The Social Security Administration (SSA) has confirmed that beginning in January 2026, Social Security benefits will rise by 2.8%, offering critical relief to millions of American beneficiaries. However, the increase doesn’t come automatically—recipients must take steps now to ensure they receive the updated payments on time and avoid unnecessary delays or errors.

This article outlines the necessary actions to take before the adjustments kick in.

Social Security Increase for 2026

| Key Fact | Detail |

|---|---|

| COLA Increase | 2.8% for 2026 |

| Average Benefit Increase | ~$56 per month for retirees |

| Payment Start Date | January 2026 for Social Security; December 31, 2025 for SSI |

| Taxable Earnings Cap | $184,500 in 2026 |

What the Increase Entails

The 2026 Social Security COLA (Cost-of-Living Adjustment) will apply to all beneficiaries in the OASDI (Old-Age, Survivors, and Disability Insurance) program, including retirees, individuals with disabilities, and survivors of deceased workers.

This 2.8% adjustment translates into an average monthly benefit increase of approximately $56 for retired workers. For a married couple where both individuals receive Social Security, the total benefit increase is estimated to be around $176 per month.

Additional changes in 2026 include:

- Maximum Taxable Earnings: In 2026, the maximum earnings subject to Social Security tax will rise to $184,500, up from $176,100 in 2025. This adjustment means individuals who earn more than this amount will contribute higher taxes to the Social Security fund.

- Earnings Limits for Workers: Social Security beneficiaries under full retirement age who work will be subject to the earnings test, with a new threshold of $24,480 per year. For those reaching full retirement age in 2026, the earnings limit increases to $65,160.

Why You Should Take Action Now

1. Review Your my Social Security Account

The most important step for all beneficiaries is to ensure their my Social Security account is active and up to date. This account provides the easiest way to track your benefit status and receive COLA notices faster than by traditional mail.

- Action: If you don’t have an account, create one at ssa.gov/myaccount.

- Deadline: Create or update your account by November 19, 2025 to get early digital notifications.

2. Verify Your Earnings Record

Social Security benefits are based on your lifetime earnings, so it’s critical to verify that the SSA has accurately recorded your earnings history. Mistakes in this record could reduce your future benefits or COLA increases.

- Action: Log into your SSA account, review your earnings for each year, and report any discrepancies to the SSA.

- Deadline: Review by December 2025 to ensure all earnings are reported accurately.

3. Update Payment Information

Direct deposit is the safest and most efficient method for receiving benefits. If you haven’t already set up direct deposit or if your account information has changed, now is the time to act.

- Action: Visit go-direct.gov to set up or update your direct deposit information.

- Deadline: Complete this process by December 2025 to avoid delays.

4. Monitor Medicare Premiums

While the 2.8% COLA increase is welcome news, it’s important to remember that Medicare premiums may rise as well, reducing the overall benefit increase. According to AARP, the standard Medicare Part B premium in 2026 could increase by $21.50 per month, meaning the COLA adjustment might not fully offset the increased healthcare costs.

- Action: Monitor your Medicare premium notices to understand how the changes will affect your net benefit.

- Deadline: Review your Medicare premium in late 2025 to understand your new deduction.

The COLA Calculation Explained

The COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure of inflation tracked by the Bureau of Labor Statistics (BLS). Each year, the SSA reviews the CPI-W from the third quarter of the year to determine the percentage increase needed to keep Social Security payments in line with inflation.

The 2.8% COLA for 2026 is slightly higher than the 1.3% increase in 2025, but lower than the 5.9% adjustment in 2022. This rise reflects the ongoing effects of inflation, which has steadily increased since 2021. However, for many seniors, the increase does not fully cover rising costs, especially in areas like healthcare and housing.

A Comparison with Past COLAs

It’s useful to put the 2026 increase in perspective by comparing it to previous years. For example:

- 2025: 1.3% COLA increase

- 2024: 3.2% COLA increase

- 2023: 8.7% COLA increase (one of the highest in recent history)

While 2026’s increase is modest, it is still in line with long-term inflation trends. However, inflationary pressures, especially in food, healthcare, and energy, mean that many beneficiaries feel the increase doesn’t go far enough.

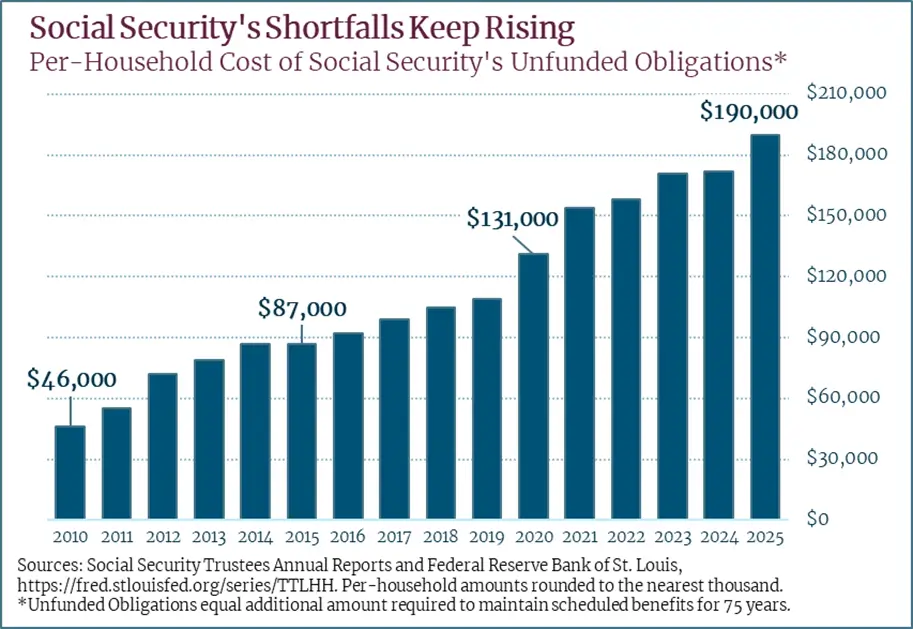

The Bigger Picture: Social Security’s Future

While the 2026 COLA is beneficial, Social Security remains under financial strain. According to the Social Security Trustees Report, the Social Security trust fund may be depleted by 2034 unless adjustments are made. Policymakers are under increasing pressure to reform the system to ensure it remains solvent for future generations.

- Younger Workers’ Considerations: Younger workers should be mindful of these long-term risks and start planning for their own retirement, including considering additional retirement savings options beyond Social Security.

- Potential for Future COLAs: If inflation continues at its current pace, future COLA increases may exceed 2.8%, but without proper reforms, the purchasing power of those increases could diminish.

Real-Life Examples: How the Increase Works for Different Recipients

Example 1: Retiree

Nancy, a retiree who receives $2,000 per month, will see a $56 increase to her monthly benefit under the 2.8% COLA adjustment, bringing her new monthly payment to $2,056.

Example 2: Married Couple

John and Lisa, a married couple receiving a combined benefit of $3,200, will see an increase of $176, bringing their combined monthly payment to $3,376.

Example 3: Disabled Worker

A disabled worker receiving $1,500 per month will see an increase of $42, bringing the new monthly payment to $1,542.

These examples demonstrate how the COLA increase will vary based on the individual or family’s benefit amount but provides important relief across the board.

Related Links

$725 Monthly Stimulus Checks Continue — Next Round of Payments Arrives This Week

Arizona Considers Law Requiring Speeders to Install $250 Tracking Devices With Daily Fees

Final Thoughts

The 2026 Social Security increase is a significant development for millions of beneficiaries, especially as inflation continues to affect purchasing power. However, it’s critical that individuals take the right steps now to ensure they receive their full benefit on time, including reviewing their my Social Security account, updating their contact and payment information, and staying informed about Medicare premiums.

By preparing now, you can avoid delays and ensure that your COLA increase reaches you without complications, enabling a smoother transition into the new benefit year.

FAQ About Social Security Increase for 2026

Q1: How much will my Social Security benefit increase in 2026?

The average increase will be 2.8%, which translates into about $56 per month for retirees. However, the exact amount varies based on your individual benefit.

Q2: When will the COLA increase take effect?

Social Security payments will reflect the COLA increase beginning January 2026, and SSI payments will start on December 31, 2025.

Q3: How can I avoid delays in receiving my new payment?

Ensure your my Social Security account is set up and your direct deposit details are accurate. If you receive a paper check, consider switching to electronic payments.

Q4: Will my Medicare premium affect my new Social Security amount?

Yes, increases in Medicare premiums could reduce the net amount you receive from Social Security. Be sure to check your new Medicare premium in late 2025.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores