The December 10 Payout will be distributed to Social Security beneficiaries whose birthdays fall between the first and tenth of any month. The payment is one of the final regularly scheduled disbursements of the year and arrives at a time when many retirees face increased seasonal expenses.

Benefit amounts vary widely, and only a small number of recipients qualify for the program’s maximum monthly payment.

December 10 Payout

| Key Fact | Detail |

|---|---|

| Who is paid on Dec. 10 | Beneficiaries born 1st–10th |

| Average retirement benefit | ≈ $2,000 monthly |

| Average SSDI benefit | ≈ $1,580 monthly |

| Maximum retirement benefit | Above $5,000 for 2025 schedule |

| SSI included? | No — SSI pays Dec. 1 and Dec. 31 (Jan benefit) |

How the December 10 Payout Fits Into SSA’s Monthly System

The Social Security Administration issues most benefits on a staggered schedule built around the primary beneficiary’s birth date. Payments are divided across the second, third, and fourth Wednesdays of each month. The second Wednesday—December 10 this year—applies to individuals born between the first and tenth.

This system has been in place since 1997 and reduces administrative strain on both the SSA and financial institutions handling high-volume transactions. December payments are often scrutinized more closely than those earlier in the year because SSI beneficiaries receive two payments in the same month:

the normal December 1 benefit and the advance January benefit paid on December 31 due to the New Year’s holiday. This overlap increases public attention on Social Security’s year-end schedule.

How Much Beneficiaries Receive on December 10

Average Retirement Payments

Most beneficiaries receiving a December 10 Payout fall under the retirement category. The Social Security Administration reports that the average retirement benefit is around $2,000 per month, although individual payments vary based on wages, years worked, and the age at which benefits were claimed.

Retirees who begin receiving benefits at age 62 see reduced payments. Claiming at full retirement age—between 66 and 67 depending on birth year—results in the full benefit. Those who delay retirement until age 70 earn delayed retirement credits, increasing their monthly amount.

Average SSDI Payments

Those receiving Social Security Disability Insurance (SSDI) receive an average monthly payment of about $1,580. SSDI benefits are calculated according to the disabled worker’s past earnings and are not affected by the severity of the disability. Payments on December 10 reflect the standard SSDI schedule for disability beneficiaries whose birthdays fall within the first third of the month.

Survivor Benefits

Survivor benefits provide financial support to spouses, children, and in some cases, parents of deceased workers. The amount varies according to family circumstances and the deceased worker’s earning record. Widowed spouses of full retirement age may receive up to 100% of the worker’s benefit.

Who Receives the Maximum Possible Amount?

Only a small proportion of beneficiaries receive the maximum Social Security monthly benefit, and eligibility is determined by long-term earnings and retirement age.

Maximum Retirement Benefit

The maximum benefit for someone retiring at full retirement age in 2025 is above $5,000 per month. To qualify, an individual must:

- Have earned at or above the annual taxable wage base for 35 years.

- Have no significant gaps in their work record.

- Claim benefits at full retirement age or later.

Delaying benefits until age 70 yields the highest possible monthly payment due to delayed retirement credits that increase benefits by approximately 8% per year past full retirement age.

Maximum SSDI Benefit

The maximum SSDI benefit is lower because disability often shortens earnings histories. Although some high earners may receive payments above $3,000 per month, very few reach this threshold.

Maximum SSI Payments

SSI provides needs-based support, not wage-based benefits. Maximum SSI payments are far lower than Social Security retirement or disability benefits and vary by federal and state rules. SSI is not part of the December 10 Payout.

Key Factors That Influence Payment Differences

Understanding why payments differ—even among individuals receiving benefits on the same date—is essential.

1. Lifetime Earnings

Social Security is tied to the “average indexed monthly earnings” formula. Higher wages and longer work histories generally yield higher benefits.

2. Claiming Age

Claiming early reduces monthly payments, while delaying until age 70 increases them.

3. COLA Adjustments

Although the December 10 Payout does not reflect next year’s cost-of-living adjustment (COLA), retirees often use December as a reference point for forecasting their January benefit increases.

4. Medicare Premium Deductions

Medicare Part B and Part D premiums are deducted from Social Security payments for most beneficiaries, reducing the net deposit.

5. Program Category

Retirement, SSDI, and survivor benefits use different formulas, leading to different payment levels.

Historical Context: How December Payments Have Changed Over Time

Comparing current December payments with historical patterns provides insight into Social Security’s economic impact.

- In the early 2000s, average retirement benefits were roughly $900.

- By 2010, averages exceeded $1,150 following several COLA increases.

- Today, average payments hover around $2,000 due to wage growth and inflation adjustments.

This growth reflects both rising wages and the program’s reliance on COLA to ensure purchasing power does not erode entirely. However, cost-of-living increases often fall short of rising expenses for seniors—especially housing, prescription drugs, and long-term care.

Economic Backdrop and Adequacy Concerns

Retirees face rising prices across key spending categories. While inflation has moderated from recent peaks, essential costs remain elevated. Analysts note that Social Security benefits have not kept pace with typical senior expenditures, which lean heavily toward healthcare and housing—sectors that continue to outpace average inflation.

Experts warn that many retirees may see limited economic relief even with scheduled increases. December payments therefore play a crucial role in helping households navigate year-end costs.

Processing Timelines and Banking Considerations

The SSA issues payments electronically in most cases. However, processing times can vary slightly depending on the financial institution. Most deposits appear early on the payment date, although some credit unions or smaller banks may post funds later in the day.

Paper checks are rare but may take several days to arrive. Beneficiaries with outdated address information risk delays, particularly during the busy holiday mailing season.

Fraud Prevention Around December Payments

The end of the year typically brings increased fraud attempts targeting vulnerable beneficiaries. The SSA urges recipients to:

- Avoid unsolicited calls requesting personal information.

- Reject threats of benefit suspension or arrest—common scam tactics.

- Use the official SSA website for account changes.

Security specialists emphasize that the SSA never demands immediate payment or asks for personal data through phone calls or text messages.

Policy Debates and Future Considerations

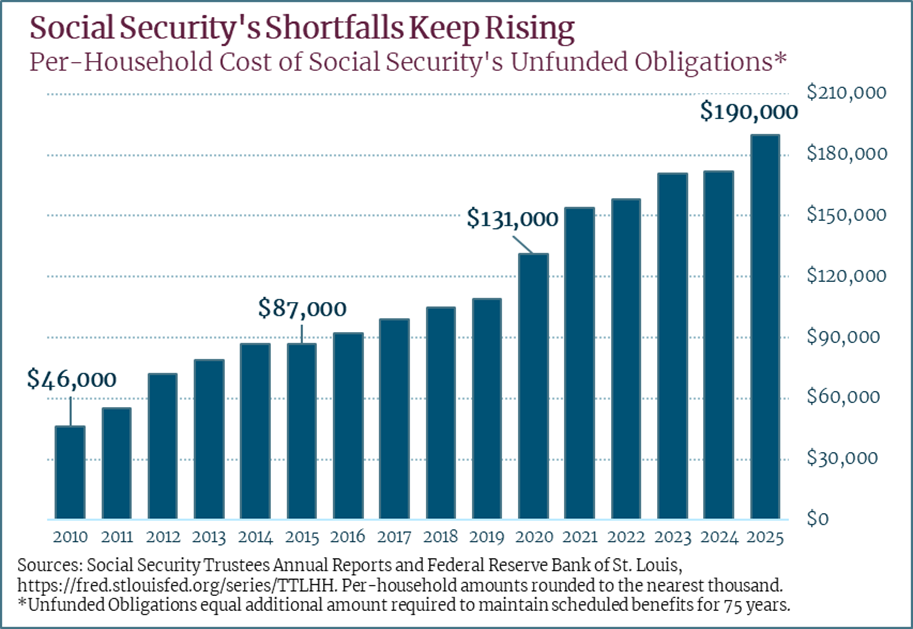

The December 10 Payout reflects the reliability of Social Security’s monthly disbursement system, but broader concerns about program solvency persist. The annual Trustees Report warns that without legislative action, the trust fund may face shortfalls in the 2030s.

Lawmakers continue to debate proposals such as raising the taxable wage cap, adjusting retirement ages, or modifying benefit formulas. Analysts expect heightened attention as demographic shifts increase reliance on Social Security and reduce the worker-to-beneficiary ratio.

What Beneficiaries Should Check This Month

- Confirm payment dates through the SSA’s official calendar.

- Review deductions for Medicare premiums beginning in January.

- Monitor for duplicate SSI payments that occur only in December due to holiday scheduling.

- Update direct deposit and mailing information to avoid delays.

- Review the upcoming COLA changes to plan for 2026 monthly budgeting.

Related Links

$2,000 Tariff Dividend: One Requirement Decides Eligibility — Trump Reveals the Expected Payout Date

Social Security Update: New Full Retirement Age Announced for Future Beneficiaries

Least Critical Information

As the December 10 Payout is issued, beneficiaries will prepare for the final payment cycle of the year and anticipate updated benefit levels taking effect in January. The SSA expects high demand for guidance during the year-end period, when budgeting needs and payment timing concerns are most common.

FAQs About December 10 Payout

Do all beneficiaries receiving a December 10 Payout receive the same amount?

No. Payment amounts vary based on earnings, retirement age, disability status, and deductions.

Does December 10 include the new COLA?

No. COLA updates begin in January.

Who receives the maximum Social Security benefit?

Individuals with 35 years of maximum taxable earnings who retire at full retirement age or later.

Do SSI beneficiaries receive a payment on December 10?

No. SSI is paid December 1 and December 31 for January.

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How

$33 Million Wells Fargo Subscription Billing Settlement: Who Qualifies and How Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad

Pago del IRS de $2,000 por depósito directo en diciembre de 2025: guía de elegibilidad $400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule

$400 Inflation Refund Checks for Everyone – 2025 December Payment Schedule Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores

Cheques de estímulo de $1,000 para todos: calendario de pagos completo de 2025 para personas mayores