The Medicare Cost Increases Ahead — What Rising Prices Mean for Retirees’ COLA in South Carolina issue has become a top financial concern for millions of older adults across the Palmetto State.

While the Social Security Administration (SSA) has confirmed a 2.8% cost-of-living adjustment (COLA) for 2026, rising Medicare premiums, deductibles, and prescription drug expenses will absorb a significant share of that increase.

For many South Carolina retirees—especially those living on fixed incomes—the expected boost may feel smaller than anticipated once healthcare costs are deducted from monthly benefits.

Medicare Cost Increases Ahead

| Key Fact | Detail |

|---|---|

| 2026 Social Security COLA | 2.8% increase (avg. +$56/month) |

| 2026 Medicare Part B premium | Estimated $202.90/month |

| Share of South Carolina retirees depending on Social Security for most income | 52% |

| Healthcare inflation vs. general inflation | Healthcare rising at nearly double CPI |

Why Medicare Cost Increases Ahead Matter for South Carolina Retirees

Medicare costs—especially Part B premiums—are closely linked to broader healthcare inflation and federal policy decisions. As costs rise, retirees experience reduced purchasing power even when COLA increases are announced.

According to the Social Security Administration, more than 1.1 million South Carolina residents receive Social Security benefits, meaning the impact of Medicare cost changes is widespread and deeply felt.

Experts warn that the combination of rising medical expenses and modest COLA increases can create a “compression effect,” where retirees’ real income growth fails to keep pace with the cost of basic needs.

Medicare Premium Increases (KW2) and Their Drivers

Federal officials cite multiple reasons why premiums continue rising:

1. Increased enrollment due to aging population

Baby boomers are entering Medicare at high rates, increasing utilization.

2. Higher service utilization

Outpatient services—such as screenings, diagnostic imaging, and specialist care—continue to surge.

3. Technology and pharmaceutical costs

New medications and advanced treatments increase Medicare’s cost base.

4. Inflationary pressures on hospitals and clinics

Staffing shortages, wage growth, and supply chain costs push overall expenses up.

CMS documents show that Medicare spending now exceeds $1 trillion annually, with Part B representing a substantial portion.

How Social Security COLA (KW3) Interacts With Rising Medicare Costs

Although the COLA formula is designed to maintain retirees’ purchasing power, the metric used—CPI-W—does not accurately track expenses most relevant to seniors. Healthcare inflation often increases at twice the rate of general inflation, reducing the real value of COLA.

Example Impact on Monthly Budget

- $2,000 monthly benefit → +$56 COLA

- Medicare premium increase → −$17.90

- Net COLA benefit → ~$38

- Higher deductibles, prescription costs, and co-pays reduce this further

Many beneficiaries will see their effective COLA barely cover rising medical expenses.

Why South Carolina Retirees (KW4) Are Especially Vulnerable

Demographics amplify the impact

South Carolina has one of the highest proportions of retirees in the Southeast, and many depend primarily on Social Security.

Key factors:

- Lower median retirement savings

- Higher rates of disability and chronic illness

- Greater dependence on hospital and specialist care

- Higher poverty rates among adults 65+ in rural counties

- Limited access to lower-cost Medicare Advantage plans in some regions

For retirees living on roughly $1,700–$2,000 per month, every Medicare cost increase has a pronounced effect.

Regional Breakdown: South Carolina Counties Most Affected

Upstate (Greenville, Spartanburg, Anderson)

Growing populations increase demand for specialist care, raising out-of-pocket expenses.

Midlands (Columbia, Sumter, Lexington)

Hospitals report rising prices for outpatient services, impacting Medicare spending.

Coastal (Charleston, Beaufort, Horry)

Housing and healthcare costs run significantly above the state average.

Rural Counties (Marion, Allendale, Bamberg, Dillon)

Limited provider networks mean more travel, higher costs, and fewer Medicare Advantage options.

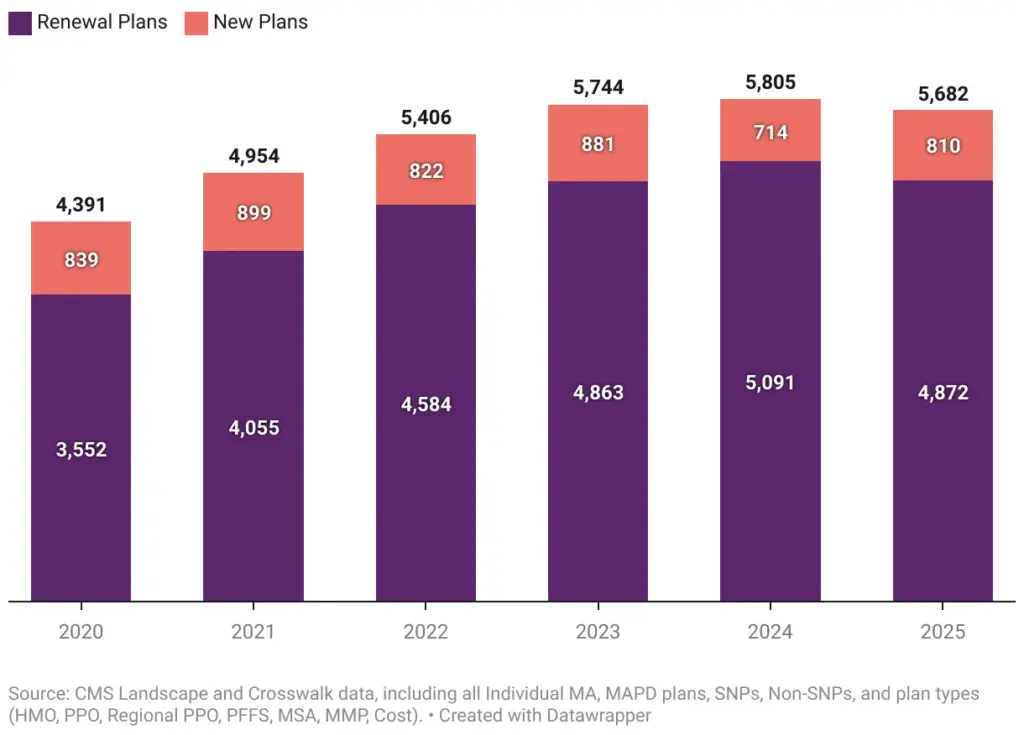

How Medicare Advantage Changes Will Affect Retirees in 2026

Medicare Advantage (MA) plans often update premiums, co-pays, and network rules annually. In South Carolina:

- Some counties will see higher MA monthly premiums

- Out-of-pocket maximums may rise

- Prescription formularies may tighten

- Specialist visits may see higher co-pays

Retirees relying on chronic disease management—such as diabetes, heart disease, and arthritis—are particularly affected.

Prescription Drug Cost Reforms and Their Impact on 2026 Premiums

The Inflation Reduction Act (IRA) introduced several Medicare drug-price reforms, including:

- Annual Part D out-of-pocket cap

- Expanded insulin price caps

- Negotiated pricing for select high-cost drugs

These reforms lower some costs but may increase premiums as insurers adjust for the new cost structure.

The Hold-Harmless Rule Explained

The hold-harmless provision protects some retirees from seeing a net decrease in their Social Security benefit due to Medicare premium increases. But:

- It does not protect new Medicare enrollees

- It does not protect higher-income beneficiaries subject to IRMAA

- It does not cover Medicare Advantage enrollees

- It only applies if premiums are deducted directly from Social Security

Many South Carolina retirees fall outside this rule, especially those on Medicare Advantage or with Medicaid support.

Interaction With Medicaid for Low-Income South Carolina Seniors

South Carolina Medicaid covers Medicare premiums for certain low-income seniors through programs like:

- QMB (Qualified Medicare Beneficiary)

- SLMB (Specified Low-Income Medicare Beneficiary)

- QI (Qualified Individual)

However:

- Eligibility thresholds are low

- Many seniors fall into the “coverage gap”—too much income for Medicaid but too little to absorb rising Medicare costs

As a result, many vulnerable retirees feel the full impact of Medicare cost increases.

Fraud and Scam Risks Spike During COLA and Medicare Transition Months

The SSA and CMS warn that the period from October–January sees a surge in:

- Fake Medicare “renewal” calls

- Fraudulent COLA “activation” emails

- Scams demanding bank information to issue new Medicare cards

- Criminals impersonating SSA agents

Retirees should know:

- Medicare never requires personal data via email or phone

- SSA will not ask beneficiaries to “confirm” their COLA

- Official notices come by mail or through MySocialSecurity.gov

Economic Pressures Unique to South Carolina

Healthcare Inflation in SC Is Higher Than National Average

Hospital systems in Charleston, Greenville, and Columbia report rising labor costs and supply shortages, driving medical inflation.

Housing and Utilities Outpacing COLA

The South Carolina Housing Authority shows rent increases of 8–12% in many metro areas.

Retirement Income Below National Median

This reduces margin for absorbing Medicare increases.

Expert Commentary from Policy, Economic, and Medical Fields

Dr. Margaret Allen, South Carolina Department on Aging

“Medicare premiums rising faster than Social Security income leaves many seniors with fewer choices and less stability.”

Economist Daniel Ruiz, Federal Reserve Bank of Richmond

“Healthcare is the fastest-growing segment of retiree spending. When Medicare costs rise faster than COLA, real income for seniors shrinks.”

AARP Senior Advisor Robert Hartwell

“The COLA is necessary but insufficient for South Carolina’s retirees, who face high medical needs and limited retirement savings.”

What South Carolina Retirees Can Do to Prepare

1. Carefully examine Medicare Advantage and Part D plans during Open Enrollment

Formularies, networks, and premiums change every year.

2. Utilize SHIP (State Health Insurance Assistance Program)

Free counseling helps retirees compare plans and optimize benefits.

3. Adjust budgets early

Financial planners recommend preparing for both premium and deductible increases by fall.

4. Consider Medigap plans

For retirees with chronic medical needs, Medigap may reduce long-term out-of-pocket costs.

5. Set MySocialSecurity.gov alerts

Retirees can verify annual benefit changes, deductions, and notices securely.

Legislative Solutions Being Debated

Lawmakers have proposed:

- Switching COLA to CPI-E (a senior-focused inflation measure)

- Expanding Medicare drug negotiations

- Lowering IRMAA thresholds

- Offering supplemental COLA for low-benefit retirees

- Increasing Medicare Advantage oversight

None are finalized, but policy momentum is growing due to concerns about senior poverty.

Related Links

Next Social Security Check: Full 2025 Payout Schedule for All Beneficiary Groups

TSA’s New $18 Fee Shocks Travelers — What It Really Covers and Who Pays More Starting January

International Comparison: How Other Nations Adjust Pension Benefits

- Canada: Pension indexing tied to CPI but adjusted quarterly

- United Kingdom: Triple-lock protection ensures benefits rise with inflation, wages, or 2.5%

- Germany: Pension increases tied to wage growth

The United States’ COLA system is stable but often inadequate to match retiree expenses.

For South Carolina’s growing retiree population, the Medicare Cost Increases Ahead — What Rising Prices Mean for Retirees’ COLA in South Carolina reflects a challenging economic reality. As healthcare costs grow faster than COLA adjustments, many older adults must plan carefully, seek guidance, and consider all available programs to maintain financial stability in the year ahead.

FAQ About Medicare Cost Increases

Retirees still receive the full COLA?

Yes, but Medicare deductions reduce the net amount.

Q: Why is COLA not keeping up with healthcare inflation?

Because it uses CPI-W, which does not represent retiree spending patterns.

Q: Can retirees switch plans to reduce costs?

Yes—Medicare’s annual open enrollment period provides options.

Q: Do Medicare Advantage plans protect against rising costs?

Not always; many are raising premiums and out-of-pocket maximums.

Q: Can Medicaid help with premiums?

Only for low-income seniors meeting specific eligibility criteria.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores