The 2026 Social Security Schedule has been released by the Social Security Administration (SSA), outlining when more than 70 million Americans will receive retirement, disability, and Supplemental Security Income benefits in January 2026. The update provides clarity for households that rely on January 2026 Social Security payments, which follow a staggered schedule based on claimant category and birthdate.

2026 Social Security Schedule Released

| Key Fact | Detail / Statistic |

|---|---|

| COLA Adjustment | 2.8% cost-of-living increase for 2026 benefits |

| SSI January Payment | Issued Dec. 31, 2025, due to federal holiday schedule |

| Regular SSA Payments | Distributed Jan. 14, 21, and 28 based on birthdate |

| Early Eligibility Group | Individuals receiving benefits before May 1997 paid on Jan. 2 |

Understanding the 2026 Social Security Schedule

The SSA releases its annual benefit payment calendar several months in advance to help recipients plan for essential expenses. According to the agency’s published schedule, payments in January 2026 will follow the standard Wednesday distribution cycle, with adjustments for federal holidays and special claimant categories.

SSA spokesperson Jeffrey Lerner said in a telephone briefing that the agency aims to give beneficiaries “clear, predictable guidance to manage their financial planning,” noting that early publication of the schedule “helps reduce uncertainty for millions of households.”

How January 2026 Social Security Payments Will Be Distributed

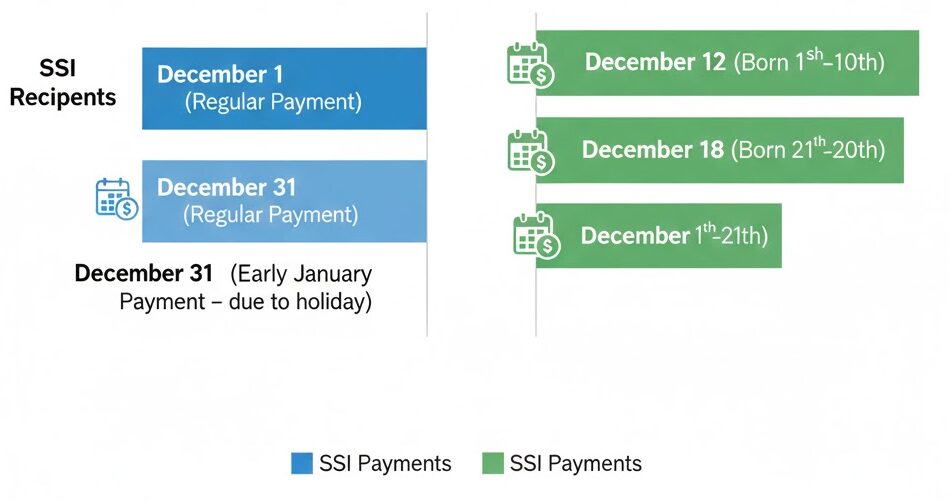

SSI Payment Timing

Recipients of Supplemental Security Income (SSI) will receive their January 2026 benefit on December 31, 2025, because January 1 is a federal holiday. The SSA confirms this adjustment annually to ensure uninterrupted support for low-income seniors and disabled adults.

Payments for Retirees, Survivors, and Disability Beneficiaries

Most Social Security beneficiaries are paid according to their birthdate:

- Birthdates 1–10: Wednesday, January 14, 2026

- Birthdates 11–20: Wednesday, January 21, 2026

- Birthdates 21–31: Wednesday, January 28, 2026

The SSA states that this system “helps distribute administrative workload evenly across the month.”

Americans Who Receive Early-in-the-Month Payments

Individuals who began receiving benefits before May 1997, as well as those who receive both Social Security and SSI, will be paid on Friday, January 2, 2026. This group includes roughly 8 million beneficiaries, according to SSA data.

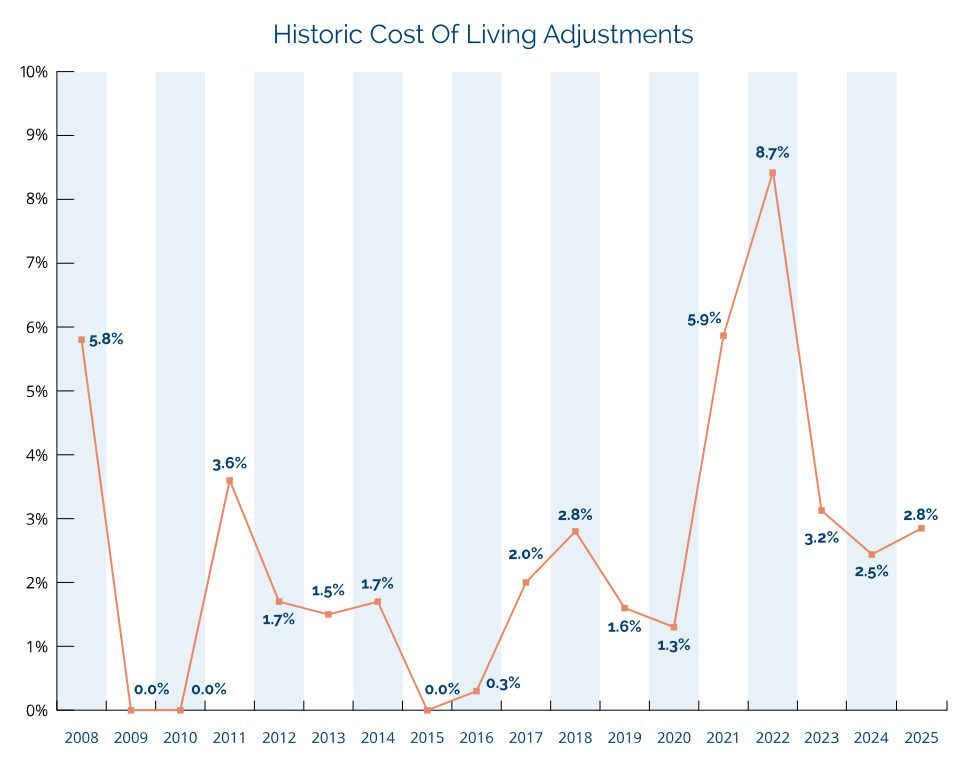

Cost-of-Living Increase Boosts Monthly Benefits

The 2.8% cost-of-living adjustment (COLA) for 2026 reflects inflation trends measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers. The adjustment prevents benefit erosion due to rising prices.

Dr. Emily Hart, a senior economist at the Urban Institute, said the adjustment “remains modest by historical standards but still represents meaningful support for retirees navigating higher costs of essentials such as food, utilities, and housing.”

Why These Payment Dates Matter For January 2026 Social Security

Many retirees depend on their benefits as a primary source of income. According to a 2024 report from the Congressional Research Service, Social Security provides at least half of household income for roughly 40% of older Americans. Timely and predictable payments are therefore essential for budgeting rent, healthcare, and other recurring expenses.

Financial planner Renee Caldwell, a certified adviser with the National Association of Personal Financial Advisors, said the schedule offers “a blueprint for managing cash flow in the first quarter of the year,” especially for older adults with fixed incomes. She encouraged beneficiaries to “review the full 2026 calendar early to avoid surprises.”

How the January 2026 Social Security Schedule Compares to Previous Years

The 2026 payment pattern mirrors the structure used for the past decade, but several notable changes provide context:

Later Distribution Weeks

Because January 1, 2026, falls on a Thursday, SSA’s mid-month payments occur slightly later than in some recent years. This shift may influence short-term budgeting for beneficiaries with rent or mortgage payments due on the first of the month.

Holiday Shift and Early SSI Payment

The early SSI payment, arriving on December 31, 2025, follows the federal rule mandating payments be issued on the preceding business day when a scheduled date falls on a weekend or holiday.

Steady COLA Trend

The 2.8% COLA is lower than the sharp increases seen in 2022 and 2023 but aligns with inflation normalization across major sectors.

Dr. Samuel Ortiz, a public policy researcher at the University of Michigan, said the 2026 COLA “reflects a cooling but still elevated inflation environment.”

Economic Factors Influencing the January 2026 Social Security

Although the SSA’s payment schedule is fixed, the economic impact on beneficiaries varies according to broader national conditions. Analysts say three major factors define the 2026 landscape:

1. Slowing but Persistent Inflation

Energy and housing costs remain high, particularly in metropolitan regions. This limits the purchasing power of the COLA increase, even as inflation declines.

2. Rising Healthcare Costs

Projections from the Centers for Medicare & Medicaid Services (CMS) show Medicare Part B premiums rising modestly in 2026, which may offset part of the COLA increase for many retirees.

3. Consumer Debt Trends

Higher credit card interest rates have increased financial strain for older Americans. The Federal Reserve reports that adults aged 65 and older have seen rising debt levels since 2021.

Economist Hart warned that “COLA increases often lag behind real-world cost changes, especially for older adults who spend more on healthcare than the average consumer.”

Advice for Beneficiaries Planning for 2026

Experts recommend several steps for recipients preparing for the new payment year:

Verify Direct Deposit

The SSA reports that more than 99% of payments are now sent electronically. Even small errors in account numbers can delay receipt.

Track Payments Through mySSA

The online portal allows users to confirm deposit dates, access benefit verification letters, and update banking information.

Account for Early SSI Deposit

Beneficiaries should remember that the December 31 SSI payment represents January’s amount—not a bonus payment. Budget planning should reflect this.

Prepare for Medicare Adjustments

Medicare costs typically change at the start of each year. Beneficiaries should factor those adjustments into their January budgeting.

Consider Automatic Bill Payments

Experts caution that automatic withdrawals can occur before Social Security deposits arrive. Financial planners recommend confirming due dates with service providers.

Policy Discussions and Long-Term Considerations

Lawmakers continue to debate long-term Social Security reform. While the 2026 payment schedule remains unaffected, analysts warn of future pressure on the program’s trust fund.

According to the 2024 Social Security Trustees Report, the combined trust funds may face depletion by the mid-2030s without congressional action. Such projections do not affect current benefit levels but drive ongoing debate in Washington.

Policy specialist Lena Porter, a senior fellow at the Brookings Institution, said the 2026 schedule “is stable and predictable, but long-term solvency remains a major national concern requiring bipartisan solutions.”

What Beneficiaries Should Do Next

Individuals receiving benefits are encouraged to:

- Review the SSA’s full 2026 payment calendar.

- Ensure their direct deposit information is current.

- Set up or maintain a my Social Security account to track payments.

- Plan for potential delays caused by bank holidays.

Up to $4,018 in Social Security Payments Going Out This Week — Check If You’re on the List

Final Outlook

While the payment structure for early 2026 follows established SSA practices, officials say they will continue to monitor administrative and economic conditions. As Lerner noted, the agency “remains committed to timely payments and transparent communication,” adding that recipients should check the SSA website for any future updates.

FAQs About January 2026 Social Security

When will I receive my January 2026 Social Security payment?

Most beneficiaries are paid on January 14, 21, or 28, depending on their birthdate. Early-eligibility groups are paid January 2.

Why is the SSI payment arriving on December 31, 2025?

Federal law requires payment adjustments when the scheduled date falls on a weekend or holiday.

Does the 2026 COLA affect January benefits?

Yes. The 2.8% increase applies to all January 2026 Social Security and SSI payments.

Where can I check my exact payment date?

The SSA’s online calendar and individual my Social Security accounts provide personalized scheduling information.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores