Millions of American borrowers face major adjustments this fall as the federal student loan changes arriving in October 2025 take effect. The U.S. Department of Education (ED) has confirmed that repayment rules, interest calculations, and loan forgiveness criteria will all shift, affecting nearly 43 million people nationwide.

Officials say the move is part of the Biden administration’s broader effort to fix long-standing administrative errors and make the repayment system “fairer, more transparent, and easier to navigate.”

Federal Student Loan Changes Arriving

| Key Fact | Detail |

|---|---|

| Forgiveness Restarts | About 2 million borrowers notified for automatic forgiveness under IDR plans |

| Tax Exemption Window | Tax-free forgiveness ends Dec. 31, 2025 |

| SAVE Forbearance Ends | Interest and payments resume Oct. 31, 2025 |

| New Interest Rates | Updated loan rates effective Oct. 1, 2025 |

Forgiveness Resumes After Years of Delays

The October 2025 federal student loan changes will restart and expand long-promised forgiveness under Income-Driven Repayment (IDR) programs such as IBR and PAYE. According to the Education Department, approximately 2 million borrowers have already received eligibility notices.

Education Secretary Miguel Cardona stated that the action “delivers long-overdue relief for borrowers who have faithfully paid for decades.” The process stems from an “account adjustment” initiative launched in 2023 to fix record-keeping errors that miscounted qualifying payments.

“This correction restores trust in a system that has failed too many,” said Dr. Anya Sharma, senior fellow at the Brookings Institution. “It also signals that the Department is serious about data integrity and equitable treatment.”

Who Qualifies for Federal Student Loan Relief

Eligibility depends on a borrower’s payment history, loan type, and plan enrollment:

- Full forgiveness applies to borrowers with 20 years of qualifying payments (for undergraduate loans) or 25 years (for graduate or consolidated loans).

- Partial relief may apply for those near completion, reducing balances proportionally.

- Parent PLUS borrowers can qualify only if they consolidate into a Direct Loan and enroll in an income-driven plan before July 1, 2026.

The Department will verify records automatically using National Student Loan Data System (NSLDS) data, though borrowers can request a manual review through their servicer.

Tax-Free Window Nears Its End

Borrowers who secure forgiveness before December 31, 2025, will benefit from the American Rescue Plan Act (ARPA) provision that exempts discharged student debt from federal income tax. Unless Congress acts, the exemption expires in 2026—potentially making forgiven balances taxable as income.

Mark Kantrowitz, a long-time financial aid expert, warned: “Timing matters. For someone with $40,000 in forgiven debt, a missed cutoff could mean a $4,000 tax bill next spring.”

Some states, such as California and New York, are expected to align with the federal extension if it is renewed, but others may still treat forgiven balances as taxable.

The SAVE Plan’s Transition

The Saving on a Valuable Education (SAVE) plan—touted as the most affordable repayment option—enters a new phase this fall. Its temporary interest subsidy and forbearance protections expire on October 31, 2025.

Borrowers currently in SAVE forbearance will resume payments, though interest will remain capped so unpaid interest does not compound. ED says all affected borrowers will receive 30 days’ notice before their first statement.

“We want a smooth and fair transition,” an ED spokesperson said. “No one should be caught off-guard when the temporary relief ends.”

Financial aid counselors advise borrowers to update income information now to avoid payment miscalculations once regular billing resumes.

Interest Rates and Origination Fees Adjust

Beginning October 1, 2025, interest rates for new Direct Loans will rise slightly in line with U.S. Treasury yields:

- Undergraduate Direct Loans: about 5.6 %

- Graduate Direct Loans: around 7.0 %

- PLUS Loans: roughly 8.0 %

Origination fees remain 1.057 % for Direct Loans and 4.228 % for PLUS Loans. The rates apply to new disbursements through September 2026. Officials note that these adjustments mirror broader interest-rate trends, not new legislative changes.

The Broader Context: From Pause to Reform

These updates follow the unprecedented COVID-19 payment pause, which suspended federal loan interest and collections from 2020 to 2023. The resumption exposed systemic servicing errors, prompting lawsuits and calls for reform.

While President Biden’s broader cancellation plan was blocked by the Supreme Court in 2023, the administration pivoted to targeted relief—using existing statutory authority to adjust and forgive balances under IDR programs.

Analysts at the Urban Institute note that these targeted reforms “balance fiscal caution with administrative fairness,” though they caution that long-term solutions must address rising tuition costs and financial-aid transparency.

Economic and Political Implications

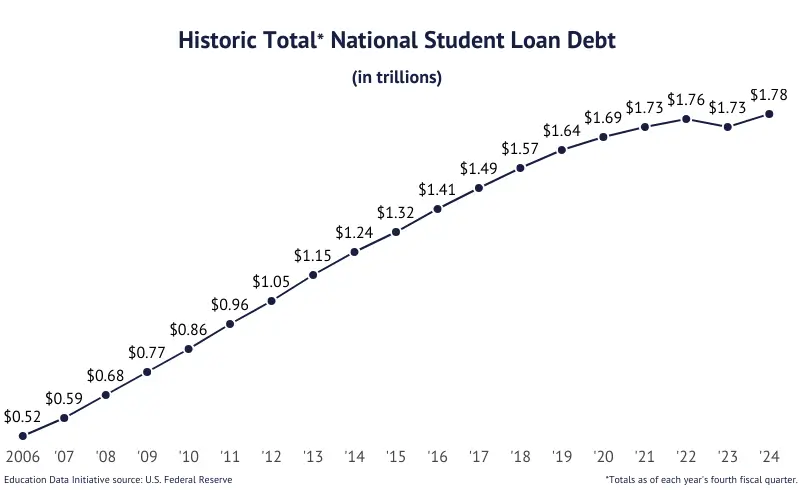

The student-loan sector represents over $1.6 trillion in outstanding federal debt. Economists say the 2025 forgiveness wave could boost consumer spending in the short term but strain federal budgets in the long term.

A Pew Research Center poll found that 62 % of Americans support targeted debt relief but remain divided along partisan lines. Critics argue the timing—less than a year before the 2026 midterms—may invite renewed political scrutiny.

Jason Delisle, senior policy fellow at the American Enterprise Institute, said, “This is sound policy from a borrower perspective, but the government must ensure future lending remains sustainable.”

What Borrowers Should Do Now

Experts recommend the following immediate actions:

- Check your servicer account on StudentAid.gov for updated payment counts.

- Update income data to ensure accurate SAVE or IBR payment calculations.

- Watch for ED communications about forgiveness or repayment restart.

- Consult a certified tax professional if forgiveness is expected near the end of 2025.

- Avoid scams—ED never charges for processing forgiveness or repayment changes.

Persis Yu, managing counsel at the National Consumer Law Center, cautioned: “Scammers target borrowers during transitions like this. Verify all notices directly with your servicer.”

Related Links

Veterans Now Eligible for Expanded Burial Reimbursement If They Pass Away at Home

Looking Ahead

The Department of Education says further administrative reviews will continue into 2026, with more forgiveness rounds expected. Additional rulemaking—particularly around borrower defense and servicing accountability—is under consideration.

“We’re building a system that rewards responsibility and provides real second chances,” Secretary Cardona said.

FAQ About Federal Student Loan

Who qualifies for forgiveness in October 2025?

Borrowers with 20 or 25 years of qualifying payments under income-driven plans, including IBR and PAYE.

Will forgiven debt be taxed?

Not federally if discharged before December 31, 2025, under ARPA; after that, normal tax rules apply.

What happens to the SAVE Plan after October?

Interest waivers end, and monthly payments resume, though SAVE still caps unpaid interest to prevent balance growth.

Do I need to reapply for repayment?

No, but borrowers should confirm servicer contact details and income certification before payments restart.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores