New Social Security Proposals Advance in Congress — Retirement Age and ID Protection Under Review

Recent legislative proposals in Congress aim to address long-standing concerns over the future of Social Security in the United States. Key among these proposals are potential increases to the retirement age for future beneficiaries and enhanced protection for Social Security recipients’ personal information.

As the country grapples with an aging population and fiscal challenges, these proposals aim to ensure the system’s long-term sustainability while improving the security of recipients’ data. This article explores the implications of these changes, what they mean for current and future retirees, and how lawmakers are working to balance financial solvency with consumer protection.

Overview of Proposed Changes: Retirement Age and ID Protection

The proposals under review in Congress represent significant shifts in both how Americans will access their Social Security benefits and how secure their personal information will be. These proposed changes are meant to ensure the program remains solvent and effective while addressing the growing concerns of fraud in the system.

| Key Proposal | Description | Purpose |

|---|---|---|

| Raising the Full Retirement Age | Future beneficiaries may need to wait longer to claim full benefits. | Help ensure the program’s financial solvency. |

| Improved ID Protection | New measures to safeguard Social Security numbers and prevent fraud. | Prevent identity theft and secure benefits. |

Raising the Full Retirement Age: A Closer Look

The proposal to raise the full retirement age is part of a broader effort to preserve Social Security’s long-term viability. Currently, individuals can claim full benefits at age 66 or 67, depending on their birth year. However, lawmakers are considering increasing this age to 68 or even 70 for younger generations of workers. This would reduce the system’s payout obligations, potentially extending the solvency of the Social Security Trust Fund.

Why the Change is Being Proposed

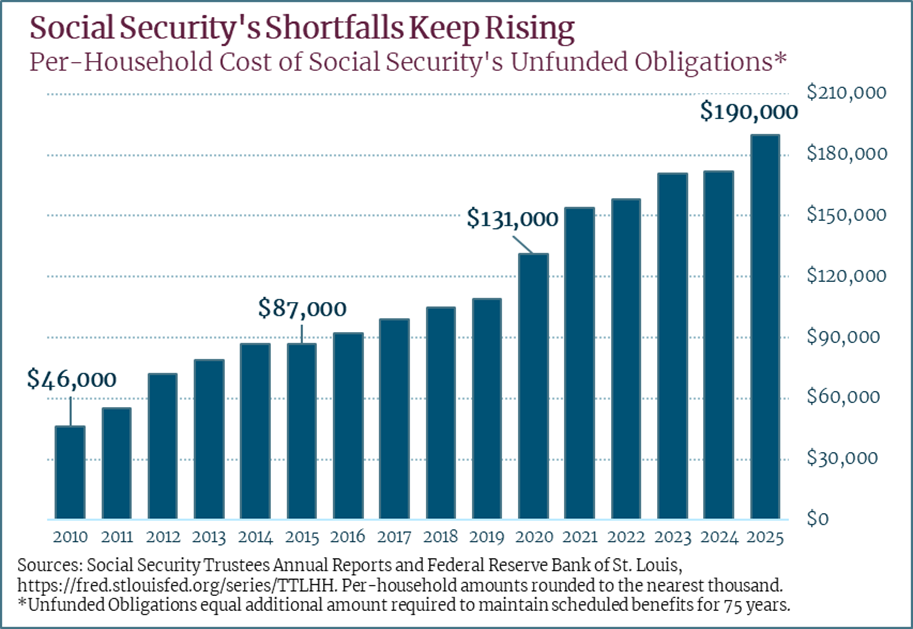

The primary reason for considering a raise in the retirement age is the increasing life expectancy and the rising number of retirees relative to the working-age population. According to the Social Security Administration (SSA), the trust fund is projected to be depleted by 2034 if no changes are made to the current system.

The argument for increasing the retirement age stems from the reality that people are living longer and healthier lives, and delaying benefits could help balance the program’s finances.

Financial Impact and Alternatives

Experts estimate that raising the retirement age could save the Social Security Trust Fund hundreds of billions of dollars over the next few decades. Some proposals suggest increasing the retirement age gradually for those currently under 50, with the goal of extending the solvency of Social Security through 2024 and beyond.

However, increasing payroll taxes or raising the income cap on Social Security taxes are also viable options to generate more funding without directly cutting benefits.

Impact on Future Beneficiaries

While proponents argue that raising the retirement age is necessary for keeping Social Security sustainable, opponents contend that it could disproportionately harm lower-income workers who rely on Social Security for a larger portion of their retirement income.

Many of these workers do not live as long as their higher-income counterparts and may have physically demanding jobs that prevent them from working into their late 60s. Advocates for these groups suggest alternative reforms such as increasing payroll taxes or taxing higher earnings to generate revenue for the program without cutting benefits.

Strengthening ID Protection: A Response to Growing Fraud Concerns

In addition to discussions about the retirement age, Social Security fraud has become a key concern for lawmakers. With identity theft increasingly affecting Social Security recipients, Congress is moving forward with plans to enhance identity protection.

The new legislative measures propose creating a more streamlined process for individuals whose Social Security numbers (SSNs) are compromised. This would involve direct assistance from the Social Security Administration (SSA) to help victims report fraud and recover their benefits.

Addressing Rising Fraud Rates

According to the Federal Trade Commission (FTC), identity theft and fraud have surged over the past decade, with millions of people affected by fraudulent claims and misuse of their SSNs. These types of fraud not only affect individuals but also drain resources from the Social Security system, potentially leading to greater costs and inefficiencies.

Proposed Measures for Identity Protection

Under the new proposals, fraud victims would have a single point of contact at the SSA, making it easier to report fraudulent activities and receive timely assistance. Additionally, the proposals would make the verification process for new beneficiaries more secure, requiring multi-factor authentication to access accounts and services. The idea is to simplify the claims process for victims and make fraud recovery quicker and more effective.

Why This is Important

For many older Americans, Social Security is their primary source of income. The ability to access and secure these benefits is crucial for their financial security. As the digital age evolves, there is a pressing need for enhanced cybersecurity measures.

Identity protection reforms will help restore trust in the system, ensuring that vulnerable populations are not exploited and that the process remains transparent and efficient.

Balancing Solvency and Security: Challenges Ahead

Both the raising of the retirement age and the strengthening of identity protection represent significant efforts to address Social Security’s long-term sustainability and the safety of its beneficiaries. However, these proposals are not without their challenges.

Raising the retirement age, in particular, could disproportionately affect low-income workers, who may already face challenges due to health or physical limitations. On the other hand, the proposed fraud protection reforms could increase the administrative burden on the SSA, requiring additional funding and resources to implement effectively.

Potential Impact on Beneficiaries

For younger workers, the proposed retirement age increase might feel like a distant issue, but it will directly impact their retirement plans. This shift could affect how much they need to save on their own or how long they need to continue working before they can retire.

For those closer to retirement age, the changes to Social Security fraud protection may bring much-needed relief. The implementation of a single point of contact could simplify an otherwise complex and frustrating process for those who fall victim to fraud.

Political Landscape and Public Opinion

Both of these proposals face political hurdles. Raising the retirement age is a difficult sell, as it touches on core issues of equity and economic security. On the other hand, expanding identity theft protections is a popular measure and has the support of both lawmakers and advocacy groups.

Related Links

New York Begins Sending $400 Inflation Refund Checks — See If Yours Is on the Way

2026 Will Bring Four Major Social Security Changes — Here’s What Every Retiree Should Know

What’s Next for Social Security Reform?

The full retirement age proposal is still in the early stages of debate and may undergo significant modifications before it’s voted on. However, if enacted, it could be phased in over several years, impacting individuals under the age of 50 the most.

The identity protection measures, meanwhile, are expected to gain faster traction and could be implemented relatively quickly, given the broad bipartisan support for enhanced fraud prevention.

Social Security faces a precarious future, and the latest proposals represent an attempt to address both its fiscal health and the security of its beneficiaries. As lawmakers in Congress move forward with these reforms, the challenge will be balancing the program’s long-term sustainability with the needs of today’s workers and retirees.

Raising the retirement age and enhancing identity theft protections are only the beginning. What happens next will shape the future of Social Security for generations to come.