January 2026 Social Security Payments: Check Official Deposit Dates and Updated Benefit Amounts

The January 2026 Social Security Payments will reflect a new cost-of-living adjustment (COLA) as more than 72 million Americans begin receiving higher benefits next month. The Social Security Administration (SSA) confirmed updated deposit dates, early payments for Supplemental Security Income recipients, and an across-the-board 2.8% increase designed to offset inflation. Officials say the adjustments aim to maintain stability for retirees, disabled workers, and low-income households.

January 2026 Social Security Payments

| Key Fact | Detail / Statistic |

|---|---|

| COLA for 2026 | 2.8% increase |

| Average retiree benefit | About $2,071 per month |

| SSI January payment | Deposited Dec. 31, 2025 due to holiday |

| Birth-date group payments | Jan. 14, 21, and 28, 2026 |

As January approaches, officials emphasize that beneficiaries should expect a stable payment schedule and a modest increase in monthly income. Although the 2.8% COLA offers limited relief, the adjustment reflects ongoing efforts to preserve purchasing power for millions who depend on Social Security as a cornerstone of financial security.

How the January 2026 Social Security Payment Schedule Works

The SSA confirmed that Social Security deposit dates will continue to follow the widely used Wednesday distribution model based on beneficiary birth dates. The schedule is designed to reduce administrative bottlenecks and ensure a predictable flow of payments throughout each month.

Payments will be issued on:

- January 14, 2026 — Beneficiaries born between the 1st and 10th

- January 21, 2026 — Birth dates between the 11th and 20th

- January 28, 2026 — Birth dates between the 21st and 31st

An SSA spokesperson said the staggered approach “helps maintain processing efficiency and avoids placing excessive demand on banking systems on a single day.”

Exceptions for Early Beneficiaries and SSI Recipients

Individuals who started receiving Social Security benefits before May 1997 remain on the older schedule. Their payments will arrive on January 2, 2026, as January 3 falls during a weekend and January 1 is a federal holiday.

Supplemental Security Income (SSI) payments will be deposited early on December 31, 2025. Because SSI serves some of the nation’s lowest-income households, the early payment rule ensures no delays occur during holiday closures.

Dr. Alan Ricks, a public policy scholar at the Urban Institute, said, “These scheduling adjustments are fundamental to safeguarding the financial stability of beneficiaries who rely on timely payments for everyday expenses.”

Understanding the 2026 COLA Increase

The 2026 COLA increase of 2.8% is tied to inflation as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). While the adjustment remains lower than the historically high increases of 2022 and 2023, economists note that inflation has stabilized over recent months.

According to the SSA:

- Average retired worker: $2,071 per month

- Average disabled worker: approx. $1,590 per month

- Maximum SSI: $994 per month for individuals, $1,491 for couples

- Maximum taxable earnings for 2026: $176,400

Dr. Elise Monroe of Georgetown University said, “The adjustment helps restore some purchasing power, but households facing higher medical costs may still feel pressure.”

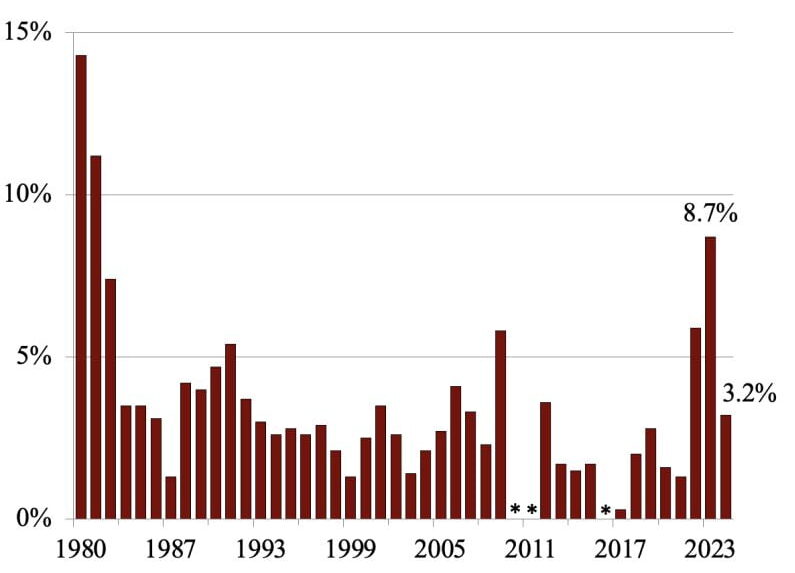

How January 2026 Compares With Previous Years

The new year marks the fourth consecutive year of above-average COLA growth.

- 2022: 5.9%

- 2023: 8.7% (largest in four decades)

- 2024: 3.2%

- 2025: 3.4%

- 2026: 2.8%

Although the 2026 increase is modest, it reflects the Federal Reserve’s progress in stabilizing inflation. According to the Bureau of Labor Statistics, price growth has slowed since mid-2024, particularly in food and energy categories that disproportionately affect seniors.

Economist Lauren Steele said, “While COLA lags real-time inflation, recent increases have kept Social Security benefits aligned with long-term cost pressures better than earlier decades.”

Impact on Retirees, Disabled Workers, and Survivors

Retirees

For most retired workers, Social Security remains the primary source of income. AARP reports that about 40% of retirees rely on the program for at least half their income.

Disabled Workers

Workers receiving Disability Insurance (SSDI) will also see a 2.8% increase. Economic analysts note that SSDI beneficiaries are especially sensitive to inflation because many face recurring medical expenses.

Survivor Benefits

Widows, widowers, and dependent children will receive proportional increases based on program rules. Survivor benefits now account for nearly 15% of all Social Security payments.

Real-Life Impact Example

Maria Thompson, 74, a retired teacher from Ohio, said the higher payment will “help with increasing prescription costs, even if it doesn’t stretch as far as it once did.”

Economic Context Behind the 2026 Adjustments

The 2026 COLA reflects economic trends that shaped the U.S. financial landscape over the previous year. Inflation moderated compared with pandemic-era surges, though many essential goods continue to rise in price.

According to the Federal Reserve, inflation remains slightly above its long-term 2% target, prompting continued caution in monetary policy decisions. While seniors welcome the COLA increase, purchasing power remains a concern.

A report from the Congressional Budget Office (CBO) warned that rising healthcare costs could exceed COLA adjustments through the end of the decade, pressuring fixed-income households.

Program Solvency and Ongoing Policy Debate

Experts continue to raise concerns about the long-term stability of Social Security’s trust funds. According to the latest Social Security Trustees Report, the Old-Age and Survivors Insurance (OASI) Trust Fund may face depletion by 2033–2034 without legislative action.

Congress has debated several proposals, including:

- Raising the payroll tax cap

- Gradually increasing the retirement age

- Adjusting COLA formulas

- Means-testing benefits for higher-income retirees

Lawmakers remain divided. Some argue the program requires modernization, while others warn that benefit cuts could worsen senior poverty.

Scam Prevention and Beneficiary Security

The SSA continues to warn about increasing fraud attempts, especially during months when payments change. Officials emphasize that the agency never:

- Demands payments by phone

- Requests bank information through unsolicited calls

- Threatens immediate suspension of benefits

The Office of Inspector General (OIG) urges beneficiaries to report suspicious contact through its dedicated fraud portal.

Next Wave of December Social Security Checks Arrives Soon — Here’s the Updated Timeline

Payment Logistics, Banking Delays

Most beneficiaries receive payments through direct deposit, which reduces delays caused by holidays or mail disruptions. Those receiving paper checks may experience slower delivery around New Year’s week due to USPS closures.

The SSA advises beneficiaries to:

- Confirm account details in my Social Security

- Notify the SSA immediately of address or banking changes

- Monitor financial statements for discrepancies

- Keep copies of benefit letters for filing taxes

Looking Ahead to the 2027 COLA and Economic Forecast

While it is too early to predict the 2027 COLA, early analysis from Moody’s Analytics suggests continued moderation if inflation stays near target levels. The firm notes that any unexpected rise in energy or medical costs could influence next year’s calculation.

The SSA is also expected to announce further modernization initiatives, including digital service improvements and expanded call-center capacity, to address long-standing customer service delays.