New Rules Could Reduce Annual Benefits by $4,573: Social Security Overhaul Ahead

The United States faces mounting pressure to enact a Social Security overhaul after the latest federal projections show the program’s trust funds could be depleted by 2034. Without legislative action, retirees may face automatic benefit cuts of about 19 percent, a reduction equal to more than $4,500 per year for many beneficiaries. The new forecast has intensified debate across Washington over how to stabilize the system that supports more than 70 million Americans.

New Rules Could Reduce Annual Benefits

| Key Fact | Detail / Statistic |

|---|---|

| Projected trust fund depletion | 2034 for combined retirement/disability funds |

| Automatic cut if no reforms | ~19% across all beneficiaries |

| Estimated annual loss | About $4,573 for average retiree; up to $16,500 for dual-beneficiary couples |

| Near-term COLA | 2.8% increase projected for 2026 |

| Largest affected group | Future retirees under age 55 |

| Official Website | Social Security Administration |

Why a Social Security Overhaul Is Back in the Spotlight

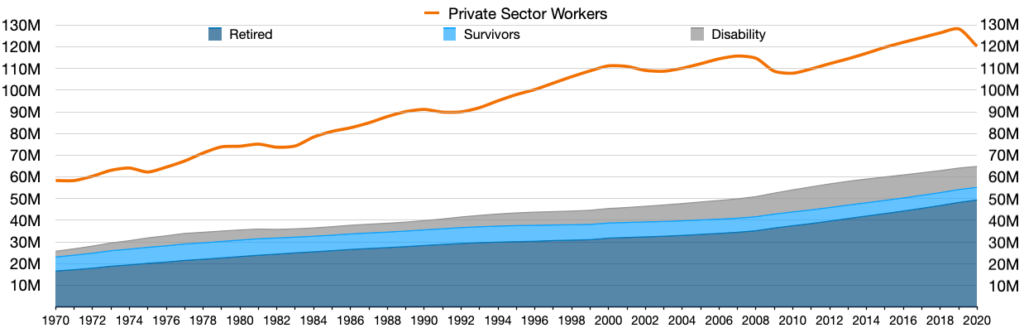

The warnings surrounding trust fund depletion are not new, but the timeline has moved closer in recent years as demographic and economic trends reshape the program’s financial foundation. According to the Social Security Trustees Report, the number of beneficiaries continues to outpace the number of workers paying into the system. This shift has strained a structure originally designed for a population with higher birth rates, shorter lifespans, and a more robust ratio of workers to retirees.

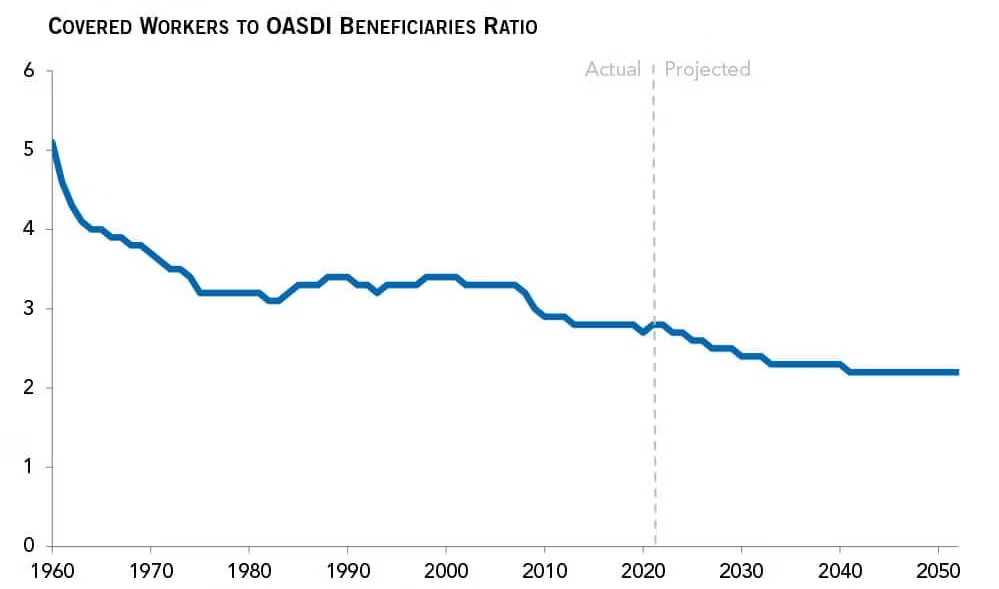

Economists note that in 1960, there were more than five workers per Social Security beneficiary. Today, the ratio has declined to barely three workers per beneficiary, and it is expected to fall below 2.5 by 2035. This imbalance means payroll taxes—the program’s primary revenue source—are no longer sufficient to cover annual benefit obligations.

Additionally, wage growth has slowed compared to prior decades, reducing payroll tax revenues. Combined with rising life expectancy and the aging Baby Boomer population, these trends have deepened the long-term funding gap.

What Happens If Congress Does Nothing

Automatic Cuts Begin in 2034

Under current law, Social Security cannot borrow money or run a deficit. Once the trust funds deplete, the program may pay only what it collects each year in payroll taxes. The Congressional Budget Office estimates this would result in an automatic 19 percent reduction in all Social Security benefits beginning in 2034.

Retirees who receive roughly $24,000 annually would lose more than $4,500 per year. For couples earning two benefit streams, the reductions could exceed $16,000 annually. Economists warn that such cuts would push millions of older Americans toward poverty, especially those who depend on Social Security as their primary income.

Disability and survivor benefits also impacted

The cuts would not be limited to retirees. Payments for disabled workers, widows, and dependent children would also fall by nearly one-fifth. Several advocacy groups warn that these reductions could disproportionately affect low-income seniors, women, rural communities, and people with disabilities who have fewer alternative income sources.

Proposals Under Consideration in a Social Security Overhaul

Lawmakers, economists, and think tanks have proposed dozens of reforms. While none has gained enough bipartisan support for passage, experts agree that earlier action allows for more gradual—rather than abrupt—changes.

Raising or eliminating the payroll tax cap

Currently, income above $168,600 is not subject to Social Security payroll tax. Some proposals would raise or eliminate this cap, a move that could close up to one-third of the financing gap. Supporters say it reflects modern income inequality, while critics warn that it breaks the link between contributions and earned benefits.

Gradually increasing the retirement age

Another proposal raises the full retirement age from 67 to as high as 69. Proponents argue that life expectancy has increased, while opponents note this gain is uneven—many low-income workers have not experienced similar longevity improvements.

Changing benefit formulas

Several plans propose shifting the benefit calculation method to slow growth for higher-earning workers while protecting low-income retirees. This approach resembles progressive adjustment models used in Canada and parts of Europe.

Adjusting COLA calculations

The cost-of-living adjustment (COLA) could be tied to a “chained CPI” or a “retirement CPI,” each of which alters how inflation is measured. These proposals attempt to better match actual spending patterns but may slow long-term benefit growth.

Creating supplemental or hybrid funding sources

A small number of economists advocate for supplemental trust fund revenue drawn from dedicated taxes on investment income or carbon emissions. Such approaches have limited political traction but could diversify funding streams.

How Politics Shape the Social Security Debate

High stakes in an election year

Social Security remains one of the most politically sensitive issues in the United States. Many analysts believe the lack of reform stems from political risk: proposing cuts or tax increases may alienate voters. Polling consistently shows bipartisan opposition to major changes, especially those affecting current retirees.

Bipartisan consensus on timing, not solutions

While Democrats and Republicans generally agree the system requires action, they remain divided on how to proceed. Democrats often prefer raising revenue, while Republicans usually focus on reducing long-term expenditures. Several bipartisan commissions have recommended blended approaches, but Congress has yet to reach consensus.

Experts warn that delaying action increases the pain

Economists at the Brookings Institution and the Congressional Research Service emphasize that early reform allows gradual phase-ins, protecting current retirees from sharp reductions. Delaying action until the trust fund’s depletion year risks abrupt, unavoidable cuts.

A Look Back: How the U.S. Repaired Social Security in the Past

Social Security has faced financing shortfalls before. In the early 1980s, trust funds neared depletion, prompting a bipartisan rescue package led by President Ronald Reagan and House Speaker Tip O’Neill. The reforms included raising the retirement age, adjusting payroll taxes, and temporarily taxing benefits. Those changes stabilized the system for several decades.

Analysts point to the 1983 reforms as evidence that bipartisan compromise is possible, though the current political climate is more fractured. Unlike in 1983, demographic pressures today are stronger, leaving policymakers with fewer painless options.

International Comparisons: How Other Nations Adjusted Similar Systems

Countries with aging populations have also faced pension shortfalls. For example:

- Japan gradually raised retirement ages and reduced some benefit formulas.

- Germany adopted automatic stabilizers that adjust benefits and contributions to preserve solvency.

- Sweden implemented a notional defined-contribution system tied to economic performance.

Experts suggest the United States may eventually consider similar automatic adjustments to avoid future political crises.

Impact of The New Rules Could Reduce Annual Benefits on Workers and Retirees

Older workers

Reduced benefits or higher retirement ages may force many older Americans to work longer, despite health limitations or limited job opportunities.

Younger workers

Younger generations face uncertainty about future retirement security. Surveys by Pew Research Center show that a majority of Americans under 40 doubt they will receive full benefits.

Low-income households

Any uniform reduction would fall hardest on low-income retirees, for whom Social Security constitutes 80–90 percent of total income.

Mississippi SSI Pause Explained: Why January Payments Won’t Be Sent

What Happens Next

Congress is expected to consider multiple reform proposals over the next few years, though no major legislation is imminent. Analysts warn that waiting until the trust funds reach the brink of depletion will leave policymakers with fewer—and more painful—options.

For now, the future of Social Security remains uncertain, with millions of Americans watching closely as lawmakers debate how best to preserve the nation’s most widely used safety-net program.

FAQs About New Rules Could Reduce Annual Benefits

Q1: Will current retirees lose benefits?

Not necessarily. Many reform proposals protect people already receiving benefits, though automatic cuts occur if Congress takes no action by 2034.

Q2: Could taxes increase instead of benefits being cut?

Yes. Several proposals raise payroll taxes or expand the tax base to preserve existing benefit levels.

Q3: What is the most likely reform approach?

Analysts expect a hybrid package including revenue increases, adjustments to benefit formulas, and gradual retirement age changes.

Q4: Is Social Security going bankrupt?

No. Payroll taxes will continue to fund roughly 80 percent of benefits even if the trust funds become depleted.