Social Security’s 2026 COLA Revealed – Here’s What Retirees Can Actually Expect

The Social Security Administration (SSA) has officially announced a 2.8% cost-of-living adjustment (COLA) for 2026, meaning millions of Americans will see an increase in their benefits. For the average retired worker, this translates into an additional $56 per month.

While this bump is a welcome relief for many, especially after years of rising costs, the reality of these adjustments is more complex. Higher premiums for Medicare and rising medical and living expenses may effectively reduce the actual benefit increase that retirees see.

This article provides an in-depth analysis of the 2026 COLA, breaking down what retirees can expect, how it may impact their finances, and what steps they can take to prepare.

Social Security’s 2026 COLA Revealed

| What’s Changing | 2026 Update | What It Means for You |

|---|---|---|

| Social Security COLA | +2.8% increase | Average retirees will see about $56/month more |

| Benefit Payments Rise | From ~$2,015 to ~$2,071 for average retiree before deductions | Modest income bump, but varies widely by beneficiary history |

| SSI Benefits | New 2026 maximum: $994/month for individuals, $1,491/month for couples | Beneficiaries relying on SSI see similar proportional increases |

| Taxable Wage Base | Raised to $184,500 | Higher‑earning workers pay more into the system |

| Medicare Part B Premium | $202.90/month | Higher premiums offset COLA gains |

| Medicare Part A Deductible | $1,600 for hospital stays | Higher hospital costs could affect retirees |

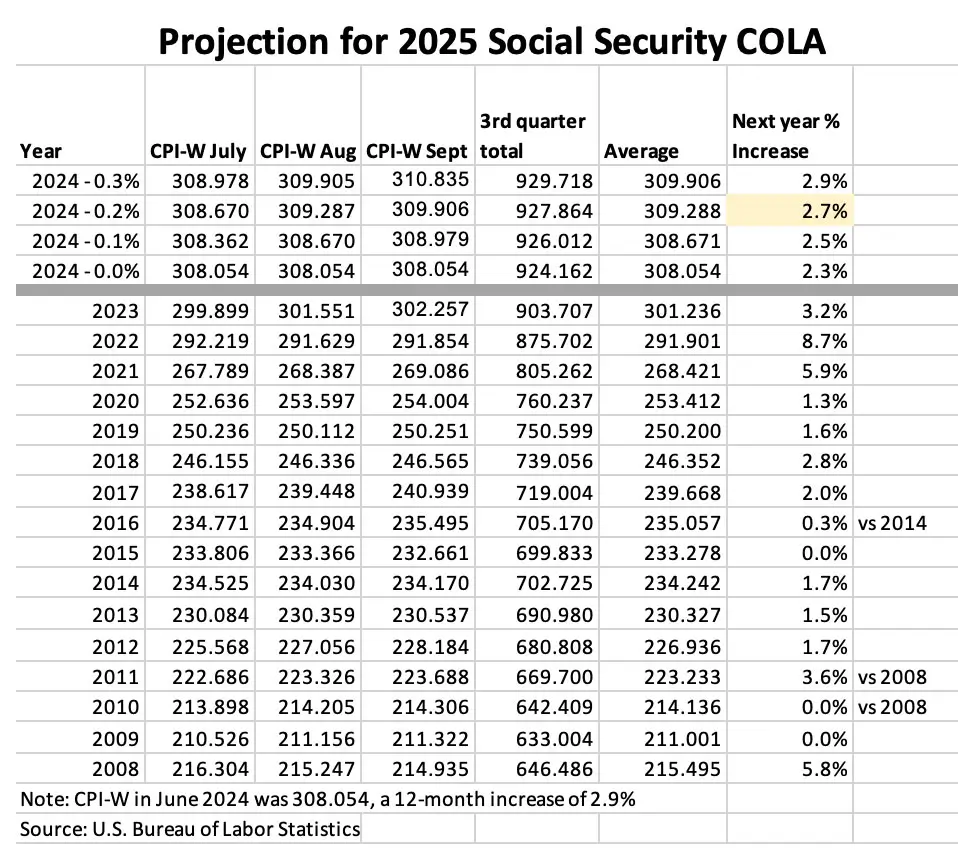

Understanding Social Security’s COLA Calculation

The COLA formula is designed to help benefits keep pace with inflation. It uses the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) to measure how much prices have increased. While this is intended to protect the purchasing power of retirees, it doesn’t always work perfectly.

The formula measures inflation in categories like food, energy, and housing, but it does not fully capture the rising costs that seniors face, especially in health care. Seniors spend disproportionately on health care — a category where inflation consistently outpaces the general inflation rate.

This means that while Social Security payments are increased, the actual increase may not match the cost increases in critical areas like medical care or housing.

How the COLA Affects Different Beneficiaries

- Retirees and Disabled Beneficiaries: Retirees will see an average increase of about $56/month in 2026, with exact amounts depending on individual benefit levels. For some, this modest raise will barely make a difference after factoring in higher medical costs.

- SSI Recipients: Those on Supplemental Security Income will also receive a 2.8% increase, bringing the maximum benefit for individuals to $994 per month, and for couples to $1,491 per month. While this will help offset inflation, SSI recipients, who are among the most vulnerable, still face challenges with rising costs that could outstrip the COLA increase.

The Impact of Rising Medicare Costs

While the 2.8% COLA sounds like a good increase, many retirees will experience a smaller net benefit once rising Medicare premiums are factored in.

Medicare Part B Premiums

In 2026, the Medicare Part B premium will increase to $202.90 per month, an increase of $17.90 from 2025. Since Medicare Part B premiums are deducted from Social Security checks, this means the extra $56/month retirees receive from the COLA will be reduced by about $18, leaving only $36/month in additional benefits.

For retirees with higher incomes, IRMAA (Income-Related Monthly Adjustment Amount) could result in an even larger premium increase, reducing or eliminating the net gain from the COLA adjustment altogether.

Medicare Part A and Other Costs

Along with Part B premiums, other Medicare-related costs are also set to rise. The Part A deductible for 2026 is expected to increase to $1,600. This means that seniors requiring inpatient hospital stays will face higher out-of-pocket costs before their coverage kicks in.

Additionally, prescription drug costs under Medicare Part D are expected to rise, although the $2,100 annual cap on out-of-pocket expenses for Part D will help mitigate some of these costs.

SSI and Taxable Wage Base: How Social Security’s Earnings Limit Impacts High-Income Workers

The Social Security taxable wage base — the income level at which workers start paying Social Security taxes — will rise to $184,500 in 2026, up from $176,100. This means that workers earning above this threshold will pay more into the Social Security system.

For higher-income earners, this means higher payroll taxes, but it may also affect their Social Security benefits. Social Security is intended to provide income for workers who are retired or disabled, so those earning the maximum wage cap are contributing significantly to the system’s funding.

Medicare Part A and Prescription Drug Changes

In addition to the rise in Medicare Part B premiums, other Medicare Part A costs, including hospital stay deductibles and coinsurance, will see increases as well. Those with extended stays in hospitals or skilled nursing facilities will experience higher out-of-pocket costs, which could seriously affect the finances of seniors who rely on Medicare for inpatient services.

What Retirees Can Expect with Medicare Part D

Medicare’s prescription drug plan (Part D) is also undergoing changes. Although the out-of-pocket cap on prescriptions will help many seniors, the actual cost of some brand-name drugs continues to rise. Seniors who take expensive medications may still feel financial pressure despite the out-of-pocket cap.

Preparing for the 2026 COLA: What Retirees Should Do

Retirees must take a proactive approach in 2025 to manage the impact of the COLA increase and rising Medicare costs.

1. Review Your Social Security Benefits

Beneficiaries should always review their Social Security statements to ensure that all information, such as earnings history, is up to date. Log into your My Social Security account to track your benefits and estimate the impact of the COLA adjustment.

2. Reevaluate Your Health Plan

Given the rising Medicare premiums, seniors should evaluate whether Medicare Advantage or Medigap plans offer better coverage and protection against increasing medical expenses.

3. Budget for Rising Costs

Retirees should prepare for rising out-of-pocket costs by adjusting their budgets. With the increasing cost of healthcare, housing, and daily living, careful planning will ensure that they can make the most of the COLA increase.

Related Links

Alert: Extra Social Security Payment Coming in December — But There’s a Catch

December 2025 Social Security Payment Chart: Exact Dates for Every Group Revealed

The Future of Social Security: What’s Next for COLA?

While 2026 brings much-needed COLA increases, the long-term solvency of Social Security remains a key concern. As the number of retirees grows and life expectancy rises, the trust fund will face growing strain.

What’s Being Done to Address This?

Legislators are discussing various reforms, including increasing the Social Security payroll tax or adopting more progressive COLA formulas, like the CPI-E (Consumer Price Index for the Elderly), which more accurately reflects the spending patterns of seniors.

A Modest Help, But Not a Windfall

The 2026 COLA increase provides a welcome, albeit modest, relief for Social Security recipients. However, retirees need to account for rising Medicare premiums and the increasing cost of health care.

This year’s COLA increase, while helpful, is far from a windfall and will require seniors to carefully consider their budgets, health plans, and income sources moving forward. It remains to be seen how future COLAs will evolve, but for now, it is clear that retirees must plan wisely and prepare for the complexities of these changes.