If you feel a little tense every time tax season is mentioned, you are definitely not alone. The 2026 tax year is shaping up to be one of those years when paying attention early can genuinely save you money and stress later. The IRS has announced major updates for 2026 that will affect how much you owe, how much you can deduct, and even how you file. Instead of waiting until the last minute, this is the perfect time to understand what is changing and what you should start preparing for now.

These IRS updates are not just small technical tweaks. They touch core areas like standard deductions, tax brackets, credits, retirement contributions, and even some lesser‑known perks that could matter a lot depending on your situation. If you take the time to adjust your withholding, fine‑tune your savings, and organize your documents with these changes in mind, 2026 can be much smoother when you finally sit down to file.

IRS Announces Major Updates for 2026

| Area | Key 2026 Change | Who It Impacts Most |

|---|---|---|

| Standard Deduction | Higher amounts for all filing statuses | Most individual filers |

| Tax Brackets | Income thresholds increased, rates unchanged | All income levels |

| Earned Income Tax Credit | Maximum credit amount increased | Low‑ to moderate‑income workers |

| Adoption Credit | Maximum qualified expenses limit raised | Families completing adoptions |

| Foreign Earned Income Exclusion | Higher exclusion limit for overseas income | Americans working abroad |

| Retirement Contributions | Higher 401(k) and IRA contribution limits | Workers and retirement savers |

| Transportation And Parking Benefit | Monthly pre‑tax limits increased | Employees using commuter benefits |

| Health FSA And Cafeteria Plans | Higher contribution and carryover limits | Employees with employer health plans |

| Medical Savings Accounts | Higher deductible and out‑of‑pocket limits | Participants in qualifying high‑deductible plans |

| Estate And Gift Related Amounts | Higher basic exclusion for estates | Higher‑net‑worth households |

For most taxpayers, the immediate impact will come from three areas. First, the standard deduction is going up again, which reduces the amount of income exposed to tax. Second, the income ranges for each tax bracket are moving higher, which helps more of your income stay in lower brackets. Third, several credits and exclusions such as the Earned Income Tax Credit, adoption credit, foreign earned income exclusion, and some fringe benefits are being adjusted upward. All of this means your 2026 tax picture could look subtly but meaningfully different from 2025.

Notable Changes Under the One, Big, Beautiful Bill

A big driver behind the 2026 tax updates is a package of provisions often referred to as the “One, Big, Beautiful Bill.” This law did not rewrite the entire tax code, but it did quietly change dozens of key amounts that affect everyday taxpayers. Among the headline items are larger standard deductions, updates to the alternative minimum tax exemption, and higher thresholds related to estates and certain credits. For you as a taxpayer, the key takeaway is this: the basic structure of the system remains the same, but the numbers inside that structure shift. That means your old mental shortcuts how much you usually owe, whether you itemize, which credits you typically get may no longer be accurate. It is worth running fresh projections instead of assuming that “it will be roughly the same as last year.”

Standard Deduction

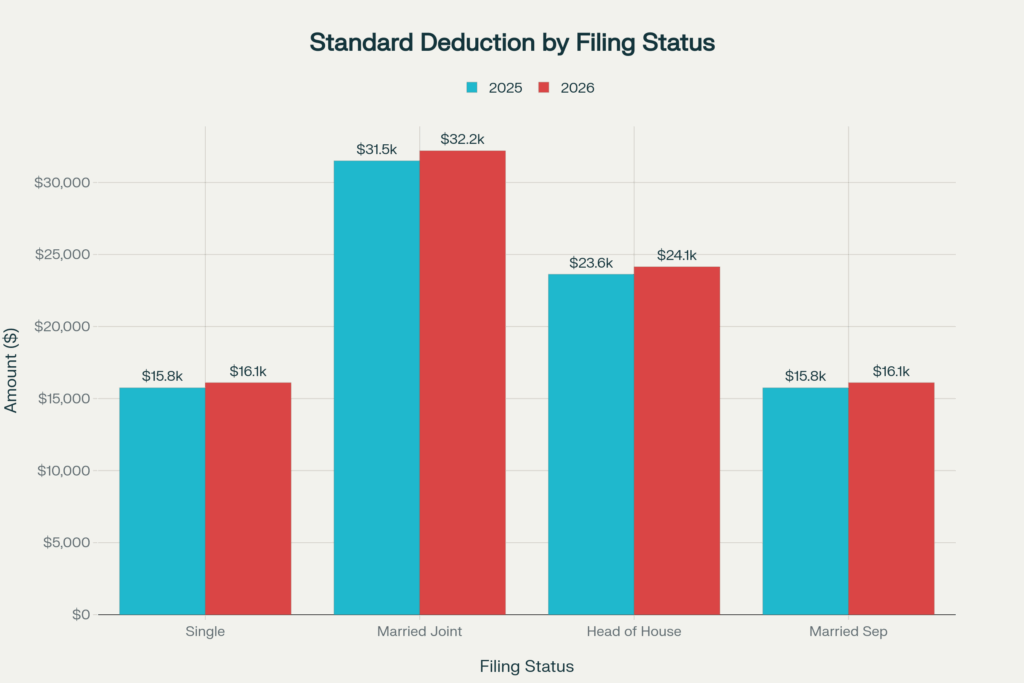

- For 2026, the standard deduction rises again across all filing statuses. Married couples filing jointly, single filers, heads of household, and married filing separately all see higher deduction amounts. This increase reduces the slice of income that is subject to federal income tax before any credits even enter the picture.

- Because of these higher standard deductions, even more people will find that itemizing no longer makes sense. If you usually list out mortgage interest, state and local taxes, and charitable gifts, you may want to compare the total against the new standard deduction. Many filers will discover that the simpler option now provides at least as much benefit as itemizing.

Marginal Rates

The seven familiar tax rates 10, 12, 22, 24, 32, 35, and 37 percent are not changing in 2026. What does change is the income range attached to each of those percentages. The top rate of 37 percent now kicks in at a higher income level than in 2025, and every bracket below it shifts upward as well.

This adjustment is designed to combat “bracket creep,” where inflation pushes your income into a higher bracket even though your real purchasing power has not actually increased. With the 2026 updates, more of your income should remain in lower brackets than it would have without these inflation adjustments, which may slightly soften the tax impact of raises or bonuses.

Alternative Minimum Tax Exemption Amounts

- The alternative minimum tax (AMT) is a parallel tax system that can catch higher‑income taxpayers who have a lot of certain deductions or preferences. For 2026, the exemption amounts for AMT are higher, and the income levels where those exemptions begin to phase out are also adjusted.

- If you have ever been hit with AMT in the past often due to incentive stock options, high state taxes, or certain types of deductions these new thresholds matter. You may find that you are less likely to trigger AMT, or that the bite is smaller than in a prior year. It is worth asking your preparer or running a detailed software check if you are anywhere near the usual AMT range.

Estate Tax Credits

Estate‑related amounts also move upward in 2026. The basic exclusion available to estates of individuals who die in 2026 is higher than it was in 2025. In plain language, this means more wealth can be passed on without triggering federal estate tax, at least under the current structure. While this change mainly affects higher‑net‑worth families, it is an important planning detail. If you have a growing business, real estate portfolio, or investment assets that might eventually cross into estate‑tax territory, this higher exclusion can create some additional breathing room but tax laws can shift again in future years, so long‑term planning is still crucial.

Adoption Credits

For families growing through adoption, the maximum adoption credit for 2026 has been increased. The credit covers qualified adoption expenses up to a higher limit, with a portion potentially refundable. This adjustment helps offset the rising costs of adoption and can significantly reduce a family’s tax bill in the year the adoption is finalized. Because the credit phases out at higher income levels and the rules around qualified expenses can be detailed, families should track every adoption‑related cost carefully. Coordinating timing when finalization occurs and when expenses are recognized can make a real difference in how much of the credit is actually usable.

Earned Income Tax Credits

- The Earned Income Tax Credit (EITC), a major benefit for low‑ and moderate‑income workers, also receives an update. The maximum EITC amount for families with three or more qualifying children is higher in 2026 than in 2025, and the income ranges and phase‑out thresholds are adjusted.

- If you qualify for EITC especially if you have children these changes can translate directly into a larger refund or a smaller balance due. It is important to make sure you file accurately, as EITC claims are closely scrutinized. Double‑check income, filing status, and dependent information to avoid delays or denials.

Qualified Transportation Fringe Benefit

- For commuters, the monthly limits for qualified transportation fringe benefits and qualified parking are higher in 2026. This means you can set aside more pre‑tax dollars to pay for transit passes, vanpools, or parking, reducing your taxable income dollar for dollar up to the new limits.

- If your employer offers a commuter benefits program, review your election amounts early in the year. Many people set these once and forget them, leaving tax savings on the table. With higher caps, you may be able to shield more of the money you already spend getting to work.

Health Flexible Spending Cafeteria Plans

- Health flexible spending arrangements (FSAs) get a small but useful boost as well. The maximum amount you can contribute through salary reductions increases, and the allowed carryover for unused amounts also rises. These changes make FSAs slightly more forgiving and more powerful as a tax‑saving tool.

- To take advantage, be realistic about your expected medical expenses for the year—prescriptions, copays, therapy, dental, vision, and so on. Overestimating can still leave money unused, but with higher carryover limits, a minor miscalculation is less painful than it used to be.

Medical Savings Accounts

For those enrolled in certain high‑deductible health plans that qualify for medical savings accounts (MSAs), both the minimum deductibles and out‑of‑pocket maximums increase in 2026. These changes reflect higher medical costs and maintain the structure required for these accounts to keep their tax‑favored status. The practical move here is simple: confirm that your plan still qualifies, understand the new deductible levels, and adjust your savings strategy accordingly. If your out‑of‑pocket exposure is higher, you may want to increase what you set aside in tax‑advantaged health accounts where possible.

Foreign Earned Income Exclusion

Americans working abroad will see a higher foreign earned income exclusion for 2026. This allows qualifying taxpayers to exclude a larger amount of foreign salary from U.S. taxable income, which can significantly reduce or even eliminate their U.S. tax liability on that income, depending on the situation. If you are an expat or planning a move overseas, factor this higher exclusion into your compensation planning and housing choices. Coordination with foreign tax rules, tax treaties, and foreign tax credits is still essential, but the increased exclusion is an important piece of the puzzle.

Why Rising Medicare Premiums Are Reducing the COLA Increase for Many Retirees

What Taxpayers Should Start Preparing For Now

- To make these 2026 changes work in your favor, start with a simple action plan. First, run a rough projection of your 2026 income and plug in the new standard deduction and brackets. This does not have to be exact, but it should be enough to show whether you are likely to owe more, less, or about the same.

- Second, revisit your paycheck withholding and estimated tax payments early in the year. A small tweak now is far better than a big surprise bill later. Third, review all the areas where you might benefit from the updated limits: retirement contributions, FSAs, commuter benefits, adoption, childcare, or foreign income. Finally, keep organized records throughout 2026. When you reach the filing deadline in 2027, you will be glad you treated these “major updates” as an opportunity to plan instead of a reason to panic.

FAQs on IRS Announces Major Updates for 2026

Q1. Will most people pay more or less tax in 2026?

Most people are likely to see a similar or slightly lower effective tax rate because standard deductions and tax brackets are being adjusted upward for inflation.

Q2. Do the 2026 IRS changes mean I should update my paycheck withholding?

Yes, it is a smart move to review your withholding early in 2026. Even though brackets and deductions are rising, your personal situation may have changed, so adjusting your W‑4 can help you avoid a big bill or an unnecessarily large refund at tax time.

Q3. Is it still worth itemizing if the standard deduction is higher in 2026?

Itemizing can still make sense if your deductible expenses such as mortgage interest, state and local taxes within limits, and charitable donations add up to more than the new standard deduction.

Q4. How do the 2026 changes affect retirement savers?

Retirement savers benefit from higher contribution limits for accounts like 401(k)s and IRAs in 2026.

Q5. What is the most important thing to do now to get ready for the 2026 tax year?

The most important step is to run a simple projection using the new standard deduction and bracket structure, then adjust your withholding, estimated payments, and savings accordingly.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores