Sweeping changes to Medicare and Social Security will take effect in January 2026, marking the most significant benefits shift for retirees, disabled Americans, and working beneficiaries in more than a decade.

The Massive Medicare & Social Security Shake-Up includes a 2.8% Social Security cost-of-living adjustment (COLA), major Medicare premium hikes, new prescription drug caps, and updated income thresholds that may raise costs for some households while offering limited relief for others.

Massive Medicare & Social Security Shake-Up

| Key Change | 2026 Update | Impact on Beneficiaries |

|---|---|---|

| COLA Increase | +2.8% | Raises average benefits by ~ $56/month before deductions |

| Medicare Part B Premium | Expected $202.90/month | Reduces net COLA gains; higher-income penalties |

| Prescription Drug Cap | $2,100 annual Part D limit | Major savings for high-usage seniors |

| Social Security Wage Cap | Approx. $184,500 | Higher payroll taxes for top earners |

| Earnings Test Threshold | Increased | Working beneficiaries can earn more before reductions |

These adjustments reflect ongoing economic conditions — including persistent inflation and rising medical expenses — and demonstrate the federal government’s attempt to manage both near-term affordability and long-term sustainability of programs relied upon by over 70 million Americans.

The Massive Medicare & Social Security Shake-Up will reshape how retirees, disabled workers, and Medicare enrollees experience federal benefits in 2026. A 2.8% Social Security increase, combined with higher Medicare premiums and new income rules, will change what millions take home in monthly benefits.

The changes aim to counter inflation and rising health-care costs, but financial experts caution that many seniors may see limited net gains.

Social Security COLA: Modest Increase Amid Persistent Inflation

The SSA confirmed a 2.8% COLA increase for 2026. Although smaller than the historically high adjustments of 2022 and 2023, the increase is intended to maintain purchasing power amid still-elevated inflation.

Breakdown of Benefits

- Retired workers: average rise from $1,848 → $1,899

- Couples: $2,939 → $3,021

- SSDI recipients: + ~$44/month

- SSI beneficiaries: + ~$23/month

Limits of COLA

Senior advocacy groups argue that the CPI-W inflation formula fails to reflect seniors’ real spending. Older Americans spend:

- 300% more on health care

- 50% more on housing than younger households

Experts at the National Committee to Preserve Social Security & Medicare note: “The COLA helps, but it does not reflect the inflation seniors experience every month.”

Medicare Part B Premium Surge — The Biggest Source of Concern

The standard Medicare Part B premium is projected to rise to $202.90 per month, driven by increased outpatient costs and coverage of high-cost drugs.

How Much Will This Offset COLA?

A typical senior might gain:

- + $56 from COLA

- – $17 to $20 for the Part B premium hike

Net monthly increase: + $36 to $39

For those subject to IRMAA, the impact is far worse — some will lose their entire COLA increase.

The Hold-Harmless Provision

Lower-income Social Security beneficiaries will be partially protected, ensuring they do not see a decrease in net benefits — but this protection does not apply to:

- new Medicare enrollees

- IRMAA recipients

- those not paying Part B premiums through Social Security

Prescription Drug Relief: The New $2,100 Part D Cap

A significant win for seniors is the new $2,100 out-of-pocket cap for Medicare Part D plans.

Who Benefits Most?

- Cancer patients

- Seniors taking biologics or specialty drugs

- Those with chronic illnesses requiring expensive medications

The Kaiser Family Foundation estimates that at least 1.5 million seniors hit catastrophic drug thresholds each year — these individuals could save thousands starting in 2026.

Social Security Wage Cap Rise — Good for Solvency, Tough on Workers

The 2026 taxable wage cap will increase to approximately $184,500, meaning high-income workers will pay more in payroll taxes.

Who Is Affected?

Roughly 940,000 workers earn above the current wage cap and will see an increased tax burden.

Why It Matters

This change is necessary to slow the depletion of the Social Security Trust Fund, which is projected to face shortfalls by 2033–2035 without congressional action.

Earnings Test Changes Help Working Beneficiaries

More retirees are working later in life. The updated 2026 earnings limit helps those below full retirement age (FRA) keep more of their benefits.

New 2026 Limits

- Under FRA: $24,480 (before benefits are reduced)

- Reaching FRA in 2026: $65,160

This is especially important for part-time workers who rely on Social Security as supplemental income.

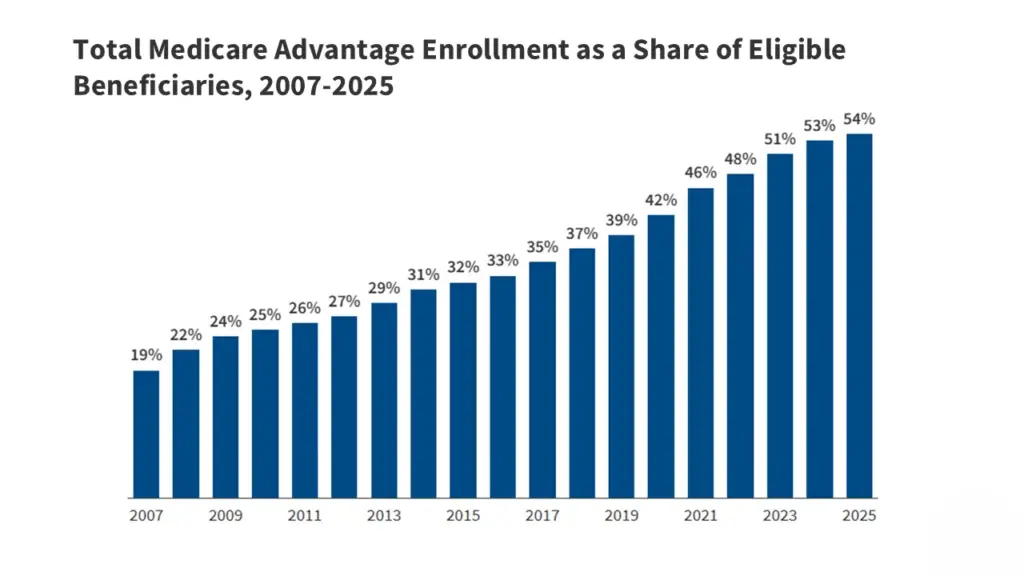

What About Medicare Advantage and Medigap?

Medicare Advantage (MA) enrollment now exceeds 33 million. In 2026:

Medicare Advantage Changes

- Some MA plans are expected to raise copays and reduce supplemental benefits

- Higher cost-sharing for outpatient services

- Potential reductions in dental/vision extras

Medigap

- Premiums are expected to rise 4–7% nationwide

- Plan G and Plan N remain the most popular

- Older seniors (over 75) are likely to see the largest premium increases

Winners, Losers, and Neutral Groups in the 2026 Shake-Up

Winners

- Seniors with high drug costs

- Low-income Medicare enrollees

- Disabled beneficiaries facing consistent medical needs

Losers

- Higher-income retirees subject to IRMAA

- Workers earning over $184,500

- Seniors with Medicare Advantage facing rising copays

Neutral or Mixed Impact

- Middle-income retirees: gain from COLA but lose to premium increases

- New Medicare enrollees: no hold-harmless protection

What Experts Say

On COLA

A Boston University economist said: “COLA is stabilizing but still insufficient for seniors who spend heavily on health care and rent.”

On Medicare Premiums

A health-policy analyst noted: “Rising Medicare costs are increasingly eroding Social Security gains. This should concern policymakers.”

On Long-Term Solvency

The Congressional Budget Office continues to warn that reforms are needed to avoid benefit reductions within a decade.

Political Context and Legislative Debates

2026 changes arrive amid:

- A divided Congress

- Debates over raising the retirement age

- Proposals to tax income above $400,000 for Social Security

- Pressure to adopt the CPI-E inflation measure for seniors

Both parties have released frameworks, but no comprehensive reform has passed.

What Beneficiaries Should Do Before 2026

1. Review your SSA benefit letter

It arrives in December and outlines your exact 2026 payment after deductions.

2. Reevaluate Medicare Advantage vs. Original Medicare

New premium increases make choosing an efficient plan more important.

3. Review prescription drug usage

You may save significantly under the new Part D cap.

4. Check your income

Avoid IRMAA surcharges if possible.

5. Update your MySocialSecurity account

Ensures accurate notifications and benefit calculations.

Related Links

$500 Monthly Support Now Extended Through 2026 — Check If You Can Qualify

Alert: Extra Social Security Payment Coming in December — But There’s a Catch

The 2026 Medicare and Social Security update reflects the ongoing struggle to balance affordability for older Americans with the fiscal pressures facing federal programs. While the PRIMARY-KEYWORD offers modest gains for many beneficiaries, rising health-care costs will continue to test the limits of fixed incomes. The true impact will become clear when millions receive their updated benefit statements in early 2026.

FAQs About Massive Medicare & Social Security Shake-Up

Q: Will everyone receive a higher Social Security payment in 2026?

Yes, but net gains vary depending on Medicare deductions.

Q: Are Medicare premiums rising for all seniors?

Almost all; some low-income beneficiaries may be buffered.

Q: Will prescription drug costs decrease?

For many seniors, yes — especially those with high annual drug expenses.

Q: What if I am still working while receiving Social Security?

Higher earnings limits may allow you to keep more benefits.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores