SSA Beneficiaries in 10 States Set for Bigger Checks — Check Why and How Much You’ll Get

A breakdown of the recent news on Social Security Administration (SSA) benefit increases, who’s affected, and how much you might get.

SSA Beneficiaries in 10 States Set for Bigger Checks

| Key Fact | Detail |

|---|---|

| 2026 COLA increase | 2.8% |

| Average national monthly benefit (2026) | $2,071 |

| States with highest median benefits | NJ, CT, DE, NH, MD, MI, WA, MN, MA, IN |

| Average increase for high-benefit states | $58–$61 per month |

| Implementation date | January 2026 (SSI: December 31, 2025) |

A Moderate Increase, but a Welcome One

The Social Security Administration (SSA) has announced a 2.8% cost-of-living adjustment (COLA) for 2026, providing modest relief to more than 70 million Americans who receive Social Security and Supplemental Security Income (SSI) benefits.

The adjustment, effective January 2026, aims to preserve beneficiaries’ purchasing power amid a cooling inflation environment. According to official SSA projections, the average monthly retirement benefit will increase from about $2,015 to $2,071, an estimated gain of $56. SSI recipients will see their new rates reflected in payments sent out at the end of December 2025.

Why Beneficiaries in 10 States Will See Larger Checks

Although the COLA is standardized nationwide, its impact varies by income level and region. States with higher average benefits—often due to stronger lifetime earnings and later retirement ages—will experience greater dollar gains.

According to SSA data and independent analyses, the top 10 states with the highest median Social Security benefits are: New Jersey, Connecticut, Delaware, New Hampshire, Maryland, Michigan, Washington, Minnesota, Massachusetts, and Indiana.

Residents in these states currently receive between $2,016 and $2,172 per month on average. After the 2.8% COLA adjustment, monthly checks in these areas are expected to rise by $56 to $61, compared to about $52 nationwide.

“The cost-of-living adjustment is based on a uniform formula, but its effects are more visible in states where retirees earn more,” said Stephen Goss, Chief Actuary at the SSA. “It ensures benefits maintain their real value despite inflationary pressures.”

How the Adjustment Is Calculated

Each year, the SSA bases its COLA on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), published by the Bureau of Labor Statistics (BLS). The comparison uses third-quarter averages from consecutive years to determine whether inflation warrants an increase.

This year’s 2.8% adjustment follows a 3.2% increase in 2025 and larger jumps of 5.9% and 8.7% during 2022 and 2023, respectively—reflecting the spike in inflation following the COVID-19 pandemic.

“The smaller COLA signals economic stabilization,” explained Nancy Altman, President of Social Security Works. “After several years of high inflation, this adjustment indicates the Federal Reserve’s policies are gradually succeeding.”

The Broader Economic Context

While the COLA helps retirees keep pace with prices, many analysts note that rising healthcare, housing, and energy costs continue to outpace the official inflation rate. The CPI-W, critics argue, does not accurately reflect the spending habits of older Americans.

A 2025 report from the Senior Citizens League estimated that retirees have lost roughly 36% of their purchasing power since 2000, due largely to medical and housing costs that rise faster than general inflation.

“The COLA helps but doesn’t fully bridge the gap,” said Mary Johnson, a policy analyst with the League. “For many retirees, even a few extra dollars a month are quickly absorbed by prescription costs or rent increases.”

Who Benefits Most

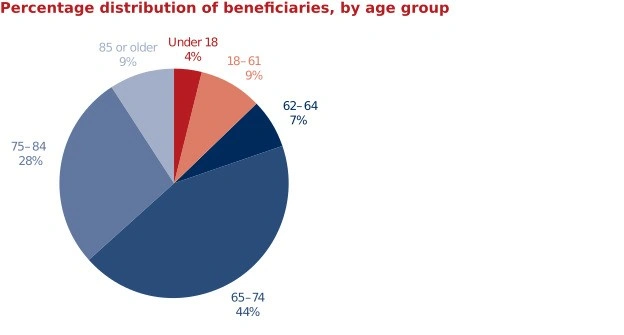

The 2026 COLA will affect a broad cross-section of Americans, including:

- 47 million retired workers, the largest group of beneficiaries.

- 8 million disabled workers under the Social Security Disability Insurance (SSDI) program.

- 5 million survivors, including widows and children.

Those who delayed claiming benefits until full retirement age or later will see the most significant increases in dollar terms, as their base benefits are higher.

The maximum possible Social Security benefit—for someone retiring at age 70 after paying the maximum taxable amount for 35 years—will rise from $4,873 to roughly $5,009 per month.

The Fiscal Outlook for Social Security

The COLA announcement also renews focus on the long-term sustainability of the program. The 2025 Trustees Report projects that the combined Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) trust funds could be depleted by 2035.

Without congressional action, that would reduce benefits by an estimated 17% across the board.

“While COLAs protect beneficiaries in the short term, they also accelerate the drawdown of the trust funds,” noted Dr. Andrew Biggs, senior fellow at the American Enterprise Institute (AEI). “Any serious reform will need to balance inflation protection with fiscal responsibility.”

Lawmakers have proposed several potential solutions, including raising the payroll tax cap, gradually increasing the retirement age, or revising how inflation adjustments are calculated. However, no major reform appears imminent ahead of the 2026 election cycle.

What Beneficiaries Should Do Now

SSA officials stress that recipients do not need to take any action to receive the increase. Updated benefit notices will be posted to mySocialSecurity accounts and mailed by December 2025.

Financial planners recommend that retirees use the adjustment as an opportunity to review their budgets.

“Even small increases can compound when properly managed,” said Alyssa Montgomery, a certified financial planner with Charles Schwab & Co. “Retirees should consider using part of their COLA for savings or debt reduction.”

Regional Cost-of-Living Differences

While beneficiaries in higher-cost states will see larger checks, regional disparities in expenses remain wide. According to the Council for Community and Economic Research (C2ER), the cost of living in New Jersey and Massachusetts remains about 25% above the national average, while states like Michigan and Indiana fall near or below it.

As a result, even though the nominal increase may be larger in high-benefit states, the real purchasing power of retirees often varies significantly.

Related Links

$1,000 Federal Payout Available with One Simple Requirement — Check If You Can Qualify

New Yorkers Could Already Have $400 Inflation Refund Checks — Here’s How to Confirm Yours

Looking Ahead

The 2026 COLA underscores the importance of Social Security as a financial lifeline for tens of millions of Americans. Although the adjustment is modest compared with recent years, it marks continued stability following a volatile inflation period.

“Social Security remains one of the most successful anti-poverty programs in U.S. history,” said Goss. “While the COLA may fluctuate, its mission—to protect retirees against inflation—remains constant.”

FAQ About SSA Beneficiaries in 10 States Set for Bigger Checks

When does the new COLA take effect?

January 2026. SSI beneficiaries will see payments adjusted on December 31, 2025.

Does everyone receive the same increase?

Yes, 2.8% across all beneficiaries. However, the dollar amount varies depending on current benefit levels.

How can I check my updated amount?

Log in to your mySocialSecurity account to view your updated benefit notice later this year.

Will the COLA affect taxes or Medicare premiums?

Possibly. Higher benefits may push some recipients into higher tax brackets or slightly increase Medicare Part B premiums.