IRS Unveils 2026 Tax Brackets — Here’s How Inflation Could Affect Your Take-Home Pay

The Internal Revenue Service (IRS) has unveiled the 2026 federal income tax brackets and other inflation-related adjustments that will affect nearly every taxpayer.

IRS Unveils 2026 Tax Brackets

| Key Fact | Detail |

|---|---|

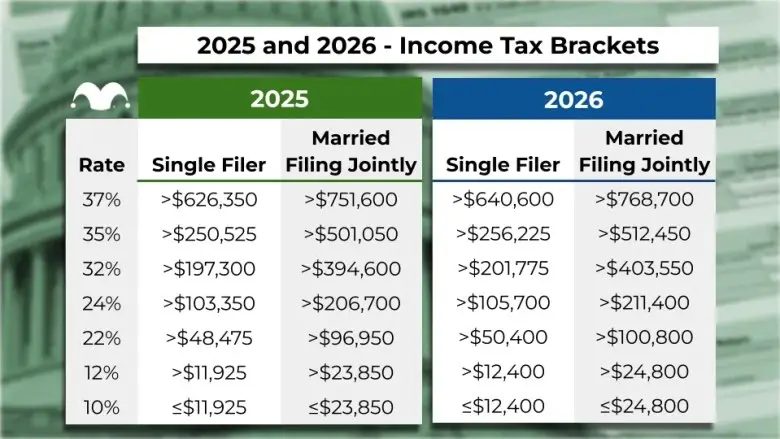

| 2026 Inflation Adjustment | Roughly 2.7% increase across most bracket thresholds |

| Standard Deduction | $16,100 (single); $32,200 (married); $24,150 (head of household) |

| Top Marginal Tax Rate | 37% — begins at $640,600 (single filers) |

| Inflation Measure Used | Consumer Price Index for All Urban Consumers (CPI-U) |

| Key Purpose | To prevent “bracket creep” and maintain real income levels |

IRS Announces Inflation-Linked Tax Brackets for 2026

The new brackets—effective for income earned in 2026 and reported on tax returns filed in 2027—reflect modest changes following a cooling inflation trend. Officials said the updates ensure taxpayers do not face higher tax rates simply because of inflation-driven wage gains.

The standard deduction will rise to $16,100 for single filers, $32,200 for married couples filing jointly, and $24,150 for heads of household. The top marginal rate of 37% remains unchanged but will apply to incomes above approximately $640,600 for single filers and $1.28 million for joint filers.

“The annual inflation adjustment helps maintain fairness by keeping tax burdens stable even as wages increase,” said IRS Commissioner Danny Werfel in a written statement.

Why the IRS Adjusts Tax Brackets Each Year

The IRS revises dozens of tax provisions annually to align with inflation, using data from the Consumer Price Index for All Urban Consumers (CPI-U), published by the Bureau of Labor Statistics (BLS).

Without these updates, inflation would push taxpayers into higher tax brackets, even if their real income—the amount their earnings can actually buy—remains unchanged. Economists refer to this as “bracket creep.”

“Indexing brackets to inflation is one of the simplest yet most important safeguards for taxpayers,” said Erica York, senior economist at the Tax Foundation. “It ensures that modest pay raises don’t automatically trigger higher tax rates.”

The IRS began indexing tax brackets for inflation in 1985, following a period of high inflation in the 1970s and early 1980s that eroded real wages.

What the 2026 Changes Mean for You

The impact of these adjustments will vary depending on income level and household status. For many workers, the new thresholds mean slightly lower effective tax rates if their wages grow at or below inflation. For example:

- A single filer earning $80,000 may owe about $250 less in federal taxes compared to 2025.

- A married couple filing jointly earning $160,000 could save around $400–$500, assuming steady income and no major deductions.

However, those with significant raises or capital gains may still see larger overall tax bills, as their earnings surpass the adjusted bracket limits.

“Inflation adjustments offer modest relief,” said Mark Steber, chief tax officer at Jackson Hewitt. “They keep taxes fair for most Americans, but they can’t shield everyone from rising costs or rapid income growth.”

Standard Deduction, Credits, and Other Adjustments

In addition to tax brackets, the IRS raised other key thresholds for 2026:

- Earned Income Tax Credit (EITC): Maximum benefit for families with three or more children increases to $8,231, up from $8,120.

- Alternative Minimum Tax (AMT) exemption: Rises to $89,450 for single filers and $179,000 for joint filers.

- Foreign Earned Income Exclusion: Climbs to $129,200 from $125,500.

- Gift Tax Exclusion: Increases to $19,000 per recipient, reflecting inflation.

Retirees and seniors will also see a modest rise in the additional standard deduction available for those over 65 or blind.

“These small adjustments matter for households that depend heavily on credits or deductions,” explained Elaine Maag, senior fellow at the Urban-Brookings Tax Policy Center. “They ensure the tax system reflects real-world living costs.”

Inflation Context and Policy Debate

The IRS’s announcement follows two years of slowing inflation after the pandemic-era surge that peaked in 2022. The Federal Reserve’s interest rate policy has helped stabilize prices, but many households continue to struggle with higher housing and healthcare costs.

The IRS now uses chained CPI-U, a refined index that accounts for consumer substitutions, such as switching brands or products when prices rise. Critics argue that chained CPI tends to understate inflation, potentially slowing future adjustments.

“Chained CPI reflects economic behavior but not the full pain of inflation for fixed-income households,” said Nancy Altman, president of Social Security Works. “It’s a technical improvement but can dampen real relief.”

Historical and Legislative Context

The adjustments come just one year before key provisions of the Tax Cuts and Jobs Act (TCJA) are set to expire at the end of 2026. Unless Congress acts, the current bracket structure—featuring lower rates and higher standard deductions—will revert to pre-2017 levels, effectively increasing taxes for many households.

“These 2026 brackets are likely the last under the TCJA regime,” said Howard Gleckman, policy analyst at the Tax Policy Center. “Without legislative renewal, millions of taxpayers could face higher rates starting in 2027.”

Lawmakers remain divided on whether to extend the TCJA. Fiscal conservatives argue for permanence to maintain middle-class relief, while budget hawks warn that extending the cuts could deepen the federal deficit, which already exceeds $1.7 trillion.

Practical Steps for Taxpayers

Financial experts recommend several proactive measures in light of the 2026 updates:

- Review your payroll withholding early in 2026. Employers will update IRS tables automatically, but double-check to ensure correct withholding based on your household situation.

- Maximize tax-advantaged accounts. Contribution limits for 401(k)s, IRAs, and Health Savings Accounts (HSAs) are also inflation-adjusted; boosting contributions can offset taxable income.

- Evaluate itemization versus standard deduction. With higher standard deductions, fewer households benefit from itemizing unless mortgage interest or charitable giving is substantial.

- Track income growth relative to inflation. If your pay increases faster than 3%, anticipate moving into higher brackets even with indexing.

“Understanding where you fall on the bracket spectrum allows smarter year-end planning,” said Kathy Pickering, Chief Tax Officer at H&R Block.

Related Links

Big Win for New Yorkers; State Officially Drops $30 Fee for Enhanced Driver’s Licenses

It’s Official: Maryland Unleashes New “Super Speeder” Fines—Here’s How Much You’ll Pay

Broader Implications

While the inflation-linked updates protect most households from higher effective tax rates, the broader fiscal outlook remains uncertain. The U.S. debt is nearing record levels, and slower economic growth could pressure future adjustments.

“Inflation indexing is a fairness mechanism, not a stimulus,” said York of the Tax Foundation. “The real question is whether the U.S. can sustain these tax structures as entitlement and debt costs rise.”

Still, for everyday taxpayers, the IRS’s 2026 announcement provides clarity and modest reassurance amid persistent financial uncertainty.

“Taxpayers can expect some breathing room next year,” Werfel said, “but long-term tax policy remains in the hands of Congress.”

FAQ About IRS Unveils 2026 Tax Bracket

When do the new 2026 tax brackets take effect?

They apply to income earned in 2026 and will affect returns filed in 2027.

Will tax rates change?

No. The seven tax rates—10%, 12%, 22%, 24%, 32%, 35%, and 37%—remain unchanged; only the income thresholds rise.

How will this affect my paycheck?

Employers will update withholding in early 2026, likely resulting in slightly higher net pay for most workers.

What happens after 2026?

Unless Congress extends the TCJA provisions, tax brackets and standard deductions will revert to pre-2017 levels, potentially increasing taxes for many.