A new state tax credit is set to provide financial relief to more than 940,000 Pennsylvania families, marking one of the largest state-level expansions of refundable tax benefits in years. The Working Pennsylvanians Tax Credit (WPTC) — designed to supplement the federal Earned Income Tax Credit — will be available beginning with the 2025 tax year and is expected to deliver more than $193 million in annual financial support.

State officials say the initiative is intended to curb rising living expenses, boost household stability, and reduce child poverty across Pennsylvania.

New Tax Credit Brings Relief

| Key Fact | Detail |

|---|---|

| Estimated beneficiaries | ~940,000 families |

| Maximum annual credit | Up to $805 |

| Modeled after | Federal Earned Income Tax Credit (EITC) |

| First year of distribution | 2026 (for Tax Year 2025) |

| Total yearly cost | $193 million |

Understanding the Working Pennsylvanians Tax Credit

The new tax credit, modeled directly on the federal Earned Income Tax Credit (EITC), aims to support low- and moderate-income workers. The state credit equals 10% of the federal EITC, and because it is fully refundable, families will receive the remainder as cash if their credit exceeds their state income-tax liability.

State leaders describe the initiative as an effort to “reward work” and reduce the financial burden facing families amid persistent inflation, housing shortages, child-care costs, and medical expenses.

Why Pennsylvania Created a State Credit

Pennsylvania historically lacked a state-level earned-income credit, making it one of the few states offering no additional support beyond federal benefits. According to the Governor’s Office, the new credit is part of a broader plan to:

- Ease cost-of-living pressures

- Increase take-home income for working families

- Reduce state poverty rates

- Strengthen child-welfare and educational outcomes

- Stimulate local economic activity

The credit also reflects a growing national trend. As of 2025, 31 U.S. states have implemented some form of EITC supplement. Research from Columbia University and the Center on Budget and Policy Priorities shows that refundable tax credits are among the most effective tools for reducing child poverty.

Who Qualifies — Eligibility Criteria for New Tax Credit

To receive the Working Pennsylvanians Tax Credit, taxpayers must:

- Be eligible for the federal EITC, including meeting federal income thresholds.

- Have earned income from employment or self-employment.

- File a Pennsylvania (PA-40) tax return and a federal tax return.

- Meet standard requirements, such as:

- A valid Social Security number

- U.S. citizenship or legal residence

- Filing status of Single, Married Filing Jointly, Head of Household, or Qualifying Widow(er)

Automatic Qualification — No Additional Application

One of the most significant features: Any taxpayer who qualifies for the federal EITC automatically qualifies for the state credit. The Pennsylvania Department of Revenue will calculate the amount using information already supplied in the federal return.

How Much Families Will Receive

Because the state credit equals 10% of the federal EITC, benefit amounts vary by family size, income, and filing status.

Examples

- Single parent with three children earning about $23,000

→ Federal EITC: ~$8,050

→ State credit: ~$805 - Married couple with two children earning around $30,000

→ Federal EITC: ~$7,150

→ State credit: ~$715 - Single filer with no dependents earning around $17,000

→ Federal EITC: ~$600

→ State credit: ~$60

Nearly two-thirds of all benefits will go to families with children, according to state estimates.

The Economic and Social Impact of the Credit

Reducing Poverty and Improving Household Stability

Multiple national studies show that refundable tax credits:

- Lower child poverty rates

- Improve newborn health outcomes

- Reduce food insecurity

- Increase high-school graduation rates

- Reduce reliance on emergency public assistance

- Improve children’s long-term earnings as adults

A 2023 study by the National Bureau of Economic Research found that even modest refundable credits generate “significant and measurable improvements in economic stability.”

Supporting Pennsylvania’s Economy

Low-income families typically spend additional funds quickly on:

- Rent and utilities

- Groceries

- Transportation

- Childcare

- School supplies

- Medical co-pays

Economists refer to this as a high marginal propensity to consume, meaning the credit returns money directly into local businesses and communities. A Pennsylvania legislative analysis estimated that for every dollar distributed through refundable credits, the state economy gains between $1.40 and $1.70 through increased consumer activity.

Impact Across Counties

State data shows the credit will reach families statewide:

- Philadelphia County — largest number of beneficiaries

- Allegheny County — second largest

- Rural counties such as Fayette, Clearfield, and Schuylkill see among the highest per-capita benefit levels

- Suburban counties such as Bucks, Montgomery, and Chester have moderate but significant numbers of eligible working families

This distribution reflects the program’s focus on working, low- and moderate-income households, not only urban poverty.

Where the Credit Falls Short — Remaining Challenges

While widely praised, the new credit includes notable limitations:

1. Benefit size may not match rising costs

A maximum credit of $805 is meaningful but modest in the context of:

- Rising rents

- Groceries up 20% since 2021

- Increasing childcare costs

- Higher medical deductibles

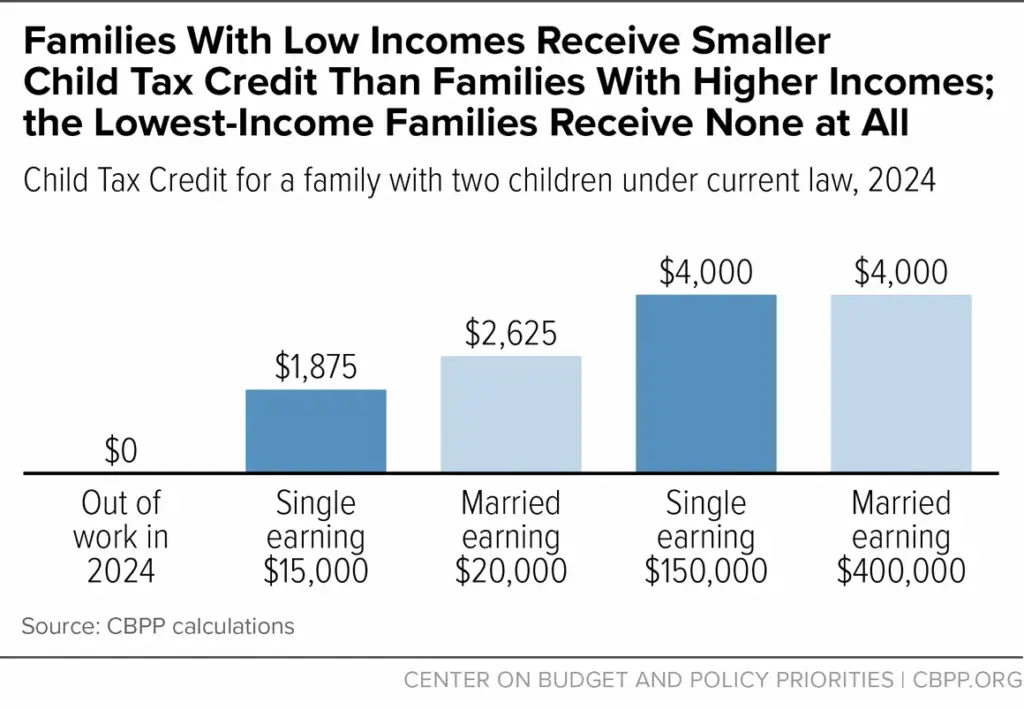

2. Workers with extremely low or no income receive nothing

Because eligibility is tied to earned income:

- Households facing unemployment

- Caregivers outside the workforce

- Disabled individuals not receiving earned income

…are excluded, even if financially strained.

3. Administrative dependence on federal filing

Families must file both state and federal taxes.

Missing documentation or incorrect dependent information can disqualify them.

4. Future funding is not guaranteed

While bipartisan support is unusually strong, the credit must compete with future:

- Education spending

- Infrastructure demands

- Health and human services budgets

- Economic downturn pressures

Sustaining the program long-term may require additional budget commitments.

What Families Need to Do — Next Steps after New Tax Credit

1. File your federal tax return

Claim the federal EITC (Form 1040 + Schedule EIC if needed).

2. File your Pennsylvania return (PA-40)

The state will calculate credit eligibility automatically.

3. Use free filing support if needed

The state encourages eligible families to use:

- VITA (Volunteer Income Tax Assistance) clinics

- AARP tax-aid sites

- University legal clinics

4. Use the state’s EITC calculator

Pennsylvania provides an online calculator to estimate expected benefits.

5. Expect funds in early 2026

Because the first credit applies to the 2025 tax year, refunds will be delivered during the 2026 tax-filing season.

Related Links

Why Some Retirees Will Receive Three Social Security Checks in December

2026 Social Security Increase Set — But Will Higher Medicare Part B Costs Reduce Your Raise?

Long-Term Implications of New Tax Credit

Policy analysts and economists say the credit’s success will depend on:

1. Take-up rate

Will all 940,000 eligible families file correctly?

2. Impact on poverty rates

The state aims to reduce child poverty levels, which rose sharply during the post-pandemic period.

3. Potential expansion

Lawmakers could consider:

- Raising the state credit percentage

- Adding bonus credits for young children

- Increasing support for childless workers

4. Other states’ responses

If the program succeeds, it may accelerate similar initiatives nationwide.

The Working Pennsylvanians Tax Credit represents a major shift in how Pennsylvania supports working families — offering a simple, automatic, and evidence-based financial benefit.

While not a cure-all for the state’s broader affordability challenges, the credit promises meaningful relief for nearly a million households. Over time, researchers, policymakers, and families will closely watch its impact on poverty, economic mobility, and household stability.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores