OAS CPP GIS Benefit Payment On this date of November 2025: Check Payment Amount & Eligibility

OAS CPP GIS Benefit Payment: When it comes to retirement income in Canada, knowing your Old Age Security (OAS), Canada Pension Plan (CPP), and Guaranteed Income Supplement (GIS) payment details is pure gold. Whether you’re about to start collecting or already depend on these payments, understanding the how, when, and how much helps you manage your finances better. This article offers a clear, friendly, and expert breakdown of these benefits for November 2025 — laying out payment amounts, eligibility rules, payment dates, practical advice, plus tips to maximize your cash flow. We’ll kick things off easy so even a 10-year-old could get the gist, while also packing enough punch for professionals and financial planners needing detailed info. Let’s get started and help you get that secure retirement income you deserve.

OAS CPP GIS Benefit Payment

Understanding your OAS, CPP, and GIS benefits for November 2025 takes the mystery out of retirement planning. These programs provide essential income tailored to your residency, work history, and financial needs. By knowing eligibility, payment dates, clawbacks, and how to manage your benefits well, you can maximize your income and avoid pitfalls.

| Program | Payment Date (Nov 2025) | Max Monthly Payment | Who Qualifies? |

|---|---|---|---|

| Old Age Security (OAS) | Nov 26, 2025 | $740.09 (65-74 yrs), $814.10 (75+ yrs) | 65+, 10 yrs residency in Canada |

| Canada Pension Plan (CPP) | Nov 28, 2025 | About $1,433 (max for 65-yr-olds) | 60+, valid contributions to CPP |

| Guaranteed Income Supplement (GIS) | Nov 26, 2025 | Up to $1,105.43 single; $665.41 couple | Receiving OAS + low income threshold |

A Bit of History: Why Do These Programs Exist?

The Canadian government designed these programs as a cornerstone to fight senior poverty and provide a stable safety net for retirement. The Old Age Security (OAS) program was launched in 1952 as a universal pension aimed at all seniors over 65, representing a significant social commitment at the time. It ensures all eligible Canadians receive a basic income in retirement regardless of their work history.

The Canada Pension Plan (CPP) started later in 1966 to complement OAS by basing benefits on how much and how long individuals contributed during their working years. This meant people who worked more and earned more would get higher pensions.

In 1967, the Guaranteed Income Supplement (GIS) was introduced as a temporary solution to help low-income seniors on top of their OAS pension. However, it became permanent due to its success in reducing senior poverty and continues to provide critical financial support to vulnerable retirees.

These programs have evolved to cover millions — currently, about 7.9 million Canadians receive OAS, nearly 5 million get CPP pensions, and roughly 2.7 million qualify for GIS. They represent crucial pillars of Canada’s three-tier retirement income system today.

OAS CPP GIS Benefit Payment Dates in November 2025: What to Expect

The government schedules these pension payments consistently each month, but they fall on slightly different dates:

- OAS and GIS payments will be disbursed on November 26, 2025.

- CPP payments are scheduled for November 28, 2025.

Opting for direct deposit is recommended for safe, fast receipt. Paper checks mailed to your home can face delays, especially near holidays or bad weather. Setting up direct deposit through your My Service Canada Account (MSCA) ensures payments land promptly in your bank account without fuss.

How Much Will You Get in November 2025?

OAS Payment Amounts

For seniors between ages 65 and 74, the maximum monthly payment will be about $740.09 for November 2025. If you’re 75 or older, you’ll receive around $814.10 monthly. This reflects a quarterly cost-of-living adjustment (COLA) based on inflation, aiming to keep your purchasing power steady regardless of price changes.

CPP Payment Amounts

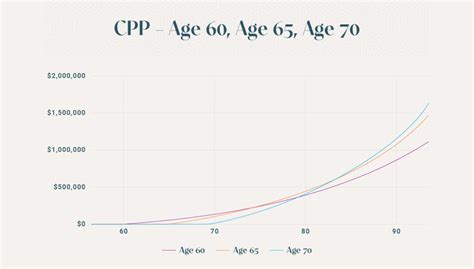

The maximum CPP monthly payment for someone retiring at 65 is approximately $1,433 as of 2025. CPP payouts depend on how much you contributed during your working years and when you start drawing benefits. Delaying CPP up to age 70 increases your monthly payment by 0.7% for each month deferred, enhancing your income but reducing total months paid.

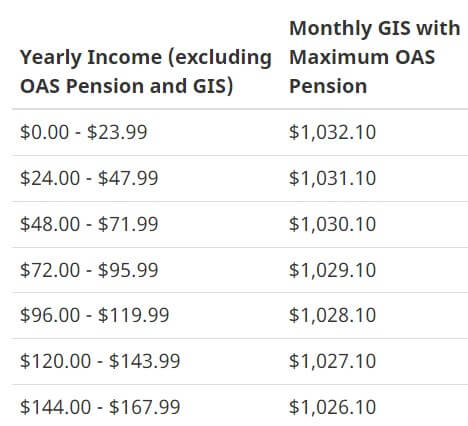

GIS Payment Amounts

The GIS top-up aims to ensure low-income seniors maintain a basic standard of living by topping up their OAS. The max payment for a single individual in November 2025 will be around $1,105.43 per month. For couples, the maximum GIS varies by income but can reach about $665.41 per senior.

These payments fluctuate based on your reported income from the previous year, so the less you make, the more GIS money typically flows your way.

Eligibility Rules Made Simple

Who Qualifies for OAS?

- Be 65 or older at time of application.

- Be a Canadian citizen or legal resident when approved.

- Have lived in Canada for at least 10 years after age 18 to receive partial benefits, or 40 years for full pension.

- If living outside Canada, eligibility requires Canadian citizenship/legal residency before departure and sufficient residence duration (usually 20+ years after 18).

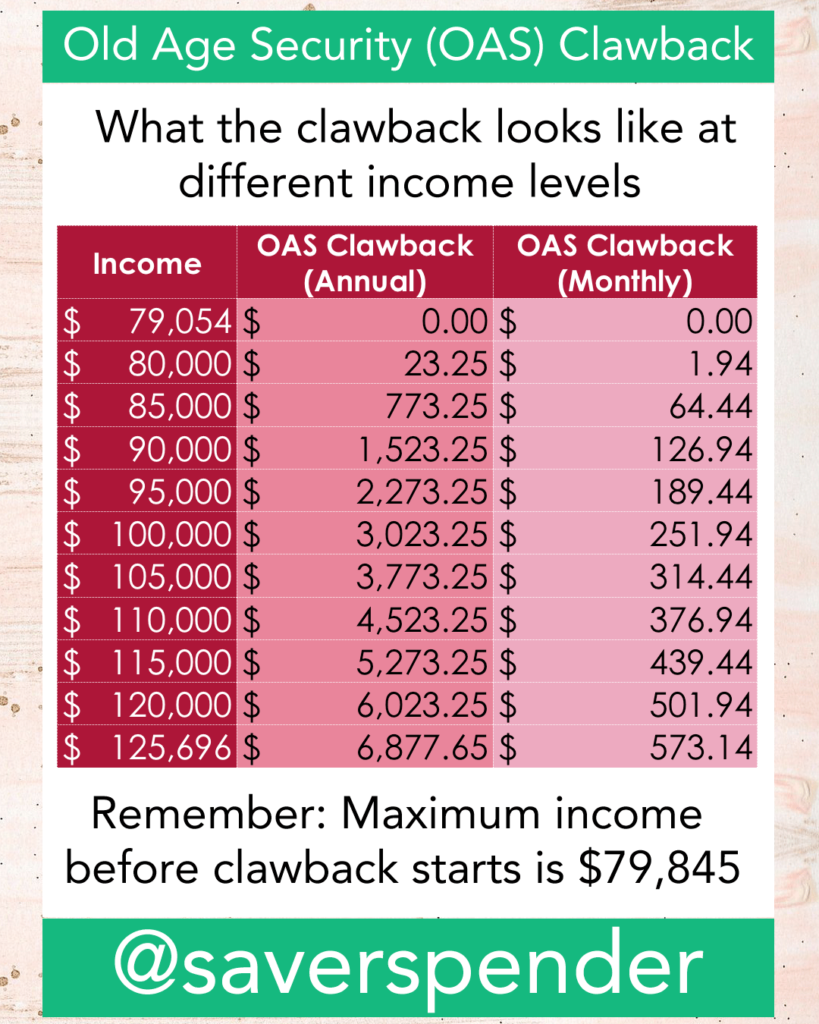

- Income over $90,997 triggers the OAS clawback, which reduces your pension by 15 cents for every dollar above the threshold.

Who Qualifies for CPP?

- Be at least 60 years old to start receiving CPP retirement benefits.

- Have made at least one valid CPP contribution during your working life.

- Your CPP amount depends on the length and amount of contributions and your age when you begin taking it.

- Self-employed Canadians pay both employee and employer CPP portions, potentially increasing their benefits.

Who Qualifies for GIS?

- Must be receiving the OAS pension first.

- Have income below government-set thresholds based on the previous year’s net income reported on tax filings:

- Singles must have income below about $22,440.

- Couples have thresholds ranging between $29,616 and $53,808 depending on whether spouse receives OAS or allowance.

- Must be a resident of Canada.

- Sponsored immigrants are ineligible for GIS during their sponsorship period as of October 1, 2025.

The Clawback Explained: How Income Affects Your Payments

If you earn income beyond the federal limits, your OAS benefits are clawed back to ensure high earners don’t get double benefits. The threshold in 2025 is at $90,997, meaning:

- For every extra dollar made beyond this, your OAS pension is reduced by 15 cents.

- This reduction continues until your OAS is fully clawed back (eliminated).

GIS has lower income cutoffs and a stricter clawback, phased out faster to target only truly low-income seniors.

Example:

If your income is $95,000, that’s $4,003 above the OAS clawback threshold. Multiplying by 0.15 yields $600.45 reduction yearly, or $50.04 per month less OAS paid.

Being aware of clawbacks helps you plan your income sources to avoid unexpected pension cuts.

How These Benefits Work for Newcomers & International Residents

- If you immigrated from a country with Canadian social security agreements (such as the U.S., U.K., Australia), your coverage in that country may count toward OAS or CPP eligibility.

- Sponsored immigrants cannot receive GIS benefits until their sponsorship period ends, which represents a tightening of rules as of late 2025.

- Canadian expatriates employed abroad under certain conditions (government, military, Canadian banks) may count their time outside Canada towards residence qualifications.

How to Apply and Track OAS CPP GIS Benefit Payment?

- Set up a My Service Canada Account (MSCA): Your online portal to manage and track all OAS, CPP, and GIS benefits.

- Apply early: You can apply for OAS and CPP up to 11 months before you turn 65 to avoid missing payments.

- File taxes timely: GIS payments depend on your income tax returns; ensure you file annually, even if your income is low or nil.

- Keep information current: Update your address, marital status, and income information on MSCA for accurate benefit calculations.

Avoiding Common Pitfalls

- Failing to file taxes can cut off GIS payments abruptly.

- Ignoring direct deposit setup delays payments and makes you vulnerable to missed mail.

- Postponing CPP application can result in lost up-front monthly payments, though delaying increases your monthly amount.

- Not reporting income changes can lead to overpayments you must repay later.

What to Do if Your Claim Is Denied?

- File a Reconsideration Request within 90 days with Service Canada.

- Provide clear documentation supporting your case, including tax records and residency proof.

- If reconsideration is denied, appeal to the Social Security Tribunal of Canada for an independent review. Persistence pays off.

Interaction With Other Income Sources

Your government pension benefits supplement your personal savings, workplace pensions, and provincial programs. Work with financial advisors to combine these intelligently:

- Some provinces provide additional top-ups for qualifying low-income seniors.

- Strategically timing CPP can optimize total retirement income alongside private pensions.

- RRSP withdrawals and TFSA income impact income thresholds for GIS and OAS clawback.

Policy Changes & Future Outlook

- Inflation adjustments keep increasing OAS and GIS payments quarterly.

- The CPP Enhancement program started increasing contribution rates in 2019, gradually boosting future payouts.

- Watch legislative moves about raising CPP retirement age or modifying benefit formulas.

- New rules restrict access to GIS for sponsored immigrants, reflecting evolving immigration policy.

Voices from Canadian Seniors

“My CPP payments let me budget with confidence every month — no more stress on bills or groceries.” – Mary J., Toronto

“GIS helped me cover unexpected medical expenses. It’s not just money; it’s dignity and peace of mind.” – George D., Vancouver