Social Security at 70: How Retirees Can Reach the New $5,108 Maximum Benefit

The Social Security Administration (SSA) increased the maximum benefit for Social Security at 70 to $5,108 per month starting in 2025, according to updated federal benefit schedules. The change highlights how only workers with long, consistent, and high-earning careers can qualify, raising wider questions about retirement readiness, wage inequality, and How Retirees Can Reach the New $5,108 Maximum Benefit.

Social Security at 70

| Key Fact | Detail / Statistic |

|---|---|

| Maximum benefit at age 70 | $5,108 in 2025 |

| Earnings required to qualify | 35 years at or above the taxable wage base |

| Taxable wage base (2025 estimate) | Approximately $176,100 |

| FRA maximum benefit | $4,018 per month at age 67 |

| Average monthly benefit | Around $2,000 for retired workers |

| Early filing penalty | Up to 30% for claiming at age 62 |

| Official website | Social Security Administration |

As federal officials prepare for future evaluations of Social Security’s long-term viability, retirement planners say workers should take a proactive approach to understanding benefit formulas. Any future reforms could reshape the path toward achieving the New $5,108 Maximum Benefit, leaving many Americans waiting to see how potential legislation might alter their retirement plans.

Understanding the New $5,108 Maximum Benefit

The SSA confirmed the updated benefit levels in its annual release, noting that the maximum possible payment is available only for individuals who delay claiming until age 70. These increases are tied to growth in the national wage index, which influences benefit formulas and future earnings caps.

“Social Security aims to reflect long-term wage trends rather than month-to-month shifts,” said Dr. Julia Coronado, an economist at the University of Texas at Austin, in comments reported by Reuters. “The changes are formula-driven, not discretionary.”

For most workers, the new maximum raises important questions about whether delaying benefits is worth the financial trade-off.

Why Only a Small Percentage of Retirees Qualify

Achieving the Maximum Benefit requires a combination of circumstances that relatively few workers experience:

1. Earning the Taxable Maximum for 35 Years

The SSA bases retirement benefits on a worker’s highest 35 years of inflation-adjusted earnings. If a worker has fewer than 35 years of earnings, the agency uses zeros for the missing years, lowering the benefit amount.

To reach the maximum, earnings must meet or exceed the taxable wage base for most of a career. In 2025, the limit is projected at $176,100, according to federal wage index estimates.

“Most American workers don’t reach the taxable maximum even once,” said Andrew Biggs, a senior fellow at the American Enterprise Institute. “Reaching it for 35 years is extraordinarily rare.”

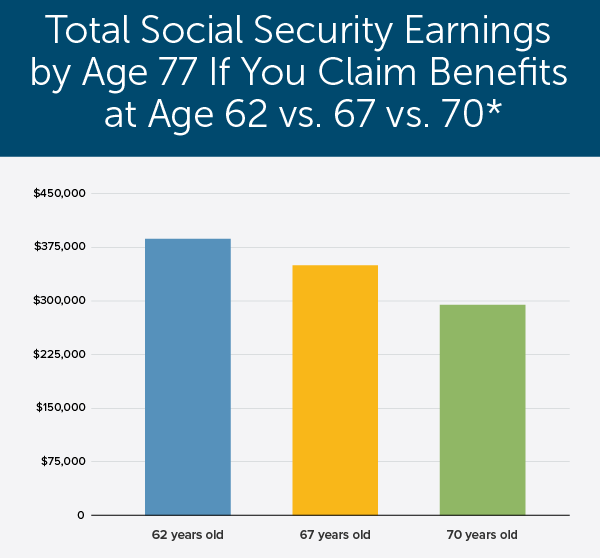

2. Delaying Benefits Until 70

Claiming early reduces monthly payments significantly:

- Age 62: Up to 30% reduction

- Full Retirement Age (67): No reduction

- Age 70: Delayed credits add about 8% per year

The SSA explains that delaying from 67 to 70 increases benefits by 24%, leading to the $5,108 upper limit.

3. Navigating Wage Gaps and Career Interruptions

Earnings disparities—whether by gender, race, geography, or industry—complicate the path to the maximum benefit. Long breaks for caregiving, job changes, or health issues often reduce a worker’s lifetime average earnings.

A study from the Urban Institute found that fewer than 6% of workers maintain taxable-max earnings even for half of their careers.

How Retirees Can Reach the Maximum Benefit of Social Security at 70

Despite the challenges, experts highlight several strategies for those aiming to maximize their Social Security payments.

Maintain High Earnings Over the Long Term

Workers in certain professions—such as advanced engineering, medicine, executive roles, and specialized technology fields—are more likely to reach the wage base. Consistent high earnings over multiple decades remain the most important factor in meeting the SSA threshold.

Optimize Claiming Strategy

Financial planners emphasize the importance of timing.

“Delaying benefits until age 70 often pays off, especially for those in good health with long life expectancies,” said Alicia Munnell, director of the Center for Retirement Research at Boston College. “The higher monthly amount is valuable insurance against longevity risk.”

Work Beyond Full Retirement Age

Continuing to work past 67 can boost earnings averages, especially if late-career income is the highest of a worker’s lifetime. Each new high-earnings year replaces a lower year in the 35-year calculation.

Review Earnings Statements for Errors

The SSA reports that errors in earnings records are more common than many expect. Correcting past inaccuracies can increase future benefits.

Workers can check their online “my Social Security” account to verify their annual earnings history.

Historical Background: How Maximum Benefits Have Evolved

Social Security has changed significantly since its introduction in 1935. In the program’s early decades, the concept of a “maximum benefit” was far simpler, tied to ceilings far below today’s levels.

Key developments include:

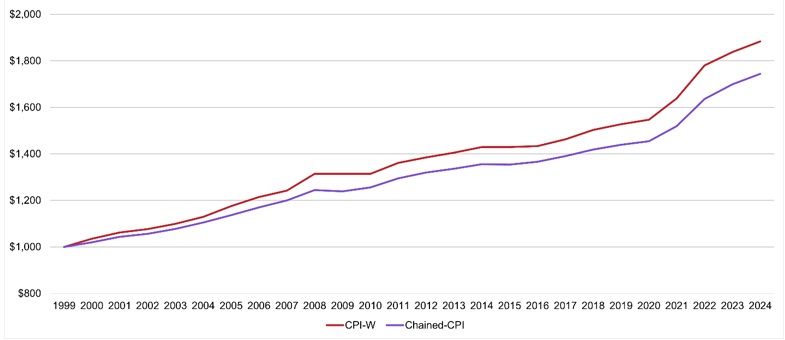

Growth of the Wage Index

Benefits track the national average wage index, which has risen over time due to:

- Inflation

- Economic growth

- Productivity increases

- Structural changes in labor compensation

This indexing helps protect benefits against long-term economic shifts.

Rise of Delayed Retirement Credits

Delayed retirement credits were introduced in the 1970s and expanded several times to encourage older Americans to work longer. These credits now play a major role in maximizing the benefit amount.

Changes in Retirement Age

The full retirement age (FRA) increased from 65 to 67 under reforms passed in 1983. The age 70 maximum remains unchanged.

Demographic Trends Influence Future Benefit Structures

As life expectancy increases and population growth slows, Social Security’s long-term outlook faces pressure.

An Aging Population

According to the Census Bureau, Americans aged 65 and over will outnumber children under 18 by 2035. This shift affects:

- Worker-to-beneficiary ratios

- Payroll tax revenue

- Trust fund solvency

Increasing Longevity

Living longer elevates the value of delaying benefits, but also raises concerns about the system’s long-term sustainability.

Changing Work Patterns

More Americans move between jobs, industries, or gig work—making it harder to achieve 35 years of high earnings.

Policy Debate: Is the Maximum Benefit Too High or Too Low?

Opinions differ sharply on whether the New $5,108 Maximum Benefit is appropriate.

Those Who Support the Current System

Advocates argue the benefit appropriately rewards decades of high contributions.

- Reflects fairness for high earners who pay more into the system

- Encourages delayed retirement

- Adds predictability to retirement planning

Those Who Criticize the Maximum Benefit

Others believe reforms should focus more on low-income retirees.

- The system was not designed to be a wealth-building tool

- Many Americans rely heavily on Social Security

- Lower-income workers face disproportionately shorter life expectancies

In comments to the Associated Press, Nancy Altman, president of Social Security Works, said, “Reforming the system must balance fairness with stability, while protecting the most vulnerable beneficiaries.”

Financial Planning Considerations

Experts advise retirees to treat Social Security as just one part of a broader financial strategy.

Savings and Investments

Retirees often need additional income sources, such as:

- 401(k) or IRA savings

- Employer pensions

- Investment income

- Part-time earnings

Health and Longevity Factors

Those in poor health may not benefit from delaying to age 70. In contrast, healthier individuals often gain thousands more over their lifetimes by waiting.

Starting Benefits in 2026? Three Key Changes New Retirees Will Notice Immediately

Tax Implications

Up to 85% of Social Security benefits may be taxable, depending on income. Financial planners recommend strategies that reduce taxable income during retirement.

FAQs About Social Security at 70

Who qualifies for the maximum $5,108 benefit?

Those with 35 years of earnings at or above the taxable wage base who delay claiming until age 70.

Does the maximum benefit change each year?

Yes. It adjusts annually based on the national average wage index.

Can I qualify without hitting the taxable maximum?

No. The formula requires reaching or exceeding the taxable wage base.

Is waiting until age 70 always the best choice?

Not always. Individual health, finances, and job prospects matter.