As the calendar turns to December 2025, the Social Security Administration (SSA) is executing a rare payment‑shift — issuing some benefit checks on Christmas Eve and New Year’s Eve.

The change stems from holiday scheduling rules and affects mainly recipients of Supplemental Security Income (SSI), not a permanent increase in benefits. Understanding the adjustment can help beneficiaries manage their year‑end finances.

Social Security Checks Set for Christmas Eve

| Key Fact | Detail |

|---|---|

| Standard retirement/disability payments are scheduled by birth date | Payments occur on 2nd, 3rd, or 4th Wednesday depending on birth date (1‑10 → 2nd; 11‑20 → 3rd; 21‑31 → 4th) |

| SSI payments are normally issued on the 1st of each month | If 1st is a weekend or federal holiday, payment moves to previous business day |

| December 2025 will see two SSI payments for many recipients | One on Dec. 1 for December benefit, one on Dec. 31 as early January benefit (Jan 1 is a holiday) |

| The extra December deposit is not additional benefit | The Dec. 31 check covers January 2026 benefit. No second January payment will occur. |

| Paper checks have been discontinued as of Sept. 2025 | All Social Security benefits now go via electronic payment (direct deposit or debit card) |

How the Regular Payment Schedule Works

Retirement, Disability, and Survivor Benefits

For the vast majority of those drawing monthly retirement, disability, or survivor benefits under SSA’s Old‑Age, Survivors, and Disability Insurance (OASDI) program, the payment schedule is determined by their birth date.

- Birthdays 1–10 → payment on the second Wednesday of each month.

- Birthdays 11–20 → payment on the third Wednesday.

- Birthdays 21–31 → payment on the fourth Wednesday.

A small subset — those who began receiving benefits before May 1997, or who receive both Social Security and SSI — are paid on the third of each month (or the preceding business day if that falls on a weekend or holiday).

This staggered system was adopted in 1997 to reduce the administrative burden of processing millions of payments in a few early-month days.

Supplemental Security Income (SSI)

SSI, a separate program aimed at providing financial support to low‑income seniors, blind, or disabled Americans, follows its own schedule. Under standard rules, SSI payments are made on the first day of each month. If the first day falls on a weekend or federal holiday, the payment is issued on the previous business day.

Why Payments Shift in December 2025 — And Who Gets Two Checks

The Holiday Rule

The SSA — like most U.S. federal agencies — avoids making payments on weekends or federal holidays. If a payment date falls on such a day, the distribution shifts to the previous business day. This rule ensures that funds arrive in beneficiaries’ bank accounts before banks and post offices close for holidays, helping guarantee uninterrupted access to critical benefits.

December 2025: A Unique Overlap

In 2025, the calendar aligns in such a way that the regular December SSI payment (Dec. 1) and the January 2026 payment (normally Jan. 1) both land in December. Because Jan. 1, 2026 is a federal holiday (New Year’s Day), SSA is issuing the January payment on Wednesday, Dec. 31, 2025.

Thus, eligible SSI beneficiaries will see two deposits in December:

- Dec. 1, 2025 — December benefit

- Dec. 31, 2025 — Early January 2026 benefit.

Standard Social Security beneficiaries under the Wednesday schedule are unaffected this month — their payments will occur on the regular dates (Dec. 10, 17, or 24 depending on their birthday).

Recipients who collect both SSI and Social Security may see three deposits in December: SSI on Dec. 1, Social Security on Dec. 3, and the early SSI payment on Dec. 31.

What Has Changed in 2025 — And Why It Matters

Transition from Paper Checks to Electronic Payments

As of September 30, 2025, SSA has officially discontinued issuing physical paper checks. Nearly all recipients — over 68 million Americans — now receive their benefits via direct deposit or prepaid debit cards (such as the government’s Direct Express program).

This shift to electronic-only payments carries additional importance this December: with two scheduled payments for many SSI recipients, timely deposit is critical for budgeting and cash flow. It also reduces the risk of delays or losses associated with mailed checks.

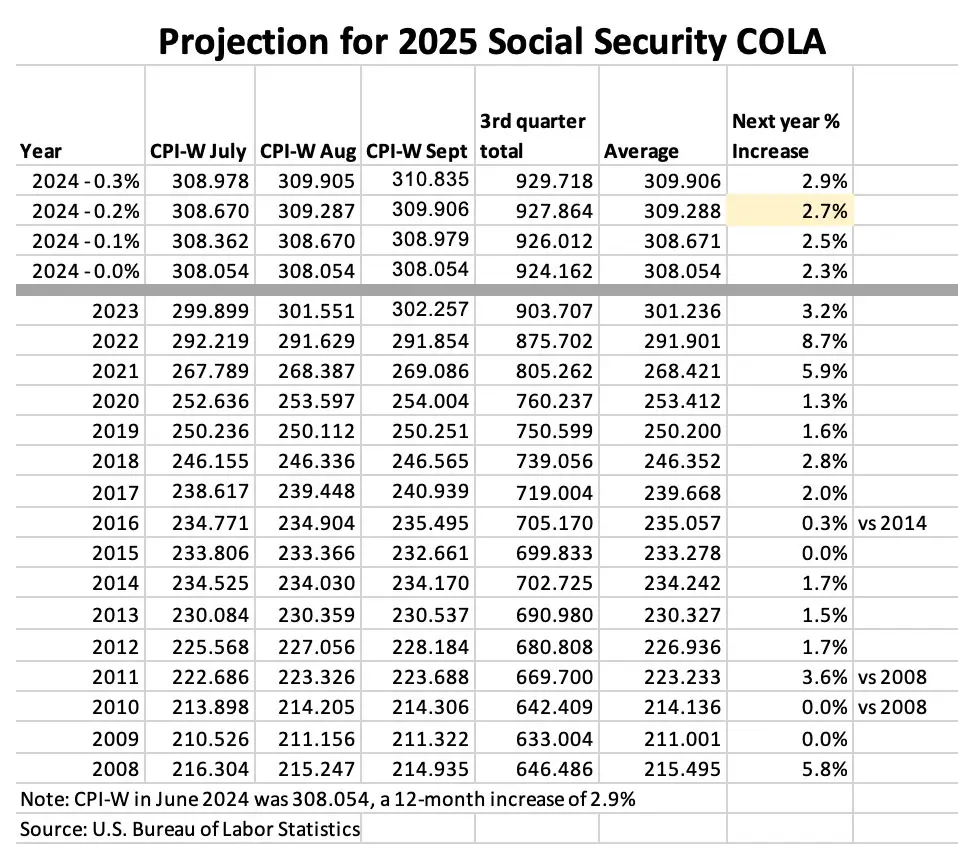

Cost‑of‑Living Adjustment (COLA) on the Horizon

Another relevant development: beginning in 2026, benefits across Social Security and SSI will see a 2.8% cost-of-living adjustment (COLA).

For many recipients, the early January payment arriving on Dec. 31 marks the first deposit with the increased amount. According to reporting, the average monthly boost for beneficiaries is projected to be around $56 per month. That makes the Dec. 31 deposit more significant — it carries updated benefit amounts under the new law.

What Beneficiaries Should Know — And Do

Plan Ahead for Two Deposits: If you rely on SSI, expect both a December deposit (Dec. 1) and an early January deposit (Dec. 31). Recipients with both SSI and standard Social Security may receive three deposits.

Budget Accordingly: The second deposit represents January’s benefit. Treat it as such — don’t assume it’s “extra” money for December expenses.

Check Your Bank Account Early: Since SSA now relies entirely on electronic payment, confirm that funds arrive as expected. If a payment does not appear on the scheduled deposit date, allow at least three business days before reaching out to your bank or SSA.

Be Aware of COLA Effects: The late-December deposit likely reflects the 2026 cost‑of‑living increase. Ensure you account for that in planning budgets or upcoming expenses.

Broader Context: Why the System Is Designed This Way

The staggered Wednesday payment schedule for OASDI recipients dates back to 1997, when SSA changed its system to handle the increasing volume of beneficiaries more evenly over the month.

By spreading payments across different mid‑month dates, SSA reduces administrative bottlenecks and smooths cash flow for the agency and recipients alike.

Meanwhile, SSI — funded by general federal revenue and targeted to low-income, elderly, blind, or disabled individuals — retains the simple “first-of-the-month” structure to ensure predictable monthly cash flow for those who often rely on every cent.

Because holiday dates and weekends shift from year to year, the annual payment calendar naturally produces occasional “double‑payment” months, such as December 2025.

Potential Issues and What to Watch For

While the dual payment schedule in December can assist budgeting, it also can lead to confusion. Some recipients may misinterpret the extra deposit as an additional or bonus check, potentially overspending before realizing the funds represent January benefits.

There is also potential for delays or confusion among those who have recently switched from paper checks to electronic payments — especially elderly or low-income beneficiaries who may lack familiarity with direct deposit, online banking, or debit cards.

Finally, because some benefit amounts increase with the 2026 COLA, deposits may vary from recent months. Recipients must be alert to any changes and verify that the amount matches expectations.

Related Links

New Tax Credit Brings Relief to 940,000 Families — How the Benefit Works

Trump’s Income Tax Replacement Idea Explained — Can Tariffs Really Fund the Government?

This December, the Social Security Administration is following long‑standing rules: adjusting benefit payment dates when holidays or weekends interfere. As a result, many SSI recipients will receive two payments this month, and some dual‑benefit recipients may see three deposits.

The shift underscores the importance of clarity and planning: the second deposit is not extra benefit, but the January 2026 payment arriving early — likely already reflecting the new 2.8% cost-of-living increase.

Beneficiaries should verify their bank accounts, budget carefully, and treat the December 31 payment as January’s benefit. As one planning expert recently put it: “Know when the money hits, and plan how to use it — before the holidays catch up.”

Georgia Social Security Update: Why Some Recipients Will Receive Two Payments This Month

Georgia Social Security Update: Why Some Recipients Will Receive Two Payments This Month December 2025 Social Security: Updated Average Payment and What Will Change in 2026

December 2025 Social Security: Updated Average Payment and What Will Change in 2026 New Social Security Proposals Advance in Congress — Retirement Age and ID Protection Under Review

New Social Security Proposals Advance in Congress — Retirement Age and ID Protection Under Review Lawyers Seek $300 Million in Fees From the $1.5 Billion Anthropic Copyright Settlement

Lawyers Seek $300 Million in Fees From the $1.5 Billion Anthropic Copyright Settlement