New Social Security Map Divides Retirees Into Winners and Losers — The 10 Cities You Can Afford and the 40 States You Can’t

A new analysis of Social Security benefits across the U.S. reveals a stark divide for retirees, with some states and cities offering financial relief while others make it nearly impossible to survive on Social Security alone. This map categorizes the country into “winners” and “losers,” identifying where retirees can afford to live and where they fall short, even with full benefits.

What the Map Reveals: A Sharp Divide for Retirees

A recent study by the Senior Citizens League (TSCL) and Realtor.com highlights that retirees’ ability to live on Social Security varies drastically by region. According to the new data, there are 10 states where retirees can afford basic living expenses—housing, utilities, healthcare—on Social Security benefits alone. In contrast, 40 states are deemed “losers,” where Social Security benefits fall short of covering even these basic needs.

For example, in some states like Delaware and Mississippi, the average annual Social Security benefit covers all essential costs, with a modest surplus. Meanwhile, in states like California, New York, and Hawaii, retirees are facing annual shortfalls ranging from $2,000 to $8,000 even without a mortgage.

The Role of Housing in Affordability

A key factor contributing to this divide is housing costs. Housing is one of the largest expenses for retirees, and in many high-cost states, it disproportionately impacts a retiree’s budget. In some areas, even for homeowners who do not have a mortgage, property taxes, utilities, and insurance fees continue to rise, outpacing the increase in Social Security benefits.

For instance, the analysis shows that in states like California, New Jersey, and Massachusetts, high property taxes and maintenance costs push expenses above what Social Security can cover. In contrast, states with lower living costs like Arkansas and Alabama allow retirees to stretch their Social Security benefits further.

“Housing is a major driver of financial pressure on retirees,” said Dr. Anya Sharma, an economist with the Brookings Institution. “In high-cost areas, even with Social Security, retirees often find themselves with insufficient funds to cover essential needs.”

The 10 Cities Where Social Security Benefits Go Further

While the national map paints a bleak picture for many retirees, certain cities stand out as havens where Social Security income can adequately cover living costs. According to the study, Tallahassee, Florida, Raleigh, North Carolina, and Jacksonville, Florida are among the top cities where retirees can live comfortably on Social Security benefits.

Cities with a lower cost of living, favorable tax conditions, and access to affordable healthcare make these areas attractive for retirees. For instance, Raleigh, with its combination of moderate rent prices and a lower tax burden on retirement income, offers one of the best environments for Social Security recipients.

Why Geography Matters for Retirees

The analysis highlights a growing trend where location plays a critical role in retirement planning. According to AARP, retirees who plan to live on Social Security alone must consider various factors beyond just the amount of their monthly benefit. Key considerations include:

- State income taxes: Some states tax Social Security income, while others, like Florida and Wyoming, do not, making those states more affordable for retirees.

- Healthcare access: As retirees age, healthcare becomes a critical part of their budget. Areas with robust healthcare systems, such as Raleigh, where medical costs are lower, tend to be more affordable.

- Cost of living: While urban areas often have more amenities, they come with higher costs. Smaller cities and towns, which often have lower rents and taxes, offer a more affordable option.

The Challenge of Living on Social Security Alone

According to the TSCL report, 22 million retirees in the U.S. rely exclusively on Social Security benefits for their income. The median Social Security benefit in 2025 is expected to be around $1,700 per month. While this may seem sufficient for basic needs in some areas, it falls short in high-cost states, where retirees are often forced to choose between healthcare, housing, and daily expenses.

“The gap between what Social Security provides and what is needed to maintain a decent standard of living is growing,” said Mary Johnson, a policy analyst at the Senior Citizens League. “In many parts of the country, retirees need additional sources of income to stay afloat.”

What Retirees Can Do to Close the Gap

For those who find themselves in “loser” cities and states, there are several strategies to make Social Security go further:

- Relocation: Moving to a more affordable state or city is often the most practical solution. Retirees can lower their costs by moving to areas where living expenses are lower.

- Part-Time Work: Many retirees are turning to part-time work or freelancing to supplement their Social Security income. While not ideal for everyone, this can help cover the gap.

- Downsizing: For homeowners, downsizing to a smaller property or renting can free up cash to cover other expenses.

- Supplementary Savings: Building additional retirement savings or investing in an IRA or 401(k) during the working years can provide a financial cushion later in life.

Related Links

$1,000 Federal Payout Available with One Simple Requirement — Check If You Can Qualify

New York Inflation Refund Checks: Two-Step Claim Process Starts This November

The Road Ahead: Will Social Security Be Enough for Future Retirees?

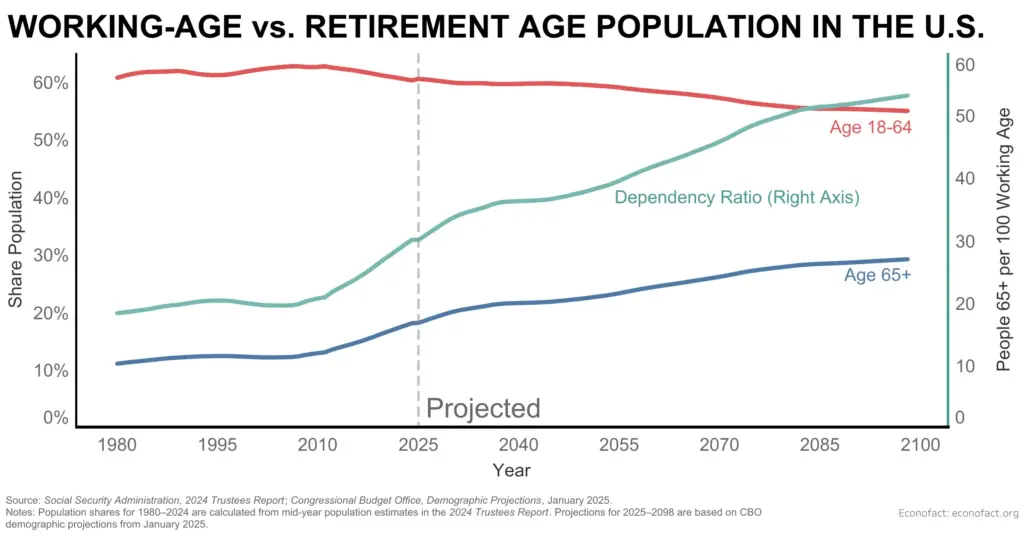

Looking ahead, experts agree that the situation is unlikely to improve significantly in the near future. With the Social Security trust fund projected to be depleted by 2034, there are growing concerns about the system’s ability to meet the needs of an aging population.

“Even with small annual increases through the Cost of Living Adjustment (COLA), Social Security isn’t designed to be a stand-alone retirement income source,” said Dr. John Peterson, an economist at the National Retirement Institute. “Most retirees will need to rely on savings, pensions, or other sources of income to maintain their lifestyle.”

The new map showing where retirees can afford to live on Social Security benefits underscores a growing financial divide in the U.S. While some areas allow retirees to live comfortably, most states and cities impose significant financial burdens that Social Security alone cannot cover.

For many retirees, strategic planning—whether through relocation, downsizing, or part-time work—will be essential to closing the gap. As the nation faces an aging population and an uncertain future for Social Security, these challenges are expected to intensify.