The Social Security Administration (SSA) has officially announced a 2.8% cost-of-living adjustment (COLA) for 2026. This increase means that retirees and other beneficiaries will see a modest boost in their monthly payments.

For the average retiree, this translates into an additional $56 per month, increasing the average monthly payment from about $2,015 to $2,071. This article explains why the 2026 COLA increase may not be enough and why millions of Social Security beneficiaries are concerned about their future.

Social Security Increases

| What’s Changing in 2026 | Details | Impact on Beneficiaries |

|---|---|---|

| Social Security COLA Increase | +2.8% | Average benefit increase of $56/month |

| Medicare Part B Premiums | $202.90/month | Higher premiums absorb much of the COLA increase |

| SSI Benefits | $994/month for individuals, $1,491/month for couples | SSI benefits also increase by 2.8% |

| Medicare Part A Deductibles | $1,600 for hospital stays | Increases hospital cost-sharing for seniors |

| Earnings Limit for Working Retirees | $24,480/year | More flexibility for retirees working part-time |

| Taxable Wage Base | $184,500 | Higher-income earners contribute more to the system |

While the announcement seems promising at first glance, millions of retirees and Social Security recipients are worried. Rising Medicare premiums, increased out-of-pocket costs, and inflationary pressures are expected to quickly erode the purchasing power of these increases.

Why the 2026 COLA Increase May Not Be Enough

Rising Medicare Premiums Diminish Gains

While the 2.8% COLA increase sounds like a positive adjustment, many retirees will see a substantial chunk of it absorbed by rising Medicare premiums. The standard Medicare Part B premium will increase to $202.90/month in 2026, up from $185/month in 2025.

This means that for many retirees, the $56 increase they receive from the COLA will be largely offset by the higher premium, leaving them with only $38 per month in additional benefits.

- Impact on Average Retiree: For an average Social Security check of $2,015, after the $17.90 premium increase, retirees will net only about $39 per month.

- Higher-Income Retirees: Those with higher incomes may face even higher Medicare premiums due to the Income-Related Monthly Adjustment Amounts (IRMAA), further diminishing the effect of the COLA increase.

Increasing Costs for Medical and Hospital Care

Along with higher Part B premiums, the Part A deductible for hospital stays is expected to rise to $1,600 in 2026, increasing the out-of-pocket costs for seniors needing inpatient care. Additionally, prescription drug prices under Medicare Part D continue to rise, and while a cap on out-of-pocket prescription costs is being implemented, many seniors may still face significant expenses in areas not covered by Medicare.

- Increased Out-of-Pocket Costs: These increases are particularly concerning for those with chronic conditions or who need frequent hospital care, as the Medicare Part A costs can quickly add up.

How Inflation and COLA Fail to Keep Up with Retirees’ Costs

The COLA formula is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), which tracks the general inflation rate in the economy. However, CPI-W does not fully reflect the spending patterns of retirees, who tend to spend more on health care, housing, and other essential services that see higher inflation rates than the broader economy.

For instance, health care costs for seniors typically grow much faster than general inflation, yet the COLA formula does not account for this. As a result, even with a 2.8% increase, many retirees find that their Social Security payments are not keeping pace with rising expenses.

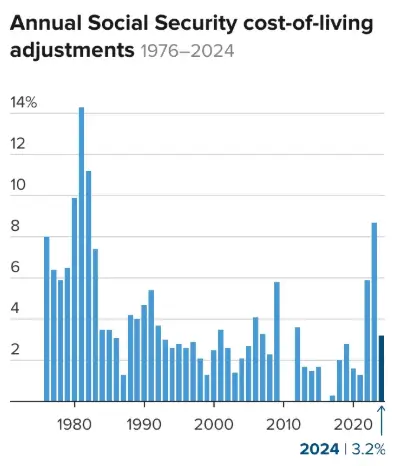

Historical Context: Why Seniors Are Falling Behind

Looking at the past decade’s COLA increases, it’s clear that Social Security payments have not kept pace with inflation in key areas. For example, since 2010, Medicare premiums and other health-related costs have increased at a rate much faster than COLA. As housing, transportation, and especially medical costs rise, the real increase in Social Security benefits often feels like a mere drop in the bucket for most retirees.

The Concerns Over Social Security’s Long-Term Viability

While the 2026 COLA increase provides some relief for retirees, it’s important to keep in mind that Social Security’s future remains in jeopardy due to funding challenges. The Social Security Trust Fund, which pays out benefits, is expected to be depleted by 2034 unless Congress takes action.

- What This Means for Beneficiaries: As the trust fund runs out, there will be less money to pay benefits, which could result in a 23% cut in benefits unless significant reforms are made.

- What Could Be Done: Policymakers are discussing various proposals, including raising tae payroll tax cap and increasing Social Security taxes for high earners. However, these ideas have yet to gain traction in Congress.

What You Can Do to Protect Your Retirement Income

- Reassess Your Social Security Benefits: Review your Social Security statement regularly to track your benefits and estimate the impact of COLA adjustments. You can use the SSA’s online tools to make sure your earnings history is accurate.

- Review Your Healthcare Plan: With rising Medicare premiums, it’s important to explore whether Medicare Advantage plans or Medigap policies might offer better coverage at a more affordable rate.

- Plan for Rising Costs: Budget carefully for inflationary increases in housing, utilities, and medical care, all of which affect retirees disproportionately.

- Consider Supplementary Income: If you can work part-time or have access to other income sources, consider diversifying your income streams to make up for the shortfall created by rising costs.

What Advocacy Groups Are Saying

Many advocacy groups, such as AARP and the National Committee to Preserve Social Security and Medicare, are raising concerns about the insufficient COLA adjustments and the long-term solvency of Social Security.

These groups argue that Social Security needs more comprehensive reform to account for the rising costs that seniors face.

AARP’s Viewpoint

AARP has called for the adoption of the CPI-E (Consumer Price Index for the Elderly) to ensure that COLA better reflects the true cost of living for seniors. According to AARP, seniors typically spend a larger share of their income on health care and housing — both of which have inflated at much higher rates than the general economy.

The National Committee’s Concerns

The National Committee to Preserve Social Security and Medicare (NCPSSM) has also emphasized that unless more is done to address rising costs and ensure future funding, millions of seniors will struggle to keep up with inflation, especially in the years to come.

Related Links

CalFresh December 2025 — When Food Stamp Benefits Will Be Deposited This Month

$1,000 December Stimulus — Here’s the Expected Deposit Date for the Payment

Managing Expectations for 2026 and Beyond

While the 2026 COLA increase offers a much-needed adjustment, it’s clear that retirees and Social Security beneficiaries may find themselves facing financial strain despite the increase.

Rising Medicare premiums and health care costs, combined with inflation in critical areas, could result in many beneficiaries finding their purchasing power is barely increasing — if at all. Moreover, concerns about the long-term viability of Social Security remain.

Policymakers will need to act soon to address these issues and ensure that the program remains sustainable for future generations of retirees.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores