Major Social Security Adjustments Coming in 2026 — What Retirees Should Prepare For

The Major Social Security Adjustments Coming in 2026 will affect more than 75 million Americans, as the Social Security Administration (SSA) implements a 2.8% cost-of-living increase, higher taxable wage limits, and new earnings thresholds for working retirees.

While benefits will rise, many experts warn that Medicare premiums, inflation trends, and long-term funding concerns may offset gains for older Americans preparing for the year ahead.

Major Social Security Adjustments

| Key Fact | Details for 2026 |

|---|---|

| COLA increase | 2.8% rise in Social Security & SSI payments |

| Avg. retiree benefit boost | + ~US$56 per month (before deductions) |

| New earnings limit (under full retirement age) | US$24,480 |

| Taxable wage base | US$184,500 |

| Full retirement age threshold limit | US$65,160 |

Understanding the 2026 Social Security Adjustments

The 2026 changes represent the routine but important set of adjustments the SSA makes each year to help benefits keep pace with inflation. These updates are tied to federal economic indicators, wage-index calculations, and benefit-eligibility rules designed to maintain fairness and long-term stability within the system.

Below is a deeper look at what is changing, why it matters, and what retirees should consider as they plan for the coming year.

The 2.8% COLA Increase: What It Means for Retirees

A Modest Boost Amid Persistent Price Pressures

The SSA announced a 2.8% cost-of-living adjustment (COLA) for 2026, a slight increase from the previous year’s 2.5%. The average retirement benefit will rise by about US$56 per month, bringing typical checks to just over US$2,070 before deductions.

The COLA is tied to inflation data from the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). But CPI-W often understates the real-world costs faced by retirees, especially healthcare and housing, which rise faster than overall inflation.

“COLA helps, but it rarely reflects where older Americans spend most,” said Dr. Laura Middleton, a senior economist at the Urban Institute. “Retirees face inflation very different from that measured in the CPI-W.”

Medicare Premiums May Offset Gains

Most Medicare Part B premiums are deducted directly from Social Security checks. If premiums rise—as analysts widely expect—the net benefit could be smaller than retirees anticipate. For many fixed-income seniors, this means the real-world increase from the COLA may feel significantly smaller.

Wage Base and Taxes: Higher Cap for High Earners

In 2026, the taxable wage base—the maximum amount of income subject to Social Security payroll taxes—will rise to US$184,500. This change affects higher-income workers, increasing their annual contributions to the system.

The adjustment reflects growth in national average wages and is intended to keep Social Security’s funding mechanism aligned with long-term economic patterns.

“Raising the taxable wage base is essential for maintaining system solvency,” said Michael Harris, a policy analyst at the Bipartisan Policy Center. “But it also highlights the need for deeper reforms in the coming decade.”

New Earnings Limits for Working Beneficiaries

For retirees under full retirement age:

The earnings limit will increase to US$24,480. If individuals exceed that amount, the SSA will temporarily withhold US$1 in benefits for every US$2 earned above the limit.

For those reaching full retirement age in 2026:

The threshold rises to US$65,160, with US$1 withheld for every US$3 earned above the limit. These adjustments help beneficiaries who continue to work while receiving benefits, allowing greater income flexibility without immediate reductions.

Supplemental Security Income (SSI) Adjustments

SSI payments—supporting around 7 million low-income elderly and disabled Americans—will also increase in line with the 2.8% COLA. This adjustment applies to both individuals and couples.

However, advocates say the increase remains insufficient to meet rising living costs, particularly for disabled Americans and the very elderly.

“SSI recipients are among the most economically vulnerable,” said Amy Rollins, director at the National Council on Aging. “Even with COLA, many continue to fall behind rising rent and healthcare expenses.”

Why These Adjustments Matter: The Bigger Economic Picture

Inflation Remains a Key Driver — But Not the Only One

Recent inflation has moderated from the peaks seen in 2022, but prices for essentials—including prescription drugs, medical visits, housing, and utilities—remain significantly higher than pre-pandemic levels.

Because COLA is backward-looking, retirees must navigate inflation in real time while relying on an adjustment based on the previous year’s data.

Fiscal Sustainability Concerns Are Mounting

The Social Security Trustees Report continues to warn that the Old-Age and Survivors Insurance (OASI) Trust Fund could face depletion by the mid-2030s if no reforms are implemented. While benefits would not disappear, the SSA would only be able to pay an estimated 77% of scheduled benefits.

The 2026 adjustments will not materially affect solvency, but analysts note they highlight the urgency of Congressional action.

“Incremental changes like COLA are normal,” said Professor Daniel Kroft, Social Policy Chair at Georgetown University. “But they sit atop a much larger structural challenge. Without reform, a funding shortfall is inevitable.”

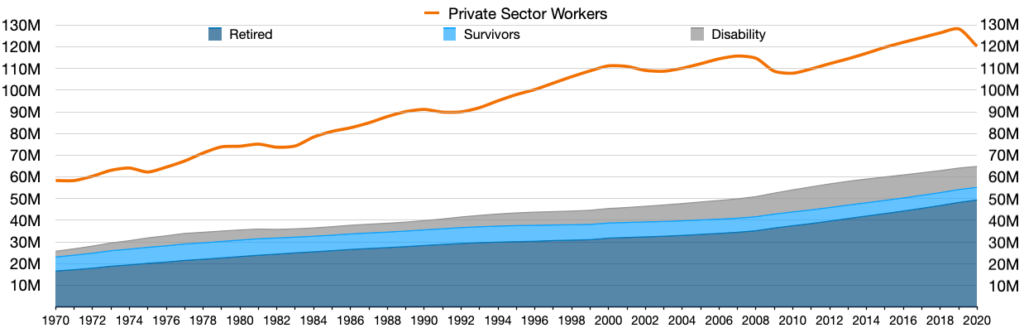

Demographic Pressures: An Aging Population and Falling Birth Rates

Shifting population dynamics are reshaping Social Security’s financial baseline

- Baby boomers continue to enter retirement in large waves.

- Americans are living longer, increasing lifetime benefit payouts.

- Declining birth rates reduce the number of workers paying into the system.

The worker-to-beneficiary ratio—once 5:1 in 1960—is projected to fall to 2:1 by 2035.

This demographic shift sits at the center of debates about the future of Social Security, influencing everything from benefit calculations to tax policy debates.

Political Implications Heading Into 2026

With federal elections approaching, Social Security reform is expected to be a major political issue. Proposals currently circulating in Congress include:

- Raising or eliminating the taxable wage cap

- Adjusting full retirement age

- Revising the COLA formula to better match senior spending patterns

- Increasing payroll taxes for high earners

- Introducing new revenue mechanisms

Each proposal carries political risks, making bipartisan agreement difficult. Analysts expect heightened debate throughout 2026 as lawmakers respond to public pressure.

What Retirees Should Do Now After Major Social Security Adjustments

1. Review Your SSA Benefit Statement

Understand your projected 2026 payment and how deductions may alter your net income.

2. Account for Medicare Premium Adjustments

Healthcare spending is often the largest variable affecting retirees’ budgets.

3. Consider Additional Income or Savings Strategies

Part-time work, annuities, or retirement account withdrawals may help offset living-cost increases.

4. Stay Updated on Legislative Developments

Any reforms enacted in late 2025 or 2026 could further impact benefits.

Related Links

Social Security Shifts Again: New Retirement Age Rules Replace the Old 67 Benchmark

December Payout Schedule: Dates for All Subsidy and Pension Payments This Month

As the 2026 adjustments take effect, retirees will navigate a landscape shaped by inflation, healthcare costs, demographic change, and evolving public policy. While the COLA offers some relief, many older Americans will continue facing financial pressure, keeping Social Security reform a central topic in national economic discussions.

FAQs About Major Social Security Adjustments

1. Will all retirees receive the 2.8% increase?

Yes. All Social Security and SSI beneficiaries are eligible for the COLA adjustment.

2. Will the COLA cover inflation entirely?

Not necessarily. COLA uses CPI-W, which may underestimate retiree-specific costs, especially healthcare.

3. What happens if I earn more than the earnings limit?

Your benefits may be temporarily reduced, but not permanently lost.

4. Does the wage base increase affect current retirees?

No. It only affects workers paying Social Security payroll taxes.