SSA Confirms December Payment Amounts — Why January Checks Will Be Higher for Millions

The Social Security Administration (SSA) has finalized December 2025 payment amounts, confirming that beneficiaries will receive their usual checks with no immediate increase.

Beginning January 2026, however, payments will rise for millions due to a 2.8% cost-of-living adjustment (COLA), which aims to offset persistent inflation affecting retirees, disabled workers, and low-income households.

The updated figures reflect national economic trends and the continued financial pressure facing older Americans.

SSA Confirms December Payment Amounts

| Key Fact | Detail |

|---|---|

| 2026 COLA Increase | 2.8% increase for Social Security and SSI |

| Average Retiree Increase | ~$56 per month (from ~$2,015 to $2,071) |

| December Payments | Issued under 2025 rates |

| SSI Special Case | January SSI check arrives early on Dec. 31 |

| Notices to Beneficiaries | Sent/posted starting early December |

Why the December Payments Remain at 2025 Levels

Primary Keyword Applied: SSA Confirms December Payment Amounts

The Social Security Administration has confirmed that all December 2025 payments — whether for retirees, disabled beneficiaries, survivors, or Supplemental Security Income (SSI) recipients — will remain at the current year’s rate.

No COLA increase appears in December payments because federal law mandates that cost-of-living adjustments take effect in January of the following year. December’s payment schedule follows the standard structure:

- December 3 for beneficiaries who started receiving payments before May 1997.

- December 10, 17, and 24 for those receiving benefits based on birth date ranges.

For many households living on fixed incomes, December’s unchanged payment underscores the anticipation of January’s higher checks.

Why January Checks Will Be Higher: The 2.8% COLA Explained

COLA Adjustment and Economic Context

The 2.8% benefit increase taking effect in January 2026 is driven by changes in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), the metric required by federal statute. Inflation patterns from Q3 2024 to Q3 2025 guide the formula.

This adjustment reflects ongoing cost pressures:

- Food prices remain higher than pre-pandemic levels.

- Rents and energy costs have outpaced overall inflation.

- Healthcare and prescription drug expenses continue rising for older adults.

Federal Reserve strategies to curb inflation have lowered rates modestly, but economic stabilization remains incomplete.

How Much More Will Beneficiaries Receive?

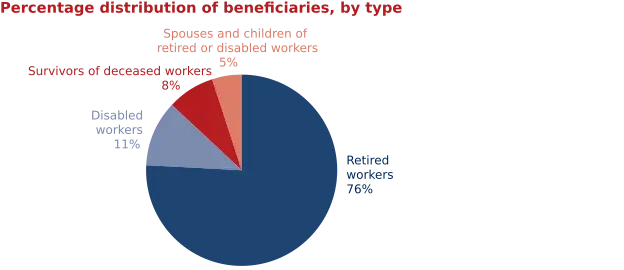

The average retiree will see an increase of approximately $56 per month, bringing the typical check to $2,071. Disabled workers, survivor beneficiaries, and spouses will also see proportional increases.

Below is a detailed snapshot:

| Beneficiary Type | 2025 Average | 2026 Projected Average | Increase |

|---|---|---|---|

| Retired Worker | $2,015 | $2,071 | ~$56 |

| Disabled Worker | ~$1,537 | ~$1,580 | ~$43 |

| Survivor Parent + Two Children | ~$3,700 | ~$3,803 | ~$103 |

| SSI Adult | ~$696 | ~$715 | ~$19 |

| SSI Child | ~$771 | ~$793 | ~$22 |

These figures may vary based on personal earnings histories, Medicare deductions, and dual-benefit eligibility.

SSI: Early Arrival of January Payment

Because January 1 is a federal holiday, the January 2026 SSI payment will be deposited on December 31, 2025.

This means:

- Two SSI payments in December — Dec. 1 and Dec. 31.

- No SSI deposit in January until Feb. 1 (regular cycle resumes).

It is important to note that the early payment is not extra income; it simply shifts timing to account for holiday closures.

Why Inflation Still Shapes Benefit Adjustments

Despite cooling from earlier highs, inflation remains “sticky,” particularly in cost categories heavily affecting seniors. According to independent analysts:

- Medicare premiums have risen faster than COLA in several recent years.

- Housing costs for older adults outpace CPI-W measurements.

- Healthcare inflation continues to pressure fixed incomes.

Some economists argue that CPI-W underestimates real costs for older adults because it tracks wage earners, not retirees. The push for adopting a CPI-E (Consumer Price Index for the Elderly) continues among advocacy groups, although no legislative shift has occurred.

Beneficiary Guidance: Preparing for the January Increase

1. Review Your COLA Notice

SSA has begun sending individualized COLA notices online and by mail. These specify:

- Your new payment amount

- Adjustments to Medicare Part B premiums

- Updated SSI eligibility if receiving dual benefits

2. Verify Direct Deposit Details

Direct deposit errors are among the most common causes of delayed payments. Beneficiaries should ensure bank details are updated in their my Social Security account.

3. Anticipate Medicare Adjustments

Higher premiums or deductibles may reduce the effective increase beneficiaries see. SSA automatically applies these calculations.

4. Be Alert to Fraud

Scammers often exploit COLA announcements by posing as SSA agents. Officials stress the SSA never calls to demand information or payment.

Longer-Term Implications for the Social Security System

Even as payments rise in January, long-term funding concerns remain prominent. SSA trustees project that the combined trust funds could face shortfalls within the next decade unless Congress reforms revenue collection or benefit structures.

Potential policy responses discussed by lawmakers include:

- Raising the taxable earnings cap

- Increasing payroll tax rates

- Modifying benefit formulas

- Introducing means testing for higher-income retirees

- Adjusting retirement ages

None of these proposals are finalized, but discussions intensify as demographic shifts reduce the worker-to-beneficiary ratio.

Groups Most Impacted by the January Increase

Retirees

Face inflation in housing, medical costs, and utilities. Even modest COLA increases materially affect their budgets.

Disabled Workers

Often have limited employment options and rely heavily on SSDI; the increase offers crucial support.

Survivor Families

Many households with dependent children see some of the largest absolute increases in 2026.

Low-Income Seniors on SSI

The January SSI increase — arriving on December 31 — helps cover basic living expenses during a peak-cost season.

Related Links

A New Rebate Program Is Offering Up to $1,500 — Who Can Claim It This Year

Smart Ways to Cut Taxes on a $1 Million Retirement RMD – Check Details

As the SSA confirms December’s payment amounts, beneficiaries can now shift focus to the upcoming COLA increase that will raise January 2026 checks.

While the 2.8% boost offers welcome relief, the broader economic environment and rising senior costs highlight the continued importance of accurate indexing and sustainable Social Security funding.

For now, millions can expect higher checks in the new year — and should review notices and updates carefully to understand their exact benefit changes.

FAQs About SSA Confirms December Payment Amounts

1. When will I see the COLA increase?

Social Security retirement and disability checks increase in January 2026; SSI recipients receive the raise early on December 31.

2. Do I need to apply to get the COLA increase?

No. COLA updates apply automatically.

3. Will Medicare premium changes affect my increase?

Possibly. Higher premiums could offset part of the 2.8% raise.

4. Why do SSI recipients receive two checks in December?

Because Jan. 1 is a federal holiday, the payment is issued the previous business day.