Warehouse retailer Sam’s Club has released a new frozen chicken product that is generating significant attention from shoppers for its reported similarity to offerings from fast-food giant KFC. The launch of the Member’s Mark Southern Style Chicken Bites highlights a growing trend of consumers seeking high-quality, convenient, and affordable fast-food alternatives at grocery stores.

Key Product Insights

| Key Fact | Detail / Specification |

| Product Name | Member’s Mark Southern Style Chicken Bites |

| Size & Price | 3 lb. (48 oz.) resealable bag; pricing varies by location but is approximately $10-$12. |

| Consumer Comparison | Widely compared to KFC’s Popcorn Nuggets and chicken recipe. |

| Market Trend | Part of the growing premiumization of private label products. |

New Product Sparks Consumer Buzz and Sales

Sam’s Club, a division of Walmart Inc., recently introduced its Member’s Mark Southern Style Chicken Bites into its frozen food aisles. The product quickly gained traction on social media platforms after shoppers began posting reviews and taste comparisons, with many noting a strong resemblance to the flavor and texture of chicken from Kentucky Fried Chicken (KFC), a subsidiary of Yum! Brands.

The attention was significantly amplified by posts from popular social media accounts that track new items at the warehouse club. An Instagram post from the account @samsclubmembers described the chicken as “so tender and juicy” and “a must try,” according to multiple news outlets that covered the viral reaction. This online enthusiasm appears to be translating into real-world sales, with shoppers reporting high demand at local stores. The product is sold fully cooked and frozen, designed to be reheated in an air fryer or conventional oven. This focus on convenience taps into a key consumer demand for quick meal solutions that can be prepared at home, a market that has expanded significantly in recent years.

Analyzing the Appeal: Cost, Convenience, and Quality

The popularity of the new Sam’s Club fried chicken can be attributed to several factors aligning with current consumer behavior, according to retail analysts. The primary drivers are perceived value and the continued growth of at-home food consumption. “We are seeing a major shift where consumers are looking for restaurant-quality experiences without the restaurant price tag,” said Dr. Jennifer Kaplan, a consumer behavior analyst at the Retail Insights Group. “A product like this hits the sweet spot. It offers a familiar, craveable flavor profile at a fraction of the cost of a typical fast-food family meal.”

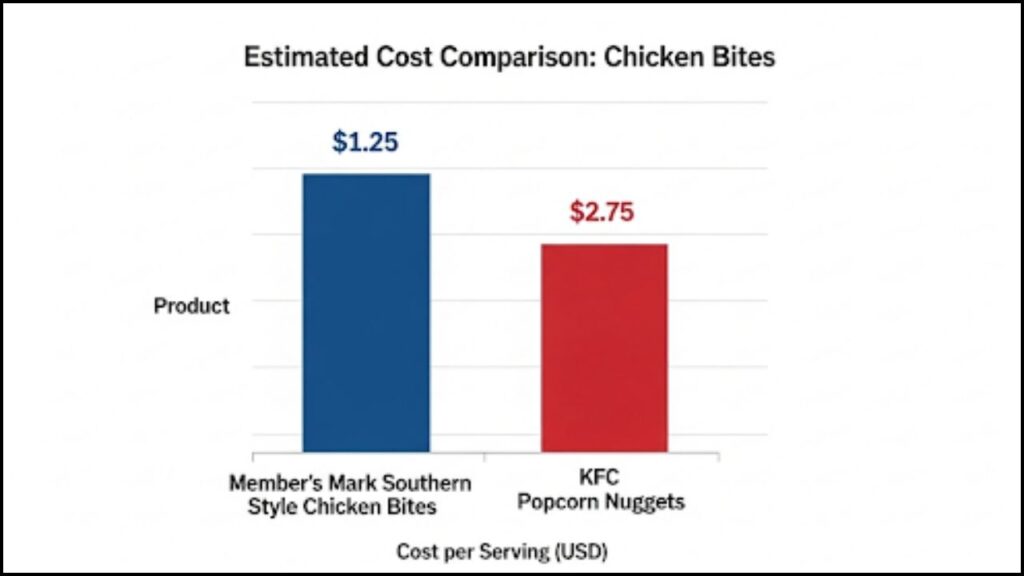

A 3-pound bag of the Member’s Mark chicken, which contains approximately 10 servings, retails for around $10-$12. This price point presents a compelling economic alternative for families when compared to purchasing equivalent items from a quick-service restaurant (QSR), where a single large meal can often exceed that cost.

The Rise of Premium Private Label Products

This launch is emblematic of a larger strategy within the retail industry: the elevation of store brands, also known as private label products. Once considered generic, low-cost alternatives, brands like Costco’s Kirkland Signature and Walmart’s Great Value have evolved to compete directly with national brands on quality and innovation. According to a 2024 report from the Private Label Manufacturers Association (PLMA), store brand sales have consistently outpaced the growth of national brands, capturing a larger share of the consumer’s wallet. The report notes that this growth is particularly strong in the frozen food and prepared meals categories, as retailers invest in developing more sophisticated and appealing products.

Competitive Landscape: Grocers vs. Quick-Service Restaurants

The introduction of high-quality fast food alternatives by retailers like Sam’s Club represents a blurring of the lines between the grocery and restaurant industries. This trend has accelerated as retailers leverage their scale and supply chain efficiencies to develop competitive products.

“Warehouse clubs and grocery chains are no longer just competing with each other; they are competing for what we call ‘stomach share’ against fast-food and fast-casual restaurants,” stated David Matthews, a food and beverage industry consultant. “They can offer bulk sizing and lower prices that are very difficult for a traditional QSR model to match.”

This competition poses a potential challenge for established fast-food chains like KFC. While brand loyalty and the convenience of a drive-thru remain powerful advantages, persistent inflation has made many consumers more price-sensitive. If retailers can consistently deliver on taste and quality, more households may opt for the “fake away” a homemade version of a takeaway meal. As of this report, neither Sam’s Club nor Yum! Brands have issued an official public statement regarding the product or the consumer comparisons. The broader market context suggests this trend is likely to continue. As consumer cooking habits evolve and economic pressures persist, the demand for value-driven, convenient meal solutions is expected to grow, further fueling innovation in the private label sector.

New Member’s Mark Cake Pops at Sam’s Club Garner Perfect Scores from Shoppers

Citing Consumer Trends, Newman’s Own Expansion Targets $130 Billion Snack Industry

Citing Consumer Trends, Newman’s Own Expansion Targets $130 Billion Snack Industry The 11 Grocery Categories Consistently Cheaper at Sam’s Club Amid Rising Food Costs

The 11 Grocery Categories Consistently Cheaper at Sam’s Club Amid Rising Food Costs Wendy’s Free Breakfast Offers Sandwiches This Weekend Amid Fierce Fast-Food Competition

Wendy’s Free Breakfast Offers Sandwiches This Weekend Amid Fierce Fast-Food Competition Investigation Launched into Radioactive Shrimp Recall Affecting Walmart Stores Nationwide

Investigation Launched into Radioactive Shrimp Recall Affecting Walmart Stores Nationwide