As discussions continue around economic relief and tax policy within the United States, hypothesis has emerged approximately the possibility of $2,000 stimulus checks related to a future Trump-subsidized thought in 2026. While no such program has been formally authorized at this stage, the idea displays ongoing political debate about how first-class to guide families dealing with inflation, economic uncertainty, or slowing growth. If a stimulus package of this nature have been to be authorized, beyond experience shows that many Americans may want to pass over out—or face delays—due to avoidable errors.

Understanding what to look at for is important, mainly if stimulus checks much like those issued in 2020–2021 are revived.

Understanding the Hypothetical 2026 Stimulus

Any potential $2,000 stimulus checks in 2026 would require Congressional approval and a signed federal regulation. Even if promoted or supported through former President Donald Trump, no payments might be issued without legislation defining eligibility, income thresholds, and distribution methods.

If approved, the program would likely follow familiar patterns:

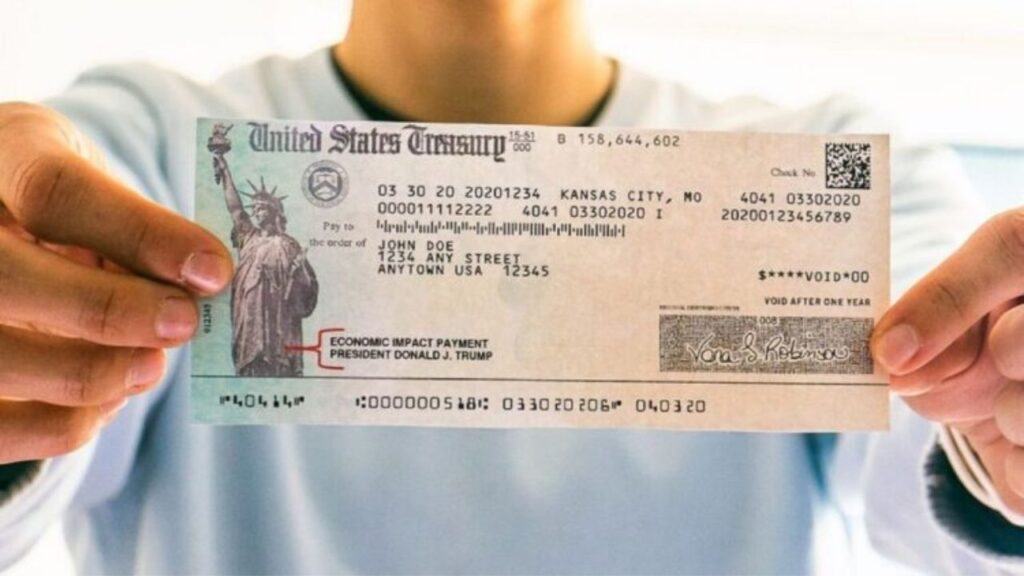

- Payments issued by the U.S. Treasury

- Distribution through direct deposit, paper checks, or prepaid debit cards

- Eligibility based on income, filing status, and tax records

With that framework in mind, avoiding common mistakes becomes critical.

Mistake 1: Assuming Approval Is Guaranteed

One of the most common mistakes is assuming that stimulus checks are inevitable. Even if political leaders publicly discuss or support relief payments, proposals do not equal law. Many stimulus ideas never pass Congress or are significantly altered before approval.

Relying on unapproved stimulus finances for budgeting, debt repayment, or primary purchases can cause economic pressure if bills do not materialize. Until professional legislation is signed and announced via the federal government, stimulus checks should be considered as unsure and speculative.

Mistake 2: Falling for Scams and Misinformation

Whenever stimulus payments are discussed, scams increase sharply. Fraudsters often use fake headlines, social media posts, emails, and text messages claiming people must “apply now” or “verify their information” to receive stimulus checks.

If a $2,000 stimulus were approved, legitimate payments would be distributed automatically using IRS records. The government does not charge fees, request gift cards, or ask for personal details via unsolicited messages. Acting on false information could result in identity theft or financial loss.

Mistake 3: Not Updating IRS Information

If stimulus checks were issued, payments would likely be based on recent tax filings. Individuals who fail to update their mailing address, direct deposit information, or filing status could experience delays or missed payments.

Common issues include:

- Closed or changed bank accounts

- Outdated mailing addresses

- Not filing recent tax returns when required

Keeping IRS records current is one of the best approaches to keep away from complications if any future stimulus is permitted.

Mistake 4: Misunderstanding Eligibility Rules

Stimulus programs commonly include income limits and eligibility necessities. In past programs, better-profits earners obtained reduced payments or none at all. Dependents, combined-reputation families, and non-filers had been also difficulty to precise policies.

Assuming eligibility without reviewing authentic criteria can lead to unhappiness or incorrect financial planning. If a stimulus is accredited in 2026, eligibility information might be absolutely mentioned by using federal businesses.

Mistake 5: Ignoring Tax Implications

While most beyond stimulus checks were now not taxable income, confusion around tax reporting become common. Some individuals mistakenly reported stimulus payments as profits, whilst others omitted associated tax credit or healing rebates.

If future stimulus payments are issued, it’ll be important to understand how they have interaction with tax filings to keep away from errors, delays, or IRS notices.

Mistake 6: Spending Without a Plan

Stimulus checks are designed to provide brief relief, now not long-term financial security. A commonplace mistake during beyond packages turned into spending swiftly with out addressing crucial needs.

Financial experts generally recommend prioritizing:

- Rent or mortgage payments

- Utilities and essential bills

- Food and medical expenses

- Emergency savings or high-interest debt

Having a plan guarantees the money offers meaningful aid in preference to quick-lived alleviation.

Mistake 7: Expecting Repeated Payments

Another misconception is assuming stimulus checks might be ordinary. Historically, maximum stimulus programs worried one-time or restricted payments, not ongoing monthly guide. Building economic expectations round repeated checks can create long-term instability.

Conclusion

While discussion round Trump’s potential $2,000 stimulus checks for 2026 keeps, it’s miles essential to split confirmed policy from hypothesis. No payments have been accredited, and any destiny stimulus might require legislative movement and authentic government announcements.

If such checks are ultimately legal, averting commonplace mistakes — such as falling for scams, assuming eligibility, neglecting IRS updates, or spending without a plan — can assist recipients maximize the benefit. Until then, staying knowledgeable through reliable authorities sources and preserving sensible economic expectations stays the smartest approach.