Social Security 2026 Update — Higher Payments, New Work Limits and an Updated Benefit Ceiling

The Social Security Administration (SSA) has announced a major Social Security 2026 Update that will affect nearly 71 million Americans starting January 2026. The changes include a 2.8 percent cost-of-living increase, higher earnings thresholds for working beneficiaries, and a raised taxable earnings ceiling.

While designed to reflect changing economic and work-force realities, analysts caution the net benefit for many may be smaller than the headline increase suggests.

Social Security 2026 Update

| Key Fact | Detail |

|---|---|

| COLA increase for 2026 | 2.8 percent; average increase ~$56/month |

| Taxable earnings base for 2026 | $184,500, up from $176,100 in 2025 |

| Earnings test limits (2026) | Under FRA: $24,480; Year of FRA: $65,160 |

| Estimated average monthly benefit | From approx. $2,015 to $2,071 after COLA |

What’s in the 2026 Update?

Social Security 2026 Update — Key Changes Explained

The 2026 update to Social Security covers three major structural elements: benefit increases, work-related rules, and tax/earnings limits. Each of these adjustments plays a role in how beneficiaries receive payments, how much they can earn while collecting benefits (KW2), and the ceiling on taxable wages that feed into the program (KW3).

Benefit Increase (COLA)

The SSA announced that benefits will increase by 2.8 percent starting January 2026 — applying to retirement, survivors, and disability benefits under the Old-Age, Survivors, and Disability Insurance (OASDI) program.

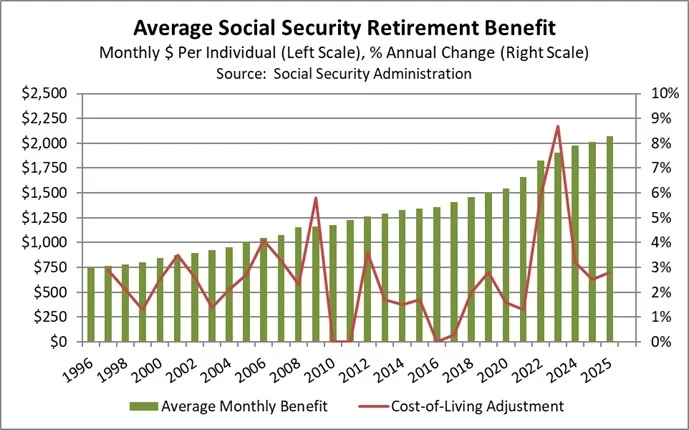

For the average retired worker, the monthly benefit will rise from about $2,015 to approximately $2,071. While this boost helps maintain purchasing power against inflation, advocacy groups note that real-world costs for housing, health care and food have often risen faster than the measure used for the adjustment.

Updated Work Limits and Earnings Rules

A second pillar of the update involves the “earnings test” for individuals who start receiving benefits before reaching their full retirement age (FRA). Under the new rules:

- Beneficiaries under FRA may earn up to $24,480 annually in 2026 before $1 in benefits is withheld for every $2 earned above that threshold.

- Those who reach FRA in 2026 may earn up to $65,160 before $1 is withheld for every $3 earned above that threshold until the month they attain FRA.

- These changes provide some added flexibility for older Americans who want to continue working while collecting benefits (KW2).

Raised Taxable Earnings Ceiling (Benefit Ceiling)

The taxable wage base — meaning the maximum earnings subject to the Social Security payroll tax (6.2%) — will increase to $184,500 in 2026, up from $176,100 in 2025.

This limit also affects how future benefits are calculated because higher covered earnings raise the baseline for benefit formulas, and it strengthens revenue flow into the system (KW3).

Historical Context & Why These Changes Matter

The SSA’s 2026 update is rooted in three driving forces: inflation, evolving work patterns among older Americans, and the long-term financial health of the Social Security system.

Inflation and Cost-of-Living Adjustments

The COLA has been a feature of Social Security since 1975 to ensure benefits keep pace with inflation measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The 2026 adjustment of 2.8 % is slightly above the 20-year average of about 3.1 % but well below the high increases seen in 2022 (8.7 %) when inflation spiked.

For many beneficiaries, especially those on fixed incomes, the COLA may matter less than rising out-of-pocket health-care costs, housing, and inflation-driven expenses.

Work Patterns and Beneficiary Earnings

Older Americans are more likely to stay in the workforce longer than past generations. Adjusting earnings rules and work limits reflects this trend. The higher thresholds permit more earned income without reducing monthly benefits, reinforcing flexibility for phased retirement or part-time work (KW2).

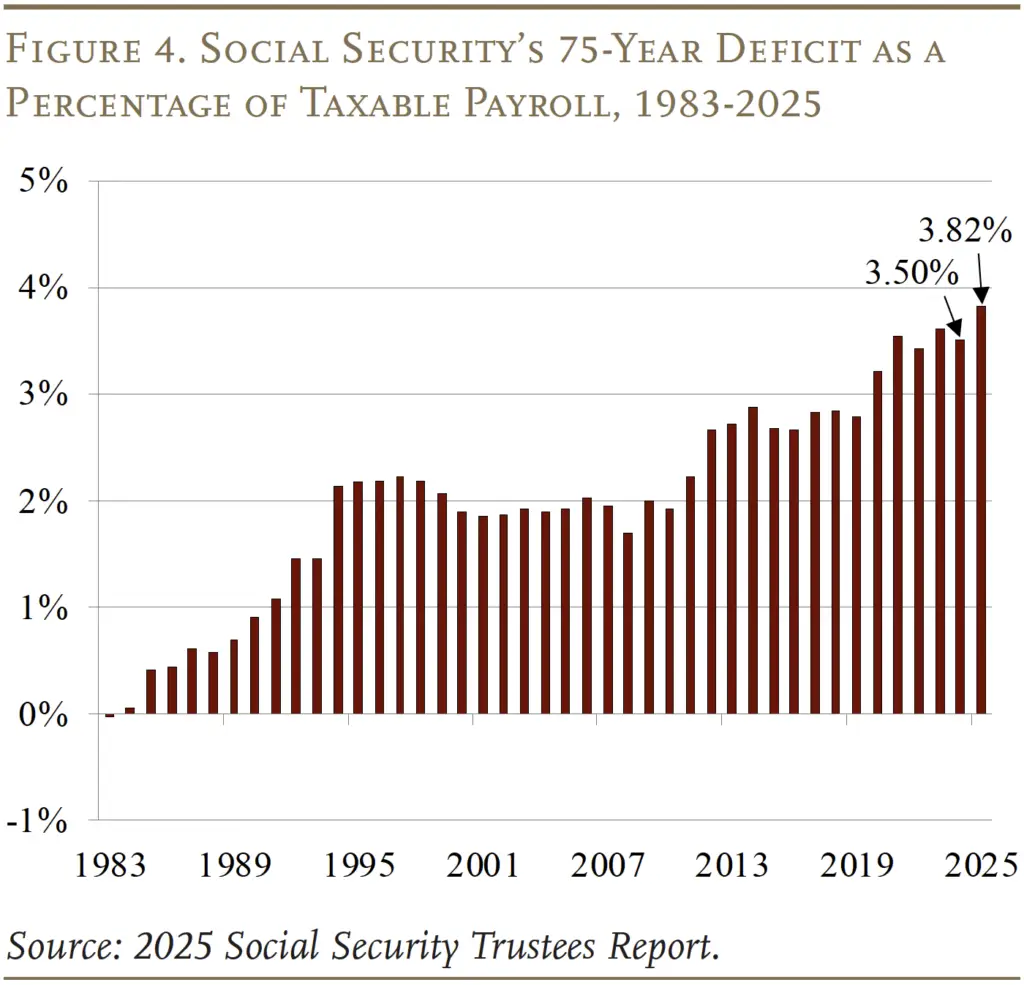

Program Financing and Solvency

Social Security’s trust funds rely on payroll taxes and earnings indexing. According to the SSA’s 2025 Trustees Report, the OASDI trust funds may become depleted by 2034 under current law. Without reforms, benefit payments could face reductions of about 20 %.

Raising the taxable wage base (KW3) is one piece of maintaining revenue, though it alone will not resolve long-term solvency challenges.

What This Means for Different Groups

Retirees

Retired workers stand to receive modest increases in monthly checks. However, many may find that the net benefit — after deductions, health-care premiums and other costs — is smaller than the headline raise suggests.

Working Older Americans

Workers who plan to claim benefits and continue earning will benefit from higher earnings limits. This may reduce incentive to stop working but requires planning around when to claim and how much to earn.

Future Claimants and Higher Earners

Those farther from retirement or earning high incomes will see the effects of the raised taxable earnings ceiling. Over time, slightly higher covered earnings may raise future benefit levels, but higher earnings also mean higher tax exposure.

Low-Income Beneficiaries

Even with the COLA increase, low-income retirees face cost pressures that can exceed incremental benefit increases. For them, small increases may still translate into tight budgets, making additional support or cost-containment critical (KW4).

Expert Perspectives

Dr. Rebecca Lawson, a retirement-policy scholar at the Heritage Foundation, stated:

“The 2.8 percent adjustment is needed, but it may not be sufficient given that medical-care inflation and housing costs tend to exceed general inflation for seniors.”

John Redding, senior analyst at the Center for Retirement Research at Boston College, observed:

“Working longer with higher earnings limits is helpful, but the timing of claiming remains an important decision for older workers.”

These comments reflect how the interplay between work rules, benefit timing, and costs influences retirement planning.

Comparative View: This Update Versus Previous Years

- The 2026 COLA of 2.8 % marks a return toward typical levels after unusually large increases in recent years (for example, 8.7 % in 2023) due to high inflation.

- Earnings limits and wage-base caps continue their indexed increases but have gained greater visibility as part of the “work longer, earn more” paradigm (KW2, KW3).

- Observers note that while the annual rule changes are steady, they do not replace the need for deeper structural reform given long-term funding pressures.

Related Links

SSA November Payments — Four Important Dates and Eligibility Details to Know

$1,450 Stimulus Still Available — Families Can Apply Before December Deadline

State-by-State Considerations

While the changes apply nationwide, their impact can vary depending on cost of living, state tax treatment of Social Security benefits and local workforce dynamics. States with higher costs of housing and health care may see beneficiaries feel the raise less, while states with more opportunities for older-worker employment may benefit more from the work-limit adjustments (KW4).

Practical Steps for Beneficiaries

- Review your “my Social Security” account on the SSA website to view your updated benefit estimate ahead of January 2026.

- Examine your employment plans if you intend to continue earning while receiving benefits — use the new thresholds ($24,480 under FRA, $65,160 in year of FRA) in your calculations.

- Update your budget, factoring in the 2.8 % benefit increase and likely higher health premiums.

- Consider timing your benefit claim, as delaying may lead to higher monthly checks and may offset some deductions or costs.

- Stay informed about future reforms, especially given the projected depletion date of the Social Security trust funds, which may require congressional action (KW4).

The Social Security 2026 Update reflects incremental but significant updates to how Americans receive and can earn while collecting Social Security benefits. While the increases and adjustments are helpful, they do not fundamentally change the program’s long-term finances.

Analysts expect continued policy discussions focused on solvency and benefit structure. Beneficiaries and future claimants must now plan not only for higher immediate payments, but also for how changes in work rules, earnings ceilings and cost pressures will affect their overall retirement financial security.