The 5 States Will See Bigger Social Security Raises in 2026 as the federal cost-of-living adjustment (COLA) increases benefits by 2.8% nationwide next year.

While every retiree and disability recipient will receive the same percentage increase, residents of Connecticut, New Jersey, New Hampshire, Delaware, and Maryland will see the largest dollar gains due to higher average lifetime earnings.

The updated analysis underscores how regional income patterns continue to shape retirees’ financial security.

Social Security Raises in 2026

| Key Fact | Detail / Statistic |

|---|---|

| 2026 COLA | +2.8% benefit increase |

| National average increase | ≈ $56/month for retired workers |

| Top five states with highest increases | CT, NJ, NH, DE, MD |

| CPI-W basis for COLA | July–September inflation measure |

| Primary reason for larger raises | Higher lifetime earnings → higher base benefits |

Why 5 States Will See Bigger Social Security Raises in 2026

The 5 States Will See Bigger Social Security Raises in 2026 because Social Security benefits are directly tied to a worker’s highest-earning years. COLA applies uniformly across all states, but the dollar value of the adjustment is proportional to the benefit amount.

In states where workers historically earned more, the average Social Security benefit is higher. As a result, a 2.8% increase produces a larger dollar boost.

The five states with the largest projected monthly gains:

- Connecticut — $60.66

- New Jersey — $60.57

- New Hampshire — $60.11

- Delaware — $59.97

- Maryland — $58.96

By comparison, the national average monthly increase is expected to be about $56.

How COLA Is Calculated — And Why It Doesn’t Affect All States Equally

The cost-of-living adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) — an inflation measure published by the Bureau of Labor Statistics.

COLA = Percentage change in CPI-W from Q3 of previous year.

Why this creates unequal dollar outcomes:

- The percentage is identical nationwide

- The dollar increase depends on the pre-existing benefit amount

- Higher wages → higher benefits → larger COLA raises

Retirees in high-wage states therefore receive a COLA that is worth more money than those in low-wage regions — a structural feature of the program.

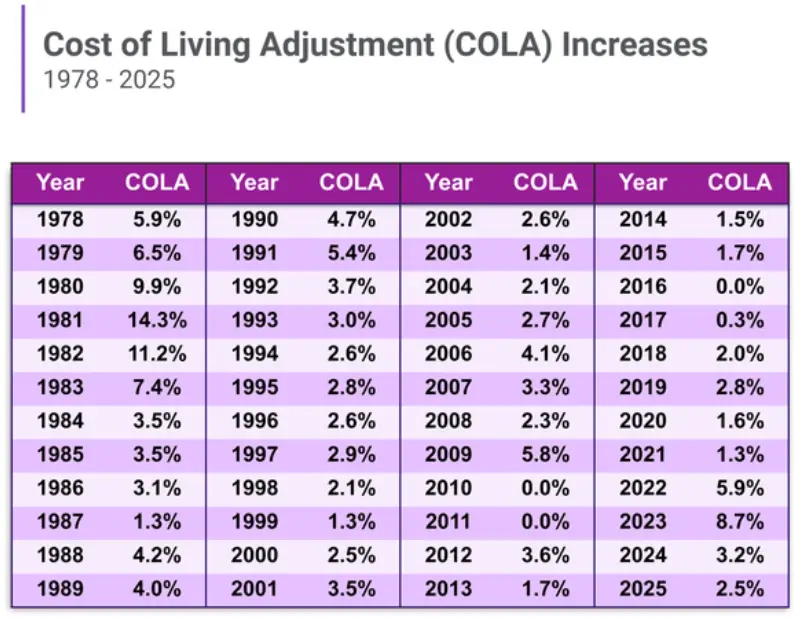

Historical Context: How 2026 Compares to Previous COLA Years

| Year | COLA % |

|---|---|

| 2022 | 5.9% |

| 2023 | 8.7% (highest since 1981) |

| 2024 | 3.2% |

| 2025 | 2.6% |

| 2026 | 2.8% |

The 2026 increase is modest by historical standards, but higher than in 2025. Analysts note that inflation has stabilized compared with the pandemic period but remains elevated in specific categories like housing and healthcare.

What Drives These Larger Social Security Raises in 2026?

Connecticut

Connecticut leads the nation in the nominal increase because retirees there have some of the highest average lifetime earnings. Many worked in finance, insurance, healthcare, and advanced manufacturing — sectors with strong, stable wage growth.

New Jersey

New Jersey’s retirees often have earnings connected to the New York metropolitan labor market. High-wage industries including pharmaceuticals, logistics, technology, and financial services result in larger-than-average benefits.

New Hampshire

While smaller in population, New Hampshire benefits from retirees who previously worked in Massachusetts or federal government roles. The state’s strong wage base contributes to higher overall benefit amounts.

Delaware

Delaware’s location between major economic hubs (Philadelphia, Baltimore, Washington) influences its workforce. Many performed high-income professional work in finance, healthcare, or corporate headquarters.

Maryland

Maryland consistently ranks high due to its concentration of federal employees, defense contractors, and university-hospital systems — all providing solid lifetime earnings.

How Benefit Structure Determines Real Gains

Social Security benefits are influenced by:

- Highest 35 years of earnings

- Indexing for wage inflation

- Retirement age

- Earnings caps and contributions

Workers in the five highlighted states often had:

- Longer careers in high-income professions

- Greater access to employer-sponsored retirement plans

- Higher wages relative to national averages

This pushes their initial benefits above the national baseline and increases the dollar value of COLA.

Expert Commentary: What These Raises Really Mean

Policymakers and economists offer differing interpretations of the regional disparities.

On structural inequality

A senior economist at the Center on Budget and Policy Priorities notes: “COLA preserves purchasing power, but because benefits reflect lifetime earnings, higher-income regions will always see bigger increases. The structure protects retirement stability but also reproduces wage-based inequalities.”

On regional cost pressures

A retirement policy professor adds: “A $60 COLA increase in Connecticut may still buy less than a $50 increase in a lower-cost state. The real value of the raise depends on where retirees live.”

CPI-W vs. Senior Spending: The Misalignment Debate

Many experts argue that COLA does not reflect actual inflation experienced by seniors. CPI-W tracks workers, not retirees, who spend differently.

Seniors spend more on:

- Healthcare

- Prescription drugs

- Housing and utilities

- Transportation services

The Elderly Consumer Price Index (CPI-E), though experimental, often shows faster inflation than CPI-W. Some lawmakers advocate adopting CPI-E to adjust future COLA calculations.

The 5 States Will See Bigger Social Security Raises in 2026 — But Will It Be Enough?

While the nominal increase is measurable, rising economic pressures may offset much of the gain:

Key 2026 cost trends:

- Healthcare inflation remains above general inflation

- Medicare Part B premiums are expected to rise

- Prescription drug costs continue long-term upward trends

- Housing and rental markets remain tight nationwide

For millions, the added Social Security income will help, but may not fully cover rising expenses.

Impact on Taxes: Where the Raise Will Be Taxed More Heavily

Social Security benefits may be taxable at the state level depending on location.

None of the top five states tax Social Security income.

This means retirees in CT, NJ, NH, DE, and MD keep more of their COLA increase. States that do tax Social Security include: Colorado, New Mexico, and Montana (under limited conditions). For retirees in those regions, a portion of COLA gains may be partially offset by tax liabilities.

Poverty Trends Among Seniors: Will the Raise Help?

Nationally, about 10% of seniors remain below the poverty line.

Even with COLA:

- Many low-income seniors will see increases of less than $40 monthly

- Rising medical bills continue to outpace COLA adjustments

- Inflation’s impact compounds over time

Analysts warn that COLA does not fully address structural financial insecurity in older populations.

Demographic Insights: Who Lives in the Top Five States?

These states tend to have:

- Higher average education levels

- Larger white-collar professional workforces

- More retirees with federal, corporate, or tech-sector pensions

- Higher cost of living than national averages

- Greater proportions of older residents with strong earnings histories

This demographic mix amplifies COLA’s nominal impact.

Policy Debate: Should COLA Reflect Senior Living Costs?

Advocates argue for:

- Switching to CPI-E

- Increasing minimum benefits

- Reforming Medicare deductibles

- Providing targeted support to low-income seniors

Opponents argue that:

- CPI-E is experimental and less reliable

- Increased COLA could create long-term solvency challenges

- Reform must balance fairness with program sustainability

Related Links

Social Security Shifts Again: New Retirement Age Rules Replace the Old 67 Benchmark

December Payout Schedule: Dates for All Subsidy and Pension Payments This Month

Looking Ahead: What to Expect for 2027 and Beyond

Early indicators suggest moderate inflation levels in healthcare and housing may push COLA slightly higher or similar in 2027. Analysts expect:

- Ongoing debate over the accuracy of COLA methodology

- Increased focus on senior economic vulnerability

- Pressure for Social Security reform as the trust fund approaches projected depletion in the 2030s

The fact that 5 States Will See Bigger Social Security Raises in 2026 highlights how deeply wage patterns influence retirement outcomes across America. While COLA helps protect purchasing power, rising costs and regional disparities continue to shape the real value of Social Security.

As policymakers debate program reforms, millions of retirees will look closely at how annual adjustments affect their long-term financial security.

FAQs About Social Security Raises in 2026

Why do only these five states see bigger raises?

Because benefits are tied to past earnings, and these states have higher average lifetime wages.

Do retirees everywhere receive 2.8%?

Yes. But the dollar amount varies based on each person’s benefit.

Will Medicare premiums reduce the raise?

Possibly. Many retirees have premiums deducted from their checks.

Will COLA be enough to offset inflation?

For most retirees, no — especially with rising healthcare costs.

Does moving to a low-cost state reduce your Social Security?

No. Benefits are tied to earnings history, not where you live.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores