New Yorkers Could Already Have $400 Inflation Refund Checks — Here’s How to Confirm Yours

New York State residents may already be receiving $400 inflation relief checks aimed at easing the financial burden of rising living costs. These one-time payments were introduced as part of the 2025 state budget, marking a significant step in addressing the impact of inflation on households.

If you’re a New Yorker, here’s how to confirm whether you qualify and how to check if your refund has already been issued.

New Yorkers Could Already Have $400 Inflation Refund

| Key Fact | Detail |

|---|---|

| Refund Amount | $400 per eligible taxpayer |

| Eligibility | Based on income thresholds, adjusted gross income (AGI) under $75,000 for singles, $150,000 for couples |

| Refund Issuance | Check or direct deposit |

| Application Deadline | December 31, 2025 |

| Payment Period | Payments issued starting late 2025 |

The $400 inflation relief checks are a much-needed financial boost for many New Yorkers, offering direct assistance to those feeling the effects of rising living costs. If you haven’t received your check yet, follow the steps outlined above to confirm your eligibility and track the status of your payment.

As the state continues to address inflation through various relief programs, these payments provide timely support to residents across New York.

Why Is New York Offering $400 Inflation Refund Checks?

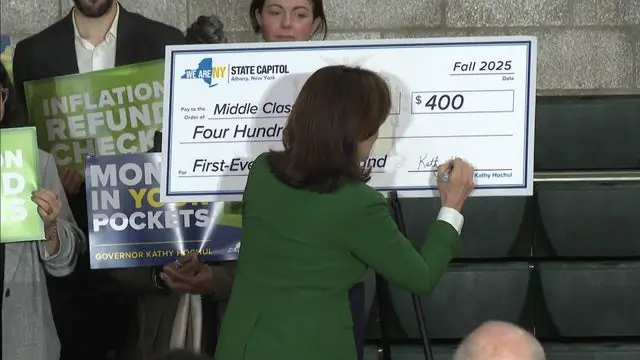

In response to inflation and the rising cost of living, the state of New York has introduced a $400 inflation refund aimed at providing direct financial relief to residents. The measure, part of Governor Kathy Hochul’s 2025 state budget, was created to help individuals and families who are struggling to keep up with rising expenses, such as groceries, rent, and transportation costs.

The $400 checks are designed as a one-time payment to support households, particularly those with middle- and lower-income earners. According to the New York State Department of Taxation and Finance, the goal is to provide quick, tangible relief to offset the negative effects of persistent inflation, which has reduced purchasing power across the state.

Governor Hochul emphasized that this initiative aligns with the state’s broader strategy to reduce the financial strain on vulnerable populations while stimulating the economy. “This inflation relief is a direct response to the financial pressures many New Yorkers are facing. It’s about easing the burden,” she stated in a press release.

How Is the $400 Inflation Relief Funded?

The $400 inflation refund is part of the 2025 state budget and is financed through a combination of state revenue surpluses and carefully managed economic policies designed to maintain fiscal responsibility. According to officials from the New York State Division of the Budget, the funds for the relief payments come primarily from excess tax revenues collected in previous years, coupled with the state’s robust budget surplus.

However, this move has raised questions about the long-term impact on state finances. Some analysts warn that although these relief checks are a welcome short-term solution, continued inflationary pressures could lead to budget challenges in the coming years, particularly as the state faces rising costs in other areas like healthcare and infrastructure.

Who Is Eligible for the $400 Inflation Refund?

To qualify for the $400 inflation refund, taxpayers must meet specific criteria related to income, residency, and tax filings. The key eligibility points are:

- Income Limit:

- Single filers must have an adjusted gross income (AGI) of $75,000 or less.

- Married couples filing jointly must have an AGI of $150,000 or less.

- Heads of household are eligible with an AGI of $112,500 or less.

- State Residency: You must be a resident of New York State for the full tax year.

- Tax Filing: To be considered for the refund, you must have filed a tax return for the 2024 tax year.

The refund checks will be issued to those who meet these criteria, and recipients will either receive a check by mail or a direct deposit, depending on the method chosen during their last tax filing.

Confirm if You’ve Received Your $400 Refund

If you believe you are eligible for the $400 inflation refund but are unsure whether you have already received it, follow these steps to confirm:

- Check Your Tax Account Online:

- Visit the New York State Department of Taxation and Finance website.

- Log in or create an account on the site to access your tax records.

- From there, you can check the status of your refund and whether it has been issued.

- Look for a Direct Deposit: If you previously set up direct deposit with your state tax return, check your bank statements for any payments labeled as inflation relief or refund payments. The refund will likely be deposited into the account used for your 2024 taxes.

- Check Your Mail: If you did not set up direct deposit, the $400 refund check will be mailed to the address listed on your 2024 tax return. Be patient, as checks are being sent in waves.

- Use the “Check My Refund Status” Tool: The New York State Tax Department offers an online tool called “Check My Refund Status,” which allows residents to track the progress of their refund. It provides updates on whether your payment has been issued, is in process, or if there are any issues with your claim.

What to Do if You Haven’t Received Your Refund Yet

If you meet the eligibility requirements but haven’t received your $400 inflation refund, here are some steps you can take:

- Review Your Tax Filing: Ensure that your 2024 tax return is accurate and that the information on it matches your current details, such as your name, address, and income. If there were discrepancies or errors in your filing, your refund may be delayed.

- Check Your Filing Status:If you filed your tax return after the initial processing period or missed deadlines, your refund may be delayed. Ensure that your filing status aligns with the eligibility requirements.

- Contact the New York State Tax Department: If your refund status is unclear or if you believe you are eligible but haven’t received your check, contact the Tax Department directly. They can provide more information and assist in resolving any issues with your claim.

- Verify Your Address: If you’ve moved recently or didn’t update your address on your tax return, your check could have been sent to the wrong location. Be sure to update your contact information with the state.

How Does This Relief Compare to Other States?

New York is not the only state offering inflation relief payments, but its approach stands out in several ways. While states like California and Colorado also provided direct payments to residents, New York’s focus on middle-income earners sets it apart, as most other states prioritized low-income households.

This broad approach ensures that more families receive support during difficult economic times. Furthermore, New York’s $400 inflation refund is a one-time payment, while some other states have implemented recurring or larger relief programs. It will be interesting to see whether New York continues this program in the future or explores other ways to address inflation.

Related Links

Big Win for New Yorkers; State Officially Drops $30 Fee for Enhanced Driver’s Licenses

IRS Reveals 2026 Tax Refund Changes; These New Credits Could Mean a Fat Check

What Happens If You Don’t Receive the Refund?

If you haven’t received your $400 refund within a reasonable timeframe (usually 6-8 weeks), there could be a few reasons for the delay:

- Errors in Your Tax Filing: If there was a mistake in your 2024 tax return, such as an incorrect address or missing information, it could delay your refund.

- You Missed the Filing Deadline: If you didn’t file your 2024 taxes by the deadline, you might not qualify for the refund.

- You’re in a Later Payment Batch: Refund checks are distributed in waves. Your payment could be delayed depending on your tax filing timeline.

If there are no obvious reasons for the delay, be sure to reach out to the New York State Tax Department. They can help resolve the issue.

FAQ About $400 Inflation Refund

Q1: Can I still receive the $400 refund if I didn’t file taxes last year?

If you did not file your 2024 tax return, you may not qualify for the refund unless you file an updated return or meet specific conditions set by the state.

Q2: Is the $400 inflation relief check taxable?

The $400 refund is not taxable and does not need to be reported as income on your 2025 tax return.

Q3: What if I don’t live in New York full-time but worked there during 2024?

If you are a part-year resident or earned income in New York during 2024, you may still qualify for the refund. However, you will need to file a tax return reflecting your income earned while residing in New York.