The Social Security Administration (SSA) will implement a 2.8% cost-of-living adjustment (December 31 Deadline Looms) for 2026, raising the average retired worker’s monthly benefit by about $56. To ensure the increase is applied correctly and on time, seniors must review their information and complete several administrative steps before December 31, 2025, according to updated federal guidance.

December 31 Deadline Looms

| Key Fact | Detail |

|---|---|

| COLA Increase | 2.8% benefit rise for 2026 |

| Avg. Retired Worker Benefit | $2,015 → $2,071 per month |

| SSI Effective Date | First increased payment on Dec. 31, 2025 |

| Online Notice Deadline | mySocialSecurity by Nov. 19, 2025 |

| Key Administrative Risk | Outdated records or unreported life changes may delay benefit adjustments |

Why the December 31 Deadline Matters for the

Although the 2.8% COLA is triggered automatically under federal law, seniors must ensure that their Social Security records are accurate and complete in order to receive the updated benefit without interruption. The SSA has emphasized that mailing delays, incorrect addresses, unreported life events, or incomplete SSI paperwork can hold up implementation—especially during the holiday period, when postal delays are common.

For SSI recipients, in particular, the new payment arrives on December 31, meaning any unresolved eligibility issues can push the updated deposit into early 2026. For seniors who rely entirely on fixed income, even a short delay can affect rent, utility payments, and essential spending.

SSA officials have reiterated that beneficiaries who maintain updated records experience far fewer delays when annual COLA changes are processed.

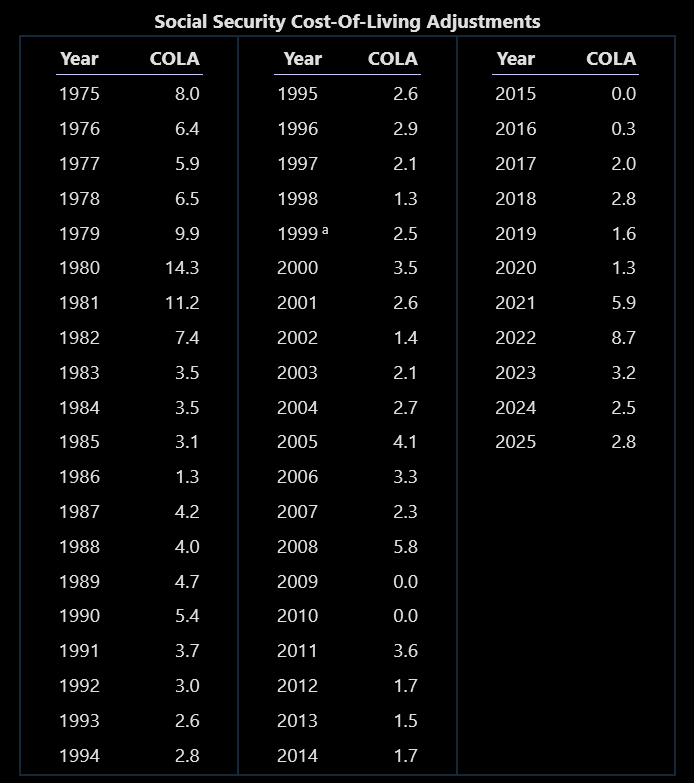

Background: How the 2.8% COLA Was Calculated

The cost-of-living adjustment is tied to inflation as measured by the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). The SSA compares third-quarter CPI-W data from one year to the next and applies the percentage difference.

Why CPI-W Has Critics

Many retirement researchers note that CPI-W reflects spending patterns of working adults, not seniors. Older Americans spend proportionally more on:

- Health care

- Housing

- Prescription drugs

- Utilities

These categories often rise faster than overall inflation.

An economist at Boston College’s Center for Retirement Research recently said:

“COLA preserves purchasing power on paper, but seniors face a different cost structure.”

The 2.8% increase is higher than the 2025 COLA but below the unusually large adjustments seen in 2022 and 2023, when inflation surged.

What Seniors Must Do Before December 31

1. Set Up or Verify Your mySocialSecurity Account

Seniors who want to receive their COLA notice online must have an active account before November 19, 2025. After that date, notices will default to postal mail.

Beneficiaries should:

- Confirm their login credentials

- Ensure contact information is correct

- Check two-factor authentication preferences

- Update their mailing address if they have moved

SSA reports that nearly one in five mailed COLA notices are returned due to outdated addresses, leading to confusion and avoidable delays.

2. Carefully Review the COLA Notice When It Arrives

The notice includes:

- New monthly benefit amount

- Exact implementation date

- Medicare premium deductions

- Voluntary tax withholding

- Information about overpayments or offsets

Experts recommend keeping the notice in a secure file for tax preparation and financial planning. Seniors unsure how their net benefit was calculated may speak with an SSA representative or an accredited financial counselor.

3. Report Required Life Changes Immediately

The SSA requires certain changes to be reported within 10 days:

- Marriage or divorce

- Death of a spouse

- Changes in household composition

- Income changes (for SSI)

- Relocation that affects state-supplement programs

For SSI recipients, these details are time-critical, because even small changes can alter payment amounts or eligibility.

4. Check Medicare Premium Changes

Medicare Part B and Part D premiums adjust annually and are typically deducted from Social Security payments. Seniors should anticipate that rising health care premiums could partially offset the COLA increase.

Health policy experts note that Medicare cost growth has trended above general inflation for several years. Understanding the net effect is essential for accurate budgeting.

5. Beware of Scams Targeting COLA Recipients

COLA season often brings a surge in fraudulent calls and emails.

SSA warns that legitimate officials will never:

- Ask for money or gift cards

- Demand personal information by phone

- Threaten benefit cancellation

Seniors should rely on SSA.gov or paper notices—not unsolicited messages.

Additional Considerations Often Overlooked

Tax Implications

Depending on total income, a COLA increase may push some seniors into taxable Social Security territory. The IRS taxes up to 85% of benefits for households exceeding certain income thresholds.

Return-to-Work Rules

Seniors who work and receive early retirement benefits must be aware of the earnings limit. Exceeding the limit can temporarily reduce monthly payments, which may affect how the COLA applies.

State-Level SSI Supplements

Some states (e.g., California, New York, New Jersey) provide their own SSI supplements. These states may require additional forms or eligibility confirmations at year-end.

Caregivers and Representative Payees

The SSA requires representative payees—often family members or caregivers—to update beneficiary information. Older adults with memory, mobility, or health impairments may need assistance reviewing their COLA notice.

Historical and Economic Context

How This COLA Compares to Past Years

- 2022: 5.9%

- 2023: 8.7%

- 2024: 3.2%

- 2025: 2.2%

- 2026: 2.8%

The 2026 increase is higher than projections earlier in the year suggested, due to modest inflationary pressures in energy, housing, and medical services.

Related Links

Two Social Security Payments Arriving This Week — One Group Receives an Extra Deposit

$725 Monthly Benefit Continuing Through 2026 — Check If You Qualify

Do Seniors Benefit Equally?

Not always. Low-income seniors who rely on SSI and face rapid increases in essential goods may still experience declining real purchasing power.

Looking Ahead to 2027 and Beyond

Economic analysts at several research institutions predict a 2.5–3.1% COLA for 2027, depending on inflation trends. Meanwhile, Social Security’s long-term finances remain under Congress’s scrutiny. Without legislative action, current projections suggest the Old-Age and Survivors Insurance (OASI) Trust Fund may face depletion within the next decade.

While this does not affect 2026 payments, experts warn that younger retirees may see future adjustments or tax changes.

The 2.8% COLA increase offers modest but meaningful relief for millions of retirees, yet receiving it correctly requires timely action. As the December 31 deadline approaches, seniors and caregivers are encouraged to verify their records, review their COLA notices, and remain alert to official SSA communication. With accurate preparation, beneficiaries can ensure a smooth transition into the 2026 payment cycle.

FAQ About 2.8% COLA Increase

Do I need to apply for the COLA?

No. The adjustment is automatic but requires updated beneficiary information.

Will Medicare reduce my COLA?

It may reduce the net amount deposited, depending on your premium.

What if I miss the December 31 deadline?

You will still receive the COLA, but processing may be delayed and the notice may arrive late.

How can caregivers help?

Representative payees should log in to the beneficiary’s account, confirm details, and ensure required reports are filed.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores