends, Newman’s Own Expansion Targets $130 Billion Snack Industry

Citing Consumer Trends, Newman’s Own Expansion Targets $130 Billion Snack Industry The 11 Grocery Categories Consistently Cheaper at Sam’s Club Amid Rising Food Costs

The 11 Grocery Categories Consistently Cheaper at Sam’s Club Amid Rising Food Costs Wendy’s Free Breakfast Offers Sandwiches This Weekend Amid Fierce Fast-Food Competition

Wendy’s Free Breakfast Offers Sandwiches This Weekend Amid Fierce Fast-Food Competition Investigation Launched into Radioactive Shrimp Recall Affecting Walmart Stores Nationwide

Investigation Launched into Radioactive Shrimp Recall Affecting Walmart Stores Nationwide