Millions of older Americans expecting a modest Social Security raise in 2026 will find their gains reduced as rising Medicare premiums absorb a significant share of the annual cost-of-living adjustment.

The Social Security Administration (SSA) has confirmed a 2.8 percent COLA increase for next year, but the Centers for Medicare & Medicaid Services (CMS) will raise Medicare Part B premiums sharply, leaving many retirees with less purchasing power despite inflation adjustments.

Rising Medicare Premiums Are Reducing the COLA

| Key Fact | Detail/Statistic |

|---|---|

| COLA increase for 2026 | Approximately 2.8% |

| Medicare Part B premium | Rising to roughly $202.90 per month |

| Net benefit impact | One-third of COLA often absorbed by premiums |

| Protected by Hold Harmless rule | Only certain Social Security beneficiaries qualify |

| Trend | Healthcare inflation consistently outpaces COLA |

The Rising Medicare Premiums Are Reducing the COLA, rising Medicare premiums, directly affects retirees because Medicare Part B premiums are automatically deducted from monthly Social Security benefits. As costs increase faster than inflation, a growing share of retirees’ COLA raise is consumed before it reaches their bank accounts.

CMS announced a projected standard Part B premium of about $202.90 per month for 2026, an increase driven by growing healthcare utilization, payment rate adjustments and the high price of new drugs. Meanwhile, the COLA increase averages roughly $56 per month for typical beneficiaries, leaving many with a net increase of $36 to $39 after premium deductions.

Why the COLA Increase (KW2) Falls Short for Many Retirees

The CPI-W formula and its limitations

The COLA increase (KW2) is tied to the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W), a measure that does not fully capture the spending habits of older adults. According to the Bureau of Labor Statistics, seniors spend substantially more on healthcare, housing, and prescription drugs—categories where inflation is higher.

Prof. Janet Allen, an economist at Stanford University, notes:

“CPI-W understates the inflation seniors experience. Health costs rise faster than consumer goods, so COLA is structurally insufficient.”

The growing healthcare gap

Healthcare costs have outpaced overall inflation for more than 20 years. Retirees buying supplemental insurance, prescription drug plans or long-term care coverage will also feel cost pressure beyond Part B premiums.

What Is Driving Rising Medicare Premiums (KW3)?

Medical inflation and utilization

Healthcare service use is rising as the population ages. CMS reports show higher-than-projected spending on outpatient care, preventive services, imaging, and durable medical equipment.

Expensive new drugs and breakthrough therapies

Approval of high-cost treatments—especially cancer drugs and biologics—drives Medicare spending upward.

Provider reimbursement growth

Medicare must adjust reimbursements for physicians and hospitals annually. These adjustments reflect wage growth, inflation and regulatory changes.

Part D drug plan pressures

Though the Part B premium receives the most attention, Part D premiums are also climbing, particularly for comprehensive drug plans. This further squeezes retirees’ budgets.

What the Hold Harmless Rule Actually Protects

The Hold Harmless rule prevents Social Security checks from decreasing due to rising Medicare Part B premiums for eligible beneficiaries. However, it does not apply to:

- New Medicare enrollees

- Higher-income beneficiaries subject to IRMAA surcharges

- Individuals who pay premiums directly rather than through Social Security

- Medicare Advantage beneficiaries in certain plans

- Retirees who delay Social Security until later

As a result, a large segment of the population feels the full effect of premium increases each year.

Real-World Impact on Retirees (KW4: Social Security benefits)

Case Study 1 – Moderate-income retiree

A 72-year-old living on $1,750 per month in Social Security benefits may receive an additional $49 from the COLA. But if Medicare premiums rise by $18, the net monthly gain is only $31—a limited buffer against rising electricity, rent, and food prices.

Case Study 2 – Low-income retiree

A retiree receiving $1,100 per month may see almost the entire COLA consumed by the premium hike. The Hold Harmless rule keeps checks from going down but does not protect purchasing power.

Case Study 3 – High-income beneficiary

Someone paying IRMAA surcharges may see Part B premiums rise by significantly more than the standard increase. Their COLA gain may be offset entirely.

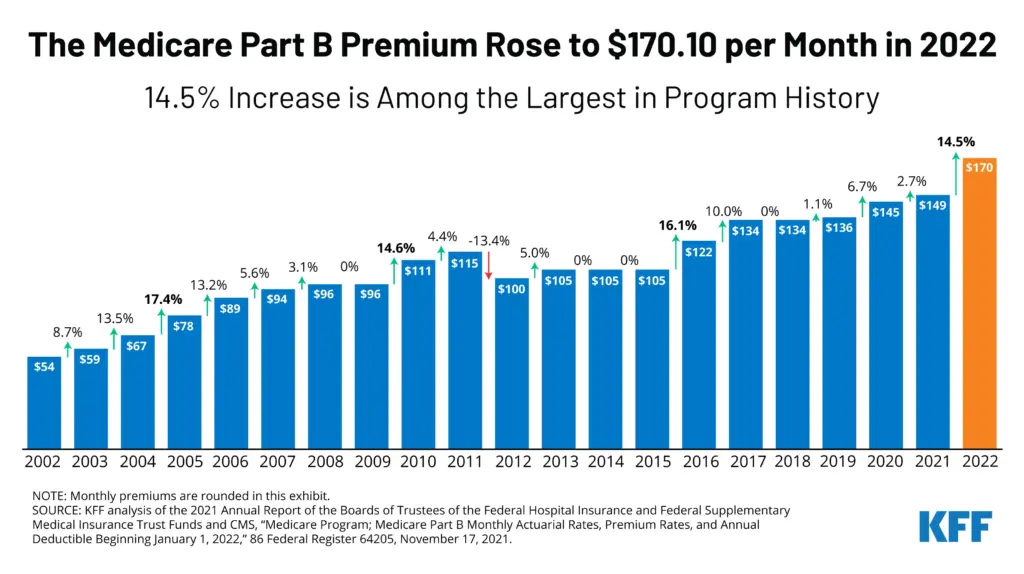

Historical Trends: A System Under Strain

A decade of mismatched growth

Over the past 10 years:

- Average annual COLA: 1.8%

- Average annual Medicare Part B premium increase: 5.4%

The imbalance has steadily reduced retirees’ net income growth.

Trustees’ forecast

According to the annual Social Security Trustees Report, both Social Security and Medicare face long-term financing challenges. Unless Congress acts, trust fund reserves could become depleted by the mid-2030s.

The demographic shift

There are now fewer workers supporting more retirees. In 1960, there were 5.1 workers per beneficiary. Today, there are 2.8, and the ratio continues to shrink—further increasing financial pressure on both systems.

Broader Economic Impact

Higher medical costs strain household budgets

According to the Kaiser Family Foundation, retirees spend more than twice the share of their income on medical expenses compared with working-age adults.

Inflation makes essentials more expensive

Food, housing and energy costs have remained elevated, leaving less financial room when premium deductions increase.

Financial planners warn of hidden risks

Alex Rivera, a certified financial planner in Chicago, noted:

“Many retirees believe a COLA guarantees stability. But rising healthcare premiums can wipe out much of the increase, which creates major budgeting challenges.”

Policy Debates and Reform Proposals

Alternative inflation index (CPI-E)

Some lawmakers recommend switching the COLA formula to the CPI-E, an experimental index that measures inflation for people 62 and older. Studies show CPI-E grows faster than CPI-W.

Premium caps or subsidies

Several proposals in Congress seek to cap annual increases in Part B premiums or expand subsidies for lower-income beneficiaries.

Medicare negotiation expansion

The Inflation Reduction Act allows Medicare to negotiate prices on a limited number of drugs. Advocates argue expanding negotiation could reduce premium pressure.

Long-term solvency measures

Ideas under discussion include:

- Raising payroll taxes

- Increasing or removing the taxable wage cap

- Adjusting full retirement age

- Reforming Medicare’s payment structure

None have broad bipartisan support yet.

Related Links

SNAP Update: USDA Says All Recipients Must Reapply Under New Verification Rules

New Mortgage Costs After the Fed’s October Rate Cut: What Buyers Will Pay Monthly

Steps Retirees Should Consider Now

- Review Social Security and Medicare notices mailed each winter.

- Confirm automatic premium deductions to avoid missed payments.

- Compare Medicare Advantage plans during open enrollment.

- Reassess monthly budgets anticipating higher healthcare costs.

- Use SSA and CMS online tools to calculate net benefit changes.

- Consult certified financial planners specializing in retirement income.

With healthcare costs expected to continue rising, retirees may face increasing pressure as annual COLA amounts struggle to keep pace. The widening gap between inflation adjustments and medical cost growth highlights the financial vulnerability facing older Americans and underscores the urgency for broader reform.

FAQ About Rising Medicare Premiums

1. Why are Medicare premiums rising faster than the COLA?

Healthcare inflation is higher than general inflation, increasing Medicare spending faster than Social Security benefits increase.

2. Will everyone see a reduced COLA?

Most beneficiaries will see smaller net gains, but those protected by the Hold Harmless rule won’t see reduced checks—though their purchasing power still declines.

3. Are prescription drug plans affected?

Yes. Premiums for many Part D plans are rising, adding further strain.

4. Can retirees reduce premiums?

Premiums are largely fixed unless eligible for income-based subsidies or choosing cost-efficient Medicare Advantage plans.

5. Will the COLA increase ever fully offset rising medical costs?

Unlikely under the current CPI-W formula.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores