SG Silver Support Scheme 2025 Confirmed; Who Gets It, How to Apply, and When Money Hits Accounts

SG Silver Support Scheme 2025: The SG Silver Support Scheme 2025 stands as a vital financial lifeline for seniors in Singapore who have faced low incomes during their working life and now find themselves with limited retirement savings. This government initiative provides quarterly cash payouts to low-income seniors aged 65 and above—helping them cover everyday expenses like groceries, medical bills, and transportation. The beauty of this scheme is that it requires no application—eligibility assessments are automatic, based on recorded income history, CPF contributions, and current household circumstances. Official payments begin the quarter a senior turns 65, with amounts ranging from S$215 to S$1,080 depending on housing type and household income.

This article offers a comprehensive, clear, and professional breakdown of the scheme, making it both approachable for younger readers and deeply informative for financial professionals or caregivers supporting seniors. Let’s unpack what this means, whom it benefits, how money gets to these seniors, and more.

SG Silver Support Scheme 2025

The SG Silver Support Scheme 2025 provides an essential financial boost to Singapore’s elderly population facing limited retirement means. Its automatic, no-application process ensures timely aid delivered quarterly, helping seniors afford basic living needs without stress. By understanding eligibility, payout details, and integrating this scheme with other government supports, seniors and their families can better navigate retirement finance with confidence and dignity. This scheme is a clear demonstration of Singapore’s commitment to leave no senior behind in the path toward a secure, comfortable retirement.

| Feature | Details |

|---|---|

| Eligibility | Singapore Citizens aged 65+, with low lifetime CPF contributions or low net trade income, living in 1-5 room HDB flats |

| Application Process | No application needed; government automatically assesses eligibility every year |

| Payment Schedule | Quarterly in January, April, July, and October |

| Payment Amount Range | Between S$215 and S$1,080 per quarter based on household income & HDB flat type |

| Special Provision | Fixed payment of S$430/quarter for ComCare Long-Term Assistance beneficiaries |

| Official Information | CPF Silver Support Scheme |

What Is the SG Silver Support Scheme 2025?

The Silver Support Scheme is a specially designed, means-tested program meant to top up the incomes of low-earning older adults who face financial challenges in retirement. It was introduced in 2016 and significantly enhanced in 2025, reflecting Singapore’s commitment to ensure seniors with less savings still enjoy decent financial security.

The government leverages comprehensive data such as decades of CPF contributions, self-employment income reports, household composition, and housing details to pinpoint seniors truly in need of aid. This automatic system eliminates paperwork hassles and makes sure assistance reaches recipients without delay or complicated processes.

This program is particularly important for seniors who might have worked irregular or low-paying jobs, including the self-employed and gig economy workers, who often lack robust retirement savings.

How Does the Silver Support Scheme Fit Into Singapore’s Broader Senior Support Framework?

Singapore’s government operates a multi-layered safety net for seniors, integrating various supports aimed at retirement and healthcare needs. Here’s how the Silver Support Scheme connects with other pillars:

| Support Program | Purpose | Type of Benefit |

|---|---|---|

| Central Provident Fund (CPF) Retirement Sum | Main savings pool for retirement income | Monthly payouts or lump sums |

| Silver Support Scheme | Additional income support for low-income seniors | Quarterly cash payouts |

| ComCare Long-Term Assistance | Support for severely financially vulnerable | Fixed cash grants and social services |

| MediSave/MediShield Life | Healthcare financing and subsidization | Medical insurance and subsidies |

Together, these programs create a comprehensive cushion enabling seniors to maintain economic independence and access essential services.

Who Qualifies for the Silver Support Scheme?

Eligibility is based on stringent but fair criteria that cover several factors:

Age and Citizenship

- Must be a Singapore Citizen.

- Must be at least 65 years old in the year of assessment.

Income and Work History

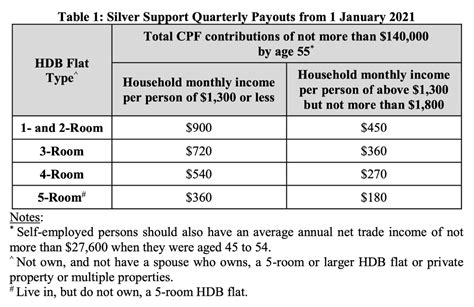

- For salaried workers: CPF contributions by age 55 cannot exceed S$140,000.

- For self-employed or platform workers: average annual net trade income between ages 45 to 54 must be not more than S$27,600.

- This considers years of lower income, especially for workers with fluctuating earnings.

Housing Conditions

- Must live in a 1- to 5-room HDB flat.

- Neither the senior nor spouse should own a 5-room or larger HDB flat, private property, or multiple properties. This ensures targeting is fair and benefits reach those with fewer assets.

Household Income Threshold

- Monthly household income per person must be at or below S$2,300.

- This average is calculated by dividing total household income by residents, fairly adjusting for family size.

Special Category: ComCare Long-Term Assistance (LTA)

- Seniors on ComCare LTA automatically qualify for a fixed quarterly payment of S$430, irrespective of housing type, complementing existing financial aid.

Understanding Income Calculation for Eligibility

Income calculation is the linchpin of eligibility and aims to accurately reflect a senior’s economic capacity.

- Monthly Household Income per Person is computed by summing total household earnings (wages, CPF contributions, trade income) and dividing by household size.

- This method prevents unfair exclusion due to a single high earner balancing other low-income elders.

- For example, a household income of S$6,900 split among three occupants results in S$2,300 per person—right at the threshold, qualifying those seniors for support.

This calculation acknowledges diverse family arrangements, enabling weighted, precise targeting.

How to Apply for the SG Silver Support Scheme 2025?

Automatic Government Assessment — No Paperwork Required

The judgement call happens once a year, informed by CPF and housing data:

- Eligible seniors receive notification letters by December for the upcoming year.

- Payments commence in the quarter the individual turns 65.

Where to Get Help

For questions, financial difficulties, or more info:

- Visit local Social Service Offices for personalized assistance.

- Access digital resources like the gov.sg Silver Support page.

- Contact CPF customer service for detailed support.

When and How Will Payments Be Made?

- Payment Schedule: Four times a year — first week of January, April, July, and October.

- Mode of Payment: Funds are deposited directly into bank accounts linked to government records or through PayNow tied to the recipient’s NRIC.

- This eliminates physical visits and ensures seamless access to funds.

Eligible seniors can expect timely payments to help smooth budget management, avoid financial shortfalls, and address living expenses proactively.

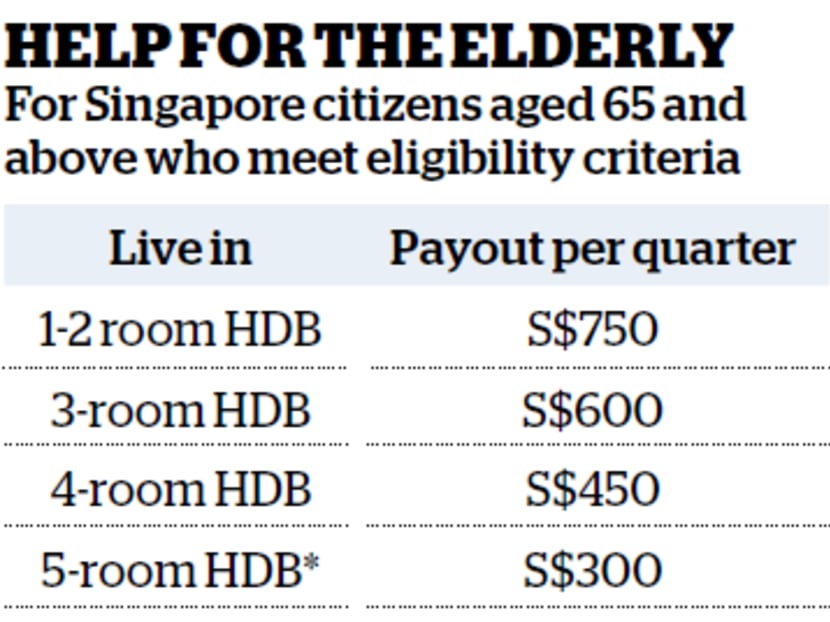

How Much Can Seniors Expect per Quarter?

Payments vary reflecting housing and income, balancing fairness with financial sustainability:

| HDB Flat Type | Max Quarterly Payout (S$) |

|---|---|

| 1- & 2-Room Flats | 1,080 |

| 3-Room Flats | 750 |

| 4-Room Flats | 450 |

| 5-Room Flats | 215 |

For those on ComCare LTA, payouts are static at S$430 per quarter regardless of flat size.

Real-Life Example: Auntie Tan’s Experience

Auntie Tan, a 68-year-old who worked retail with modest wages, lives alone in a 3-room HDB flat. Before Silver Support, finances were tight especially with rising medical costs. Now, receiving S$750 quarterly through the scheme, Auntie Tan can comfortably afford nutritious groceries, attend regular health appointments, and keep utilities running smoothly. This support transformed her peace of mind and independence.

Tips for Maximizing Your Benefits

- Keep Records Up to Date: Confirm contact and bank details with CPF.

- Explore Complementary Supports: Look into CPF Retirement Sum options and healthcare subsidies.

- Seek Help Early: Visit Social Service Offices before financial strain worsens.

- Budget Around Payouts: Use quarterly clearing to manage expenses smartly.

Looking Ahead: Future of Senior Support in Singapore

The government continuously reviews the scheme to ensure it keeps pace with:

- Inflation and cost-of-living trends.

- Demographic shifts including aging population projections.

- Expanding eligibility criteria to new work patterns.

- Enhancing digital portals for transparency and ease of access.

Seniors can expect ongoing improvements to protect their retirement security.