The First U.S. Guaranteed Income Program is built around a simple promise: if you qualify, you receive 500 dollars every month for a set period, with no conditions on how you spend it. You can use the money for rent, groceries, gas, childcare, debt payments, or to start building a small emergency fund that protects you from sudden expenses. Unlike many traditional assistance programs, there is no requirement to report receipts or prove that every dollar went to a specific type of expense, which keeps things respectful & straightforward.

This program also serves as an important test case for policymakers who want to understand how direct cash support impacts poverty, employment, health, & overall community well-being. Early pilots have already shown that when people have predictable extra income each month, they are better able to stabilize their lives, stay in their homes, keep working, & reduce their reliance on high-interest loans or emergency credit cards.

First U.S. Guaranteed Income Program

What Is The First U.S. Guaranteed Income Program

At its core, the First U.S. Guaranteed Income Program is a modern anti-poverty tool that uses direct cash instead of complicated vouchers or tightly restricted benefits. It is not meant to replace work; instead, it recognizes that even people who are working hard can still struggle to cover basic expenses in an economy with high housing, food, & healthcare costs.

This kind of guaranteed income is different from universal basic income because it is targeted, not universal. Only residents who meet specific eligibility criteria such as income thresholds & residency rules can apply, which ensures that limited funds go to those most affected by economic insecurity.

Eligibility Criteria For The First U.S. Guaranteed Income Program

To find out whether you can join the First U.S. Guaranteed Income Program, the first step is to check the eligibility criteria carefully. While the exact details can vary depending on the city or county running the program, most versions follow a similar pattern designed to reach low & moderate-income households.

Typical requirements include:

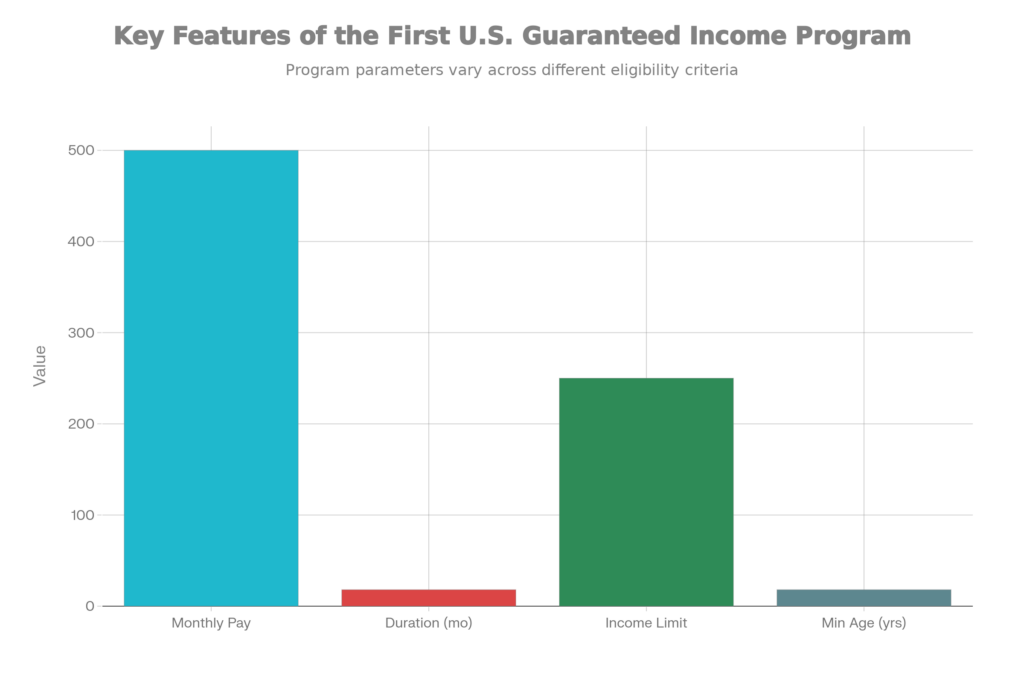

- Age: You must be at least 18 years old when you apply.

- Residency: You need to live in the participating area & often show proof of address, such as a lease, ID, or utility bill.

- Income: Your household income usually must fall at or below a set percentage of the Federal Poverty Level, often around 250%.

- Program overlap: You generally cannot be enrolled in another guaranteed income pilot at the same time.

- Status: Many programs welcome applicants regardless of immigration status, as long as residency requirements are met.

Because funding is limited, meeting all these criteria does not automatically guarantee a spot. Instead, your application typically goes into a pool, & participants are chosen randomly to keep the process fair among all eligible residents.

How The Monthly 500 Dollars Payments Work

Once you are selected for the First U.S. Guaranteed Income Program, the process is intentionally simple. You receive 500 dollars each month, usually on a predictable schedule, either through direct deposit to your bank account or via a prepaid card if you do not use traditional banking.

There are no restrictions on the types of expenses you can cover with this money. Many participants use the funds to catch up on rent, clear overdue bills, pay for childcare so they can work more stable hours, repair a car that is essential for commuting, or handle medical & prescription costs that were previously out of reach.

This flexibility is a key feature of the First U.S. Guaranteed Income Program, because it respects that every household has a different mix of priorities & pressures. Instead of forcing you to fit into one rigid box, the program adapts to your situation through simple, unconditional cash.

How To Apply For The First U.S. Guaranteed Income Program

When applications open, they are usually available online through an official government or trusted partner website, with clear dates for when the application period starts & ends. Since there is often high interest, it is important to act quickly & complete the form correctly the first time.

A typical application process looks like this:

- Check the official announcement

Visit the official website for your city or county & look for the guaranteed income or 500-dollar monthly payments section, where all current details are posted. - Review eligibility rules

Carefully read the eligibility criteria, focusing on residency, age, & income guidelines, so you do not waste time applying if you clearly do not qualify. - Gather your documents

You may need a government-issued ID, proof of address, recent pay stubs, benefit letters, or tax returns to show your household income & living situation. - Complete the online form

Fill in your personal information, contact details, household size, & income data honestly, as false information can result in disqualification. - Submit & wait for notification

After submission, your application enters the pool for random selection, and you will be contacted by email, SMS, or mail if you are chosen or if more information is needed.

If you are selected, you will receive clear instructions on how payments will be delivered, when they will start, & how to update your contact or bank details if anything changes.

IRS Shares New Holiday Scam Alerts — Important Signs to Watch Before Christmas

Benefits Of The First U.S. Guaranteed Income Program

The benefits of the First U.S. Guaranteed Income Program show up both in day-to-day life & in the bigger picture. On a personal level, having an extra 500 dollars each month can mean the difference between constant crisis mode & a more stable, predictable budget.

Participants often report that they feel less anxious about money, sleep better, & can finally plan for the next month instead of constantly worrying about the next week. Many are able to avoid eviction, keep up with utility bills, pay down high-interest debt, or invest in education & skills that help them progress at work.

At the community level, guaranteed income pilots provide valuable information about how direct cash support affects employment, health, crime rates, & local economies. Early evidence suggests that people do not quit work en masse; instead, they use the breathing room to seek better jobs, maintain steady hours, and handle emergencies without losing everything.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores