The Social Security Administration (SSA) confirms that only a small fraction of American workers will ever qualify for the maximum $5,108 Social Security benefit available in 2025. Achieving this amount requires meeting three strict criteria involving lifetime earnings, work history, and the timing of retirement.

These rules determine how much a person can receive, making them essential for workers aiming to maximize their retirement income.

Maximum $5,108 Social Security Benefit

| Key Fact | Detail / Statistic |

|---|---|

| Maximum benefit | $5,108 monthly at age 70 in 2025 |

| Required work history | 35 years of high earnings |

| Earnings limit (2025) | $176,100 taxable wage base |

| Claim timing | Must wait until age 70 |

Understanding the Maximum $5,108 Social Security Benefit

The maximum $5,108 Social Security benefit is the highest monthly retirement check the SSA will issue in 2025. It applies only to workers who claim benefits at age 70, have consistently earned the maximum taxable amount throughout their careers, and maintain an unbroken high-earning work history.

Although millions receive Social Security benefits, only a very small group meets all the necessary conditions to reach this ceiling. According to the Social Security Administration, the maximum amount depends on three factors:

- How much you earned over your lifetime

- How long you worked

- When you choose to start receiving benefits

Together, these rules form the foundation for determining retirement income.

Rule One — Meet the 35-Year Work Requirement

Why Social Security Uses 35 Years of Earnings

The SSA calculates your retirement benefit based on your 35 highest-earning years, adjusted for inflation. This formula is intended to reflect a long-term view of your earning capacity. If you have fewer than 35 years of earnings, the missing years are counted as zeros, which lowers your monthly check.

According to SSA publications and numerous analyses from Bankrate, SmartAsset, and Forbes, this rule is one of the biggest obstacles for many workers.

Earning at or Near the Social Security Earnings Cap

To qualify for the maximum benefit, simply working for 35 years is not enough—you must earn at or above the taxable wage limit for most of those years. For 2025, this Social Security earnings cap (KW4) is $176,100. Any earnings above this limit are not counted toward Social Security calculations.

The earnings caps have increased nearly every year, meaning today’s workers must consistently meet rising thresholds.

Why This Requirement Eliminates Most Workers

Very few workers maintain high earnings for 35 consecutive years. Income gaps, part-time work, layoffs, caregiving breaks, and lower-paying jobs early in a career can bring the average down. Even one or two low-earning years can reduce your monthly benefit.

Economists from the Center for Retirement Research at Boston College explain that only a very small percentage of individuals sustain earnings near or above the cap for decades.

Rule Two — Collect Delayed Retirement Credits

Why Waiting Until Age 70 Matters

Workers can claim benefits as early as age 62, but doing so triggers a permanent reduction. To receive the maximum $5,108 benefit, you must wait until age 70, when delayed retirement credits stop accruing.

According to the SSA, waiting past full retirement age (between 66 and 67 depending on birth year) increases benefits by approximately 8% per year until age 70.

Example of Delayed Retirement Credits in Action

A worker who qualifies for the maximum benefit at age 70 would receive:

- Around $3,800–$4,000 at full retirement age

- Around $2,800–$3,000 if claimed at age 62

This means that delaying benefits from 62 to 70 can increase monthly income by more than 70%.

Health, Longevity, and Financial Considerations

Although delaying boosts the monthly benefit, not everyone benefits equally. Financial planners note that individuals with serious health issues or shorter life expectancy might not receive the same long-term advantage.

Rule Three — Maintain Consistently High Earnings Throughout Your Career

Why Consistency Matters

High earnings in only part of your career are not enough. Social Security benefits are based on an average of 35 years, meaning short periods of low income—or years missing entirely—bring down your benefit calculation.

Correcting Your SSA Earnings Record

The SSA urges workers to review their annual earnings reports online. Mistakes do happen, especially for:

- Job changes

- Self-employed workers

- Incorrect reporting by employers

- Name or Social Security number changes

If uncorrected, errors can lower lifetime benefits.

Replacing Low-Earning Years

Workers can replace earlier low-earning years by working longer, especially in their 40s, 50s, and 60s when earnings typically peak.

Financial planners often call this one of the easiest ways to improve retirement checks—even if a worker cannot reach the maximum benefit.

How These Three Rules Work Together

To qualify for the maximum $5,108 Social Security benefit, you must:

- Earn at or above the Social Security earnings cap for most of your career

- Work at least 35 years at high income levels

- Delay claiming benefits until age 70

If any one of these conditions is missing, the benefit will be substantially lower. Because of this strict combination, experts estimate that less than 2% of all retirees meet these requirements in any given year.

Broader Policy and Economic Context

Responding to Rising Longevity

As Americans live longer, Social Security’s delayed retirement credit system encourages later retirement to help ensure stable lifelong income.

Wage Growth and Economic Inequality

The requirement to earn at the taxable wage limit each year brings attention to broader wage disparities. Only high-income earners—especially in specialized or technical fields—have sustained earnings near the cap.

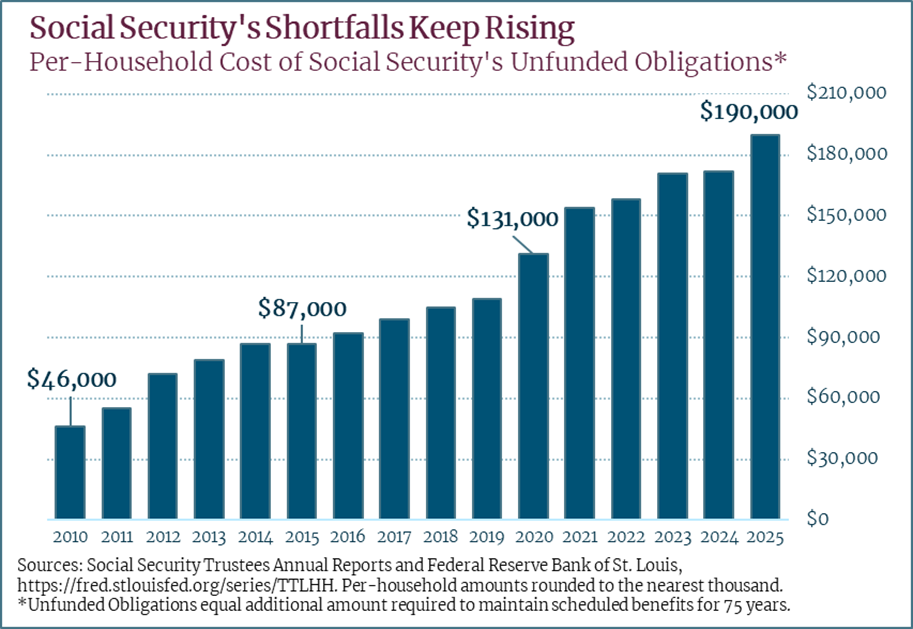

Impact on Social Security Solvency

Surprisingly, high earners receiving the maximum benefit do not significantly strain the program. Their lifetime contributions are also maximized, balancing the system.

Expert Commentary

Dr. Michael Hargrove, professor of retirement policy at Georgetown University, explains:

“Reaching the maximum Social Security benefit requires discipline and luck. Very few Americans have both high incomes and long, uninterrupted careers.”

Sarah Mendoza, certified financial planner, notes:

“Working longer is the most realistic strategy for many people. Replacing low-earning years can dramatically increase benefits, even if you never approach the maximum.”

SSA spokesperson (published statement):

“Workers should regularly review their earnings records and understand how claiming age affects their final benefit amount.”

Related Links

SNAP Update: USDA Says All Recipients Must Reapply Under New Verification Rules

New Mortgage Costs After the Fed’s October Rate Cut: What Buyers Will Pay Monthly

Steps Workers Can Take Now

- Create a mySocialSecurity account to monitor your earnings

- Aim to extend your career, if possible, to replace low-earning years

- Consult a retirement planner to evaluate whether delaying to age 70 is feasible

- Increase annual income, if possible, through promotions or additional work

- Review tax strategies to maximize take-home pay while staying above the taxable wage base

While few Americans will ever qualify for the maximum $5,108 Social Security benefit, understanding the underlying rules enables every worker to take meaningful steps toward increasing their retirement income.

Earnings consistency, strategic timing, and careful planning remain the most effective tools for maximizing Social Security benefits as Americans prepare for longer, more financially complex retirements.

FAQs About Maximum $5,108 Social Security Benefit

1. Is the $5,108 benefit guaranteed if I wait until age 70?

No. You must also meet the earnings cap for 35 years.

2. Can I still get a high benefit if I earned below the cap?

Yes. You may still receive well above the national average, but not the maximum.

3. Does working past 70 increase the benefit further?

No. Benefits stop increasing at age 70.

4. Do spousal benefits apply?

Spousal benefits cannot exceed 50% of the worker’s full retirement benefit and do not use the $5,108 maximum.

5. Is the maximum benefit adjusted annually?

Yes. It typically rises each year due to increases in the taxable wage base and cost-of-living adjustments.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores