The Social Security Administration (SSA) has announced a new Social Security update deadline, requiring nearly 70 million beneficiaries to switch to approved electronic payment systems by September 30, 2025.

The change is part of a long-term modernization effort aimed at improving security and reducing fraud. Officials warn that failing to update payment information before the deadline may cause delays or disruptions in future benefit delivery.

Social Security Update

| Key Fact | Detail |

|---|---|

| New deadline | Sept. 30, 2025 |

| People affected | ~70 million beneficiaries |

| Requirement | Switch from paper checks to electronic payments |

| Payment options | Direct Deposit / Direct Express |

| Potential consequences | Delays, manual review, mailing issues |

Why the Social Security Update Deadline Matters

The Social Security update deadline is part of a national effort to transition federal beneficiaries away from paper checks and into secure, trackable, efficient electronic systems. While many Americans already use direct deposit, government data suggests that millions still rely on paper checks — a system vulnerable to fraud, mail delays, address inconsistencies, and natural disasters.

SSA officials told local media that the 2025 transition is aimed at ensuring “payment stability, security, and accuracy” across all Social Security programs.

Why the SSA Set the 2025 Deadline

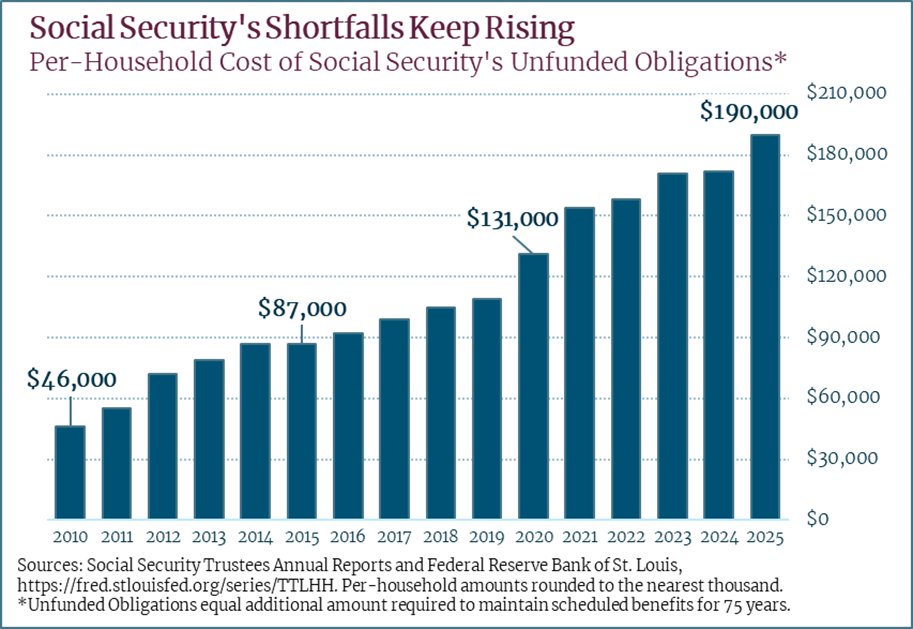

Federal Goal to Reduce Fraud

Paper check fraud cost taxpayers tens of millions annually before the expansion of electronic deposits. According to Treasury audits, fraud rates dropped sharply once direct deposit became standard for new SSA beneficiaries.

Strengthening Delivery Speed and Reliability

Mail delays remain common nationwide due to staffing shortages, increased package volume, and regional postal disruptions. Electronic payments avoid these vulnerabilities and arrive on predictable schedules.

Reducing Government Administrative Costs

Printing and mailing paper checks is significantly more expensive than digital delivery. SSA and Treasury officials have argued for years that public dollars can be better spent on program modernization and service upgrades.

Preparing for Demographic Shifts

By 2030, all Baby Boomers will be 65 or older, placing unprecedented demand on SSA resources. Reducing manual payment processes frees up agency capacity.

Who Must Comply With the New Requirement

This deadline applies to beneficiaries receiving:

- Social Security retirement benefits

- Social Security Disability Insurance (SSDI)

- Supplemental Security Income (SSI)

- Survivor benefits

- Benefits managed by representative payees

Who May Receive Exceptions?

Hardship waivers may be granted to:

- Individuals without access to banking institutions

- Those with cognitive limitations

- Victims of identity theft or domestic violence

- People living in remote areas

- Cases requiring additional verification due to legal or administrative constraints

Federal officials confirm these waivers are rare and must be documented.

How This Deadline Could Affect Your Future Payments

Risk of Payment Delays

If electronic banking information is outdated — due to mergers, account closures, or routing number changes — payments may be returned, triggering SSA reviews.

Potential for Missed Monthly Checks

Returned payments must be manually reissued. With millions transitioning before the deadline, case backlogs could increase, extending delays.

Higher Vulnerability for SSI Beneficiaries

SSI beneficiaries, who generally live on the tightest budgets, could face hardship if a monthly payment is delayed even a few days.

Impact on Representative Payees

Those managing benefits for minors, disabled adults, or seniors must verify their own banking information and the beneficiary’s records.

Historical Context — A Decade-Long Modernization Push

The 2025 deadline is not a sudden development. Key milestones include:

2011: Go Direct Campaign

The Treasury Department begins transitioning all federal benefits to electronic systems.

2013: Direct Express Expansion

SSA extends debit card options to unbanked recipients.

2016–2020: Online Services Modernization

SSA expands the mySocialSecurity portal and online claim updates.

2021–2023: Fraud Mitigation Initiatives

Federal partners increase real-time detection of suspicious transactions.

2024–2025: Final Transition

SSA establishes a firm cutoff date for paper checks for nearly all beneficiaries.

Payment Options Explained — What Beneficiaries Need to Know

Direct Deposit (Preferred Method)

Funds are sent directly to a checking or savings account.

Advantages:

- Same-day deposit

- No fees

- Automated recordkeeping

- Strongest fraud protection

- Fast resolution if errors occur

Direct Express Debit Card

Designed for beneficiaries with no bank account.

Features:

- No minimum balance

- No overdraft fees

- Nationwide ATM access

- Government-backed fraud protection

What Beneficiaries Must Do Before the Deadline

SSA recommends these steps:

- Check your payment method via the mySocialSecurity portal.

- Update bank information if you changed banks or account numbers.

- Enroll in direct deposit if you still receive checks.

- Apply for Direct Express if you are unbanked.

- Submit a hardship waiver request if needed.

- Verify your next payment to ensure the transition succeeded.

- Save SSA confirmation letters or emails for future documentation.

Who May Face Challenges Under the New Policy

Rural Residents

Limited banking access may complicate transitions.

Older Adults With Limited Digital Skills

Some beneficiaries struggle with online accounts or verification systems.

Immigrants and Non-English Speakers

Language barriers may slow compliance.

Disabled Adults Without Support Systems

Representative payees may need additional guidance.

Advocates emphasize that outreach through community organizations is critical to avoid disproportionate hardship.

Expert Commentary — Diverse Perspectives

Dr. Linda Harper, Center for Retirement Research:

“Even short delays in Social Security income can create cascading financial issues for people living on fixed benefits. This deadline must be clearly communicated.”

Carlos Renteria, Director of Senior Services Network:

“Many older Americans don’t trust electronic banking. Education and assistance will determine whether this transition works smoothly.”

Janice Miller, former SSA regional executive:

“The agency has tried for years to make this shift. Electronic payments are safer, faster, and cheaper. But the transition is only as strong as the public’s understanding.”

Economic Impact — What the Shift Means on a National Scale

Reduced Federal Spending

Treasury officials estimate that fully eliminating paper checks can save tens of millions annually, freeing funds for:

- Customer service improvements

- Technology upgrades

- Fraud prevention

Faster Response During Emergencies

During natural disasters and government shutdowns, electronic payments continue uninterrupted.

Support for Vulnerable Populations

Efficient systems reduce delays for SSI recipients, many of whom rely on timely monthly payments for basic needs.

Related Links

Next Social Security Check: Full 2025 Payout Schedule for All Beneficiary Groups

$1000 Payments Arrive on November 20 — Here’s Who Qualifies This Week

Legislative Context — How Congress Has Influenced the Reform

Congressional reports in recent years urged SSA to:

- Strengthen identity verification

- Modernize its digital infrastructure

- Reduce fraud losses

- Improve beneficiary communication

While Congress did not directly mandate the 2025 deadline, the SSA’s move aligns with broader federal modernization objectives.

As the Social Security Administration continues modernizing its infrastructure, the 2025 deadline marks an important shift toward electronic-only benefit distribution. For recipients who depend on monthly Social Security income, updating their payment method ahead of the deadline remains the safest way to avoid any potential interruptions. Advocates and officials alike stress the importance of early action as the transition enters its final phase.

FAQ About Social Security Update

1. Will my benefits stop if I do nothing?

No, but you may face delays or manual SSA review until electronic information is provided.

2. Does this apply to SSI beneficiaries?

Yes. SSI recipients also must switch to electronic payments unless exempt.

3. What if I don’t have a bank account?

You can use the Direct Express debit card.

4. Can I still get a paper check?

Only in rare, approved hardship cases.

5. How long does updating my information take?

Most changes take effect within one payment cycle.

6. Are payments safe in bank accounts?

Federal deposit protections and anti-fraud systems help safeguard funds.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores