December 2025 Social Security: Updated Average Payment and What Will Change in 2026

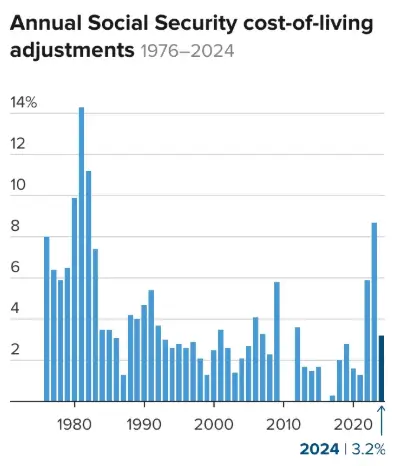

As 2025 comes to a close, Social Security recipients are set to receive their December payments, which will reflect the current year’s benefit levels. However, starting in January 2026, recipients will see a 2.8% cost-of-living adjustment (COLA). This adjustment, aimed at helping recipients keep pace with inflation, will have a significant impact on the average Social Security benefit payments.

This article breaks down the updated benefit amounts for December 2025, explores the changes to be implemented in 2026, and discusses the broader implications for Social Security recipients.

December 2025 Social Security

| Social Security Benefit Type | Average Monthly Benefit (Dec. 2025) | Expected Increase in 2026 |

|---|---|---|

| Retirement Benefits | $2,015 | Increase to $2,071 due to 2.8% COLA |

| Supplemental Security Income (SSI) | $718 | Increase to $748 for individuals, $1,491 for couples |

| Disability Benefits | $1,586 | Expected increase to $1,630 |

| Widows/Widowers (Living Alone) | $1,867 | Increase to $1,919 |

December 2025 Payments: Current Benefit Levels and Exceptions

For Social Security beneficiaries, December 2025 follows the regular payment schedule, with payments issued based on the recipient’s birth date. However, there is a key exception for Supplemental Security Income (SSI) recipients. Since January 1, 2026, falls on a federal holiday, SSI recipients will receive their January payment early, on December 31, 2025, resulting in two payments for December.

What Will Change in 2026: The 2.8% COLA Increase

The most significant change in 2026 will be the 2.8% COLA increase, which will affect millions of Social Security beneficiaries across various categories, from retirees to disabled workers. This COLA increase will be applied starting with the January 2026 payment cycle (or December 31, 2025, for SSI recipients).

Breakdown of the 2.8% COLA

In 2026, retirees can expect a modest increase in their monthly payments. The average monthly benefit for retirees will increase by $56 (from $2,015 in December 2025 to $2,071 in January 2026). Likewise, disability benefits will rise by $44, and widows/widowers’ benefits will also see an increase of about $52 per month.

This COLA adjustment is designed to keep pace with inflation, ensuring that Social Security benefits retain their purchasing power in the face of rising living costs.

The Economic Impact of the COLA

While the 2.8% COLA is significant, it may not fully keep up with the increasing costs of living, particularly in areas such as healthcare and housing. The Senior Citizens League has pointed out that healthcare costs for seniors continue to rise faster than the rate of inflation.

Additionally, housing costs and utilities, two major spending categories for retirees, have increased more steeply than the CPI-W, the basis for the COLA calculation.

Some seniors may find that the COLA boost does not cover the increased premiums for Medicare Part B or the rising prescription drug costs. Despite this, the COLA remains a critical tool for helping Social Security recipients cope with inflationary pressures.

Changes in Earnings Limits and Taxable Wage Base in 2026

In addition to the COLA increase, 2026 will bring adjustments to the Social Security payroll tax and earnings limits.

Earnings Limits for Working Beneficiaries

Workers who are still earning wages while receiving Social Security benefits will be subject to earnings limits. In 2026, individuals who are not yet at full retirement age can earn up to $24,480 annually before their benefits are reduced. Once they reach full retirement age, they can earn up to $65,160 without any reduction in benefits.

Taxable Earnings Cap

The Social Security wage base (the maximum income subject to Social Security taxes) will increase in 2026 to $184,500, up from $176,100 in 2025. This increase ensures that higher earners contribute more to the program, which helps shore up the Social Security Trust Fund.

Impact of Inflation on Social Security: A Growing Concern

While COLA increases provide relief, the reality is that inflation is often outpacing the adjustments made by the Social Security Administration (SSA). For many beneficiaries, healthcare costs, which constitute a large portion of their expenses, continue to rise faster than Social Security adjustments.

According to experts, while the 2.8% COLA might seem substantial, it may not fully cover the rising Medicare premiums or the cost of prescription drugs.

In particular, low-income seniors who rely on Social Security as their primary income may feel the effects of inflation more acutely. Advocacy groups have highlighted the need for a more accurate COLA formula that better reflects the spending patterns of older Americans.

Public Opinion and Political Debate: The Future of Social Security

The 2.8% COLA is a welcome change, but it is just one part of a larger conversation about the future of Social Security. Over the past few years, there has been increasing concern about the long-term solvency of the program.

With baby boomers retiring in record numbers, the Social Security Trust Fund is projected to be depleted by 2034 unless reforms are made. Public opinion on potential reforms is divided. Some advocate for raising the retirement age, while others propose increasing payroll taxes for high earners.

In recent public opinion surveys, Americans expressed mixed feelings about the COLA adjustments and the future of Social Security. Many are concerned about sustainability, while others believe the current system is adequate, though requiring reform.

What’s Next for Social Security: Legislative Proposals and Challenges

Beyond the COLA increase, Social Security reform remains a hot-button issue in Congress. Proposed measures include:

- Raising the retirement age: This would help reduce future benefit payouts and extend the life of the Trust Fund, but it has faced resistance, especially from senior and labor advocacy groups.

- Increasing payroll taxes: This measure would raise additional revenue for Social Security, but it may face pushback from high earners who would see their tax burdens increase.

- Adjusting the taxable wage base: Some argue that increasing the earnings cap would generate additional revenue for the system without raising taxes for lower-income workers.

These potential reforms could reshape the program’s future, but they remain contentious, and it remains uncertain which changes, if any, will pass in the near future.

Related Links

Social Security Shifts Again: New Retirement Age Rules Replace the Old 67 Benchmark

December Payout Schedule: Dates for All Subsidy and Pension Payments This Month

As 2026 approaches, Social Security recipients can look forward to a 2.8% COLA increase that will raise monthly payments. While the increase will provide much-needed relief, it may not fully address the rising costs of healthcare and housing that many beneficiaries face. The Social Security system remains at a crossroads, with ongoing debates about how to ensure its long-term solvency.

Whether through raising the retirement age, adjusting payroll taxes, or reforming the COLA formula, changes are inevitable. Beneficiaries should stay informed about these developments to ensure they are adequately prepared for future adjustments.